In every precious metals bull market since the 1970's there has always been a period in which silver outperforms gold. Since the lows in December 2015 June Gold futures plunged yesterday from $3,509 to $3,271, taking the GLD:US from the opening high of $317.63 to an intraday low of $300.75. The GLD May $300 puts — on the books at $4.10, traded up to $6.10 before a late session rebound in gold took had them go out at $5.25. I took no action yesterday as I am looking for a double to $8.20, where I will sell half, recouping my original investment, so I can ride the remaining 50 contracts for free.

I see a correction in gold lasting until June with sideways action dominating as it works off the overbought conditions which were present on the daily, weekly, and monthly charts up until the Tuesday-Wednesday crash. I am uncertain as to whether the gold price will decline enough over this corrective period to get to an oversold condition, but overbought conditions across these three time lines have me exercising "caution" over the next month or so.

Silver

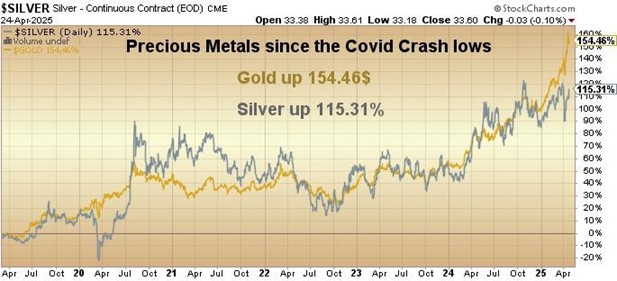

After looking through my trusty chart book over the past few days, I have been combing the archives to find a previous technical set-up for silver that could be applied to current conditions. A recent period in which gold took off to the upside while silver stayed flat was in March-June of 2020 after the Covid Crash sucked all of the liquidity out of the global markets forcing the Fed and the Treasury to embark on a highly inflationary rescue mission, injecting trillions of dollars into the global economy.

Initially, when the stimulative measures were announced, gold bolted higher without the company of silver taking the GSR (gold:silver ratio) to 125, the rationale being that shutting down the entire global economy to prevent the spread of the flu bug would hurt silver a great deal more than gold since silver demand is driven by industrial and monetary demand while gold is driven exclusively by monetary demand.

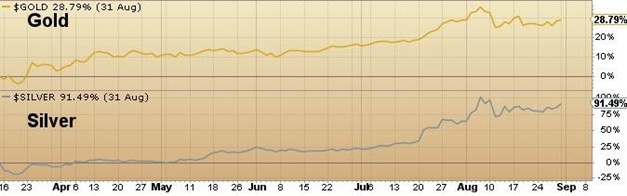

However, after I called the March 16 low in the gold and silver miners, the gold and silver started a stunning advance that would take the GSR down to 69.80 while silver outperformed gold by a margin of 91.49% to 28.79%.

What silver needed was a correction in gold before it could find its footing, and that is where I believe we are today. The current correction in gold mirrors the one in February-March of 2020 and it is important to remember that the resumption of gold's uptrend after March 16, 2020 signaled to the silver gods that is was time to assume the lead in the precious metals advance. I see the same set-up occurring today. While I do not believe that the current sell-off in gold is over, it would not surprise me if there was a tradable low sometime in late May or early June from somewhere south of $3k gold. Additionally, I do not think that the GSR is heading back to the 2020 peak around 125, and it is important to remember that the resumption of gold's uptrend after March 16, 2020, signaled to the silver gods that it, but rather trade sideways between 90 and 100 while gold completes its consolidation process.

The next item I needed to research was the performance of the silver shares in the same time frame in which silver outperformed gold back in 2020 so I pulled up the March 16 — August 30 chart for Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ) and lo and behold, PAAS advanced 163.13% during that same period.

Coeur Mining Inc. (CDE:NYSE) had a 230.47% advance in the same period while junior developer-explorers such as MAG Silver Corp. (MAG:TSX; MAG:NYSE American) and Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCQX) were up 211.85% and 469.71%, respectively.

In sum, the GGM Advisory is going to attempt to build a position in long-dated call options on PAAS and CDE and will be adding to Aftermath Silver Ltd. (AAG:TSX.V; AAGFF:OTCQX; FLM1:FRA). I am also looking at two junior silver companies — Silver North Resources Ltd. (SNAG:TSX.V; TARSF: OTCQB) and Carlton Precious Inc (CPI:TSXV; NBRFF:OTCMKTS).

SNAG/TARSF just completed a CA$1,350,000 10-cent financing in order to advance work on their two projects in the Yukon — Haldane and Kim.

The Haldane Silver Project is in the prolific Keno Hill District, host to Hecla Mining Company's Keno Hill Mine. The Haldane Project has very similar geology and vein mineralization to the Keno Hill Mine. At Silver North's Haldane Project, only a fraction of the 12 kilometers of the prospective structure that may host silver vein mineralization has been tested.

Silver North's geological team has determined that an airborne magnetics and electro-magnetics (EM) geophysical survey is a key step in unlocking the structural architecture at Haldane to aid in targeting further drilling at the Main Fault and surrounding targets. To date, Silver North has identified three additional silver-bearing vein-fault targets at the West Fault, Middlecoff, and Big Horn areas. Drilling at the West Fault returned 3.14m (TW) of 1351 g/t silver, 0.08 g/t gold, 2.43% lead, and 2.91% zinc in HLD21-24.

Silver North's second high-grade silver project, Tim, is under option to Coeur Mining Inc. ("Coeur") whereby Coeur can a earn 51% interest by spending $3.55 million on exploration and making staged cash payments to Silver North. At their election, Coeur can earn-in to a total of an 80% interest in Tim by funding a feasibility study. Analytical results from Coeur's 2024 six hole drill program at Tim, where positive characteristics of a productive CRD system were observed, are pending and will be announced as soon as they are received.

CPI/NBRFF has 100% of the Esquilache Silver Project located in southern Peru and is now advancing the permitting process to begin a drill program in the Mamacocha area in 2025 from 20 platforms. The program will be planned to bridge continuity of the known mineralization as well as extend to depth these major mineralized silver and gold-bearing veins that occur at Esquilache.

Esquilache has a historical database that includes 7,075 samples from surface and underground sampling and from two historical drilling programs, totaling approximately 5,500 meters (Vena Resources Ltd., 2009-2011 and 2014-2015) compiled by previous operators. The main Esquilache vein system consists of 12 sub-parallel, sub-vertical, primary veins (>1.0 m width) found in the Mamacocha and Creston zones, along with more than 40 secondary veins (0.3 – 0.5 m width) occurring in vein swarms in dilatant structural settings. Two mineralized breccia bodies have been recognized along structural jogs in the Elvira Vein located in the Mamacocha Zone.

Mineralization in these veins has been shown to range consistently between 3.0 and 12.0 oz/t Ag. The gold-rich Franja de Oro zone has been recognized in the Mamacocha Zone with an average of 1.94 g/t Au, 138 g/t Ag, and 1% Zn from the Ivet Vein. In 2023, Carlton's geological staff and consultants re-modelled more than 26 primary and secondary veins containing significant mineralization that were not previously recognized on surface by historical geological mapping. Website can be found here.

Chairman Marc Henderson is noted for his brilliant sale of Aquiline Resources (owner of the Navidad Silver Project) to Pan American Silver in 2010 for US$625 million. Also serving on the Board of Directors is Fitzroy Minerals Inc. Chairman Campbell Smyth.

I am inquiring as to the likelihood of a financing opportunity for Carlton and would eagerly participate if available. With a working capital position <$500k, they will need to raise money in order to drill Esquilache. So, if the silver trade works out as I described earlier and takes off on a 2020-style advance, the junior silver deals are where you want to be, especially if you can snip a two-year full warrant along the way.

Silver has actually outperformed gold and copper since the lows in 2020 gaining 128.09% while copper is ahead 125.42% and gold ahead 123.64%. However, on a year-to-date basis, silver is lagging both copper and gold with the latter being by far the best performer up 27.68% versus copper up 22.51% and silver up 16.40%.

I expect that underperformance to change in favor of silver which, if it follows late-cycle patterns such as 1979-1980 and 2009-2011, could experience extreme outperformance such as the period from September 2010 until April 2011 when it dropped from around 72.5 to 32.61 as the bull gasped its final breaths.

A 53.9% drop in the GSR back then caused an explosive move in the silver stocks with the juniors being the hands down best performers.

I wanted to get this bulletin in front of all subscribers early, even though I may be a month away from actually pulling the trigger. It feels like August 2010 with the metals trying to digest the big move off the 2008 lows. I will speculate that 2025 will indeed be the year that multi-generational demand for silver will overpower the supply created by the paper markets, resulting in a big move. Review your portfolio holdings and make sure you are liquid enough to take down some of the names mentioned earlier in this publication, with particular attention to the "penny dreadfuls," and here is why.

Here is yet another anecdote from my long career in the investment industry. In 1979, I was having lunch with our retail mining analyst, a fellow named John Skomba in downtown Toronto when the topic of silver came up. At the time, silver had doubled from $4.00 per ounce to just under $10.00 per ounce, and everyone was just beginning to take notice. About halfway through the lunch, Skomba mentioned a little "penny dreadful" silver deal that had a resource way up in Canada's Yukon Territories that went by the name Dolly Varden Minerals (not to be confused with the current Dolly Varden Silver , which trades at around CA$3.65 per share).

The "old" Dolly Varden was trading slightly south of $0.50 per share, but since it only had 12m shares issued and outstanding, it was an enormous leverage play on silver prices because the small silver resource they owned carried a cost of production of around $18/ounce. I finished my lunch with John and then went back to the office and proceeded to buy a bunch of shares (millions) for myself and my clients. Well, within a couple of months, silver took off as the Hunt Brothers pulled off the perfect "corner" on the silver market, buying up every contract on the Comex futures exchange and locking up every ounce of physical supply they could get their hands on. It soon took out $18/oz., and then $20/oz, and by the time it hit $50/oz., in 1980, little Dolly Varden wasn't do "little" anymore, trading enormous volumes above $28.00 per share.

While "muscle memory" can be a very useful human attribute, it can also be a hindrance because it only takes one little investment to go from $0.50 to $28.00, and one gets somewhat "spoiled." There hasn't been a week that goes by when I do not think about the rapture that ensued when I started taking profits at $15 per share, a 30-bagger all within a few short months.

Now, I am not suggesting that either of the two juniors mentioned earlier (Silver North and Carlton Precious) are going to repeat the incredible antics of Dolly Varden Minerals, but I do believe that these new generations of investors (the "kiddies" as I call them) while they prefer Bitcoin over gold, are going to inhale the silver narrative and make it their own private piggy bank.

The bullion banks that govern the pricing structure for silver have been fully capable of fending off the aging and depleting generation of Baby Boomers that won out the last time silver went parabolic but they will not be able to handle three new generations of investors that will all be moving in swarms to acquire silver and a lot of it at any cost and at all hours of the day and night across multiple time zones and continents.

Stay tuned and get very ready. . .

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- MAG Silver Corp., Silver North Resources Ltd., and Dolly Varden Silver Corp. are billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Pan American Silver Corp., Dolly Varden Silver Corp., Aftermath Silver Ltd., and Silver North Resources Ltd.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.