Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC) announced an increase to its non-brokered private placement, now targeting aggregate gross proceeds of up to US$950,000. The offering consists of flow-through units and non-flow-through units, each priced at US$0.015. Each unit includes one common share and one common share purchase warrant, exercisable at US$0.05 for a period of 36 months from the issue date.

The company stated that the proceeds will be allocated to the exploration and development of its Snegamook and Harrier uranium projects located in the Central Mineral Belt of Newfoundland and Labrador, Canada, as well as for general working capital. Azincourt noted that funds will not be used for payments to non-arm's length parties or investor relations activities.

Flow-through shares issued in the offering will qualify as "flow-through shares" under the Canadian Income Tax Act, with proceeds to be used for eligible exploration expenditures. The company intends to incur or be deemed to incur qualifying expenditures by the end of 2026 and renounce them to initial purchasers by December 31, 2025. The offering remains subject to customary closing conditions, including conditional approval from the TSX Venture Exchange.

Uranium Sector Constrained by Supply Challenges and Shifting Policy Landscape

The uranium exploration and development sector continues to navigate complex supply-demand dynamics shaped by evolving policy priorities and structural demand growth. According to the World Nuclear Association, global mine production accounted for approximately 90% of uranium requirements, with the balance met through secondary sources such as recycled material and stockpiles. The Association observed that while spot uranium prices recovered between 2003 and 2009, they have remained subdued in the years since, stating that “the price cannot indefinitely stay below the cost of production.” The Association’s 2023 Nuclear Fuel Report projected a 28% increase in uranium demand between 2023 and 2030, driven by the long-term nature of nuclear power generation, which is less sensitive to short-term economic fluctuations.

In a July 14 market commentary, Sprott reported a sharp rebound in uranium prices and equities during June. Spot uranium rose 9.99% to US$78.56 per pound, while uranium mining equities gained 18.19%. The firm attributed this momentum to renewed institutional investment and supportive policy developments in the United States and Europe, including the World Bank’s decision to lift its ban on nuclear project financing and the preservation of U.S. tax credits for nuclear energy. “World Bank and global governments are turning pro-nuclear, boosting the long-term uranium demand outlook,” Sprott wrote, also noting the influence of artificial intelligence infrastructure, with over 28 gigawatts of nuclear-linked capacity announced to support data centers.

Crux Investor also published a report on July 14 that highlighted ongoing challenges facing the sector. Although political support for nuclear energy has improved regulatory conditions, uranium prices remained below the levels typically required to incentivize new production. Crux noted that prices near US$65 per pound fall short of the US$100 threshold often cited as necessary for new supply to come online. Term contracts were being signed at prices above US$80 per pound, reflecting utilities’ willingness to secure supply, but long-term production constraints remain, particularly as high-grade reserves are depleted and processing infrastructure remains limited.

The report also pointed to rising interest in domestic uranium supply within North America, driven by geopolitical considerations. “Domestic uranium commands premium pricing due to supply chain security concerns,” Crux stated, highlighting the strategic advantage of U.S.-based sources. Utilities, the publication added, are increasingly focused on securing reliable domestic supply, particularly as demand from data centers and national infrastructure expands.

As reported by Discovery Alert on July 23, uranium companies across the value chain are realigning strategies to capitalize on renewed momentum in the sector. Exploration-stage firms are expanding drill programs in historically underexplored districts, while near-term developers are securing offtake agreements and optimizing project economics to address tightening supply timelines. Established producers are leveraging existing infrastructure to scale output efficiently and maintain consistent delivery to utilities. Across the sector, management teams are placing increased emphasis on jurisdictional stability, technical de-risking, and ESG performance, recognizing that investor appetite is now closely tied to both execution capability and geopolitical alignment. This strategic repositioning reflects a broader shift in how nuclear energy is viewed—no longer as a fringe alternative, but as a central pillar of global energy security and decarbonization policy.

Uranium Project Pipeline Positioned for Development

Azincourt's current focus includes the Snegamook and Harrier Projects, which together comprise a 49,400-hectare land package in a historically underexplored yet geologically active uranium district. According to the company's April 2025 corporate presentation, the Snegamook Project hosts twelve previously identified uranium mineralization zones with historical grades up to 7.48% U₃O₈. Azincourt acquired the Snegamook Deposit in October 2024 and has outlined plans to launch a drill campaign to verify and expand prior results.

The Harrier Project, adjacent to Snegamook, includes newly identified high-grade prospects and remains largely unexplored. Both projects are situated in proximity to large-scale uranium discoveries such as Paladin Energy’s Michelin Deposit.

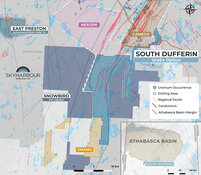

The company is also advancing the East Preston Project in Saskatchewan's Athabasca Basin, an area recognized for its high-grade uranium resources and stable regulatory environment. Exploration at East Preston has revealed uranium enrichment and hydrothermal alteration zones indicative of basement-hosted uranium systems.

Azincourt indicated that the increased funding will support its plans to digitize historical data and prepare for new drill programs. The company described its approach as focused on strategic acquisition and development of clean energy fuel projects in Canada's uranium-rich jurisdictions

Analysts Highlight Strong Technical and Exploration Momentum for Azincourt Energy

Technical Analyst Clive Maund expressed a favorable outlook on Azincourt Energy Corp. in a May 13 commentary shared with Streetwise Reports, citing technical indicators that pointed to strong upward momentum. According to Maund, the company’s stock formed a flat base between August 2024 and March 2025, followed by a breakout on increased volume, which he described as a bullish signal. The subsequent pullback to the top of the base was identified as a typical technical "buy spot," often seen before a second leg higher. He also noted that the stock’s accumulation line reached new highs despite a brief decline in price, which he interpreted as a sign of continued investor interest. Maund rated the stock a “Strong Buy,” citing the potential for a sizable second uptrend.

On May 14, Red Cloud Securities issued a research update maintaining a “BUY (Speculative)” rating on Azincourt Energy. Analyst David A. Talbot pointed to the company’s expanded 49,400-hectare land position in Labrador’s Central Mineral Belt, calling it “one of the largest land positions in the CMB” with considerable exploration upside. Talbot emphasized that the Harrier Project included multiple high-grade uranium surface samples, with values up to 7.48% U₃O₈, and noted that only 124 drill holes had tested the property to date. He added that 14 mineralized zones had been identified across Harrier, including the Moran Heights area, where historical surface samples showed grades up to 7% U₃O₈.

Talbot described Azincourt’s strategy of combining the Harrier and Snegamook projects as a move to enhance geological continuity and guide future exploration. He stated that reconnaissance work planned for 2025 would support the definition of drill targets in 2026. The report also noted that Azincourt trades at a discount to peers, citing an enterprise value of CA$8.4 million compared to a sector average of CA$105.8 million.

While the East Preston Project in Saskatchewan may receive less near-term focus, Talbot explained that the company’s renewed interest in Labrador aligns with management’s goal to prioritize uranium targets with more immediate exploration potential. Red Cloud concluded that exploration success could drive future stock performance, maintaining its speculative BUY rating as of May 14.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC)

Ownership and Share Structure

According to Refinitiv, insiders and institutional investors own 0.9% of Azincourt Energy. President, CEO and Director Alex Klenman is the major shareholder, with 0.39%. Other insider shareholders are Director Paul Reynolds and Vice President of Exploration Trevor Perkins.

Institutional investors are Arrow Capital Management LLC and Tidal Investments LLC. The rest is in retail.

Azincourt has 390.54 million (390.54M) outstanding shares and 387.5M free float traded shares. Its market cap is CA$7.14M. Its 52-week range is CA$0.01–0.45 per share.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Azincourt Energy has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Azincourt Energy

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.