Allied Critical Metals Inc. (ACM:CSE; ACMIF:OTCQB; 0VJ0:FSE) announced two significant developments: its addition to the OTCQB and its launch of a U.S.-based subsidiary, in a news release. These moves are part of the company's North American growth strategy and demonstrate its commitment to supplying tungsten and other critical minerals to U.S. customers.

Allied began trading on the OTCQB on July 28 under the ticker symbol ACMIF, a priority action item now completed. The OTCQB, or Venture Market, is the middle tier of the over-the-counter market for U.S. stocks. Companies must qualify for inclusion by demonstrating their commitment to transparency and financial reporting.

"We expect U.S. investors will be a big part of the company's success as we move forward," Allied Chief Executive Officer and Director Roy Bonnell said in the release.

Allied Critical Metals launched a wholly owned U.S. subsidiary, Allied Critical Metals (USA) Inc., or Allied USA, whose headquarters are in Nashville, Tenn. Led by a team with extensive industry expertise and market insight, Allied USA's charge is to import, market and distribute premium tungsten products to various sectors in the U.S., including defense, aerospace, electronics, energy and advanced manufacturing. Other priorities are to be reliable, responsive and technically proficient and to build strong relationships with customers.

The debut of Allied USA is timely because the U.S. is seeking a secure, reliable supply chain of tungsten given that China, reported ARANCA on June 4, produces 81% of the world's supply and restricted exports of the metal to the States. There are no commercially producing tungsten mines in the U.S. today, according to Mining.com on July 25. Allied's timing is even more crucial and urgent given that tungsten is a critical mineral to the U.S. (as it is for Canada and a handful of other countries and regions). As such, Allied USA is well-positioned to become a trusted tungsten partner for U.S. manufacturers and government contractors, the release pointed out.

"The United States is a cornerstone market for tungsten, and Allied USA will allow us to serve our customers more directly with enhanced supply chain efficiency and superior product quality," said Bonnell.

In its latest news release, Allied announced two additional news items. One, its common shares now are eligible for electronic clearing and settlement through The Depository Trust Co. (DTC) in the U.S., a subsidiary of the Depository Trust & Clearing Corp. that manages the electronic clearing and settlement of publicly traded companies. For investors, this change for Allied simplifies trading and enhances liquidity by accelerating settlement times and lowering trading costs. For Allied, it makes the company more accessible in U.S. capital markets.

Two, according to the amended July 20, 2025 agreement, Canaccord Genuity Corp. is to provide financial advisory services to Allied in exchange for 1.2 million (1.2M) common shares of Allied at a previously agreed upon price of CA$0.25 per share.

Capitalizing on Tungsten Assets

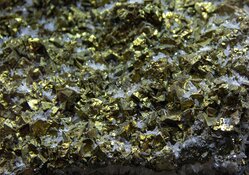

Headquartered in Vancouver, British Columbia, Allied Critical Metals is a mining company that is expanding and revitalizing its 100%-owned, past-producing Borralha tungsten project and the Vila Verde tungsten-tin project, both in the mining-friendly jurisdiction of northern Portugal, according to the company's Corporate Presentation. With both assets in the exploration stage, the company appointed a vice president of exploration last month, Vítor Arezes, noted a June 24 news release. Arezes' qualifications include 14 years of experience in geological exploration, project development, mining operations and project evaluation in Portugal and globally. He has held various technical and leadership roles in exploration and mining companies with a strong focus on tungsten, tin, other critical minerals and precious metals.

At Allied's flagship project Borralha, a 5,000 meter core drill program is underway to expand the resource and enhance project economics ahead of an updated preliminary economic assessment (PEA), reported Streetwise Reports on June 2. The concession area of this advanced-stage brownfield project spans 127.5 square kilometers. The current license allows for production of up to 150,000 tons per annum (150 Ktpa) of mineralized material over a 382.5-hectare area.

The 2025 Corporate Presentation notes that Borralha has an estimated mineral resource from July 2024 comprising 4,980,000 tons (4.98 Mt) at an average 0.22% of tungsten trioxide (WO3), 762 grams per ton (762 g/t) copper and 4.8 g/t silver in the Indicated category and 7.01 Mt at an average 0.2% WO3, 642 g/t copper and 4.4 g/t silver in the Inferred category. Historically at the project, between 1904 and 1985, 10,280 tons of wolframite concentrate were produced, averaging a grade of 65%.

Allied's Vila Verde is about 45 kilometers southeast of Borralha and has a land package three times the size of Borralha's. To generate near-term cash flow, the junior miner intends to build a pilot plant at Vila Verde to process tailings and alluvial material. To accelerate permitting of this plant, Allied plans to leverage the quarry permit it has for the historical quarry operation at Vila Verde. The permit allows for initial pre-permitted extraction of 150 Ktpa with expansion potential to 300 Ktpa. Construction of the plant is expected to commence in Q4/25.

Regarding offtake agreements, Allied has a letter of intent in place with Pennsylvania-based Global Tungsten & Powders to supply and sell it tungsten concentrate and is in offtake discussions with other refineries around the world.

With the experimental exploitation license it has for Vila Verde, Allied may develop the project as is with the existing resource over a maximum of five years. The historical resource there is 7.3 Mt using a cutoff grade of 0.05% WO3. This encompasses 4 Mt of 0.14% WO3 in the Cumieira area and 3.3 Mt of 0.10% WO3 in the Porqueira area. However, Allied applied for the same kind of mining license it has for Borralha.

Sector Growth Ahead

The outlook for the global tungsten market over the next five or so years is positive, characterized by rising demand and growth against a backdrop of constrained supply.

"The tungsten market is poised for structural tightness through 2030, with prices likely stabilizing at elevated levels," wrote Lara Smith, analyst and CEO of Core Consultants, in a May 19 article.

The primary drivers, Smith purported, are sustained military restocking, increasing industrial demand at an estimated 1.3% compound annual growth rate (CAGR) through 2029, limited greenfield supply, and China's resource depletion and its leveraging supply for political purposes.

Year to date, the European price for ammonium paratungstate (APT), the benchmark tungsten product, is up 43.2% as of July 25, at US$460–485/ton, reported Chinatungsten.

Actions by and sentiment among tungsten industry participants indicate they are optimistic about future market conditions, reported John Zadeh in a July 16 Discovery Alert article. Companies throughout the supply chain are reassessing optimal stock levels. Traders and downstream producers are exhibiting increased willingness to restock. Buying is happening despite elevated prices, thereby boosting market confidence. Buyers and sellers expect ongoing price strength.

Grand View Research expects the world's tungsten market to expand through to at least 2033, increasing in size to US$2.84 billion (US$2.84B) from US$1.85B in 2024, reflecting a 4.7% CAGR. As for the U.S. tungsten market, the research firm predicts it will see a 3.9% CAGR during the same forecast period.

Global tungsten production continues to be hampered by depletion of high-grade reserves, permitting delays, processing bottlenecks and environmental restrictions, reported Discovery Alert's Zadeh on July 17. Production in China, which dominates global new supply, for example, was down 12% year over year in Q2/25.

Other factors restricting new supply are ore suppliers intentionally withholding inventory, upstream suppliers prioritizing contracts by term length and many APT producers focusing on contract deliveries only and not providing spot market quotes.

"This combination of supply-side constraints has created an increasingly tight market where even moderate demand can trigger significant price movements," noted Zadeh. "The reluctance of suppliers to release material into the spot market has exacerbated the price discovery process, leading to sharper daily fluctuations."

At the same time, demand for tungsten remains robust, Smith pointed out. The industrial and mining/construction sectors are fueling demand, given the use of tungsten carbide in drilling equipment, wear-resistant machinery and cutting tools. Military applications, such as armor-piercing munitions, tank armor and rocket components, contribute notably to demand from the defense sector. Other industries that consume tungsten are transportation, chemical/pharmaceuticals, energy and consumer durables.

"Once overshadowed by more prominent critical minerals like lithium and rare earths, tungsten ('wolframite') is now firmly in the spotlight—not only as a key industrial material but also as a strategic military metal," Smith wrote. "The past two years have seen a structural shift as military and industrial consumers ramp up restocking, especially in Europe and North America, amid concerns over supply security."

Grand View noted that the global shift toward miniaturized and energy-efficient devices is accelerating the use of tungsten in electronics and electrical applications, a trend that will contribute to future market growth as well.

The Catalysts

Several potential share price-boosting events are ahead in the near term for Allied Critical Metals, according to the company. Regarding Borralha, they include results of the in-progress drill campaign, followed by a mineral resource update and PEA of the project.

At Vila Verde, Allied intends to start construction of a pilot plant in Q4/25.

Other potential catalysts include updates regarding Allied USA and additional offtake agreements.

Ownership and Share Structure

According to Refinitiv, six insiders own 0.47% of Allied. These investors include President and Director João Barros, Director and Nonexecutive Chairman Sean O'Neill and Corporate Secretary and Director Andrew Lee.

The rest is in retail as there are no institutional investors at this time.

The company has 198.85M outstanding shares and 109.33M free float traded shares. Its market cap is CA$25.78 million. Its 52-week range is CA$0.20–0.80 per share.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |