Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC) released the findings of compilation work done on the newly expanded, 49,400-hectare Harrier project in the Central Mineral Belt (CMB) of Canada's Labrador province, on which the company has an earn-in agreement to fully acquire, reported David Talbot, head of equity research at Red Cloud Securities, in a May 14 research note.

"With the recent Harrier option in the vicinity of its existing Snegamook deposit, Azincourt has a long exploration runway, with a lot of showings to cover and a lot of high-grade smoke," Talbot wrote.

Undervalued, Buy Rated

Red Cloud maintained its Buy rating and no target price on the uranium explorer, noted the analyst. At the time of Talbot's report, Azincourt was trading at about CA$0.03 per share at a discount to peers. The company's enterprise value is CA$8.4 million (CA$8.4M) whereas that of its peers is CA$105.8M.

"We believe that positive exploration results should help drive the stock in the near term," Talbot wrote.

Highly Prospective, Unexplored

Harrier is one the largest land positions in the CMB, and it remains unexplored, explained Talbot. The only drilling ever done at the property was 124 holes over 19,851 meters, mostly at Snegamook. The little amount of historical drilling translates to excellent discovery potential in one of the best regions for uranium mineralization, according to Azincourt's management.

Harrier has a project area encompassing 14 mineralized zones, and high-grade U3O8 was identified in several spots throughout it. Surface samples from the area returned up to 7.48% U3O8. Ten of the 14 zones host 1%-plus U3O8. Numerous showings are on trend with ATHA Energy Corp.'s (SASK:TSX.V; SASKF:OTCMKTS) Moran C Lake, with a 9,600,000 pound (9.6 Mlb) resource, and Anna Lake, with a 4.9 Mlb resource. The Moran Heights prospect at Harrier, for instance, showed up to 5% and 7% U3O8 on surface. A few other outcrop and boulder showings are noted between regional rock packages.

"Azincourt is excited about this area with lots of work to be done," wrote Talbot. "This includes new boulder discoveries of up to 3% [U3O8] from last year. The area also has copper potential."

Next Steps/Catalysts

Talbot reported that this summer, Azincourt will do reconnaissance work at Harrier to identify drill targets. Next, year it will drill, targeting the Moran Heights and Boiteau prospects that together host four of the 14 mineralized areas at Harrier. The goal will be to turn targets and showings into zones and deposits. Also, Azincourt will consider a resource estimate for Snegamook with the intention of combining it with Harrier into one property for easier geological interpretation.

"We expect management to start working in the vicinity of higher-grade uranium showings," noted Talbot.

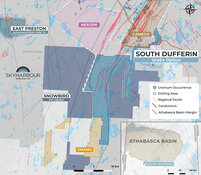

After spending about $10 million ($10M) on exploration at East Preston without making a discovery, Azincourt has chosen to switch focus to Labrador for the time being. The company may at some future point carry out further work at East Preston or opt to monetize it with a joint venture-type earn-in arrangement.

Now working on an entirely different project, Azincourt should be able to raise capital more easily, in management's opinion. The company likely will need to do so before drilling next year, given it has about CA$1–1.5M in cash now.

The Canadian explorer does have to spend a certain amount on work at Harrier, according to its earn-in agreement, but this should be easily done given the high number of showings there. The company said that these commitments are divided into phases over four years and thus are reasonable.

Next Canadian Uranium Camp?

Azincourt also believes the CMB, itself underexplored, could be Canada's next emerging uranium camp, noted Talbot. The jurisdiction is stable and home to many uranium discoveries. Other prospective regions, in the Far North, are too remote.

"There is already some critical mass in the [CMB], thus some of these emerging deposits may help push the entire district forward towards development," the analyst pointed out.

Other Stock Data

Talbot reported that Azincourt's shares outstanding amount to 374.3 million, its market cap is CA$9.4M and its 52-week range is CA$0.01–0.05 per share.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |