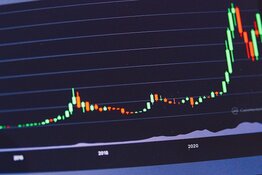

Environmental and cleantech company BioLargo Inc. (BLGO:OTCQX) announced that new engineering contracts to provide air quality control compliance services has increased its engineering segment revenue by 517%.

However, due to decreased volume of sales of its pet odor product Poop, overall revenues fell to US$ 2.78 million in the second quarter of this year and US$6.046 million in the first half, the company said in a release on August 13.

The company had reported in its annual report that it had achieved record revenues in 2024, marking a 45% increase compared to the previous year, largely driven by the success of Pooph. For the year ending December 31, 2024, revenues reached US$17,779,000, reflecting a 45% increase over 2023 and marking the 10th consecutive year of revenue growth, according to the company.

"There are many important technologies and products in our portfolio that will have a major role in industry," President and Chief Executive Officer Dennis P. Calvert said.

He continued, "Over the past few months and quarters, our team has done a tremendous job in progressing the overall value of the BioLargo portfolio … the unseen value is many multiples of our current US$50 million market cap, driven by our unmatched technologies, capital-conserving strategy, highly qualified people and high impact."

"We are very optimistic with our emerging solutions surrounding surgical products, water treatment for the global PFAS contamination crisis and battery energy storage technology," Calvert said. "Our team is focused on creating optimal partnerships to drive commercialization of these solutions across varying industries."

Calvert noted that BioLargo's investments in these technologies have yielded a suite of validated technical claims and product features that "we believe are unmatched in the marketplace." This diversification strategy has proved "especially wise" as BioLargo advances its commercial efforts into high-growth opportunities like its Clyra and Cellinity technologies, Calvert has said.

According to the company, here are some of the other key highlights of the report:

- Clyra Medical Technologies secured a series of sales and distribution agreements to make its products available to 6,100 hospitals, 6,300 ambulatory surgery centers, and 2,200 specialty wound care clinics in the U.S. alone.

- An independent evaluation by U.S. BESS Corporation, a leading provider of advanced energy storage solutions, confirmed the breakthrough performance of BioLargo's Cellinity battery technology for grid-scale energy storage.

- Cellinity, our innovative battery technology, signed four memoranda of understanding (MOUs) with prospective joint venture partners interested in building and operating Cellinity battery factories.

- Garratt Callahan, one of the company's co-development technology partners, continued efforts in selling and business development, focusing on the reuse of cooling tower water, such as at data centers.

- Engineering & Environmental Services is actively working with clients to develop scopes of work and budgets for several significant projects.

- As of June 30, 2025, stockholders' equity was $6,060,000, assets totaled $12,499,000, liabilities were $6,439,000, and the company held $3,471,000 in cash and cash equivalents.

Independent Evaluation Confirms Advantages of Cellinity

In June, BioLargo announced that an independent evaluation had confirmed the significant advantages of its Cellinity battery technology for grid-scale energy storage systems. The assessment was carried out by U.S. BESS Corp. is a leading provider of advanced energy storage solutions for critical infrastructure in utilities, defense, microgrids, and heavy industry, according to BioLargo.

"Based on our inspection and the evidence provided, U.S. BESS finds that the Cellinity Cell demonstrates a sufficient performance profile, with strong indications of high thermal stability, efficiency, energy and power density, and material sustainability, to suggest further investment in testing and commercialization," the report stated. "These attributes position this technology as a potential solution for critical gaps in grid-scale energy storage markets."

The senior technical team at U.S. BESS conducted a thorough review of Cellinity's design and assembly processes, inspected the testing infrastructure, analyzed test data, and evaluated the methodologies used for performance characterization.

U.S. BESS Corp. further determined that it is reasonable to assert that: a) the cell would not undergo thermal runaway, b) the materials used in its construction are commonly available and can be sourced domestically, c) the cell does not incorporate rare earth elements, and d) the components of the cell are fully recyclable.

Analyst Maintains Rating, Price Target

In a July 23 research note, Oak Ridge Financial Analyst Richard Ryan noted, "BioLargo's business model approach is to invent or acquire novel technologies, develop them into product offerings, and extend their commercial reach through licensing and channel partnerships to maximize their impact."

This cleantech and life sciences innovator, according to the analyst, has several core products that address PFAS (also known as "forever chemicals" because of the time they take to break down) contamination, advanced water and wastewater treatment, odor and volatile organic compound control, air quality improvement, energy efficiency and safe onsite energy storage, and infection control. BioLargo remains a Buy, according to Ryan.

Ryan noted that in a letter to shareholders in July, Calvert noted that he believes Pooph will ultimately be successful. He added that it is difficult to forecast future Pooph results given the lack of visibility into the business and the short time (three years) its products have been on the market.

The Catalyst: More Energy for AI, Data Centers, and Grid Resilience

The global need for grid-scale energy storage is rapidly growing to support increasing demands. In 2024, the U.S. Energy Information Administration (EIA) noted a 66% rise in battery energy storage capacity in the U.S. While lithium-ion batteries currently lead this sector, they present several challenges, such as fire risks due to thermal runaway, efficiency loss over time, and sourcing difficulties related to rare and critical minerals.

BioLargo said its Cellinity battery technology tackles these issues by using innovative materials and designs to deliver exceptional thermal performance and operational efficiency without relying on rare earth elements.

According to a February report by the International Energy Agency (IEA), global electricity consumption is expected to grow at its fastest rate in recent years, increasing by nearly 4% annually through 2027 as power use rises across various sectors.

"The growth in global demand will be the equivalent of adding an amount greater than Japan’s annual electricity consumption every year between now and 2027," the agency noted. This surge is largely driven by the robust use of electricity for industrial production, increased demand for air conditioning, accelerating electrification led by the transport sector, and the rapid expansion of data centers.

In the United States, the total capacity for large-scale battery storage exceeded 26 gigawatts (GW) in 2024, as detailed in the EIA's January 2025 Preliminary Monthly Electric Generator Inventory. That year, generators added 10.4 GW of battery storage capacity, marking the second-largest increase in generating capability after solar energy. Despite the rapid growth of battery storage, it accounted for just 2% of the total 1,230 GW of utility-scale electricity generation capacity in the country in 2024.

Looking forward to 2025, battery storage growth could potentially reach new heights, with operators planning to add 19.6 GW of large-scale battery storage to the electrical grid, as indicated in the January 2025 preliminary electric generator inventory data, the agency reported.

Ownership and Share Structure

About 14.6% of BioLargo is owned by insiders and management, according to Yahoo! Finance. They include Chief Science Officer Kenneth Code with 8.3%, CEO Calvert with 3.29%, and Director Jack Strommen with 1.6%, Refinitiv reported.

About 0.04% is held by the institution First American Trust, Refinitiv said.

The rest, about 85%, is retail.

Its market cap is US$56.12 million, with about 304.85 million shares outstanding and about 262.22 million free-floating. It trades in a 52-week range of US$0.32 and US$0.16.

| Want to be the first to know about interesting Technology and Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- BioLargo Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of BioLargo Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.