West Red Lake Gold Mines Ltd. (WRLG:TSX.V; WRLGF:OTCQB; FRA:UJO) reported new drill results from its South Austin Zone at the Madsen Mine on May 27.The drilling campaign continues to define and expand mineralization near existing underground infrastructure, supporting the company’s efforts to feed strong tonnages into the detailed mine plan at the newly restarted operation.

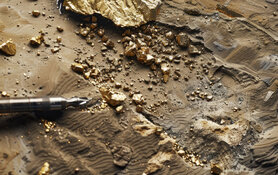

The latest assays highlight high-grade gold intercepts immediately adjacent to current mine workings. Among the most significant results was Hole MM25D-08-4380-011, which intersected 12.1 meters at 61.51 grams per tonne (g/t) gold (Au), including a 1.0-meter interval grading 725.00 g/t Au. Other key results include 8.35 meters at 43.54 g/t Au from Hole 003 and 11.2 meters at 24.61 g/t Au from Hole 026. These intercepts were confirmed to contain visible gold and are situated roughly 50 meters up-dip from previously announced high-grade intercepts and about 300 meters up plunge from the company’s mid-May drill release.

WRLG President and CEO Shane Williams emphasized the strategic location of the mineralization in the news release: “The South Austin mineralization announced on May 27 is directly beside existing workings. It’s not long-term, back-room inventory. Our engineers are working to pull it into the mine plan within 6 to 12 months,” he told Global Stocks News. Williams noted that historic operators may have left behind “a lot of high-grade material,” which the company is now working to define and incorporate.

The South Austin Zone currently contains an Indicated mineral resource of 474,600 ounces grading 8.7 g/t Au within 1.7 million tonnes, along with an Inferred resource of 31,800 ounces at the same grade. These estimates were calculated using a cut-off grade of 3.38 g/t Au and a gold price of US$1,800 per ounce, as detailed in the company’s January 2025 Pre-Feasibility Study.

The company reiterated that true thickness of the reported intervals is expected to be at least 70% of the downhole length based on observed intercept angles. All assays are part of a definition drilling program intended to enhance resource confidence and assist in near-term mine planning as WRLG advances toward production.

Gold Market Demand and Pricing Trends Intensify

Investor interest in gold remained strong as of late May and early June, with multiple indicators pointing to sustained demand and upward price momentum amid shifting economic and geopolitical conditions. According to a May 26 report by John Rubino, despite a significant rally in gold prices, the metal and related equities had not yet regained broad favor among generalist investors. He noted that “gold and gold miner ETFs seem to be an afterthought for the average investor,” contrasting this with prior bull markets when allocations rose significantly. However, Rubino indicated a potential turning point in sentiment, particularly as consumer demand surged. “Costco customers’ eagerness to put multiple ounces of gold on their store credit cards implies the kind of enthusiasm that could easily spread to equity investors,” he wrote.

On May 28, VBL reported that Costco had imposed new restrictions on gold purchases, citing heightened demand and rising prices. The retailer priced 1-ounce gold bars at US$3,279.99, up from approximately US$2,000 less than two years earlier. The report stated that spot gold prices had “appreciated over 70% during that period, reaching all-time highs in April.” Purchase limits for some gold products were reduced from five per day to two per day, reflecting tightening inventory in response to increased interest from retail buyers.

Sector observers also pointed to macroeconomic drivers behind the metal’s appeal. In a May 27 video, Goldfinger Capital’s Robert Sinn remarked that “gold has just been in a healthy correction” and described recent price action as “constructive bull market behavior.” He emphasized that while many investors had shifted focus elsewhere, gold technicals remained favorable and that “miners are beginning to outperform the metal.”

More recently, a June 2 report from Reuters highlighted renewed safe-haven demand amid escalating geopolitical tensions. Spot gold reached US$3,344.49 per ounce, marking its highest level since May 23. According to UBS analyst Giovanni Staunovo, “rising geopolitical tensions – including the escalation in tensions between Ukraine and Russia – [was] lifting demand for safe haven assets such as gold.” The report also cited U.S. trade policy uncertainties and a weakening U.S. dollar as further tailwinds.

Analysts Reaffirm Buy Ratings Amid Strong Project Economics

Analysts continued to express strong confidence in West Red Lake Gold Mines Ltd. following the company's progress at its Madsen project in Red Lake, Ontario. On May 7, Matthew O'Keefe of Cantor Fitzgerald reaffirmed a Buy rating and set a target price of CA$2.20 per share, representing a 219% upside from the then-current trading level of CA$0.69. According to O'Keefe, “The positive test results derisk the project further.” He emphasized that the 14,490-ton bulk sample not only confirmed the company's resource model but also demonstrated alignment with expected grade and mill recovery, strengthening the case for the project's restart.

On May 30, Taylor Combaluzier of Red Cloud Securities also maintained a Buy rating, assigning a higher target price of CA$2.50 per share. At the time of his report, West Red Lake Gold was trading at CA$0.84, implying a potential return of 198%. Combaluzier noted that “Madsen has a high-grade resource, existing infrastructure, deposit and mill expansion potential, the potential for further cost savings and now the opportunity for near-term free cash flow.” He described the project’s economics as compelling, citing a net present value of CA$315 million and a 255% internal rate of return based on a gold price of US$2,000 per ounce.

Combaluzier highlighted that higher gold prices, such as US$3,300 per ounce, could allow for mining of lower-grade zones surrounding high-grade areas, enabling cost reductions through long hole stoping rather than mechanized cut and fill. He further suggested that ongoing drilling and incorporation of satellite deposits like Rowan could enhance throughput and extend mine life. “Rowan could be one of the first deposits used in a potential future hub and spoke model,” he wrote, noting the deposit’s 312,000-ounce resource grading 10.97 g/t gold.

Both analysts pointed to operational improvements made under current management. Combaluzier stated that West Red Lake Gold had taken steps to avoid issues faced by the previous operator, including investing in underground development and choosing to purchase rather than lease mining equipment. These decisions were viewed as key to optimizing cost structure and improving resource recovery. Collectively, the analyses underscored growing institutional confidence in the company’s near-term strategy and long-term asset value.

Next Steps in the Madsen Revival

West Red Lake Gold’s 2025 strategy centers on ramping up operations at the Madsen Mine in the second half of the year. According to its corporate presentation, the company completed its bulk sampling in early 2025, with gold grades and tonnages largely in line with expectations. The South Austin area delivered 2,544 tonnes grading 5.59 g/t Au during the campaign, closely matching predicted grades and tonnage.

The company reported US$7.7 million in revenue from gold sales related to the bulk sample. In late February the company reported $31 million in cash, with a further US$20 million available from a debt facility signed earlier in the year. Operational readiness has also progressed, with underground development rates and high-grade stockpiles growing steadily.

WRLG’s pre-feasibility study outlined a plan for 800 tonnes per day processing and projected strong free cash flow, with an estimated net present value (NPV) of US$496 million using a long-term gold price of US$2,640 per ounce. At the time of the study, the gold price used for modeling reserves was US$1,680 per ounce. With spot gold recently trading closer to US$3,330 per ounce, the company suggested that economic parameters may improve.

The South Austin drilling is part of a broader resource expansion and de-risking effort. The company is also advancing work on nearby zones such as Austin and McVeigh and exploring potential additions to its mine plan, including the Fork and Rowan deposits. WRLG aims to increase throughput beyond the currently permitted 800 tonnes per day, with future permit amendments under consideration to target 1,000 tonnes per day or more.

In the May 27 release, CEO Shane Williams concluded, “Madsen is developing into an operation of larger scale than was envisioned just last year,” underscoring the company’s focus on redefining the project’s scope amid favorable market conditions.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

West Red Lake Gold Mines Ltd. (WRLG:TSX.V; WRLGF:OTCQB; FRA:UJO)

Ownership and Share Structure

Strategic investor Sprott Resource Lending Corp. holds about 8%. Institutions hold about 30%, management, insiders, and advisors hold about 10%, and the remaining shares are held by retail investors.

The company's market cap is CA$290 million. The 52-week range for the stock is CA$0.52 to CA$1.04.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- West Red Lake Gold is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of West Red Lake Gold

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.