Kobrea Exploration Corp.'s (KBX:TSX; KBXFF:OTCQB; F31:FSE) environmental impact report update for its 6,878-hectare El Perdido mining project was approved by provincial regulators in Mendoza, Argentina, a significant milestone, noted a news release.

Through Resolution Nos. 246/25 and 64/25, Mendoza's directorate of mining and directorate of environmental protection OKed Kobrea's phase one exploration plan. This involves constructing about a 14-kilometer-long (14-km-long) mining access road, installing a temporary exploration camp and once these are completed, diamond drilling the project's porphyry copper-gold-molybdenum system. Also, the general superintendent of irrigation granted Kobrea a water supply permit for camp and drilling operations.

"Kobrea is the first public company to have drilling activities approved in the Western Malargüe Mining District," Chief Executive Officer (CEO) James Hedalen said in the release.

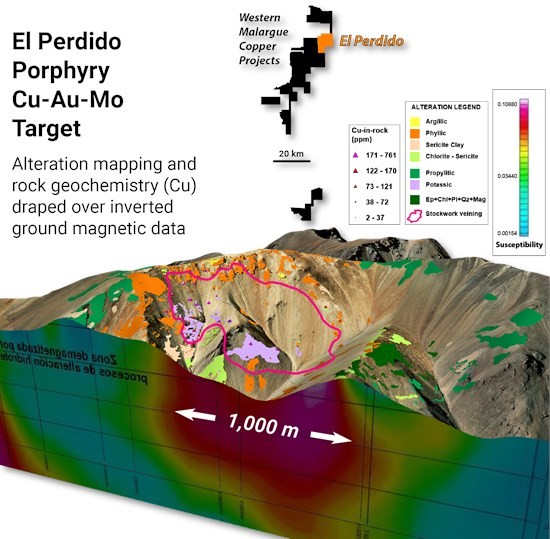

This maiden drill program will test the mapped center of the porphyry system, an attractive geophysical target characterized by a 2 km x 3 km alteration footprint. It features quartz diorite porphyry intrusions, quartz stockwork veining, anomalous copper-gold-molybdenum geochemistry, favorable geophysical expression and a large showing of hydrothermal breccia.

Exploring Highly Prospective Ground

Headquartered in British Columbia (B.C.), Kobrea Exploration Corp. is a base metals explorer-developer. The El Perdido property is one of seven adjacent, road-accessible properties in western Argentina, on which the company has the right to earn a 100% interest, called the Western Malargüe Copper Projects, notes the company's July 2025 Corporate Presentation. The others are Elena, Cuprum, Veronica, Sofi, El Destino and Mantos de Cobre.

All of the properties are highly prospective for porphyry copper and porphyry copper-gold deposits. Together they span 733 square kilometers in the prolific Neogene Porphyry Copper Belt, home to the world's first and third largest copper inventories, Zijin Mining Group's Rio Blanco-Los Bronches and Codelco's El Teniente.

"Fundamentally, Kobrea Exploration is regarded as a very interesting story and is viewed as an outstanding opportunity for investors," wrote Technical Analyst Clive Maund in a May 2 report.

He pointed out that the company holds the option to acquire a 100% interest in a huge district-scale land package at which mining major Vale S.A. (VALE:NYSE) previously identified 12 porphyry copper targets. (Due to a different jurisdictional milieu at the time, the company was denied the necessary permits and thus could not move forward.) Since then, the province of Mendoza has become much more mining friendly.

Another compelling part of the story, Maund noted, is the impending copper supply crunch expected to take the price much higher.

Kobrea has first mover advantage in the Western Malargüe Mining District (WMMD), a region determined via multiple studies, including environmental, geophysical and infrastructure, to be ideal for mining development, the company's Corporate Presentation notes.

Earlier this year, the junior miner commenced a helicopter-borne magnetic and radiometric survey of the seven properties, including the El Perdido and El Destino porphyry targets, reported Streetwise Reports in April. It was intended to help outline structures and alteration effects, associated with porphyry systems, not visibly apparent.

Kobrea has another asset, which it owns outright, in B.C. called Upland. Covering 5,300 hectares, it is about 20 km south of Taseko Mines Ltd.'s (TKO:TSX; TGB:NYSE.MKT) Yellowhead project. Upland hosts " a copper-dominant, remobilized polymetallic volcanogenic massive sulphide deposit that is open for expansion laterally and to depth," according to Kobrea.

Historically, about 50 holes were drilled at Upland between 1969 and 2010. One highlight intercept was 74 meters of 0.32% copper from surface. Several targets warranting follow-up were identified via an airborne survey. According to Maund, Upland has "lots of potential."

Long-Term Outlook Favorable

In the near term, effects of U.S. President Donald Trump's announced 50% tariff on copper imports will exert downward pressure on copper prices, according to J.P. Morgan's July 24 article. The investment banking company's global research team expects the inventory build-up that occurred in advance of the Aug. 1 tariff effective date to start unwinding and the U.S. to experience a destocking cycle over many months. As a result, U.S. refined imports are predicted to plummet, thereby shifting greater supply to the rest of the world in H2/25. At the same time, copper demand in China is forecasted to fall off, "giving the market some more breathing room." Given these influencers, J.P. Morgan is more cautious about copper prices through the rest of this year.

It expects LME copper prices to retreat to about US$9,100 per ton (US$9,100/ton) in Q3/25 then stabilize at about US$9,350/ton in Q4/25. Certain factors, though, could alter this course, its researchers said, such as tariff delays, substitution of another material for copper, a ban on U.S. copper scrap exports and a stagflationary shock to oil prices.

Shad Marquitz asserted in Excelsior Prosperity on July 27 that copper's run-up this year to nearly US$6 per pound (US$6/lb) was not all due to Trump's proposed tariffs. Rather, he wrote, the price has been creeping up over the past five years since bottoming at US$1.98/lb in March 2020 during the pandemic crash.

"This pattern of higher highs and higher lows has been well in place and playing out in the copper bull market for many years now," Marquitz wrote.

He also noted that copper stocks still offer upside.

In the longer term, copper looks favorable given the metal's strong fundamentals, wrote Dean Belder in a July 24 Investing News Network (INN) article.

Currently, the market is in a supply deficit, Jacob White, exchange-traded fund product manager at Sprott Asset Management, told INN recently.

"Uncertainties in the financial markets (trade, growth and inflation) have had a negative impact on copper demand, but this has been offset as copper is becoming less tied to global economic growth and more tied to industries that provide structural growth to the market," White added.

In a July 11 Discovery Alert article, John Zadeh quantified current supply growth at 1–2% and current demand growth at 3–4% and cited other factors supporting the copper price. Declining ore grades boosting production costs throughout the copper mining industry is one. Another is higher capex on new projects, requiring higher sustained prices to rationalize investment.

On the copper demand side, pressure continues from data centers, the green energy transition, emerging economies and industrial automation.

"This surging copper demand is driving significant investment interest in the sector," Zadeh wrote.

The supply-demand imbalance cannot be corrected any time soon.

"There aren't enough copper projects in the pipeline—not ones big enough to matter," Lobo Tiggre, CEO of CEO of IndependentSpeculator.com, told INN on July 24. "So I'm extremely bullish on copper. All those reasons to be bullish on copper are still on the table in front of us."

As for his thought on where the copper price will go, Tiggre said, "When I first made the call, copper was around US$4 or something, and now (we're) at US$5, almost US$6—and all of that tailwind is still to come and push it higher."

Between now and 2030, the global copper market is predicted to reach US$339.95 billion (US$339.95B) in size by 2030, up from US$241.88B in 2024, according to Grand View Research. This expected change in the forecast period reflects a 6.5% compound annual growth rate.

The construction, electrical and industrial sectors are the primary drivers of the copper market growth, the research firm wrote. The urbanization and infrastructural expansion, particularly in Asia Pacific and Latin America, is requiring more copper for wiring, plumbing and building materials. Also boosting consumption of the red metal is the world's transition to renewable energy and electric mobility. Technological innovations in electronics, 5G infrastructure and smart devices is accelerating copper demand, too.

The Catalysts

In the near-term for Kobrea, the company noted, investors should watch for completion of its infrastructure and camp construction at El Perdido and the subsequent start of its inaugural drill program at the property. Drill results will follow.

"At an Excellent Point to Buy"

When Analyst Maund reviewed Kobrea's stock from a technical standpoint in May, he recommended it as an "immediate Strong Buy for all time horizons." At the time, the stock was at strong support at a cyclical low in a heavily oversold state, he noted, where it was expected to stabilize before beginning its predicted ascent.

"[KBX] is looking most attractive at this juncture," Maund wrote. "This is an excellent point to buy Kobrea Exploration or add to positions in it."

The analyst noted a band of resistance around CA$0.45 and noted it was the first target for an advance. Kobrea's share price, as of the July 29 market close, already had surpassed this target by $0.08. The next target, according to Maund, is between CA$0.64 and CA$0.67.

Ownership and Share Structure

According to Refinitiv, two insiders own 8.52% of Kobrea. They are Vice President of Exploration and Director Rory Ritchie with 4.3% and CEO and Director James Hedalen with 4.22%.

The rest is in retail as there are no institutional investors at this time.

The company has 35.52 million (35.52M) outstanding shares and 32.49M free float traded shares. Its market cap is CA$11.93 million. Its 52-week high and low are CA$0.80 and CA$0.25 per share, respectively.

| Want to be the first to know about interesting Gold and Copper investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |