For the better part of the past two years, I have been lambasted by the silver bulls for ignoring gold's poor little red-haired, freckle-faced cousin that has been sitting in the corner of the precious metals classroom, sucking its thumb while seeking redemption. The mainstream media would have us believe that gold has been the best in terms of performance since the pandemic lows, but as you will soon learn, that is not exactly the case.

This week ended as a watershed of sorts with silver finally making a bold statement, moving up and away from that dogged resistance in the US35-36 range. It closed at US$39.08, up nearly 5% in a single session on massive volume as shorts scrambled for cover and those underweight investors were launched into "panic buying" mode. "FOMO" has finally arrived in the silver arena, and it is a wonderful way to not only end the week but also to celebrate the revival of the precious metals bull.

I have been speaking about the importance of the gold-to-silver ratio (shown below) for most of 2025, having watched it spike to over 100 back in late April when gold reached the all-time high above US$3,500, but absent the support and company of silver, which stayed disturbingly quiet. I said back then that I thought silver would eventually break out above the US$35-36 resistance but that it was also vulnerable to a knee-jerk bearish reaction to the US$32 level that could also fail, taking silver to the US$26.50-27.00 range before making another assault on US$35-36.

Contributing to this week's fine silver action was the performance of copper which hit a record high of US$5.8955 after the Trump Administration announced a 50% tariff on all imported copper products which was a clear message to the liberal-left, tree-hugging woke-ites that if they continue to deny permits for exploration and development for the copper companies, the price of all copper-sensitive products including refrigerators, cell phones, EV's, and toasters will all be marked higher which is not exactly the optimum preferred course for keeping a lid on inflation.

Whenever government gets in the way of commodity exploitation, shortage conditions are just around the corner because money always flees from projects and industries that are mistreated by the mindless "social consciousness" of those that get all of their daily information from a hand-held device that is comprised of no fewer than 20 key mineral-based components that are usually sourced and manufactured from abroad. Trump's intent is to force lawmakers into allowing the full exploitation of Federal lands for what are deemed "critical metals," and that is a brilliant move, and with his current approval level at astonishing levels, I would think he will get it done.

The move in copper ignited "animal spirits" in the speculative arena as Bitcoin exploded higher followed by an immediate response in gold (+US$44.80 on Friday) and then the demand-driven explosion in the only non-crypto metal anointed by the "kiddies" as their "Chosen One" — silver — decided to take over the controls of the aircraft carrier and showed everyone why it has a tendency to dominate the market narrative once it assumes the position.

Gold and copper bugs like me find themselves "shocked, I tell you, SHOCKED!" that since the pandemic lows in March 2020, the one metal that has blown everyone to pieces is not platinum or gold or copper, it is silver.

I have been a perennial skeptic on silver, not because I don't own it or because I don't like it. The graphic at the top of this publication is one of 57 100-ounce bars I bought in 2013 when it was at CA$17 (US$13/oz.) in a fit of sublime anger after the Sunday Night Massacre orchestrated by the Indian Central bank in concert with every other central bank on the planet that was watching deposits desert their vaults in favor of silver and gold. What I have learned over the years is that silver moves on raw, retail demand and not on central bank "allocations" or "newsletter advisory" touts or "email blast marketing efforts."

We have listened to the silver bugs on the various YouTube formats laud and applaud the wonderment of silver since 2020, and for the most part, they have been correct, albeit somewhat "early" as silver has been a laggard until very recently.

I turned guardedly bullish in 2025 but have chosen to remain modestly committed until this week. It is my current belief that the bullion bank behemoths have finally thrown in the proverbial towel and are standing aside in favor of a better shorting/selling opportunity at some point in the not-too-distant future.

At what level will the bad guys step up?

I have no idea, but what I DO know is that they will indeed "step up" and that is the point. The bullion banks have avoided shorting gold with any type of serious conviction because they had a perpetual bid in the form of the central banks. They have been playing around in the silver pit since 2020, which is why we have a GSR at 87 instead of 55-60, because they had no opposition to their paper-sale antics, as in no central bank silver inhalation. However, once the retail crowd started climbing over the walls to clamor into silver, the behemoths scattered like scalded dogs. Today, from where I am perched, that is exactly what is happening.

The behemoths will never get a margin call, as will the plebes out there like you and me. However, they operate on a marked-to-market compensation scheme that allows them to gather monthly profits based on their P&L statement for the month. This past week, they were net short silver futures to the tune of 79,600 contracts at $5k per contract, with the price up $2.60 per contract. That means they are offside 5,000 X 79,600 X $2.60 = $1,034,800,000 by the Friday close. That is the weekly drawdown on a "marked-to-market" basis. I suspect that a major portion of today's move simply had to be short-covering, but then again, we will not know that until next Friday when we see the next COT report.

I own only two silver juniors (Carlton Precious Inc. (CPI:TSXV; NBRFF:OTCMKTS) and Silver North Resources Ltd. (SNAG:TSX.V; TARSF: OTCQB)), with the folks at SNAG currently running a CA$0.15 financing.

The silver bugs are now fully-engaged, enlivened, and enthusiastic about the future pricing potential for the shiny metal and it there is one thing has been lodged in my septuagenarian memory banks since 1979-1980, it is that when the silver bugs get thir way, the moves in the junior silver stocks are at once mind-boggling and awe-inspiring.

Copper

The weekly chart of copper dating back to the Covid Crash lows is an impressive-looking structure and an accurate rendering of the U.S. economy during that five-year period. You can see the impact of the 2022-2023 Fed tightening campaign and then the immediate lift in 2024-2025 as conditions stabilized.

However, despite relatively high levels for the 10-year during the last 24 months, which includes the insane volatility of the Tariff Tantrum in April, the global copper demand-supply imbalance has resulted in all-time highs this week spurred on largely by the 50% tariff imposed on copper imports by the Trump Administration despite a rally in the U.S. dollar from it oversold condition last week.

As I wrote in my newsletter on Wednesday after the copper tariff was announced: "The spike in copper prices yesterday to $5.8845 in response to the "50% tariff on all imported copper products" threatened by the White House is what I consider a "tail event" and therefore will not have a lasting bullish effect on prices. While I am a long-term bull on copper for the balance of the decade, traders are cautioned against chasing this advance as it resembles the April 7 response to the Trump tariff threats, which turned out to be a buying opportunity with markets correctly assuming that the "Trump Tariffs" were all sizzle and no steak. If that turns out to be a similar outcome for copper, then it will have an opposite effect on copper prices and therefore should be faded on the assumption that demand will fail to keep pace with supply once the tariff threat is either absorbed by the market or abandoned."

While that statement was not a call to abandon the copper trade completely (by dumping all positions in copper), it was a cautionary call to avoid chasing the spike. Back in 2022, I went bullish on copper and used two companies as the backbone of portfolio positioning: Freeport-McMoRan Inc. (FCX:NYSE) at around the $27 mark (currently $46.36) as a blue-chip component and Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) (then Norseman Silver) in the sub-CA$0.10 range (currently CA$0.33).

I have been trading in and out of FCX but have stubbornly held onto every share of FTZ/FTZFF on the assumption that the junior copper developers will have a long way to go on the journey to $15,000 m/t copper.

In pounds, that is $6.8058, and at levels above that, new mines are going to be coming on stream as CAPEX requirements can be comfortably amortized over LOM ("Life of Mine") with prices at or above that level.

More importantly, the mega-producers like BHP and FCX are not going to spend their free cash flow exploring for new sources of supply; they are first going to acquire all of the low-hanging fruit (Tier One deposits) owned by the junior developers.

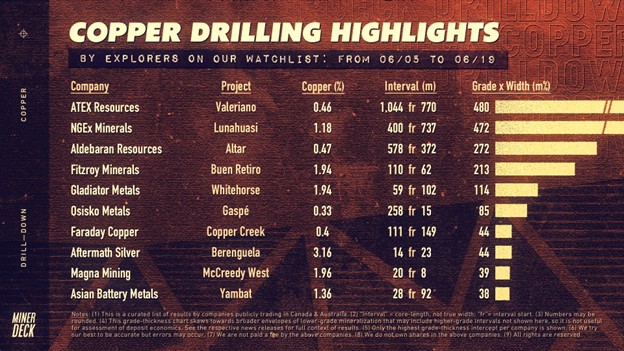

Therein lies the reason that companies like ATEX Resources Inc. (ATX:TSXV), Osisko Metals (OM:TSXV), Marimaca Copper Corp. (MARI:TSX), and NGEx Minerals Ltd. (NGEX:TSX) have been highlighted for "copper drilling highlights."

For the week ended June 19, Fitzroy Minerals stood fourth on the totem pole with the Buen Retiro hole #22 that yielded 110m of 1.94% Cu.

Intercepts like the ones shown below are what place them squarely on the radar screens of the major miners and as copper prices continue to rise, the sense of urgency in acquiring a few (or all) of these names will join the ascent.

My "trader's instinct" tells me to stand aside from the chase of copper enrichment and instead wait for the inevitable pullback that always shakes the latecomers out at the first sign of weakness.

A case in point would be the April 7 "Tariff Tantrum," where copper got puked back to $4.00 after touching $5.199 one week earlier. I see copper prices moving well above the $15,000 m/t level before the end of the decade because with these data warehouses going up literally everywhere in ever-increasing numbers and scale, the electrical grid the world over Is going to be requiring massive amounts of copper to allow the electricity to flow freely to these gargantuan data farms.

Supply will be unable to catch up to that demand until well into the next decade, and that disequilibrium will be the price driver that motivates the major miners into a buying panic in those juniors with resources. It is a good time to own copper, but on pullbacks under $5.00/lb.

Stocks

I usually reserve the section on U.S. equity markets for the beginning of the weekly missive, but this week it belongs resolutely at its terminus.

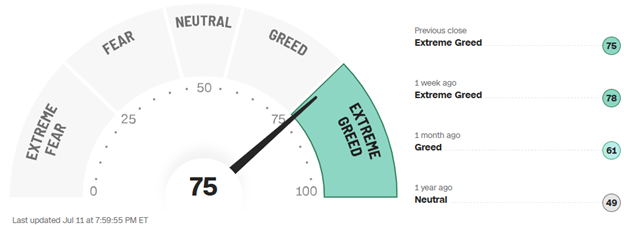

The last time we had this indicator locked squarely in the <EXTREME GREED> zone was back in February with the S&P 500 at record highs. In fact, sub-components of this indicator, including stock price strength, breadth, put-call ratio, and junk bond demand, are all in the same zone — <EXTREME GREED>.

One of the sentiment indicators I use lies in the level of jocularity between the CNBC anchors. While I rarely watch Bubblevision TV these days, it is always informative when you flick on that raving band of capitalist cheerleaders masquerading as a "financial news network" on days like April 7, when you could cut the panic with a knife as anchor Sara Eisen must have said 10 times in the first hour that "Stocks are off the lows!!!!".

That day, I counted zero smiles and not one instance of laughter as stocks careened downward into the panic selling brought on by those dastardly tariffs. Contrast that with last Wednesday with the NASDAQ 100 hitting record highs and Nvidia Corp. (NVDA:NASDAQ), trading through a record $4 trillion market cap for the first time ever for an American publicly-traded company. Sara Eisen must have flashed the NASDAQ news twenty times by noon hour and was actually breathless as she marveled at NVDA's amazing accomplishment.

Now, just as the frowns and growls and tears from the anchor desk at CNBC on April 7 marked the lows for the correction, it is my considered opinion that the celebratory air from this past week will mark a top for not only prices but also sentiment. Not only has this rally been fueled by the largesse contained in Trump's "Big, Beautiful Bill" where it is "more of the same" in the from of tax cuts for the elite class and perks, subsidies, and stimuli for the corporate class, it virtually ensures that budget deficits will continue to grow like a fairy-tale beanstalk to the heavens and beyond.

I could be a tad early in my call on U.S, equities but if history (and CNBC smiles and giggles and high-fives) are any indication of an impending reversal, then the next major move is not going to be to 6,900 for the S&P as is being trumpeted by the Goldman's of the world but rather a downward move reflecting the collapsing U.S. dollar, the weakening U.S. economy, the rollover in the U.S. labor markets, and absurdity of the averages being dominated by basically three companies — NVIDIA, Microsoft, and Meta (Facebook).

The old adage about inflation is that "the cure for high prices is high prices," but that also applies to stock prices as well. "FOMO" ("Fear Of Missing Out") is a contagion that always manifests itself at or near major tops, be that in stocks, bonds, commodities, cryptocurrencies, cannabis, or Trump hairpieces. They are feasting mightily in the unregulated casino called Wall Street, and when wine, women, and song dominate the narrative, it is time to head for the exits.

| Want to be the first to know about interesting Copper, Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Silver North Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver North Resources Ltd., Carlton Precious Inc., and Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.