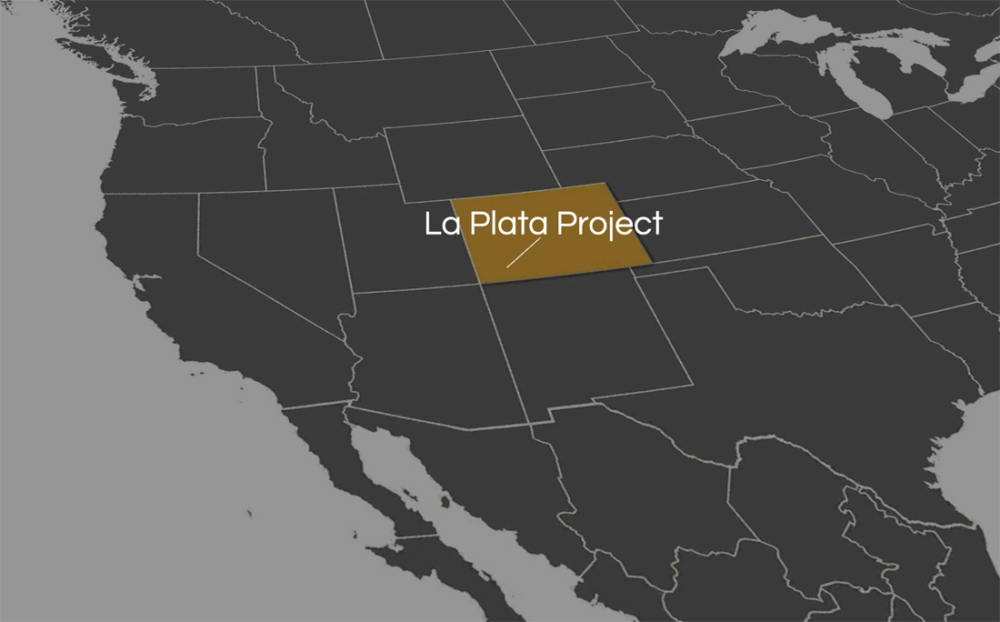

Metallic Minerals Corp. (MMG:TSX.V; MMNGF:OTCQB) on Thursday announced that "significant potential" exists for co-product critical minerals at its flagship La Plata copper-silver-gold-platinum group elements (PGE) project in southwestern Colorado.

"Recent exploration and geochemical analyses have demonstrated elevated levels of critical minerals including light rare earth elements (REEs) with lanthanum (La) and heavy REEs with yttrium (Y)," the company said in a release. "In addition to light and heavy REEs, the company has also discovered significant concentrations of fluorine (F), gallium (Ga), scandium (Sc), tellurium (Te), and vanadium (V)."

"We are increasingly encouraged by the growing evidence that La Plata is not only an exceptional copper and precious metals system but may also be a strategically significant U.S.-based source of critical minerals," said Chief Executive Officer Greg Johnson. "As the U.S. government continues efforts to secure domestic supply chains for essential and critical minerals necessary for advanced technology, clean energy and defense, we believe La Plata is uniquely positioned to support this national economic and geopolitical priority."

The U.S. Geological Survey has designated the La Plata Mining District as a Critical Minerals Resource Area under the bipartisan Earth Mapping Resources Initiative. Prior sampling work by the U.S. Bureau of Mines at La Plata had shown enriched REEs and other critical minerals in the system.

Among the 55 critical minerals identified by the USGS as vital to U.S. national security and economic resilience, five of the most import-dependent elements — along with both light and heavy REEs — have now been confirmed at La Plata, Metallic Minerals said.

"With current domestic sources for many of these elements nearly nonexistent, La Plata represents a rare, combined critical mineral and base/precious metal system within the USA," the company noted.

Minerals Co-Occur With Other Base, Precious Metals

The U.S. government's Critical Minerals Strategy was first announced in 2017 and expanded in 2022. It emphasizes building secure, domestic supply chains for these essential materials and providing strong policy support for the exploration and advancement of U.S. based critical minerals projects like La Plata.

The U.S. Senate Energy and Natural Resources Committee and the House Natural Resources Committee have demonstrated bipartisan support for securing a stable, competitive domestic critical minerals supply chain.

"To that end, proposed legislation on critical mineral exploration permitting aims to establish clearer, more consistent administrative practices, reduced bureaucracy, better defined permitting timelines, and enhanced transparency — all key components necessary to support modern, responsible resource development," Metallic noted.

At La Plata, these critical minerals co-occur with and add to the project's already well-established essential and critical mineral endowment of base and precious metals.

"These findings underscore La Plata's potential to emerge not only as a significant copper and precious metal (Ag, Au, Pt and Pd) resource, but also as a strategic source of critical minerals in the U.S. that are essential for supply chains to support advanced technologies, clean energy and defense applications," the company said.

Analyst: Stock Gaining Momentum

According to a March 26 report from Peter Krauth of Silver Stock Investor, Metallic Minerals Corp. appeared to be gaining momentum as investor recognition increased.

Krauth stated that "Metallic Minerals Corp. shares are up about 50% year to date, aided by metals prices and value recognition." He also noted that the company's shares "look undervalued and attractive to add on minor weakness," highlighting the potential for continued upside based on current valuation and sector trends.

The Catalyst: Reducing Foreign Dependence for Important Minerals

According to the International Energy Agency, critical minerals are essential for a range of clean energy technologies and have "risen up the policy agenda in recent years due to increasing demand, volatile price movements, supply chain bottlenecks, and geopolitical concerns."

According to Ahead of the Herd, the U.S. has taken steps to reduce its reliance on foreign sources by invoking the Defense Production Act and other measures to bolster domestic production. However, as noted in the same report, China's dominance in processing critical minerals continues to pose a strategic challenge. Recent Chinese restrictions on exports of materials like gallium and graphite further underscore the vulnerability of supply chains.

According to CleanTechnica, the growing demand for critical minerals, driven by the global shift toward clean energy, has positioned the sector as a crucial player in the energy transition.

Gavin Mudd, director of the Critical Minerals Intelligence Center at the British Geological Survey, emphasized the need for responsible and sustainable mining practices, highlighting the essential role these minerals play in technologies like electric vehicles and renewable energy infrastructure.

Reporting for S&P Global last summer on an IEA report on critical minerals investment, Jacqueline Holman wrote that "higher and more diversified investments into critical minerals mining and production is required to support the energy transition and help reach energy and climate goals."

"The IEA said that critical minerals markets were currently relatively well supplied, leading to a fall in prices -- which was good for affordability, but not good for new investments," Holman wrote. "This does not bode well for future supply, it added."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Metallic Minerals Corp. (MMG:TSX.V; MMNGF:OTCQB)

Production of lithium, cobalt, copper, nickel, zinc, and aluminum and other nonferrous metals is estimated to account for more than US$4 trillion this year, according to report by Carla Selman, Chris Rogers, and Sergio A. Hernandez for S&P Global. Batteries and accumulators are estimated to surpass the US$1 trillion mark by the next decade, they said.

Ownership and Share Structure

About 17% of Metallic Minerals is owned by management and insiders, including CEO Greg Johnson with 4%, Independent Director Gregor Hamilton with 0.93%, and the president, Scott Petsel, with 0.48%.

About 34% is owned by strategic investors, including Newmont's 9.5% and mining financier Eric Sprott, who owns 14.5%.

About 22% is owned institutionally. The rest, 27%, is retail.

Its market cap is CA$47.29 million, with 178.91 million shares outstanding and 130.31 million free-floating. It trades in a 52-week range of CA$0.40 and CA$0.13.

| Want to be the first to know about interesting PGM - Platinum Group Metals, Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Metallic Minerals Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.