I firmly embrace the idea that the universe has a way of telling us things, if only we listen. You might label this mystical thinking, but consider how superstition can often serve as a foundation for optimism . . . and in the prospecting world, maintaining hope isn't merely helpful — it's essential.

What sparked this optimism?

Allow me to tell a story. A friend of mine has twin sons who collect those miniature Hot Wheels automobiles. These vehicles are released in collections, and within each collection exists what collectors term a "super treasure hunt" variant of a particular model. This special edition features unique paint schemes, distinctive wheels, and exclusive details that differentiate it from the standard "mainline" release. Discovering one resembles uncovering precious metal in a streambed, and yesterday I located one destined for the children this weekend. Successfully hunting these vehicles demands optimism, because investing effort to visit retail locations means competing against others seeking identical prizes, and the sole method of verification requires personal investigation.

With this framework established, I'll draw parallels to junior mineral prospecting ventures. Regarding investments in junior mineral exploration enterprises, I've observed you must possess either madness, optimism, or some combination thereof. The probabilities consistently favor failure, and preliminary geological information remains theoretical until someone produces tangible results from drill samples.

Certainly, you understand what you're aiming for, but Mother Nature maintains as the ultimate authority. Your only option involves extracting maximum intelligence before drilling commences, developing target hypotheses, and proceeding accordingly. Typically, you experience complete failure, yet we're all familiar with narratives where wealth materialized from that exceptional phenomenon called "breakthrough discovery." Achieving mineral discovery resembles locating a super-treasure-hunt Hot Wheels automobile. Such events occur infrequently, but when they materialize, the results prove remarkably rewarding. Naturally, this discussion leads toward a particular investment idea: Northern Shield Resources Inc. (NRN:TSX.V), currently trading at $0.055.

Initial context proves necessary. I've maintained familiarity with Northern Shield's Chief Executive, Ian Bliss, for approximately two decades. My initial encounter occurred during his BNN television appearance in September 2005 or thereabouts. He pursued a platinum prospect in Ontario with significant scale potential (Ian envisions grandly). That venture eventually secured Impala Platinum as a joint venture associate, and NRN labored extensively attempting to pinpoint reef-style PGE mineralization within their stratified mafic intrusion.

Ultimately, success eluded them. Throughout subsequent years, Ian has developed and evaluated numerous additional prospects, yet he's never achieved a major breakthrough. This reflects neither insufficient capability, inadequate commitment, nor substandard prospects/ventures. Ian has consistently possessed these qualities abundantly. He collaborates with academics across multiple universities, funds graduate-level research, and cultivates extensive networks spanning business and industry sectors.

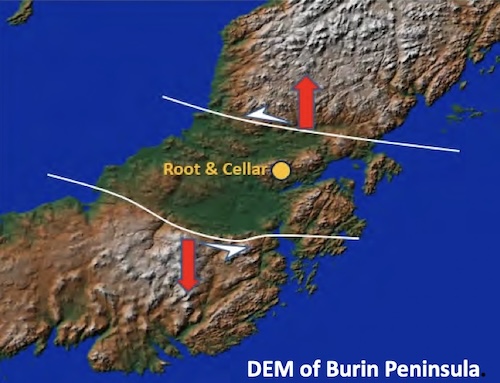

He demonstrates unwavering persistence, but recently, market participants have largely ignored Ian's activities, as reflected in stock valuation. During this writing, NRN exchanges hands at five cents with approximately 100 million outstanding shares, creating a roughly $5 million market capitalization. The corporation's present concentration involves a property designated Root and Cellar, situated within an extensional corridor of Newfoundland's Burin Peninsula. The project location offers exceptional accessibility and infrastructure (reachable via standard two-wheel drive vehicles), meaning that if Ian discovers something valuable, development expenses will decrease, and mine construction probability increases. However, the crucial term remains "if" because presently, Root and Cellar represent merely a prospect, though drilling should commence in June, placing validation relatively near.

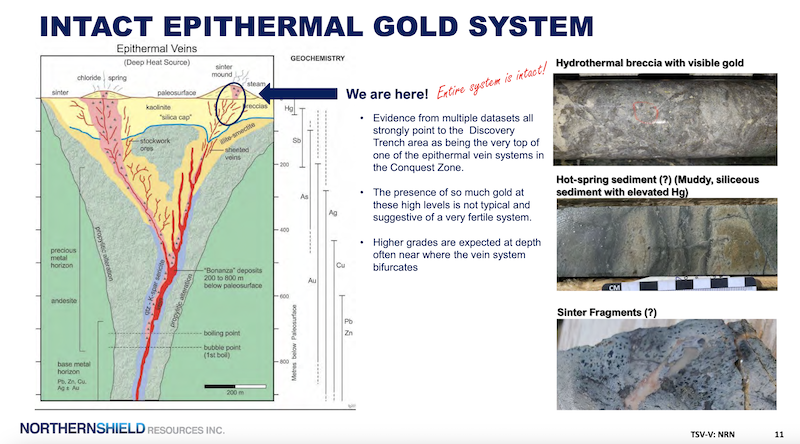

What is the exploration model at Root and Cellar? Ian believes NRN possesses a preserved epithermal system, where NRN has only penetrated the uppermost sections, with the primary objective — the boiling zone — now targeted at greater depths.

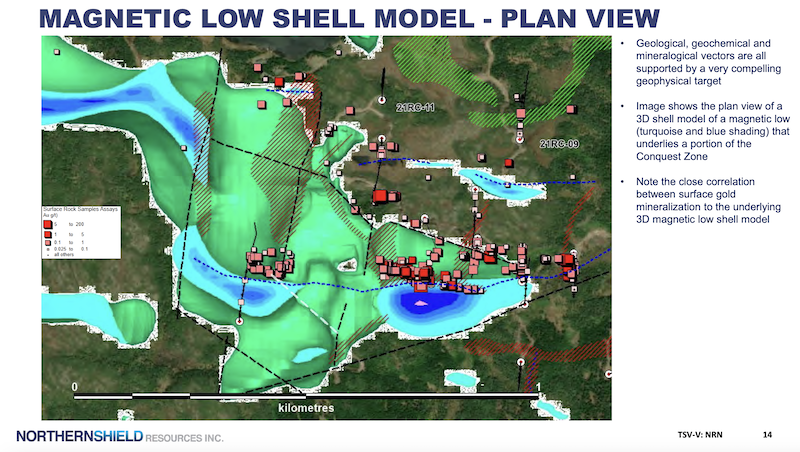

The project sits within an extensional structural corridor of the Burin Peninsula, which proves significant because extensional structural environments are required to create spaces where epithermal systems develop. Target validation emerges from both geological samples and geophysical surveys. At ground level, the company has revealed heavily modified rocks containing up to 78 grams per tonne (g/t) gold alongside 700 g/t tellurium.

The tellurium proves noteworthy because tellurium associates with alkaline magmatism, recognized for generating economically viable gold deposits. The gold also proves interesting because (a) gold presence within the system is confirmed, and (b) the gold exists in rocks positioned very high within the system, potentially having migrated from below. Ian has additionally identified alternative geochemical indicators (particularly sodium-potassium ratios) to help navigate toward the system's core based on geochemical patterns observed in other established epithermal deposits. Geophysical data over the modeled system core reveals a substantial magnetic low extending to depth, aligned with a chargeability high, both coinciding with gold in surface samples and trenches.

NRN drilled Root and Cellar to limited depths during 2023, encountering narrow high-grade (10 g/t across 1.5m) and extensive low-grade mineralization (34m of 0.6 g/t) in rocks displaying intense alteration with textures suggesting shallow epithermal system positioning.

The rocks appear thoroughly processed, and that gold didn't originate from atmospheric sources, so the logical inquiry becomes, "What exists below?" Testing the deeper target (-200-300m depth) costs relatively little, and NRN will begin drilling next month.

Concerning the roulette wheel that is junior exploration ventures, I believe this presents favorable circumstances. The market capitalization remains minimal, the potential proves substantial (envision millions of gold ounces), and the stock trades near historical lows. The risk-reward equation appears compelling.

My maximum loss potential here reaches 100% if shares become worthless. Given Ian's 20-year experience, I'm confident that if Root and Cellar proves unsuccessful, he'll identify another prospect — this individual demonstrates resilience.

So, does my downside truly reach 100%?

Probably not, but mentally, I must prepare for complete loss.

The upside potential?

Well, I'm uncertain. Perhaps 5000-10000% (a 50-100 fold increase) in the optimal scenario... something along those lines. Market capitalization measured in hundreds of millions represents a reasonable aspiration. Therefore, market mathematics suggests this project possesses a 1-in-50 to 1-in-100 success probability.

What do the geological data indicate regarding odds?

That's the essential question. For me, this undoubtedly represents a legitimate prospect . . . and I might estimate success probability closer to 1-in-10 or 1-in-5. This means odds remain HEAVILY stacked against me, but if I maintain optimism, which I do, an asymmetry exists that I can access provided I accept potential total investment loss. I cannot control geological forces, but I can manage risk through capital exposure amounts . . . never risking beyond acceptable loss limits. This represents maximum risk, explaining the risk-reward characteristics, period.

At worst, I'll add another entry to my collection of "ventures that failed," but in the success scenario, I obtain the elusive super treasure hunt Hot Wheels automobile. The Lundin organization has consistently maintained a philosophy of "no guts, no glory," and courage remains highly valued in exploration ventures. This situation proves no different.

I spotlight NRN today because my recent Hot Wheels discovery reminds me that occasionally things do succeed in the exploration arena, and you must remain vigilant to recognize what merits your attention.

Obviously, I believe this merits my time and some of my capital. I maintain long positions in the stock and also participated in the initial tranche of NRN's recent financing at 4 cents, which included a 10c warrant, valid for two years. The initial program should commence next month, consisting of 10-15 holes totaling 2000-3000m of drilling.

Will it succeed?

Perhaps, perhaps not. The odds remain stacked against me, but when seeking something rare, you must embrace the pursuit or there's no reason to participate. However, should you actually discover what you're looking for, it can create quite rewarding (financially rewarding) outcomes, because nothing compares to overcoming unfavorable odds.

I've provided NRN's corporate presentation here for anyone interested. Ian effectively summarizes the opportunity and welcomes discussions about his venture.

Happy hunting!

| Do you want the latest investment ideas delivered to your inbox? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Malcolm Shaw: I, or members of my immediate household or family, own securities of: Northern Shield. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Hydra Capital

This is not investment advice, nor is it a recommendation to buy or sell shares in the company/companies mentioned.

The information contained herein is accurate to the best of the author’s knowledge, but the material and interpretations contained herein should be independently verified by any party using this information as part of any research, editorial, or decision making process. Any views expressed here represent the author’s opinion only, and as such readers should do their own research and come to their own conclusions if they are using the opinions contained herein as part of any larger due diligence process. The author may have long or short positions in the companies mentioned and may be buying or selling in the market depending on which way the wind is blowing at any given moment. Opinions are subject to change without notice. Prospective resources, predictions, comparisons, financial projections, and extrapolated metrics are, by their nature, subjective and interpretation dependent. The topics covered are highly speculative and involve a high degree of uncertainty and risk. Speculative companies can and do go to zero. By using this site, you agree that the author(s) and Hydra Capital is/are not responsible for any damages incurred by the use of the presented materials. Anyone reading these blog posts should know that they are the author’s thoughts and opinions, which are not to be confused with or construed as research reports.