By the end of this article, you'll possess an excellent comprehension of the pressing cryptocurrency opportunity and be ready to capitalize as institutional investors flood into the market.

To begin, I will examine the current landscape. Which large, medium, and smaller cryptocurrencies deserve your investment, and which should remain untouched?

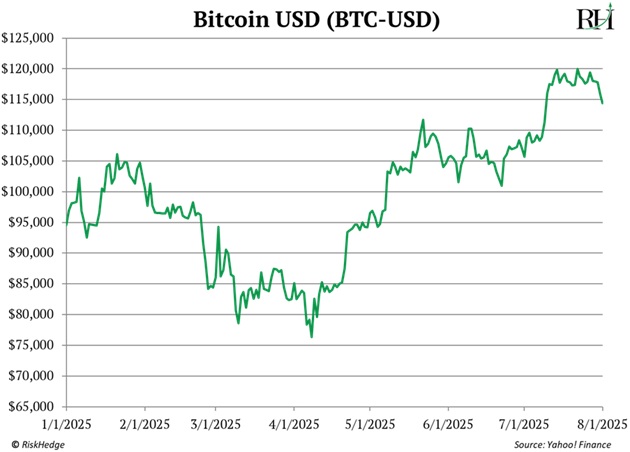

Following its climb to a record peak, Bitcoin (BTC) has taken a momentary pause . . . currently trading around $114,000 as I write.

Yet the premier cryptocurrency still shows a 23% gain this year (nearly triple the S&P 500) . . .

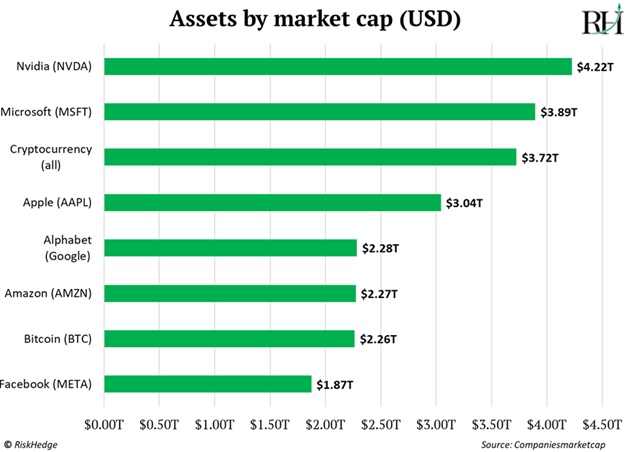

And its total valuation now reaches around $2.26 trillion.

For context, if Bitcoin were listed on stock exchanges, it would rank as the sixth-largest entity by market value . . . behind only Nvidia Corp. (NVDA:NASDAQ), Microsoft Corp. (MSFT:NASDAQ), Apple Inc. (AAPL:NASDAQ), Alphabet Inc. Class A (GOOGL:NASDAQ), and Amazon.com Inc. (AMZN:NASDAQ).

- While Bitcoin is enormous . . . avoid assuming the entire cryptocurrency sphere is similarly sized.

More than any alternative investment category, cryptocurrencies display a "top-heavy" distribution. Bitcoin alone represents nearly half the cryptocurrency market. Combined, Bitcoin and Ethereum (ETH) constitute approximately 70% of the cryptocurrency ecosystem.

As illustrated below, the complete cryptocurrency landscape remains relatively compact. In fact, the collective value of every existing cryptocurrency roughly equals the market valuation of a single corporation: Microsoft.

Meanwhile, hundreds of thousands of lesser-known cryptocurrencies comprise the remainder of the market.

That's precisely where the most substantial gains are occurring recently.

Port Finance (PORT), for example, has surged 3,145% this year. AI Network (AIN) has climbed 854%. And Sora Grok (GROK) has skyrocketed an astounding 13,649%.

- Within traditional American equity markets, investors can select from numerous established "blue-chip stocks."

These represent massive enterprises with generations of proven success.

Legendary brands like McDonald's Corp. (MCD:NYSE), Coca-Cola Co. (KO:NYSE), and Walmart Inc. (WMT:NYSE). Suppliers of essential products like Johnson & Johnson (JNJ:NYSE) and Procter & Gamble Co. (PG:NYSE). Market leaders like Nike Inc. (NKE:NYSE) . . . AT&T Inc. (T:NYSE) . . . and Starbucks Corp. (SBUX:NASDAQ).

Cryptocurrency presents an entirely different scenario. The vast majority of digital currencies effectively function as startup ventures.

Here are the six largest:

#1 is Bitcoin. It essentially serves as digital gold, a value repository outside traditional financial frameworks. Stephen believes its price will eventually exceed $1,000,000.

#2 is Ethereum. Ethereum operates as a platform business. Stephen describes it as "the greatest tech stock the world has ever known."

It forms the "base layer" upon which developers are constructing revolutionary disruptive enterprises. Better still... it generates actual revenue from all blockchain activities. Approximately $32 billion worth of transactions settle on Ethereum daily.

Stephen at RiskHedge forecasts ETH reaching $10,000 this cycle — representing a 185% increase from current levels.

#3 is XRP (XRP) . . . Stephen advises against it. It features poor tokenomics (among the crucial drivers of cryptocurrency valuations). And its operations lack transparency.

#4 is Tether (USDT) . . . . the biggest and most utilized stablecoin globally. It generated $14 billion profit last year with merely 150 employees. That's $93 million per employee. No other business comes close.

#5 is BNB (BNB) . . . a Chinese cryptocurrency exchange. According to Stephen, they essentially duplicated Ethereum's code and applied it to executing affordable, rapid cryptocurrency transactions.

And #6 is Solana (SOL) . . . one of Stephen's preferred major cryptocurrencies alongside Ethereum.

Now, let's examine the "mid-cap" cryptocurrencies.

- With a $30 billion market valuation, Dogecoin (DOGE) ranks as the ninth-largest cryptocurrency.

It is the speculative digital token featuring a fuzzy dog mascot.

Currently valued above United Airlines Holdings (UAL:NASDAQ) . . . Kellogg's (K:NYSE) . . . and M&T Bank Corp. (MTB:NYSE).

Although Stephen doesn't endorse "memecoins," DOGE's performance has been remarkable. Over ten years, it has increased 116,000%. Sufficient to transform a modest $1,000 investment into $1.16 million.

Then there's Cardano (ADA), the tenth largest cryptocurrency, valued at $26 billion.

Cardano represents another "base layer" cryptocurrency, meaning it provides the foundation upon which numerous other cryptocurrencies can develop.

So, what's problematic about Cardano?

Briefly, Stephen indicates it has virtually no functional applications built on its framework. And nothing significant is being developed on Cardano. Its value largely stems from hype rather than genuine token demand.

Furthermore, Cardano's tokenomics are problematic. 33 billion Cardano tokens circulate today, with another 12 billion scheduled to enter the market in coming years. Undoubtedly, this substantial increase will reduce its worth.

Avoid Cardano.

- Additional mid-capitalization cryptocurrencies include names like Litecoin (LTC), Sui (SUI), Avalanche (AVAX), and Uniswap (UNI).

Among these, Stephen particularly favors UNI.

Consider Uniswap as the next-generation Nasdaq. It functions as a "stock market" for cryptocurrencies, operating on blockchain technology.

Every Uniswap transaction processes through code without human intervention. It completely eliminates intermediaries from exchanges. This becomes possible exclusively because Uniswap operates via blockchain.

Uniswap isn't some insignificant venture, either. It's a multi-billion-dollar enterprise. And it represents just one revolutionary company being built using blockchain today.

- Then come small caps, microcaps, nanocaps, and hundreds of cryptocurrencies smaller than the tiniest nanocap stock.

According to Stephen, this segment will produce some of the most impressive returns over the next twelve months as Wall Street aggressively enters cryptocurrency investing.

The challenge is that 95% of these minuscule cryptocurrencies will collapse.

Success requires identifying those addressing genuine problems.

If you’re looking to learn more about the opportunity in crypto and other big disruptions in the market today, consider joining The Jolt. It’s Stephen’s twice-weekly investing letter, where he shares his unfiltered insights so you can take advantage of the trends shaping our world. Go here for details.

| Want to be the first to know about interesting Cryptocurrency / Blockchain investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Chris Reilly: I, or members of my immediate household or family, own securities of: Microsoft, Bitcoin, Ethereum, Johnson & Johnson, and Coca-Cola. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.