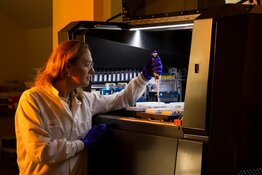

BioLargo Inc.'s (BLGO:OTCQX) subsidiary, Clyra Medical Technologies Inc., entered into agreements with multiple wholesale distributors and sales agents for its two products that tackle wound and skin infections and promote wound healing, reported Oak Ridge Financial Analyst Richard Ryan in a May 19 research note. Clyra's products are based on a proprietary copper-iodine technology.

"We believe commercial introduction could occur within the next nine months," Ryan wrote. "Clyra has a chance to be one of the most impactful and profitable operations for BioLargo."

Infection control, Clyra's focus, is one of the challenging environmental problems for which BioLargo invents and develops innovative platform technologies with an eye toward commercialization. Others include PFAS contamination, advanced water and wastewater treatment, industrial odor and volatile organic compound control, and air quality control.

Lower Target, Buy Rating

Oak Ridge lowered its price target on BioLargo to $0.35 per share from $0.38 after decreasing its full-year 2025 revenue estimate. Compared to the new target, BioLargo is trading now at about $0.21 per share. Thus, the implied return potential is 3%. The company is rated Buy.

BioLargo has 302.8 million shares outstanding. It has a market cap of $63.6 million ($63.6M). Its 52-week range is $0.16–0.33 per share.

Preparing For Rollout

The wound care market opportunity is large, and each agreement Clyra entered into, for sales and distribution in the U.S. and abroad, could generate material revenue. All parties involved are working toward a commercial launch of Clyra's products. Clyra and its distribution and manufacturing partners are working on systems integration for purchasing, accounting, forecasting, logistics, and quality assurance. Once ready, technical training and product rollout can take place.

Ryan pointed out that Clyra has invested more than 14 years of work and nearly $20M of funds into its product development.

Pooph Sales Decrease

The added expenses during Q1/25, tied to preparing to launch Clyra's products, in large part accounted for BioLargo's net loss of $1.9M versus $775,000 in Q1/24. Of the $1.9M total, $1.4M are attributable to Clyra.

Revenue during Q1/25 totaled $3.3M, down from the previous quarter's $3.7M and down from the prior year's $4.8M. Pooph sales followed a similar trend. They amounted to $2.6M and comprised 79% of total revenue. The total was lower than $2.7M in Q4/24 and $4.2M in Q1/24. Pooph sales primarily drove BioLargo's topline softness, noted Ryan, after a very strong period a year ago.

Accounts receivables during Q1/25 increased by about $1.04M quarter over quarter to $4.21M from $3.17M, likely related to Pooph. At quarter's end, BioLargo had $2.56M in cash, minimal debt and shareholders' equity of $5.1M, a strong balance sheet in other words.

Market trends are difficult to anticipate given Pooph has been on the market only for three years, and current sales are below expectations. However, management remains confident in its eventual success. For BioLargo's ONM Environmental division, management expects about the same level of sales in Q2/25 as in Q1/25, most of which were of Pooph products.

BioLargo's engineering segment has seen an uptick in service-related sales as industrial polluters are consulting with the company on possible PFAS remediation solutions. This should offset the weakness in Pooph sales expected throughout full-year 2025 (FY25).

"We estimate [overall] FY25 revenues to be $16M, down from our previous estimate of $18M," Ryan wrote.

Other Initiatives Advancing

BioLargo's pipeline of potential PFAS projects has "grown significantly," Ryan reported, as customers and potential partners become more at ease with the technology and as final Environmental Protection Agency regulations for remediation are released. Federal and state funding has begun being allocated for PFAS remediation. BioLargo's first commercial PFAS remediation project is awaiting installation.

"The large emerging market for PFAS removal and BioLargo's growing validation in this opportunity should not be overlooked," added the analyst.

As for BioLargo's long-duration battery storage program, it is progressing though still in the early stages. The company's batteries offer important technical advantages over lithium batteries. Third-party validation is needed, and this could happen in the near term.

"A key summation is that BioLargo has a unique diversified portfolio of solutions that can address the needs of very large global end markets, thus allowing the company to have 'many shots on goal.'"

| Want to be the first to know about interesting Biotechnology / Pharmaceuticals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |