NexGold Mining Corp. (NEXG:TSX.V; NXGCF:OTCQX; TRC1:FSE) released more drill results from its recently completed 26,854-meter diamond drilling campaign at the Goldboro Open Pit Gold Project in Nova Scotia.

The drilling initiative primarily aims to infill specific sections of the open pit Mineral Resource to enhance geological and grade continuity and potentially upgrade certain Inferred and Indicated Mineral Resource areas.

These assay results, for an additional 12 infill diamond drill holes (BR-25-560, 574 to 576, 580, 581, 583, 587 to 589, 591, and 604),totaling 2,163.0 meters, were obtained from drilling in the proposed east pit of the Goldboro Open Pit Gold Project.

"The high-grade intercepts in recent drilling in the east pit will be important to ongoing work on the Goldboro Mineral Resource and mine planning," said Chief Executive Officer Kevin Bullock. "Goldboro continues to demonstrate the presence of high-grade zones, near surface, within the planned open pits. We are encountering this style of mineralization at open pit depths with all intersected zones projecting to surface. We anticipate final assays from the full drill program to be returned in the coming weeks and look forward to using that information in an updated Mineral Resource Estimate."

Highlighted drill intersections from these 12 diamond drill holes include:

- 23.73 grams per tonne gold (g/t Au) over 5.3 meters (from 153.7 to 159 meters), including 244 g/t Au over 0.5 meters in drill hole BR-25-589;

- 24.65 g/t Au over 2.2 meters (from 142.2 to 144.4 meters), including 104.5 g/t Au over 0.5 meters in drill hole BR-25-576;

- 7.4 g/t Au over 3.7 meters (from 128.5 to 132.2 meters), including 51.60 g/t Au over 0.5 meters in drill hole BR-25-588;

- 1.90 g/t Au over 12.5 meters (from 56.4 to 68.9 meters), including 18.25 g/t Au over 0.7 meters in drill hole BR-25-580; and

- 5.20 g/t Au over 3.7 meters (from 255.8 to 259.5 meters), including 29.00 g/t Au over 0.7 meters in drill hole BR-25-588.

The company said it has now released assay results for 130 drill holes, covering approximately 92% of the infill program.

Results thus far continue to confirm the presence of mineralization consistent with previous drill findings in the proposed west and east pits. The existing geological model generally predicts the location of gold mineralization, with local adjustments made where mineralization is not exactly as predicted or absent.

Throughout the drill program, additional gold mineralization was discovered in areas previously unknown or under-drilled, or near historical drilling that was more selectively sampled than the current approach, NexGold said. The Mineral Resource model will be adjusted as needed to account for local variations, and any impact from additional assay data gathered during the drill program will be evaluated in the upcoming updated Mineral Resource Estimate planned for the second half of 2025.

1,010 g/t Gold

Last month, NexGold announced more results from the drilling campaign. A notable highlight was a significant intersection of 40.09 g/t Au over 17.7 meters from 120.5 meters to 138.2 meters down hole in drill hole BR-25-570, which includes 1,010.00 g/t Au over 0.5 meters, 220.00 g/t over 0.5 meters, and 124.50 g/t Au over 0.5 meters within the 17.7-meter interval.

Drilling has focused on the west pit of the Goldboro project, supported by an existing 2022 Feasibility Study. That study projected an average annual production of 100,000 ounces of gold over an estimated 11-year mine life, with a projected after-tax net present value (NPV5%) of CA$328 million at a gold price of US$1,600 per ounce. The initial capital cost was estimated at CA$271 million, assuming a contract mining fleet, and average life-of-mine all-in sustaining costs (AISC) were projected at US$849 per ounce.

The Goldboro project remains permitted for surface development under provincial regulations and holds an approved Industrial Approval application, Crown Land Lease, and Environmental Assessment authorization, the company said. The project also benefits from previously established infrastructure plans, including a tailings storage facility and water management systems, all contained within a single watershed to minimize environmental impact.

'The Best Results Reported to Date'

On July 25, Ron Stewart of Red Cloud Securities reaffirmed a Buy rating for NexGold, maintaining a target price of CA$1.35 per share. In his analysis, Stewart described the company's July 22 drill results as the most impressive in the ongoing program.

"These are the best results reported to date," he noted, emphasizing high-grade intervals such as 304 g/t Au over 0.5 meters and 286 g/t Au over 0.5 meters. Red Cloud highlighted that these findings bolster confidence in the current mineral resource model and offer valuable data for further modeling.

Stewart also pointed out the discovery of new mineralized zones in areas previously thought to be unmineralized, calling them "important new discoveries" with potential to enhance future resource evaluations.

The permitting process was another focus in Red Cloud's coverage. The firm stressed that the Industrial Approval application had reached a critical stage, stating,

"The company has now reached an important milestone with the Industrial Approval application deemed complete by Nova Scotia," Stewart wrote. "A final decision is expected within the statutory review period."

Drilling Reveals New Areas of Mineralization

In a June 27 research note, Jay Taylor of Gold, Energy & Tech Stocks discussed the company's 25,000-meter diamond drilling campaign at Goldboro, which has revealed new areas of mineralization.

Taylor noted, "NexGold Mining Corp.'s 25,000-meter diamond drill program continues to intersect additional gold mineralization in areas where no mineralization was previously known or predicted."

He mentioned that the company is revising its geological model and plans to incorporate new assay data into an updated mineral resource estimate, targeted for release in the second half of 2025.

The analyst also commented on permitting progress in a separate update on June 20, noting that provincial regulators had advanced the company's application for Industrial Approval, a key permit for surface mining activities.

"NexGold Mining Corp. announced that the government of Nova Scotia has deemed the company's application for an industrial approval of a surface gold mine to be complete," he wrote. The application now enters its final review stage, with a decision anticipated within 60 days.

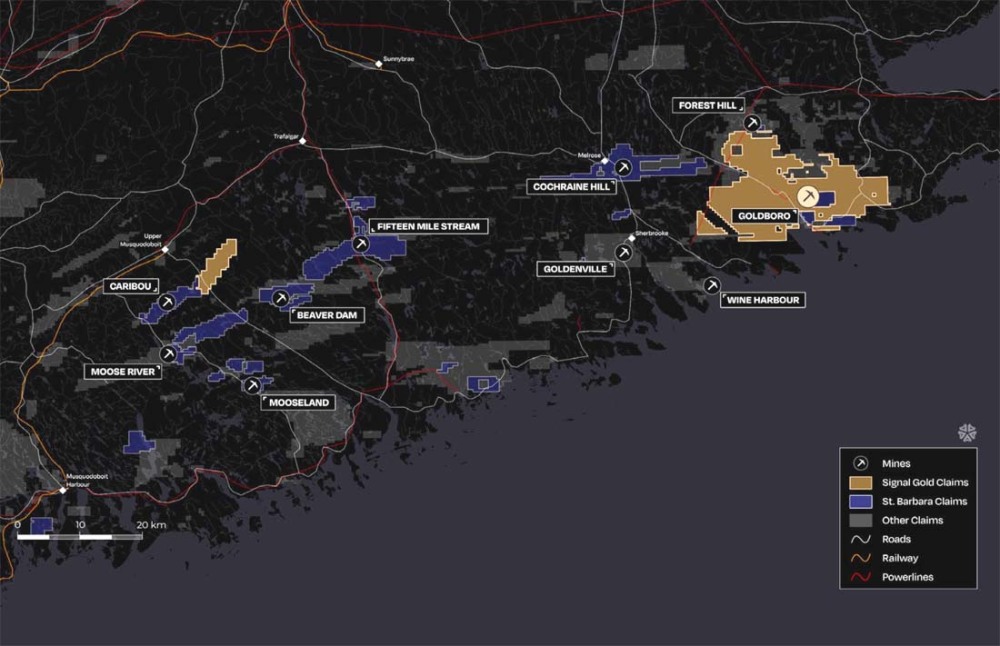

Goldboro is one of NexGold's two cornerstone assets, alongside the Goliath Gold Complex in Ontario. According to the company's July 2025 investor presentation, Goldboro is expected to become one of Canada's next permitted gold mines, with a phased development approach. The open pit component is anticipated to lead into potential underground expansion in later years, contingent on future drilling and feasibility analysis.

The Catalyst: Tariffs Hit, Sending Gold Inching Higher

Gold prices inched higher on Thursday, driven by increased demand for safe-haven assets following new tariff threats from U.S. President Donald Trump and weak U.S. economic data, which bolstered expectations for a Federal Reserve interest rate cut, reported Peter Nurse for Investing.com on August 7. At 04:30 ET (08:30 GMT), Spot Gold rose 0.1% to US$3,373.80 per ounce, while December Gold Futures climbed 0.4% to US$3,447.90 per ounce.

Investor interest in gold increased after Trump announced plans to impose a 100% tariff on imported semiconductors from certain countries unless they invest in U.S. chip manufacturing. This policy is intended to enhance domestic production but has raised concerns about further disruptions to global supply chains and rising inflation, Nurse wrote.

Additionally, Trump signed an order to double U.S. tariffs on imports from India to 50%, citing the country's purchase of Russian oil. In a post on Truth Social late Wednesday, Trump stated that these reciprocal tariffs would take effect at midnight, keeping investors on edge, the author said. The potential for increased input costs and trade tensions has supported demand for gold, which is traditionally viewed as a hedge against inflation and market volatility.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

NexGold Mining Corp. (NEXG.V:TSXV; NXGCF:OTCQX; TRC1.F:FRA)

Gold also gained support from rising expectations that the Federal Reserve might start cutting interest rates as early as September, Nurse wrote. Recent data showed a slowdown in the U.S. services sector in July, following last week's disappointing nonfarm payrolls data.

Florian Grummes told Jeremy Szafron of Kitco News on July 29 that the bigger breakout is coming, and patient investors will be rewarded.

"We're in a crack-up boom overall," said Grummes, managing director of Midas Touch Consulting, in an interview with Kitco News. "That means everything will move higher because they destroy the purchasing power of your fiat money — whether it's the euro, the dollar, or the Canadian dollar."

Ownership and Share Structure

The company notes that management and insiders own 2.9% of NexGold. Institutions and strategic investors, including Frank Giustra who owns 7.0%, own 51.9% of the shares in the company.

NexGold has 145.77 million shares issued and outstanding and a market cap of CA$119.53 million.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- NexGold Mining Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NexGold Mining Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.