Sernova Biotherapeutics Inc. (SVA:TSX.V; SEOVF:OTCQB; PSH:XETRA) has announced the formation of a Clinical Advisory Board composed of leading experts in diabetes care, islet cell transplantation, and regenerative medicine. The announcement was made on May 22, 2025, as the company continues development of its Cell Pouch Bio-hybrid Organ for treating type 1 diabetes (T1D).

Dr. Robert Gabbay, Associate Professor at Harvard Medical School and former Chief Medical Officer of the Joslin Diabetes Center and the American Diabetes Association, will chair the new five-member board. Dr. Gabbay’s research has been supported by major institutions such as the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) and the Agency for Healthcare Research and Quality (AHRQ).

Other members include Dr. Mark Atkinson, Director of the University of Florida Diabetes Institute, known for over 750 scientific publications on T1D; Dr. Melena Bellin, a leader in clinical islet transplantation at the University of Minnesota; Dr. Andrew Posselt of UCSF Medical Center, who directs the Pancreatic Islet Transplant Program; and Dr. Holger Russ, an expert in stem cell biology and autoimmune diabetes at the University of Florida.

Sernova CEO and President Jonathan Rigby stated in the news release, “We are truly honored to welcome such a renowned group of clinical and scientific leaders that believe in our mission... Their collective expertise in T1D care, islet transplantation, islet cell biology, immunology, and clinical trial execution is of great value to Sernova and the patients we serve.”

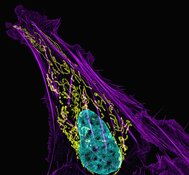

Sernova’s Cell Pouch is an implantable, biocompatible bio-hybrid organ designed to house therapeutic cells and restore hormonal balance in T1D patients. Unlike standard insulin therapy, which requires daily injections or pumps and constant glucose monitoring, the Cell Pouch aims to re-establish natural insulin production using transplanted islet cells.

The company’s ongoing Phase 1/2 clinical study has shown encouraging results. In Cohort A, all six patients receiving islet cell transplants into the Cell Pouch achieved insulin independence for durations ranging from 18 months to over four years. Follow-up data showed sustained cell survival and functionality over five years post-implantation.

Sernova is also developing a next-generation version of the therapy in partnership with Evotec, combining the Cell Pouch with induced pluripotent stem cell (iPSC)-derived islet-like clusters. These clusters are designed to replicate the function of native pancreatic islets, including the secretion of insulin, glucagon, and somatostatin. These are all critical hormones in blood sugar regulation.

Biotech Sector Faces Economic Strains and Talent Disruptions

The U.S. biotechnology sector has recently faced increasing operational and strategic pressures, driven by economic policy shifts, workforce instability, and changing global dynamics. These challenges are shaping the environment in which clinical-stage companies operate, with implications for research, development, and long-term competitiveness. Fortune Business Insights, on May 5, reported that the global diabetes drugs market size was valued at USD 88.32 billion in 2024. The market is projected to grow from USD 101.48 billion in 2025 to USD 233.84 billion by 2032, exhibiting a CAGR of 12.7% during the forecast period. Some of the key players in the market include Novo Nordisk A/S, Eli Lilly & Company, and Sanofi. These companies hold a major portion of the global diabetes drugs market. North America dominated the diabetes drugs market with a market share of 49.95% in 2024.

Beyond traditional pharmaceutical strategies, companies like Sernova Biotherapeutics are advancing device-based approaches to diabetes treatment, adding new dimensions to the sector. The Cell Pouch, an implantable bio-hybrid organ designed to house therapeutic cells, has demonstrated insulin-free outcomes in clinical trials. This innovation reflects a shift in the market toward regenerative medicine solutions, which could supplement or compete with pharmaceutical treatments.

A May 12 column in Clinical Leader further examined the implications of U.S. tariffs on the biotechnology industry. The piece cited a survey by the Biotechnology Innovation Organization (BIO), which revealed that nearly 90% of U.S. biotech companies depend on imported components for at least half of their FDA-approved products. The introduction of tariffs on imports from regions such as the European Union, China, and Canada has raised concerns about escalating manufacturing costs and disrupted supply chains. According to the survey, 94% of biotech firms expected cost increases from the April 2 tariffs on EU goods, while 80% said they would require at least a year to identify alternative suppliers. These supply pressures were also seen as contributing to investor hesitation, as higher manufacturing expenses and regulatory uncertainty weigh on R&D budgets.

DataHorizon Research on May 19, reported that the global oral anti-diabetes drugs market alone was valued at approximately USD 51.3 billion in 2023 and is expected to reach USD 90.2 billion by 2033, growing at a CAGR of 5.8%. The report identified the rising prevalence of diabetes and the demand for convenient, non-invasive treatment options as key growth drivers. Advances in sustained-release technologies, combination therapies, and precision medicine are helping reshape the therapeutic landscape.

These trends indicate the diabetes drugs market is not only expanding in size but diversifying in approach. As patient preferences evolve and healthcare systems prioritize integrated, long-term diabetes management, the convergence of biologics, devices, and digital health tools is expected to shape the next generation of treatment options.

Third-Party Expert Analysis Highlights Strong Potential for Sernova’s Cell Pouch

On May 14, analysts at H.C. Wainwright & Co. reiterated their Buy rating on Sernova Corp. and maintained a price target of CA$6.00, citing strong interim results from the company’s ongoing Phase 1/2 clinical trial evaluating the Cell Pouch device in Type 1 diabetes (T1D). According to the research team led by Joseph Pantginis, Ph.D., “8 of 12 (66%) patients achieving insulin independence” was a critical outcome and highlighted the Cell Pouch’s therapeutic potential. The analysts further noted that 75% of patients demonstrated improved HbA1c levels and that 58% exhibited C-peptide levels of 0.3 ng/mL or higher, a biomarker threshold for successful islet engraftment and insulin production.

The report emphasized that these results supported the Cell Pouch’s mechanism of action and aligned with previously reported histologic data. It stated, “We think these data are indicative of the trial being on track to succeed and helps de-risk any upcoming data readouts and subsequent studies.” Additionally, the team pointed to improvements in hypoglycemia awareness and quality of life among patients as further indicators of the device’s benefit.

In terms of market opportunity, H.C. Wainwright projected a potential launch of the Cell Pouch in the U.S. market by 2027 and assigned a 25% probability of success on peak sales of US$2.3 billion, based on a conservative market penetration estimate of approximately 2.1% in the hypoglycemic unawareness population. The analysts concluded, “We believe visibility for the company should increase around its opportunities around its Cell Pouch system across multiple indications starting with T1D in driving insulin independence in patients.” Their valuation was based on a clinical net present value (NPV) model accounting for various commercial and clinical assumptions.

Next Moves in Motion: Competitive Positioning and Clinical Expansion

Sernova’s H1 2025 investor presentation outlines several forthcoming catalysts that could shape its near-term trajectory. The company is nearing completion of Cohort B in its Phase 1/2 trial and plans to launch Cohort C in 2025. Each subsequent cohort builds on prior findings, with adjustments in immune suppression protocols and device configuration to optimize outcomes.

A key highlight from the study so far includes documented insulin independence in all Cohort A patients, a significant development for the roughly nine million people worldwide living with T1D. Sernova reported that these individuals maintained hemoglobin A1c (HbA1c) levels—the standard measure of long-term glucose control—within the non-diabetic range (≤ 6.5 percent) without requiring external insulin.

Looking ahead, Sernova intends to initiate a clinical program in 2026 for its iPSC-based Cell Pouch product, developed in collaboration with Evotec. Preclinical studies in diabetic mice showed robust glycemic normalization and excellent intra-graft vascularization, both indicators of strong therapeutic potential.

Sernova has also signed a letter of intent with GoldTrack Ventures and the Kingdom of Saudi Arabia to support funding of the T1D program, adding further momentum to its commercialization pathway.

As the company expands its clinical footprint, the combination of expert advisory oversight, promising early clinical results, and international collaboration positions Sernova as a notable player in the regenerative medicine space focused on endocrine disorders.

Ownership and Share Structure

Streetwise Ownership Overview*

Sernova Biotherapeutics Inc. (SVA:TSX.V; SEOVF:OTCQB; PSH:XETRA)

According to Refinitiv, about 4.1% of the company is held by insiders and management and approximately 0.05% by institutions. The rest is retail.

Top shareholders include Director Steven Sangha with 3.97%, Chief Financial Officer James Parsons with 0.12%, CATAM Asset Management AG with 0.05%, and Chief Business Officer Modestus Obochi with 0.02%.

Sernova has 328.48M outstanding shares and 315.01M free float traded shares. Its market cap is CA$49.5M. Its 52-week range is CA$0.15−CA$0.40 per share.

| Want to be the first to know about interesting Biotechnology / Pharmaceuticals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Sernova Biotherapeutics Inc. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sernova Biotherapeutics Inc.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.