In Greek mythology, "sirens" are creatures known for their captivating voices that lure sailors to their deaths. They are typically depicted as beings with the head and torso of a woman and the wings and lower body of a bird. Sometimes, they are portrayed with the lower body of a fish, like mermaids, but this is a later interpretation. Their alluring songs would cause sailors to abandon their ships and swim towards the Sirens, ultimately meeting their doom on the rocks surrounding the Sirens' island.

Since the Great Financial Crisis of 2008, the mainstream media has developed their own version of those "sirens" and that would be those men and women, cleverly disguised as "reporters," that serve as "cheerleaders" for the Wall Street crowd. They may not necessarily be sporting the lower body of a bird or fish and they may not always appear as mermaids, but they always carry those haunting voices that lure travelers on the seas of high finance to their rocky doom.

They are not always of the female persuasion either as CNBC's Fast Money guru Jim Cramer proved bank in 2008 when he told million and millions of panicky viewers that investment bank "Bear Stearns is fine. Bear Stearns is not in trouble . . . Don't move your money from Bear. That's just being silly." At the time Bear stock was quoted in the $62 range; five days later it was bailed out at the generous price of $2 per share. Investors sailing along on an ocean of extreme complacency took Cramer at his word and before they could say "charlatan," they found themselves dashed upon the rocks.

Another example of disingenuous drum-beating was the curious case of Dr. Benjamin Bernanke, then-Chairman of the Federal Reserve, who stated in early 2007 that the subprime mortgage crisis was "likely to be contained." He communicated this to Congress using his finest impression of Albert Einstein, detailing the early turmoil in the subprime market but suggesting its impact on the broader economy would be "limited."4

However, Bernanke later apologetically acknowledged that he and others had underestimated the extent of the crisis and the flaws within the financial system that amplified its effects. He admitted to failing to recognize how interconnected the financial system was and how problems in the subprime market could trigger a wider crisis. Nonetheless, it certainly did little to forewarn investors — American citizens — of the oncoming market crash in both stocks and housing and in fact took the form of the sirens' lilting voices breeding complacency while avoiding panic.

Here in 2025, with two major geopolitical skirmishes threatening to drag the Americans face first into the conflicts, we have the reassuring voice of Donald Trump soothing the bond markets with promises of tariff incomes reducing the deficits. Of all of the quasi-sirens of the past 40 years, his voice is the most dangerous as it can never be relied upon for either intent or veracity.

Instead, he is constantly appealing to his base, legions of MAGA-chanting riflemen (and women) that hang off his every word in the newfound belief in "America First, America First, America First!"

The irony in that haunting mantra is that since the end of WWII, America has conducted itself with self-interested priority in most matters involving foreign policy and even in instances where no policy was ever required. American interests have been at the forefront for nigh on 85 years and with its currency enjoying "reserve currency status" having replaced sterling since D-Day, the MAGA crowd are treating "America First!" as some kind of revelation or reawakening that lies somewhere between the ridiculous and the sublime.

Stocks

The capital markets in the U.S. are showing distinct signs of advancing age as delinquencies are rising in areas like credit cards and student loans. Retail sales are struggling and today the Philly manufacturing index came in at -4% versus the -1% expected.

It matched the previous months activity reading but here is what the Federal Reserve Bank of Philadelphia said:

"The data indicates that manufacturing activity in the region remains subdued, with signs of slowing demand and weakening labor market conditions. The new orders index declined, though it remained in positive territory, while the shipments index improved and turned positive. However, both metrics continued to trend below their long-term non-recession averages. Notably, the employment index dropped into negative territory, hitting its lowest level since May 2020, pointing to a contraction in factory jobs. Although price pressures eased somewhat, both input and output price indexes remain historically elevated. Meanwhile, the survey's forward-looking indicators suggest waning optimism, with fewer firms expecting growth over the next six months."

Despite weakening conditions across the continent, stocks continue to fight off any and all bearish opponents as even Jerome Powell confirmed on Wednesday's FOMC presser that economic conditions continue to be firm with little or no deviance in the labor market which is classified as being at "maximum full employment."

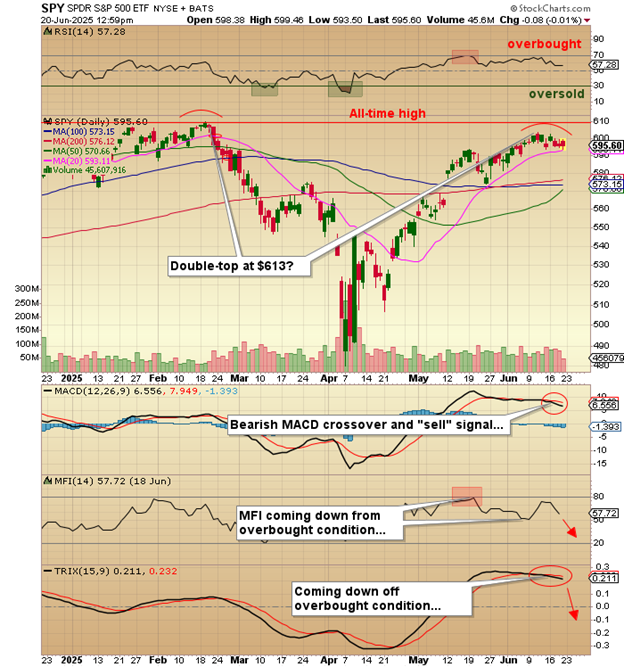

With the S&P 500 within an earshot (3%) of yet another record high, it would appear that money managers have spent the better part of May and June buying back all that stock they sold in the weeks following the "Liberation Day" bottom.

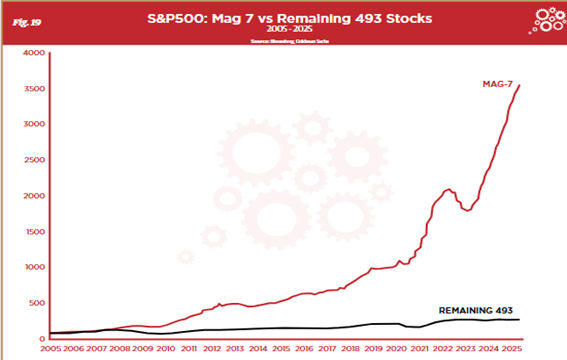

Short interest in the Mag Seven has now moved to virtually miniscule levels as hedge funds have fallen on thousands of proverbial swords in order to appear "fully invested" which usually denotes a top of sorts being imminent.

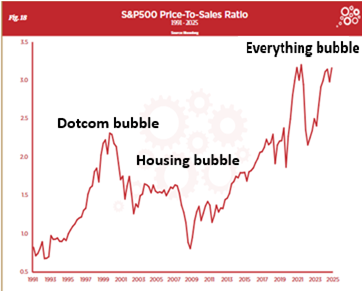

Look at the Price-to-Sales Ratio for the S&P500 dating back to 1991. When stock crashed in 2001 and 2008, the Sirens were singing lullabies to unsuspecting investors right up until the very end and that is exactly what they are doing today, with artificial intelligence stocks all clamoring for inclusion in the Nvidia Corp. (NVDA:NASDAQ) race to the top.

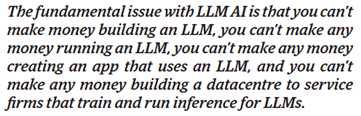

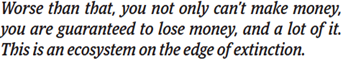

Most of the companies that comprise the Mag Seven group have found ways to capture inclusion into the "AI" family of wannabe's but the problem with "Large Language Model Artificial Intelligence" or "LLM AI" as it is called, is that, according to Andy Lees and Julian Garran of The Macro Strategy Partnership:

If that first salvo wasn't bad enough, they go further:

To describe AI as "an ecosystem on the edge of extinction" is nothing short of punctuative.

So, if the MAG Seven are the primary reason for the S&P being at record highs and if they got to record highs by tagging themselves as part of the LLM AI ecosystem, and if that ecosystem is on the verge of extinction, then, applying the commutative property of arithmetic to this sentence, the Mag Seven are on the edge of extinction.

If the weightings of the Mag Seven are responsible for tilting the S&P 500 into a deceptively high valuation point, there is no better illustration than the chart shown above. Those seven LLM AI adorned companies are so far above the rest of the pack that one has to wonder what would happen if the wheels fell off the AI bubble.

The bottom line is that stocks are over-priced, over-owned, and over-hyped. Going into month-end and into the less-friendly month of July, I want to own an ample portion of volatility by using calls on the VIX:US and a generous position in the double-leverage VIX Futures ETF (UVIX:US).

Gold (and Silver)

The month of June is typically a blasé month for the metals with particular angst levied upon the gold bugs but thus far for June, the price is up about $80 an ounce and is acting fairly well given the seasonality issues.

Mind you, I traded it like a hyperactive chimpanzee this week as my bet on a vigorous Irani retaliation to the Israeli air raids turned into dust as markets shrugged off geopolitical strife as if it was an Elon Musk tweet about the president. I exited the GLD August $315 calls for a 25% hit today in what can only be described as a "scrubbed" trade.

Mind you, I intend to re-enter the GLD:US calls hopefully around month-end because I am calling for $4,500 by year-end and the best time to buy gold according to Google is described here:

"The price cools down through the spring and summer, then takes off again in the fall. This means that on a historical basis, the best times to buy gold are early January, March, and early April, or from mid-June to early July."

I contend too that the junior gold developers and the silver explorers are going to catch a serious bid in the second half of the year. There is a ton of speculative capital on the sidelines looking for deals with no bigger example than one that my dear colleague "Freddie" (who strokes the keyboards for the incredible "Freddie's Corner" service) that graces the halls of the GGM Advisory with random "actionable ideas" from time to time.

This week on Monday pre-opening, "Freddie's Corner" featured Processa Pharmeceuticals Inc. (PCSA:US) , a junior pharma deal that had been rolled back recently such that there were only 11.8 million shares issued. The mighty-verging-on-immortal Freddie suggested to me that at $0.21 per share, it might be "an interesting speculation" so I forwarded it to my subscribers with my target price of US$0.75.

I should point out that a few months back, Freddie gave me a little gaming deal called Starlink Gaming (SBET:US) at $1.07 per share and while a few of us bought a few shares and forgot about it, May 30 we got the "nod" that it might be going into play.

Well, being the master of understatement, Freddie absolutely nailed it as the stock opened that morning at $124 per share. It took a few months to materialize but given the success of that "intel," I figured that PCSA would be a pretty good shot. Last Monday, the stock traded down to as low as $0.20 but by Tuesday's opening, the stock was at $0.58 and by 11:30, I had been taken out, lock, stock, and barrel of my 100k position at $0.75 per share!

A 270% ROI in less than twenty-four hours on volume of over 600 million shares!

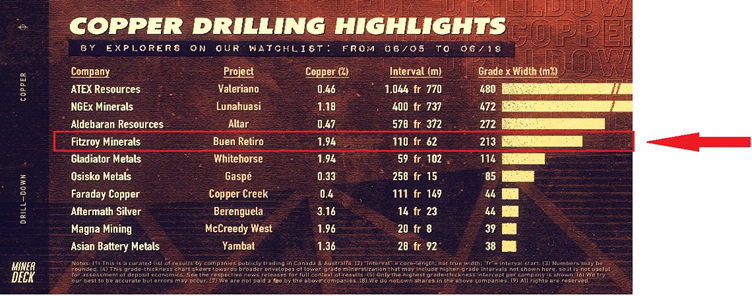

You want to know why the Canadian resource stocks are finding are tough time catching bids? Take one look at the speculative action in stocks like SBET:US and PCSA:US and you have the answer. Old baby boomers (like me) are wandering around the boardrooms of mining companies trying to grasp why drill holes like Fitzroy Minerals Inc.'s (FTZ:TSX.V; FTZFF:OTCQB) BRT-DDH022 (which was one of the richest drill core copper intercepts in recent memory) failed to ignite the FOMO crowd with massive volume leaps and breathtaking price advances. To the youthful legions of Millennial and Gen-X traders out there, nothing other than the "tape action" matters when it comes to chasing profits.

Just as they mastered the world of video games complete with exploding asteroids and Zombie car thieves, this generation cares not a whit about the "fundamentals" of any company. They care only about the "pin action" to the extent that when I ask one of them why they are buying Phoo-Phoo Pharmateck, the only response is "Stock's goin' up!" and when asked what business they are in, the answer is an astounding "Who cares?"

Now, many of my baby boomer trader buddies aren't a great deal different than their offspring but back in the day, the number of players that traded purely "off the tape" were few and far between.

Today (either sadly or not), they are everywhere. They trade from laptops in their parents' basements; they trade from their cell phones while sipping extra-hot, no foam lattes from Starbucks; they trade anything and everything as long as it has "action." They also move in swarms like locusts or flocks of birds in the marshes at sundown. They swoop down on the excitement of the "action"; take their positions; and exit with little flair and total confidence.

How many drill holes have excited the kiddies in that manner in the last ten years?

The kiddies swarm to an Elon Musk tweet far faster than they do an Eric Sprott silver podcast. Drill holes to this new generation are like cod liver oil at breakfast for the younger traders. They are addicted to the tape, the story, and the narrative as opposed to the assets, the value, and the discovery.

And they sit back and laugh at Grandma, Grandpa, and the mottled old horse they rode in on. . .

Copper

The copper market is the least controversial, least volatile, and least debated market I have ever owned. It is a wonderful market where the simple tenets of demand and supply govern the narrative. There is never any discussion of manipulation or skullduggery or manifestation of any sort when it come to the copper market.

It is probably the last bastion of true "free market capitalism" that exists because it is a deep market with above-surface bids from every corner of the planet. It is also why the fuzzy-cheeked kiddies hate it. There is nothing exciting about copper at least in their minds because it is actually a "real" market, where orders to buy the physical product actually matter as opposed to the silver market, where "paper" demand outstrips "physical" demand allowing the video-game trading throng to dominate. That obscene scenario never exists in the copper market and you KNOW that because when someone goes "short" copper purely as a "paper trade" and cannot deliver, they get absolutely crushed.

Take for example the case of the "The Nomura Copper Scandal" which refers to a situation in the 1990s where Sumitomo Corporation, a major Japanese trading house, experienced significant losses due to the actions of a rogue copper trader, Yasuo Hamanaka. Hamanaka, who controlled a large portion of the global copper market, engaged in unauthorized and manipulative trading practices, including fake trades and hoarding, to artificially inflate prices. When the scheme unraveled, it led to substantial financial losses for Sumitomo and sent shockwaves through the global copper market.

The copper market punishes manipulators and that is why I choose to "play" in the pits of the deepest metals exchange on the planet. The NY boys can play around in gold and in silver and from time to time on platinum and palladium buy they do not dare mess with copper. It will simply eat them alive and they know it.

So, when I see a world-class copper discovery, I pay attention. There have been more than a few because demand for copper is on the verge of exploding. Whenever any commodity is on the verge of shortage conditions, the Canadian and Australian explorers get active. And they find stuff. When they find stuff, markets tend to react. Especially with under-owned markets like copper.

Here is a chart that I found by accident:

The drill hole highlighted above is from Fitzroy Minerals' Buen Retiro ("good retirement" literal English translation) recently-announced hole #22 that was an absolute monster. You see, the other companies mentioned mostly use "copper-equivalent" grades in their reporting but my little darling Fitzroy used only "Cu", not "CU-Eq" in their descriptive.

Copper gets little love in the world of promotion because everyone wants the other guy to see silver and gold or uranium or lithium because they all get the attention of the Millennial or Gen-Ex demographic. For me, copper is the truest of all metals. It reacts not to CNBC narratives or New York banker interviews. It reacts to demand and supply.

Final comment: When I write comments on companies that I own, the world rolls its eyeballs and thinks that I am "horribly conflicted" or a "paid shill" neither of which is the case. I own them because I want to mimic the incredible career of my hero Richard Russell who launched "Dow Theory Letters" back in the late 1960's and continued writing until he was in his ‘90's and the only way that could have happened was by true excellence in not only his market calls but by the honesty and integrity of his newsletter. And one thing I admired in Richard was his ability to admit it when he made a bad call. He made lots; I make lots.

End (or beginning) of story.

| Want to be the first to know about interesting Technology, Critical Metals, Biotechnology / Pharmaceuticals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with [None. My company has purchased stocks mentioned in this article for my management clients: [None] I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involve