Gold has peaked for now, and gold Bugs can lick their wounds for a while. The real world is getting on with life.

T Bond yields are heading lower. The U.S. dollar is recovering, and currency rallies are over.

Small-cap resources are looking good.

Tuesday's note pretty well covered the hysteria in the markets, sensing the peak in gold for now and the bottoming in most things U.S. Bond yields are lower, and the wild surges into the Swiss Franc and Euro peaked precisely at the 50-year uptrend lines, so the goodbye kisses there should see them make new lows.

The intensely bearish sentiment in U.S. stocks has been met with strong short covering that should see new highs coming along soon. Gold has been rising in a parabola for over two years, and that US$530 final vertical move was a sure sign of some sort of peaking. Peaking for now.

My medium-term target of US$3300 has been met and exceeded. The market now has a massive overhead overhang to digest. Consolidation for a few months at least.

Gold stocks globally have not been reflecting these higher prices, so the downside here should not be great, but new highs might take a while. Small gold and resources stocks, however, will now be aided by a rising U.S. equity market and an assurance that US$2000 and possibly US$2500 will prevail.

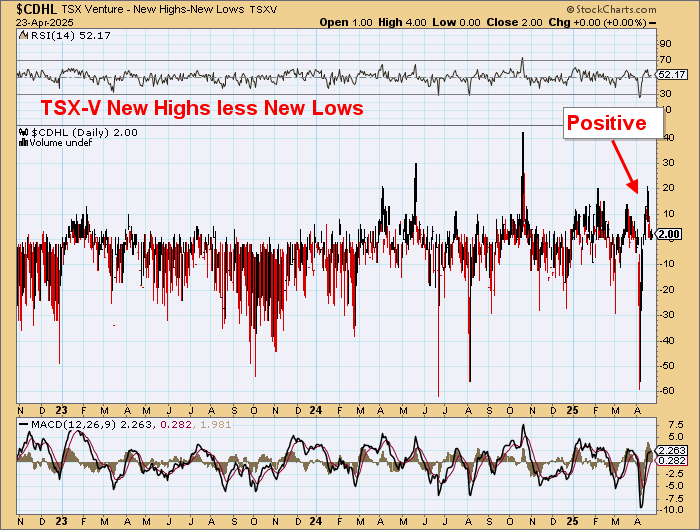

Despite the big sell of in US$ gold today the TSX-V CDNX was UP and new highs less new lows stayed positive.

The real world is turning up — up on the day.

Money flow into the sector:

Gold Stocks

Gold stocks are still in a bull market, but are probably three to five months sideways to down.

XAU is likely to pull back to 160 - ~10%.

This is looking constructive here.

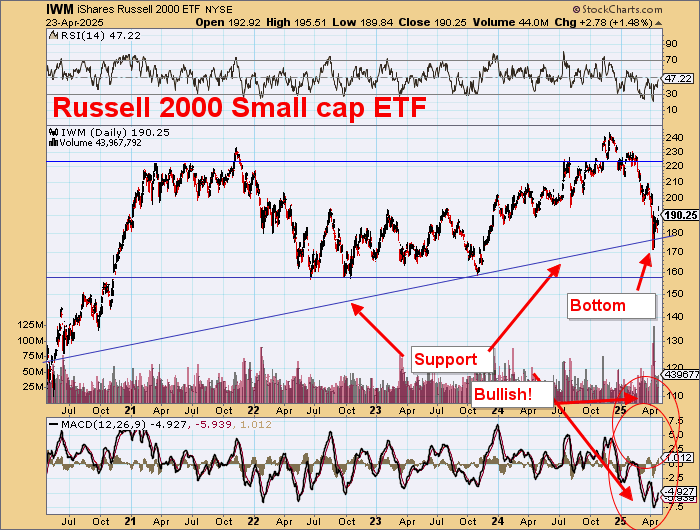

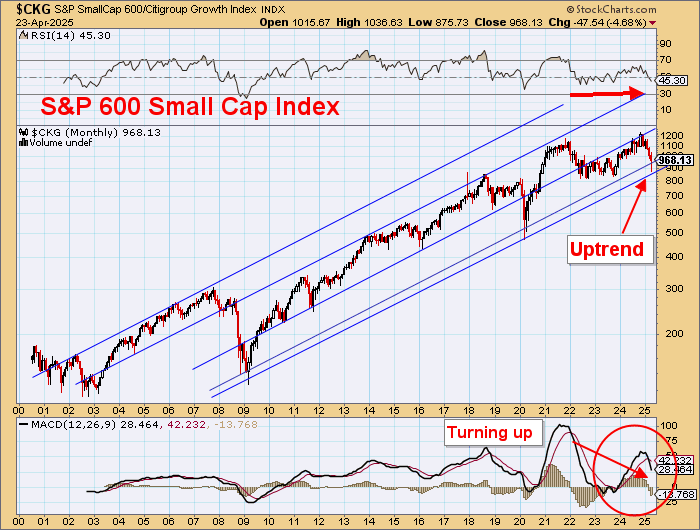

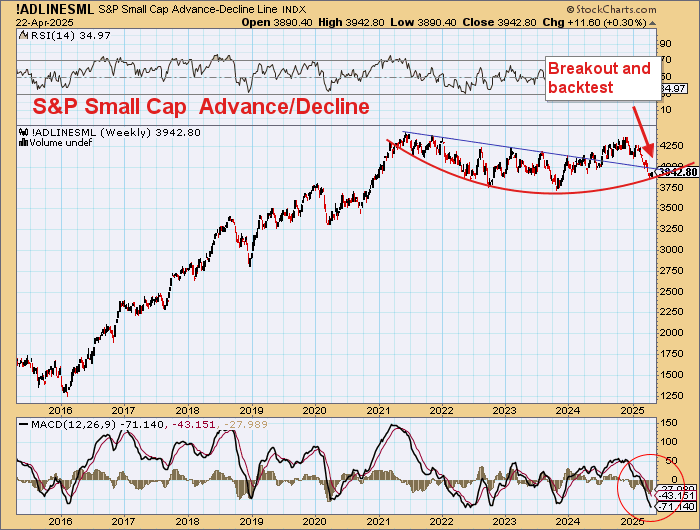

Small Caps

Now, I will focus on small caps.

The Russell 2000 Small Cap ETF had a good bound from lows.

The S&P 600 Small Cap Index's uptrends is intact.

The S&P Small Cap Advance/Decline Line is wobbly but still constructive.

It is Buy time!

The hysteria, yes hysteria, about the 10-year pushing through 5% just showed shallow thinking.

Be a Gold BULL, not a Gold BUG!

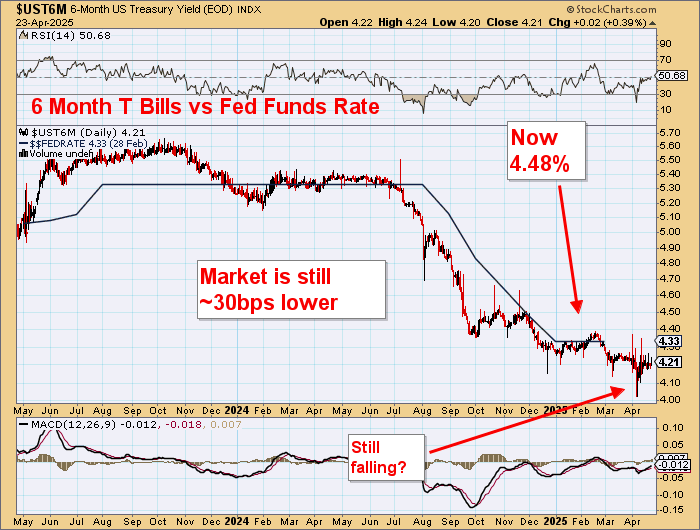

The 1-year Treasury Yield is heading lower.

Island reversal here — sharp falls are coming.

Trump is correct in calling out Fed chief Powell.

Almost 30bps higher than the market, and three to four months behind the curve.

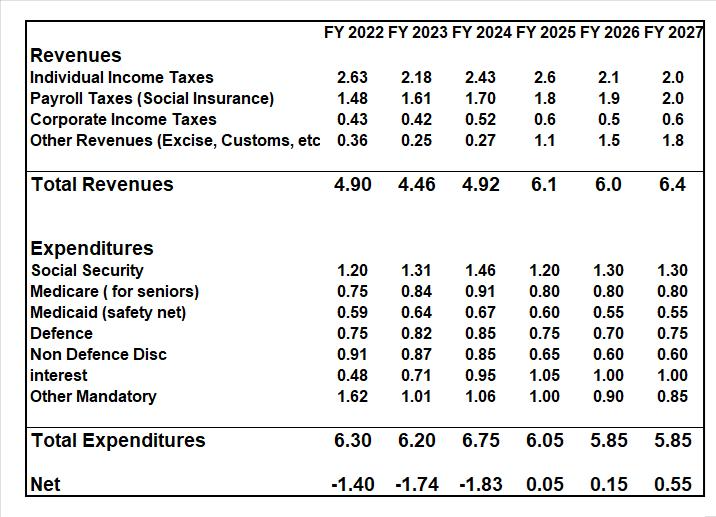

And there is still time for a balanced Federal Budget in FY2025.

And a new gold standard is coming.

It is all good.

Heed the markets, not the commentators.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.