When Ray Dalio, among the most accomplished hedge fund leaders in modern finance, projects precious metals rising 10-fold and silver reaching $500 — you don't dismiss it casually. You pay attention.

This represents far more than typical market optimism. It signals an urgent alert that our worldwide monetary framework stands on the brink of transformation — and tangible assets like precious metals are poised for dramatic appreciation.

Should his projections prove even partially accurate, my earlier forecast from White Paper #2 — placing the yellow metal between $13,000–$16,000 — will appear remarkably restrained.

Consider this development — Dalio backs his words with capital. Bridgewater Associates recently allocated $319 million toward SPDR Gold Trust throughout 2025's opening quarter, according to fresh SEC 13F documentation. For the planet's most substantial hedge fund, this transcends routine portfolio rebalancing — it represents a bold statement of conviction.

To grasp our destination, we must revisit one pivotal moment that transformed everything. . .

August 15, 1971: When Dollar Convertibility Ended

That summer night, President Nixon shocked global markets with an emergency announcement:

"I have directed Secretary Connally to suspend temporarily the convertibility of the dollar into gold."

Translated simply?

He terminated the Bretton Woods framework — the worldwide monetary pact linking America's currency to precious metal at $35 per ounce.

Though intended as temporary, it became lasting.

America's currency transformed into pure fiat money, supported solely by Washington's promise and credibility.

The consequences proved inevitable. . .

Freed From Metal Backing, America Embarked on Fiscal Expansion

The subsequent half-century witnessed:

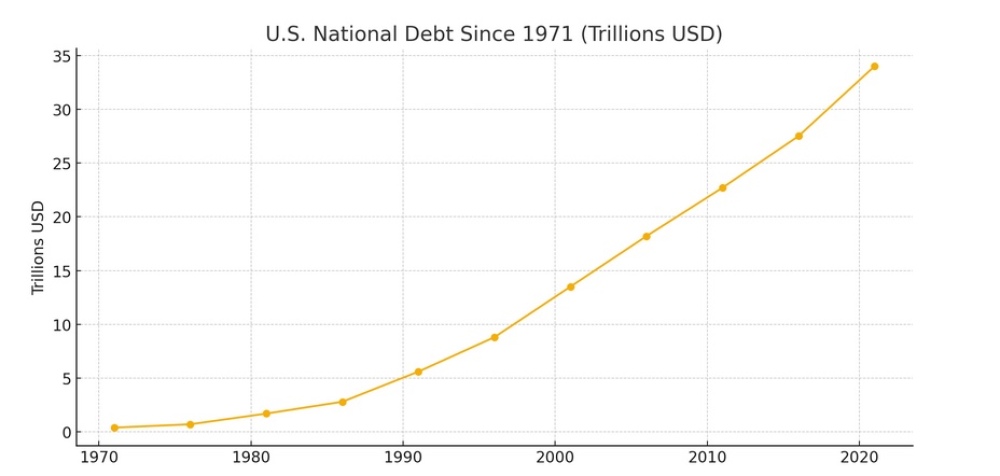

- Federal obligations skyrocketed from $398 billion beyond $36 trillion.

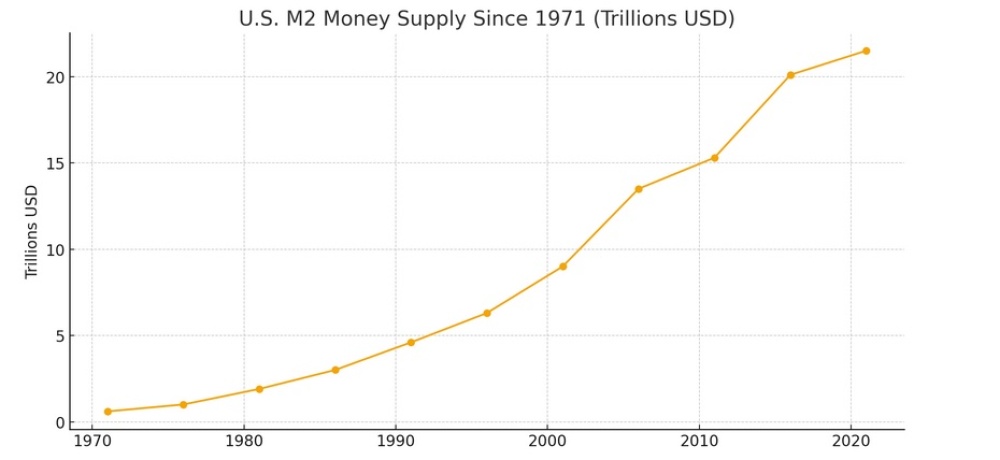

- Currency circulation expanded from $600 billion to $21.5 trillion.

- Consumer price measurements jumped from 40 above 300.

See for yourself:

This constituted gradual monetary debasement over decades.

For precious metals?

It marked the start of history's most dramatic bull run.

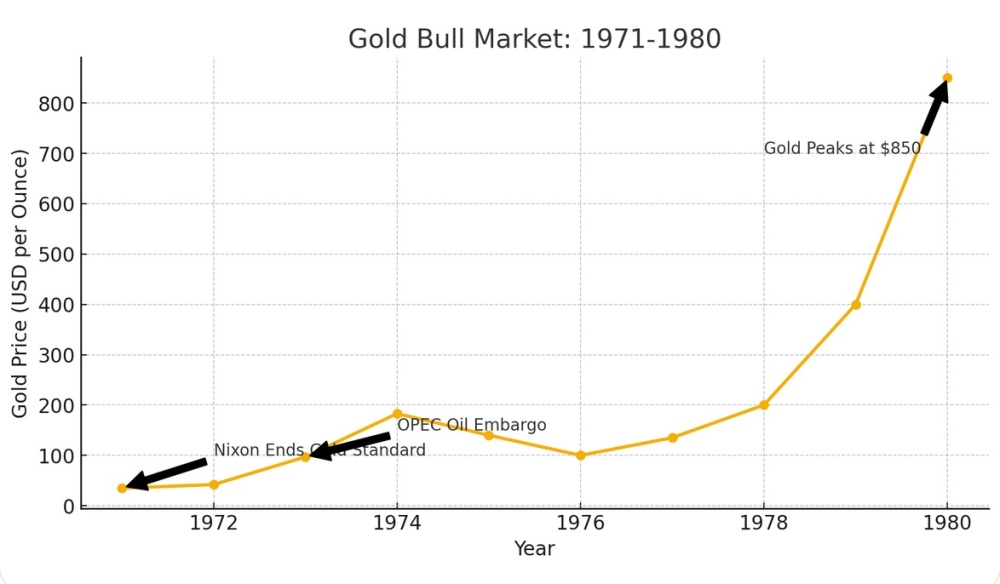

The 1970s Metal Surge: From $35 to $815

Between 1971–1980, the yellow metal climbed from fixed $35 to peak $815 per ounce — representing 1,657% appreciation.

That equals 17-fold returns within ten years.

What would $10,000 invested when Nixon severed metal ties have yielded?

Returns on $10,000 Precious Metal Investment in 1971:

- Metal purchased: 285.71 ounces

- 1980 valuation: $175,714

- Current worth (at $3,300/oz): $950,000

No error here.

Precious metals surpassed equities, property, and all other investments during America's most volatile decade.

Historical Patterns Echo Rather Than Repeat

Moving to 2025. . .

We confront $36 trillion obligations, rising inflation, conflicts across Europe, Middle East, and now India-Pakistan tensions. Confidence in paper currencies erodes. Meanwhile, BRICS nations advance their precious metal-backed digital currency plans closer to reality.

Wall Street recognizes this shift.

Investment funds flood into metal ETFs, mining companies, and physical reserves.

Even BlackRock, Goldman Sachs, and Bridgewater accumulate metal positions — rapidly.

Introducing NatGold: Tomorrow's Digital Metal Standard

Here's where developments become fascinating. . .

In 1971, America abandoned metal backing. Today, under Trump's leadership, we might return to such systems. However, this time with innovation.

New proposals circulate regarding sovereign digital currency supported by tangible assets, including precious metals, petroleum, and tokenized reserves.

Enter NatGold Digital Ltd.'s role.

This transcends typical cryptocurrency. This surpasses simple metal ownership. This represents fully digital, completely audited, geologically verified claims on confirmed unmined precious metal deposits.

These constitute authentic reserves, untouched underground — now blockchain-tradable.

NatGold merges:

- Precious metal's enduring worth

- Cryptocurrency's velocity and portability

- Blockchain's transparency and verification

- Zero-extraction environmental stewardship

This Generation's Ultimate Asymmetric Opportunity?

Consider this . . .

If you overlooked Bitcoin at $100 (when initially discussed) . . . If you bypassed Ethereum at $10 . . . And even if you missed precious metals at $1,200 . . .

As fiat currencies weaken and institutions return to precious metals, NatGold could emerge as the primary digital metal reserve in our post-dollar era.

This represents your 1971 opportunity.

This offers your chance to possess assets outlasting governmental monetary experiments.

And this provides your opportunity before the next 10x — or 20x — enters historical records.

Your Decision: Secure NatGold Tokens Now

Currently, you can reserve NatGold tokens pre-launch — with 10% savings below public pricing.

No extraction required. No delays. No intermediaries.

Simply authentic precious metal, tokenized and prepared for global finance's next chapter.

Limited quantities available during pre-sale period. Move quickly.

| Want to be the first to know about interesting Special Situations and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NatGold Digital Ltd.

- Brian Hicks: I, or members of my immediate household or family, own securities of: NatGold Digital Ltd. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.