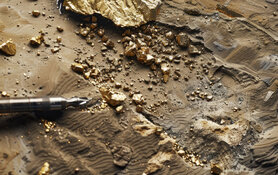

Goliath Resources Ltd. (GOT:TSX.V; GOTRF:OTCQB; B4IF:FSE) has initiated its largest drill campaign to date, mobilizing nine rigs for a 40,000-meter program entirely focused on the Surebet high-grade gold discovery at its 100% controlled Golddigger Property in British Columbia’s Golden Triangle. The program follows four years of exploration totaling 92,000 meters of drilling and more than 400 pierce points, which have significantly advanced the geologic understanding of the project. According to the company, the 2025 campaign will build on 2024’s successful results, where 92% of the 64 holes contained visible gold, and high-grade assays were returned across multiple zones.

Drill hole GD-24-260, previously reported from the Bonanza Zone, assayed 34.52 g/t gold equivalent (AuEq) over 39 meters, including 132.93 g/t AuEq over 10 meters. Additionally, mineralization from Eocene-aged granitoid dykes returned up to 12.03 g/t AuEq over 10 meters in GD-22-58. These findings are contributing to a revised geological model, which now incorporates a new interpretation based on a causative intrusive gold source. The modeling work has been supported by studies from the Colorado School of Mines, which suggested that the mineralization likely stems from a reduced intrusion-related gold (RIRG) system, a relatively underexplored model in the region.

“We have mobilized for our largest drill campaign to date totaling 40,000 meters with 9 rigs,” Goliath Founder and CEO Roger Rosmus stated, adding that recent findings of high-grade gold in Eocene-aged dykes marked “a huge new breakthrough for the Surebet discovery and for others exploring in the Golden Triangle.”

Goliath has expanded its land position by 28% to 91,518 hectares and now controls 56 kilometers of the Red Line, a regional geological boundary known for hosting major deposits. The Surebet discovery footprint currently spans 1.8 square kilometers and remains open in all directions. The site benefits from tidewater access, proximity to the town of Kitsault, and a permitted mill site, with logistical infrastructure such as barge access and high-tension power lines within 25 kilometers. Metallurgical results from the project have returned gold recoveries of 92.2% from gravity and flotation, including 48.8% free gold.

Goliath Founder and CEO Roger Rosmus noted that the updated geological model now incorporates both stacked veins and near-vertical dykes, allowing the company to better target higher-grade zones. “We have mobilized for our largest drill campaign to date totaling 40,000 meters with 9 rigs,” he stated, adding that recent findings of high-grade gold in Eocene-aged dykes marked “a huge new breakthrough for the Surebet discovery and for others exploring in the Golden Triangle.”

Gold Outperforms as Investors Hedge Against U.S. Risk

On May 22, FX Empire reported that gold rose further to US$3,345 during Asian trading, supported by growing concerns over U.S. fiscal health and a weaker U.S. dollar. The movement was partly attributed to Moody’s downgrade of the U.S. credit rating to Aa1, citing long-term debt sustainability challenges. The article noted that “a US$3–US$5 trillion tax bill and weak bond auction added pressure to U.S. assets, lifting precious metal demand.” A senior commodities analyst stated, “With growing uncertainty around U.S. fiscal policy and weakening macro indicators, safe-haven flows are likely to persist.”

Also on May 22, Stockhead highlighted a 3.31% gain in Australia’s ASX All Ordinaries Gold Index, following a 5% rise the previous day. Despite a broader 0.45% pullback in the ASX, gold equities were the top-performing segment, reflecting investor preference for defensive sectors. The article noted, “as uncertainty climbs, so does gold,” pointing to the metal’s counter-cyclical appeal amid financial instability.

By May 23, Bloomberg reported that gold was among the primary beneficiaries of renewed U.S. tariff announcements, as investors rotated capital into traditional safe-haven assets including gold, the yen, and the Swiss franc. A broader risk-off sentiment contributed to declines in U.S. equities, further strengthening interest in precious metals.

In a May 27 commentary, newsletter writer Chen Lin of What Is Chen Buying? What Is Chen Selling? observed, “Gold is moving up and down like a pinball upon Trump’s tariff news. Platinum is having a big breakout due to ‘China demands’. This is encouraging as silver could be the next as investors are spreading their love of gold to other close associates.” Lin also remarked on recent gold miner performance, noting that “CDE announced share buyback, one of many this kind of announcement lately,” and referenced a bearish report from Citi by adding, “One of the key points was that the gold miners are making too much money... I don’t agree obviously but I am only holding gold miners as they don’t need gold prices to move up!”

Analysts and Investors Highlight Goliath’s Growing Gold Potential

On May 1, Taylor Combaluzier, vice president and mining analyst at Red Cloud Securities, issued an updated research report on Goliath Resources Ltd., raising the firm’s target price by 81% to CA$2.90 per share. The upgrade was based on 2024 drill results from the Golddigger property, which supported an estimated mineral inventory of 4 to 6 million gold-equivalent ounces at 6.62 grams per ton. Combaluzier wrote, “We believe that 2024 drilling likely significantly expanded gold mineralization and that another large drill program in 2025 may do the same.” He also stated that additional positive results “could help close the gap” between Goliath’s current trading value and peer group valuations. Red Cloud maintained a Buy rating, citing a potential return of 65% at the time of publication.

In a May 2025 interview with Triangle Investor, Thomas J. Parilla, president of Parilla Investment Group, said Goliath Resources met his top two criteria for investment: strong drill results and trustworthy management. “Goliath, their drill results are just off the charts,” he stated, calling CEO Roger Rosmus “a fantastic CEO” with a global reputation. Parilla further commented, “Goliath still thinks that they've got at least a US$2.5 billion property at buyout... I would imagine that's a US$12–15 stock when you get out that far,” while also suggesting that buyout interest could begin emerging after the current drill season.

On May 18, 2025, George Billman of Resourceful Insights highlighted Goliath’s significant impact on valuation trends and land consolidation in the southern Golden Triangle. He reported that Goliath’s market capitalization had increased by US$146 million since December 31, 2023, reflecting nearly 150% growth. Billman attributed this increase to “mounting evidence of expansive Reduced Intrusion-related Gold System (RIRGS)” and “daylighting of Goliath’s discoveries” across stacked mineralized veins and feeder dykes. He noted that management and insiders had increased their ownership to 51.5%, calling the investor base “strong-handed” and suggesting this consolidation of control may position the company well for future value realization.

Targeting the Source: Goliath Drills into the Heart of the System

Goliath’s 2025 drill program is strategically designed to identify the full geometry and extent of the mineralized system at Surebet. The company is conducting systematic infill drilling to increase pierce point density in the highest-grade domains, particularly where the Bonanza and Surebet Zones intersect. Importantly, 100% of the drilling will focus on this discovery, including testing 13 previously untested feeder dykes mapped on surface and targeting the hypothesized Motherlode causative intrusive source. According to the company’s May investor materials, these targets are part of a broader push to vector toward what is believed to be the primary driver of the mineralizing system.

This season, Goliath’s geological team will relog core from 50 historical holes that intersected the Eocene dykes, which remain open and mineralized in multiple intervals. These include dyke-hosted assays up to 23.82 g/t AuEq over 5 meters and 14.26 g/t AuEq over 3 meters. The geochronology suggests these dykes were emplaced contemporaneously with the high-grade stacked vein system, supporting a syngenetic relationship.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Goliath Resources Ltd. (GOT:TSX.V; GOTRF:OTCQB; B4IF:FSE)

Ongoing collaboration with research institutions including the Colorado School of Mines and SRK Consulting has contributed to the evolving geological model, which now supports a two-stage mineralization theory. The initial high-temperature phase is associated with bismuth-bearing dykes, while a lower-temperature stage affects the surrounding sedimentary and volcanic host rocks. Goliath believes this understanding enhances its ability to vector toward undiscovered gold-rich zones and refine future drill targeting.

Ownership and Share Structure

According to Goliath Resources, management and insiders own 19% of its shares on a partially diluted basis.

Strategic and institutional investors collectively own 31%, with notable holdings including Crescat Capital LLC at 14.4%, McEwen Mining at 5.4%, Rob McEwen at 3.9%, Global Commodity Group (Singapore) at 3.5%, Eric Sprott at 3% and Larry Childress at 1%.

The remaining shares are held by other institutional funds and retail investors.

According to Refinitiv, Goliath has 151.06 million (151.06M) outstanding shares and 141.86M free float traded shares. Its market cap is CA$221.47M. Its 52-week range is CA$0.87–2.87 per share.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Goliath Resources is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Goliath Resources

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.