Golden Sky Minerals Corp. (AUEN:TSX.V; LCKYF:OTC) announced that its Board of Directors has approved the issuance of incentive stock options to purchase a total of 245,000 common shares. The options have an exercise price of CA$0.15 per share, vest immediately, and are valid for a five-year term. According to the company, the options were granted to directors, officers, and consultants as part of its equity incentive plan.

Golden Sky's exploration portfolio includes the Rayfield Property in British Columbia and has been surrounded by two of the top mining companies in the world, the Lucky Strike and Hotspot Properties in Yukon, and the Auden Project in Ontario, which is on trend with the now producing Equinox Gold new mine.

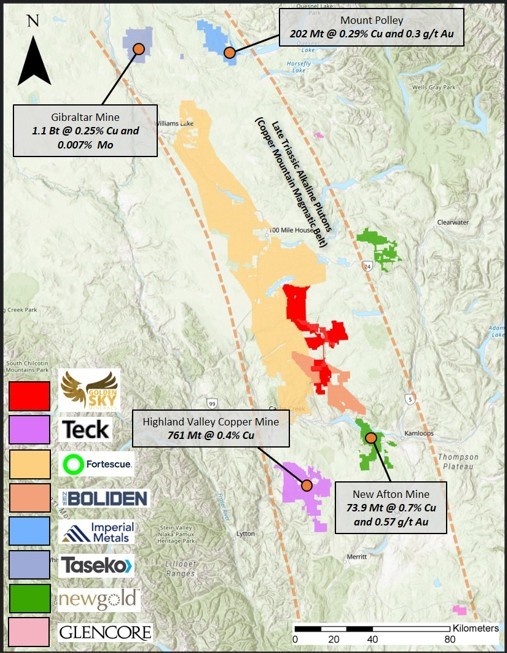

These projects are located in historically productive and mining-friendly regions, such as the Quesnel Trough, Timmins, Ontario, and White Gold District, and are 100% owned by the company with no underlying royalties or payments.

Golden Sky's exploration portfolio includes the Rayfield Property in British Columbia, the Lucky Strike and Hotspot Properties in Yukon, and the Auden Project in Ontario.

These projects are located in historically productive and mining-friendly regions, such as the Quesnel Trough and White Gold District, and are 100% owned by the company with no underlying royalties or payments.

Gold Sector Steadies Above US$3,300

Gold prices rose sharply in 2025, driven by sustained global demand and economic uncertainty. On June 27, Catherine Brock of Yahoo Personal Finance reported that gold futures opened at US$3,341.30 per ounce, representing a 45.5% year-over-year increase from US$2,296.80 on the same date in 2024. Prices briefly pulled back but remained near record levels. Brock cited consistent retail demand for physical metals — particularly bars and coins — as a key factor, noting that "gold, silver, and platinum are all up more than 22% so far in 2025."

Further insights in early July underscored gold's continued appeal. On July 1, Stewart Thomson of Galactic Updates described gold as "supreme money" and pointed to U.S. debt levels as a contributing factor. He identified an ascending triangle pattern on technical charts with a potential breakout target of US$3,800 per ounce and emphasized that momentum indicators were "poised to flash a thunderous buy signal." Thomson also noted increasing demand from China and India, which he suggested could influence sentiment in Western markets.

On July 2, Pretiorates examined recent ETF flows and investor behavior, noting that gold's consolidation since April pointed to underlying strength. While Chinese institutional investors were reportedly net sellers in recent weeks, renewed interest from Western investors appeared to offset that trend. Rising ETF holdings in the U.S. and Europe supported this view. Pretiorates flagged a notable reading from their Smart Investors Action Indicator, describing a pattern of strong action amid heavy selling — historically a bullish signal. They concluded, "It is not the Chinese who are keeping the Gold price up, but increasingly Western private investors."

Gold continued to trade above the US$3,300 level in early July. On July 7, futures opened at US$3,344.50 per ounce, up 0.4% from the previous close and 2.4% above the June 30 opening price of US$3,265.90, according to Yahoo Finance. Investor caution ahead of an expected July tariff announcement from President Trump appeared to support demand. The proposed reciprocal tariffs — ranging from 10% to 70% — are set to take effect August 1. Since the initial proposal on April 2, gold futures have gained 7%, reinforcing the metal's role as a hedge against geopolitical and policy-related risk.

Analysts Highlight Strength in Golden Sky's Uptrend

On July 5, Robert Sinn of The Charts Of The Week featured Golden Sky Minerals Corp. as a company highlighted in his analysis of junior mining stocks. Sinn reported that shares of Golden Sky had gained nearly 20% during the previous week, marking the fifth consecutive weekly increase. He noted that the company's stock had doubled from its March low, stating, "The volume expansion since mid-April helps to confirm the nascent uptrend." According to Sinn, technical indicators such as the Commodity Channel Index (CCI) and Relative Strength Index (RSI) "confirm that a strong trend is taking shape in AUEN shares."

Sinn also commented on Golden Sky's valuation, observing that the company maintained a modest CA$3 million market cap even after the recent rally. He referenced the April 24, 2025 announcement of a CA$220,000 strategic investment into the company by Rob McEwen, which he highlighted as a notable development in Golden Sky's progress.

Operational Momentum Across a Diverse Exploration Portfolio

Golden Sky's corporate presentation outlines a systematic approach to exploration, targeting high-potential areas for gold and copper mineralization. The Rayfield Property in southern British Columbia covers approximately 35,000 hectares and features multiple copper-gold porphyry target zones. Historic drilling at the site has identified shallow mineralization, and a 3,000-meter drill permit remains pending.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Golden Sky Minerals Corp. (AUEN:TSX.V; LCKYF:OTC)

In Yukon, the Lucky Strike and Hotspot Properties lie within the White Gold District, known for recent multi-million-ounce discoveries. At Lucky Strike, trenching and drilling have yielded gold values including 5.36 g/t over 22 meters. The Hotspot Property has produced drill intercepts such as 1.34 g/t gold over 71.6 meters and features geological characteristics similar to the Round Mountain deposit in Nevada.

Golden Sky's strategic focus remains on advancing these assets through early-stage exploration, supported by its capital position and experienced technical team. The company describes its assets as being "strongly undervalued" relative to their potential within Tier-1 jurisdictions.

Ownership and Share Structure

According to Refinitiv, the institution, Crescat Capital, owns 13.34%. Individual investor John Newell holds 5.29%. The rest is retail.

The company has a market cap of CA$2.74 million with 16.68 free float shares.

The 52 week range is is CA$0.075 to CA$0.13.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Golden Sky Minerals Corp.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.