Hidden within the rugged crests of Idaho's Salmon River Range sits one of America's most disputed — and potentially priceless — extraction locations.

A place bearing a moniker that whispers of enigma and might: Stibnite.

Previously, it enabled America's wartime victory. Now, it could secure America's forthcoming triumph. Since what rests under Stibnite's gusty hillsides transcends mere gold — despite abundant deposits existing.

It's antimony — an uncommon strategic element considered so crucial for American defense interests that military officials publicly identify it as indispensable for everything from anti-armor munitions to fire-retardant materials and electronics components.

The challenge?

China dominates more than 75% of worldwide antimony distribution.

America's contribution? Zero production. Precisely. Nothing.

Except potentially through Stibnite's revival.

Stibnite's Role in Defeating Fascist Forces

During the 1940s, America's Defense Ministry sought Idaho's assistance. Imperial Japan had seized antimony-yielding territories throughout Southeast Asia, eliminating Allied resource access.

Idaho's Stibnite workforce responded decisively. During peak operations, Stibnite supplied 90% of antimony utilized by American military forces throughout WWII, plus substantial tungsten volumes — another essential military material.

No overstatement: This operation helped win the war.

Post-conflict, Stibnite deteriorated into abandonment. Decrepit structures. Waste accumulations. An incomplete excavation dubbed the "Yellow Pine Pit" disrupting formerly robust salmon pathways.

Currently, Stibnite remains uninhabited.

Yet, revival approaches.

The $1.5 Billion Renaissance

An emerging corporation named Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ) possesses Stibnite's restoration potential. Supported by major investors — notably America's Defense Department — Perpetua envisions an ambitious $1.5 billion initiative targeting historic mine reopening, environmental restoration, plus extraction of:

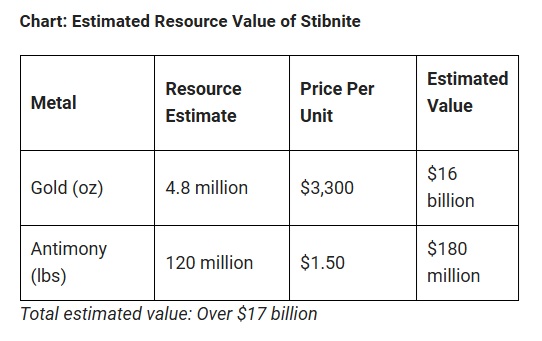

- 4.8 million gold ounces

- 120 million antimony pounds

- Forward-looking resource chains are urgently desired by federal authorities

Present calculations indicate Stibnite's aggregate mineral worth surpasses $16 billion — using contemporary valuations.

Should antimony prices maintain upward trajectories amid Chinese trade limitations and escalating international friction, this overlooked highland might eventually challenge Earth's premier gold-antimony deposits.

With Perpetua positioned advantageously.

Western Hemisphere's Sole Antimony Operation?

These remain the possibilities. With regulatory approval, Stibnite would emerge as the exclusive primary antimony-generating location throughout Western territories.

Consider this reality.

While financial markets pursue technology shares and digital currency excitement, an essential defense mineral — lacking domestic sources — awaits extraction from Idaho terrain. . .

Through an enterprise valued substantially below its potential worth.

Benefiting from federal backing.

Defense authorities recently allocated $24.8 million to Perpetua via Defense Production Act provisions for accelerated advancement.

Translation?

Military leadership rejects ongoing Chinese mineral dependency.

Domestic Antimony's Growing Strategic Importance

Per recent documentation from Defense One, China is intensifying restrictions regarding specialized minerals: Military strategists acknowledge potential vulnerabilities should Chinese authorities restrict antimony alongside other fundamental materials. Without antimony availability, American defense capabilities encounter increased expenses, production constraints, plus precarious dependencies affecting:

- Anti-armor projectiles

- Batteries and semiconductors

- Missile propulsion systems

Simply stated, antimony represents necessity, not preference. Currently, America contains a singular supply potential: Stibnite.

Environmental Opposition Meets Restoration Vision

Naturally, approval faces obstacles. Conservation resistance remains substantial. Various advocates assert that mining threatens essential watersheds, ecosystems, and recreational spaces. Legal challenges persist. Authorizations experience delays.

However, Perpetua attempts something unusual among extraction enterprises: Promising historical contamination remediation within operational planning.

Their blueprint encompasses:

- Restoring salmon corridors obstructed since the 1940s

- Eliminating millions of toxic waste

- Rehabilitation following contemporary protocols

Idaho's Nez Perce Tribe, historically skeptical, recently initiated collaboration discussions. This transcends traditional extraction approaches. This represents extraction amid geopolitical considerations and ecological responsibility — potentially America's initial genuinely modern, multipurpose mining endeavor.

From Abandonment to Strategic Resource

This exceeds precious metal operations.

It represents confluence within broader narratives:

- The collapse of American mineral independence

- The weaponization of global supply chains

- The rise of resource nationalism in a fractured world

These dynamics currently manifest within Idaho's central forests. Gold. Antimony. Conflict. Environment. Independence. Stibnite encompasses everything.

While Perpetua Resources trades below $14.

The NatGold Connection: Owning the Future of Precious Metals

During Perpetua's campaign securing national mineral priorities, investors encounter another remarkable development: NatGold Digital Ltd.

NatGold transforms precious metal ownership through combining historical gold value with distributed ledger innovation. Each NatGold unit represents authenticated, unexploited reserves — deposits remaining underground — avoiding conventional extraction's environmental consequences.

Within circumstances elevating physical asset security, NatGold provides:

- Real, verifiable gold backing

- A sustainable, eco-friendly investment alternative

- A new monetary standard merging gold's ancient wealth with tomorrow's digital economy

Like Stibnite symbolizes strategic metal renewal for defense purposes, NatGold embodies gold's restoration as reliable financial cornerstone. For those positioning themselves within America's emerging resource expansion, Stibnite alongside NatGold represent complementary elements within an identical historic narrative.

Rather than observing history's creation, participate directly. This might represent America's subsequent remarkable recovery narrative. . . Or frontlines within mineral confrontation, we cannot forfeit.

| Want to be the first to know about interesting Special Situations and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Perpetua Resources Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NatGold Digital Ltd.

- Brian Hicks: I, or members of my immediate household or family, own securities of: NatGold Digital Ltd. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.