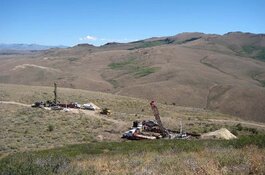

West Point Gold Corp. (WPG:TSXV; WPGCF:OTCQB) announced results from its initial reverse circulation drilling at the Frisco Graben target at the company's Gold Chain Project in Arizona.

The announcement detailed the findings from Holes GC25-53 through -56, covering a total of 1,092.7 meters, and incorporated those results with geophysical, geochemical, and hyperspectral analyses. The exploration efforts so far reinforce West Point Gold's belief in the Frisco Graben's potential for hidden gold deposits, particularly at the convergence of the northeast extension of the Tyro structural corridor and the northwest-trending Frisco Mine fault.

"Initial drilling at the Frisco Graben continues to suggest that there is potential for a large-scale gold system at depth, particularly given that anomalous gold was encountered in the alteration zone, above where one would expect to find gold mineralization," said Chief Executive Officer Quentin Mai. "The company plans to follow up with deeper drilling, guided by these results, historical drilling and ongoing studies. The Frisco Graben remains a compelling target that warrants follow-up drilling."

The first four holes, with lengths ranging from 232 to 329 meters, revealed unusual gold concentrations, including up to 0.081 grams per tonne gold (g/t Au), just beneath the Frisco Mine fault.

The drilled rocks in the Frisco Graben are significantly oxidized and altered (kaolinite-silica-hematite), underscoring the potential for deeper gold deposits, West Point noted in its release. Mercury, a traditional indicator for gold in low-sulfidation epithermal systems, was detected in significant amounts at Gold Chain for the first time. Hyperspectral and geochemical evaluations of the drill cuttings indicate that drilling remained in the "steam-altered" zone up to the Frisco Mine fault, above the target depth.

West Point said future drilling will aim for the Tyro intersection deeper within the system. The anticipated "boiling zone," which likely includes the nearby veins of the Main Tyro zone and along the extended structure, remains unexplored at depth in the Frisco Graben.

Drill Results Summary

Four RC holes were drilled through the intensely altered volcanic and sub-volcanic rocks in the hanging wall of the Frisco Mine fault near its junction with the Tyro fault/vein complex, the company said. A primary aim of this drilling was to identify gold deposits in the permeable volcanic tuffs and breccia beneath the "steam-altered" rocks.

Geochemical and subsequent hyperspectral studies suggest that drilling exited the graben at the Frisco Mine fault, above the desired location and/or elevation. Consequently, the "boiling zone" at the intersection remains untested. Notable gold anomalies were found up to 0.081 ppm (parts per million) Au in the Precambrian rocks in the footwall of the Frisco Mine fault and outside of the "steam-altered" environment.

Drilling in 2025 along the Main and NE Tyro Vein segments has better defined a structural corridor hosting a broad, steeply dipping zone of gold-bearing veins, veinlets, and breccia up to 200 meters below the surface, West Point noted.

Drilling across the Northeast Zone has revealed a greater proportion of chalcedony-calcite-adularia veins with higher gold grades, including GC25-47 (50.29 meters at 3.76 g/t Au). Continued drilling to the northeast suggests the mineralization is plunging toward the Frisco Mine fault, the company said.

The findings from 2025 suggest pursuing exploration along the Frisco Mine fault to deeper levels, beneath the vapor-dominated zone, West Point noted in the release. Before drilling can proceed, the permitted area will need to be extended to the south, where there is a potassium anomaly and magnetic low, and to the east, below the kaolinite zone.

Grades 'Bode Well' for Resource Estimate

Last month, West Point released further results. Drill hole GC25-61 intersected 59.44 meters at 1.25 g/t Au, with a higher-grade segment of 33.53 meters at 1.63 g/t Au. This hole was drilled approximately 90 meters beneath a previously explored hole, indicating continuity of mineralization at greater depths.

Hole GC25-62 yielded 68.58 meters at 0.90 g/t Au, including 15.24 meters at 2.89 g/t Au. The mineralization was found near a rhyolite dike, which the company considers a potentially significant geological feature.

Hole GC25-63, drilled roughly 200 meters south of the main zone, intersected 7.62 meters at 1.88 g/t Au. Hole GC25-64 encountered 36.58 meters at 0.91 g/t Au, about 190 meters below the surface. These findings extend the known mineralized area of the Tyro Main Zone to nearly 200 meters in vertical depth over a strike length of approximately one kilometer.

At the time, Mai said the consistent grades "bode well for a future resource estimate and a potential development scenario."

The Catalyst: 'We're in a Crack-Up Boom' for Gold

Gold and silver prices have been relatively stable this summer, but Florian Grummes told Jeremy Szafron of Kitco News on July 29 that a significant breakout is on the horizon, and patient investors will benefit.

"We're in a crack-up boom overall," said Grummes, managing director of Midas Touch Consulting, in an interview with Kitco News. "That means everything will move higher because they destroy the purchasing power of your fiat money — whether it's the euro, the dollar, or the Canadian dollar."

Gold futures were trading at US$3,411.60 per ounce on Monday, while spot gold remained relatively stable at US$3,360.09 per ounce, as

Gold made a conservative start to the week following a price jump on Friday, reported by Pedro Goncalves for Yahoo Finance UK on August 4.

"A combination of profit-taking and dollar stabilization has caused gold to ease marginally to kick-off the week," Tim Waterer, chief market analyst at KCM Trade, told Goncalves.

Last week's market movements were affected by President Donald Trump's announcement of significant tariffs on exports from key trading partners such as Canada, Brazil, India, and Taiwan.

"With Trump aggressively pursuing tariffs again, coupled with a weak U.S. jobs report that could lead to a Federal Open Market Committee (FOMC) rate cut in September, any declines in gold prices are likely to be minimal," Waterer added.

Gold is traditionally seen as a safe-haven asset during political and economic instability and tends to become more attractive when interest rates are low.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

West Point Gold Corp. (WPG:TSXV; WPGCF:OTCQB)

In a positive turn, Goncalves noted that Citi revised its gold price forecast on Monday, raising it to US$3,500 per ounce for the next three months, up from a previous forecast of US$3,300. The bank also expanded its expected trading range to US$3,300–US$3,600 from US$3,100–US$3,500, citing a worsening outlook for near-term U.S. growth and inflation.

"U.S. growth and tariff-related inflation concerns are set to remain elevated during 2H2025, which, alongside a weaker dollar, are set to drive gold moderately higher, to new all-time highs," Citi noted in its analysis. The bank also observed that gross gold demand has increased by more than a third since mid-2022, contributing to the sharp rise in prices, which are expected to nearly double by the second quarter of 2025.

Ownership and Share Structure

According to Refinitiv, about 4% of West Point Gold is owned by insiders and management, and about 1% by institutions. The rest is retail.

Top shareholders include Executive Chairman Derek Macpherson with 2.27%, Director Anthony Paterson with 1.7%, U.S. Global Investors Inc. with 1.08%, Mai with 0.17%, and Ehsan Agahi with 0.01%.

Its market cap is CA$28.96 million with 87.78 million shares outstanding, and it trades in a 52-week range of CA$0.21 and CA$0.68.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of West Point Gold Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.