Ever wondered which business tops the profitability charts worldwide?

It's not the tech giants you might expect — not Apple Inc. (AAPL:NASDAQ), Microsoft Corp. (MSFT:NASDAQ), or even Nvidia Corp. (NVDA:NASDAQ).

The crown belongs to a cryptocurrency company.

Tether (USDT) generated an astonishing US$14 billion in earnings during the previous year with a mere 150 staff members. That calculates to US$93 million per employee. No other corporation even approaches this figure.

Consider that industry powerhouse Nvidia produces "only" US$2 million per employee.

Tether is the Organization Behind USDT.

USDT stands as the biggest and most widely used stablecoin globally.

Stablecoins function as digital dollars that travel across blockchains and maintain a 1:1 ratio with American dollars.

For years, I've maintained that stablecoins represent cryptocurrency's breakthrough application.

They essentially provide everyone worldwide with immediate access to a U.S. dollar banking account. They can be dispatched anywhere globally in just moments, continuously available year-round.

If you've ever questioned, "What practical value does cryptocurrency offer?" try this exercise with me.

Attempt sending funds internationally. Recently, I needed to execute a global wire transfer, and goodness, what a process. It extracted US$20 from my wallet and nearly 60 minutes from my day.

Then, attempt the same payment using stablecoins via blockchain networks. No banking institutions. No delays. Stablecoins offer a singular method to transmit US$10,000 to someone on the opposite side of the planet instantaneously, from your smartphone, costing less than a cent.

It's finance at internet speed.

During my time living in Argentina, locals attempting to escape hyperinflation would plead with me for dollars. Today, they can instantly exchange currency for "digital dollars."

Many discuss cryptocurrency replacing the U.S. dollar. Actually, stablecoins enhance the dollar's global position. However, I'm convinced they'll supersede the 100+ worthless currencies worldwide.

In Bolivia, certain grocery establishments now display pricing in USDT:

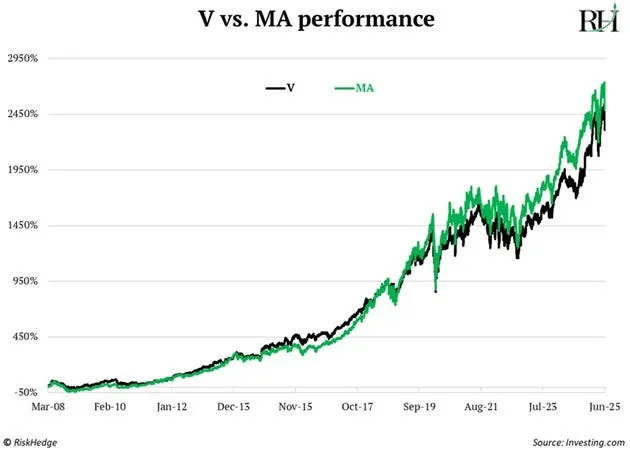

Visa and Mastercard Rank Among History's Most Successful Stocks.

Examine Visa Inc. (V:NYSE) and Mastercard Inc.'s (MA:NYSE) performance graphs.

Simply one record high following another. Truly two of the planet's greatest money-generating machines:

Visa and Mastercard control the payments landscape, handling trillions in card transactions annually. Everywhere I journey globally, I observe two things: Coca-Cola and Visa terminals.

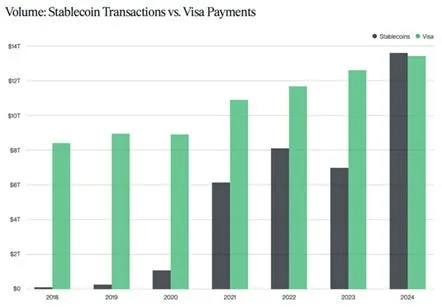

What if I revealed that stablecoin transactions just exceeded both Visa and Mastercard for the first time?

In 2024, stablecoin volumes reached US$14 trillion compared to Visa's US$13 trillion:

Wake up, folks. A financial revolution is unfolding.

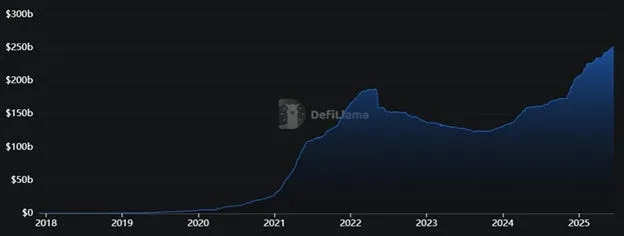

The quantity of stablecoins circulating also recently touched US$250 billion for the first time ever. We're heading toward US$1 trillion:

Tether's USDT dominates the stablecoin arena with approximately 70% market share.

Unlike money transfer services such as Western Union Co. (WU:NYSE), Tether doesn't burden you with fees.

It essentially operates a "money market" business structure.

Whenever someone purchases USDT, Tether invests that capital primarily in U.S. Treasuries. Then it harvests the yield.

Multiply that by US$155 billion in circulating USDT and presto, you have the world's most profitable enterprise.

Coming Soon: 'WalmartCoin'

The Wall Street Journal recently reported America's two largest retailers, Walmart Inc. (WMT:NYSE) and Amazon.com Inc. (AMZN:NASDAQ), are preparing to launch their own stablecoins.

Why surrender 2%–3% of every transaction to Visa when you can possess the payment infrastructure yourself?

Paying with WalmartCoin or AmazonCoin will soon become a checkout alternative.

This represents another example of stablecoins revolutionizing the financial sphere.

Payments giant Stripe recently acquired stablecoin platform Bridge for US$1 billion. And Shopify Inc. (SHOP:NASDAQ) now allows vendors on its platform to accept stablecoins and bypass card networks.

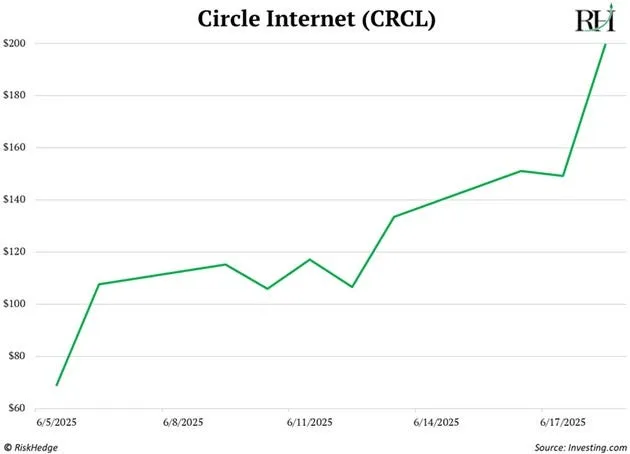

Tether's Primary Competitor Just Went Public. . .

Circle Internet Group Inc. (CRCL:NYSE) is the company behind the second-largest stablecoin, USDC.

Circle began trading a few weeks ago and soared like a rocket, tripling in value:

If Tether were publicly traded, I'd invest immediately. But I'd steer clear of Circle.

Initially, its business model appears identical to Tether's. It places its reserves into Treasuries and collects the yield.

But unlike Tether, Circle doesn't retain all its earnings.

It transfers a substantial portion of that revenue to Coinbase Global Inc. (COIN:NASDAQ).

USDC originated as a partnership between Circle and Coinbase. The crypto exchange remains the primary distribution channel for USDC. This allows Coinbase to collect half of USDC's interest income.

I'd much prefer owning Coinbase over Circle.

Circle launched impressively, but I doubt its sustainability. It will likely be purchased by Coinbase or a financial institution within the next 12—24 months.

What's the Simplest Way to Benefit From Stablecoins' Expansion?

Own the infrastructure.

As mentioned, approximately US$250 billion worth of stablecoins circulate today.

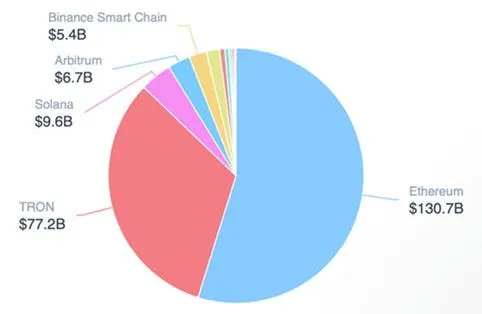

Over 60% of these transactions occur on Ethereum's (ETH) blockchain and its Layer 2 networks like Arbitrum (ARB).

Each time Ethereum's blockchain is utilized, a fee is paid.

During the past two years, stablecoin transactions alone have generated US$288 million in revenue for Ethereum.

As stablecoin volumes steadily increase, expect fee revenue to climb. That's beneficial for Ethereum and Ethereum holders, who can earn a portion of these fees by staking their tokens.

Stablecoins represent cryptocurrency's first breakthrough application, but certainly not the last.

Blockchain will transform numerous established industries in the years ahead.

For more insights, subscribe to my investing letter The Jolt.

I publish fresh research on stocks and crypto every Monday and Friday. Click here to subscribe.

| Want to be the first to know about interesting Cryptocurrency / Blockchain investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Stephen McBride: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.