Almonty Industries Inc. (AII:TSX.V) has upcoming catalysts, but related upside already is baked into the share price, reported Couloir Capital in a July 14 research note. For this reason, Couloir downgraded its rating on the tungsten producer to Hold.

Target Reached and Passed

Couloir has a CA$7.69 fair value target on Almonty, but the miner already surpassed it. Almonty's share price is CA$7.82 per share at the time of the research team's report.

"The share price has increased more than 10 times since we initiated analyst coverage," the analysts wrote.

Almonty has 195.9 million shares outstanding and a market cap of CA$1.5 billion.

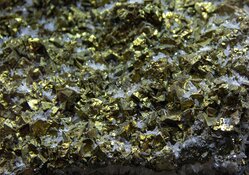

Various Tungsten Projects

Almonty Industries owns multiple assets with a tungsten or molybdenum focus, each of which Couloir Capital discussed in its report.

Panasqueira, in Portugal, the one producing project, yields tungsten trichloride, or WO3. The company plans an expansion of the mine's Level 4 (L4) by 2027. Couloir estimates that Panasqueira has a 16-year life of mine (LOM) and will produce 56,000 metric ton units (mtu) of WO3 this year. Once L4 is built out, production will increase to 124,000 mtu. In its model, Couloir assumes an ammonium paratungstate (APT) price of US$450 per mtu and expects EBITDA margins to grow to 43% in 2027 from 12% in 2025.

Another asset, the Sangdong tungsten project in South Korea, is very near production, slated to begin in H2/25. To start, throughput capacity will be 640,000 tons per annum (650 Ktpa), and 570,000 tons (570 Kt) will be processed, according to the updated NI 43-101 report. The next phase, potentially starting in 2027, will take throughput to 1,200,000 tons annually and processing to a steady state of 650 Ktpa.

Couloir estimates total capex at US$127 million (US$127M) and annual production of 231,200 mtu of WO3 over the 14-year LOM. Using an APT price of US$450/mtu, the project will generate an after-tax net present value discounted at 5% of US$343.7M.

"The transition to a fully permitted, near-term operating mine with phase-ready growth significantly derisks the project," the Couloir research team wrote. "With Sangdong, Almonty could become the world's largest producer of tungsten concentrate outside of China and a tungsten major."

Already, Almonty has offtake agreements in place with the Plansee Group and, in the U.S., Global Tungsten & Powders as well as Tungsten Parts Wyoming. Almonty will supply the latter with tungsten oxide for domestic defense applications.

A third asset, a few years out from start-up, is the planned Sangdong tungsten oxide plant downstream from the tungsten mine. Operations are projected to start in 2028 and run until 2050. For this plant, Couloir models net revenue of US$98M and adjusted EBITDA of US$26M.

Almonty has two development-stage assets, too: Valtreixal and Los Santos. Valtreixal is its tin and tungsten project in northwestern Spain, and Los Santos is its past-producing tungsten mine project in western Spain.

Molybdenum Production

The fully permitted Sangdong molybdenum project, part of the larger Sangdong tungsten project, is being developed by Almonty's wholly owned subsidiary Almonty Korea Moly Corp., noted the Couloir research team. It is scheduled to start production by year-end 2026, and the mine is forecasted to operate for 60 years.

Almonty has an offtake agreement with SeAH M&S, South Korea's largest molybdenum processor and the world's second largest molybdenum oxide smelter. SeAH is building a US$110M metals processing facility in Texas to serve SpaceX and the U.S. defense and aerospace sectors. Almonty's agreement with SeAH includes a hard floor molybdenum price of US$19 per pound.

"We see significant potential for exports to North America," Couloir Capital wrote.

Focus on U.S. Presence

A letter to Almonty from the U.S. House Select Committee recognized the tungsten miner as strategically important given its status as a key supplier of critical minerals, noted Couloir. This makes the company eligible to participate in U.S. Department of Defense programs. Also, the committee indicated it approved of Almonty's intention to change its place of incorporation to the U.S. from Canada, making it the only U.S.-based tungsten producer. As a result, the company should experience increased investor confidence and easier access to capital markets.

Also, Almonty is working toward listing on the NASDAQ under the ticker ALM to strengthen its funding base and expand its strategic presence in North America, Couloir Capital reported. The company would use such funding to develop its planned tungsten oxide processing plant and for working capital and other general purposes.

Financials at a Glance

Couloir briefly reviewed Almonty's Q1/25 financial results. Revenue was CA$7.9M, up 1% year over year (YOY), due to higher WO3 concentrate sales. With respect to costs, sales, general and administrative expense was 131% higher than in Q1/24. Consequently, the company's Q1/25 EBITDA loss was greater YOY, too.

"As Almonty gets closer to production at Sangdong and grades improve at Panasqueira over the long term, the company's income statement should improve," Couloir's researchers wrote.

At the end of Q1/25, Almonty had CA$16.9M in cash and a CA$16.7M working capital deficit. However, it will have enough cash flow from operations and financings to see it through the next 12 months, purported the analysts.

What to Watch For

According to Couloir Capital, upcoming, potential share price-boosting events include the starts of production at the Sangdong tungsten project this year and at the Sangdong molybdenum project next year. The L4 expansion at Panasqueira is anticipated by 2027. The Sangdong tungsten oxide processing plant is slated to come online in 2028.

News about financing that changes the company's capital structure could impact Almonty's stock positively, as could the announcement of development plans for its Valtreixal or Los Santos project.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |