Liberty Gold Corp. (LGD:TSX; LGDTF:OTCQX) appointed four senior technical leaders to its management team to accelerate its Black Pine gold project in Idaho through feasibility, permitting and to a construction decision, reported Paradigm Capital Analyst Lauren McConnell in a July 22 research note.

"We view this as a critical and positive step in Liberty Gold's transition from explorer to developer," McConnell wrote. "The newly expanded technical team significantly reduces execution risk as Black Pine moves into a decisive stage."

Stock Undervalued

Liberty is trading at a deep discount to its Takeover Twenty peers, noted the analyst, at only $31 per ounce ($31/oz) and at 0.05x price:net asset value versus the peer median of $46/oz and 0.11x, respectively.

"Liberty continues to be one of our favorite development names," McConnell commented.

Additions to Team

In her report, the Paradigm analyst presented each of the new appointees:

Tyler Cole, Liberty's vice president of project development, will lead completion of the Black Pine feasibility study and related engineering, procurement and construction management work. A mining engineer, Cole has worked for Kinross Gold Corp. (K:TSX; KGC:NYSE), Evolution Mining Ltd. (EVN:ASX; CAHPF:OTCMKTS) and Worley Ltd. during his 20 years of experience.

Richard Zaggle, Liberty's senior director of mining and metallurgy, will direct processing, metallurgy and mine-to-mill integration. Previously with SSR Mining Inc.'s (SSRM:NASDAQ) Marigold, Cripple Creek and Victor mines, Zaggle has extensive heap leach and flowsheet optimization experience.

Owen Nicholls, as Liberty's director of technical services, will oversee the feasibility resource model, grade control systems and integration of geotechnical/hydrogeological programs. Formerly, Nicholls was the U.S. exploration manager at Equinox Gold Corp. (EQX:TSX; EQX:NYSE.A) and vice president of exploration at Argonaut Gold Inc. (AR:TSX).

Charles Mumford will serve as Liberty's senior environmental and permitting specialist, leading environmental compliance and permitting. Having worked previously at SLR Consulting and the U.S. Bureau of Land Management, he knows the National Environmental Policy Act (NEPA) process well.

"These hires deepen Liberty's in-house capabilities across engineering, metallurgy, permitting and operations, effectively rounding out a fully formed 'owner's team' ahead of key milestones," McConnell wrote.

Project is Takeout Target

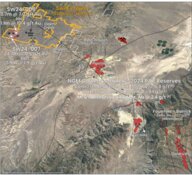

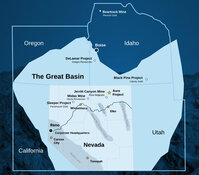

McConnell pointed out that Black Pine is an ideal takeout target, "offering scale, permitting momentum, heap-leach simplicity and meaningful reserve growth potential." Paradigm considers Black Pine a strategic gold project, open pit and heap leach with 3,100,000 ounces in Proven and Probable reserves and a 17-year mine life. Its economics are strong with an after-tax net present value (NPV) of $550 million and an internal rate of return of 32%, at a $2,000/oz gold price, according to the prefeasibility study. At $3,000/oz gold, the NPV is $1.7 billion. Located in Idaho's Great Basin, Black Pine has secured water rights, grid power and minimal environmental, social and governmental hurdles.

"[The company] currently ranks No. 1 in our Takeover Twenty screen," McConnell wrote.

What to Watch For

A handful of upcoming events could boost Liberty's stock price, noted McConnell. They are an updated feasibility resource model, expected in Q4/25; completion of the feasibility study in H2/26; progress with NEPA and state permitting, started earlier this year; preparation for a construction decision in late 2027-early 2028; and ongoing drilling (about 40,000 meters for the feasibility study are underway).

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |