Granite Creek Copper Ltd. (GCX:TSX.V; GCXXF:OTCQB) has entered into a definitive agreement to divest its wholly owned subsidiary, Element One Hydrogen Corp., to Buscando Resources Corp. (CSE: BRCO). The transaction includes the Union Bay and Star hydrogen projects, as well as the Element One Hydrogen brand. Granite Creek will receive total consideration of CA$150,000, with the deal expected to close within 30 days. All monetary values are reported as originally stated and have not been converted to US$.

In addition to the sale, Granite Creek will retain specific rights related to previous work and option agreements. These include reimbursement eligibility for work completed in 2024 and 2025 on the Star Project under a Natural Resources Canada (NRCan)-funded research partnership with Kemetco Research. The company will also retain any payments due under the first year of its option agreement with 1508260 B.C. Ltd., which was announced in December 2024.

Granite Creek Copper is a mineral exploration company focused on critical minerals in North America. The company’s portfolio includes its flagship Carmacks copper-gold-silver project in the Minto District of Yukon, the advanced-stage LS molybdenum project, and the Star copper-nickel-platinum group metals project in British Columbia.

In a company news release, Granite Creek President and CEO Timothy Johnson emphasized the strategic nature of the divestiture. He stated, “The sale of our hydrogen assets allows us to sharpen our focus on the high-potential copper and critical metals projects that form the core of our business strategy.”

Copper Market Tightens Amid Tariffs and Demand Shifts

Mining.com wrote on April 22 that copper prices reached a two-week high, with London Metal Exchange (LME) copper trading at US$9,305 per tonne and COMEX May contracts climbing to US$4.834 per pound. The article noted that a weaker US dollar supported prices, explaining that “a softer dollar makes commodities cheaper for buyers using other currencies.” Despite trade tensions, the publication stated that “metals have faced a turbulent April” but found some stability in currency movements.

At the SMM Copper Industry Conference held on April 23, Jianhua Ye of SMM highlighted that “the expected expansion of ore supply deficits and reduced copper cathode supply in 2025 also supported copper price increases.” He addressed the broader supply landscape, explaining that the global shortage of copper concentrates had intensified and the short-term supply-demand structure was unlikely to improve. Ye added that “with the decline in imported copper content, domestic copper cathode inventories are expected to decrease rapidly,” particularly as China’s imports from traditional sources like Chile and Peru fell. He also cited ongoing investments from China’s State Grid, which planned to allocate over 650 billion yuan to infrastructure in 2025, supporting end-use copper demand.

According to an April 29 update from Finimize, copper prices rose to US$9,458.50 per tonne on the LME amid strong Chinese demand and a strengthening yuan. The report stated that “China’s metal hunger has sparked a restocking frenzy,” pushing up prices by 0.9 percent ahead of the country’s Labor Day holiday. The tightening market also led to a surge in the Yangshan copper premium, which peaked at US$93 per tonne—the highest since December. The report further noted that “limited immediate supply led to a US$30 per tonne premium spread between LME cash and three-month copper contracts.”

Future-Facing Momentum in the Copper Belt

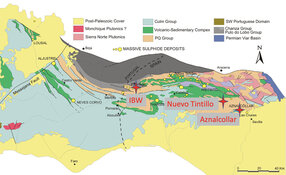

According to Granite Creek’s investor presentation, the Carmacks project remains a cornerstone of its growth plans. Located within the high-grade Minto Copper Belt, the project features 177 square kilometers of contiguous land and benefits from road access and proximity to hydroelectric power infrastructure.

A 2023 Preliminary Economic Assessment (PEA) estimated a post-tax Net Present Value (NPV) of CA$328 million (Case 1) with a nine-year mine life and a 29% internal rate of return. Metallurgical advancements reported in January 2024 suggest oxide copper recovery rates could reach 88% - an improvement over the PEA base case and a key driver of potential project economics. These improvements were noted as exceeding initial expectations, which forecasted 64 to 77% life-of-mine recovery rates.

Granite Creek has also highlighted multiple near-mine and regional exploration targets within close proximity to the Carmacks deposit, which the company believes could contribute to future mine life extension. The land package is considered underexplored, with several copper oxide and sulphide targets remaining untested.

The company noted that the copper market’s long-term fundamentals remain strong, driven by the rapid expansion of green technologies, including electric vehicles and renewable infrastructure. Citing industry research, Granite Creek’s presentation suggests that mine supply will fall short of demand in the coming years, potentially creating favorable market conditions for new production.

As Granite Creek advances drilling, optimizes metallurgical processes, and evaluates further project refinements, the company maintains its focus on copper’s role in the energy transition and the continued development of its Yukon and British Columbia assets.

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Granite Creek Copper Ltd. (GCX:TSX.V; GCXXF:OTCQB)

According to Refinitiv, insiders own 6.38% of Granite Creek Copper, including the CEO Johnson with 2.55%. The next top two, both directors, are Robert Sennott with 2.11% and Michael Rowley with 1.37%.

The company does not have any institutional investors. Retail investors own the remaining 93.71%.

Granite Creek has 198.27 million shares outstanding and 185.79 million free-float traded shares. The company's market cap is CA$3.97 million, and it trades in a 52-week range of CA$0.02 to CA$0.06 per share.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Granite Creek Copper Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.