Below is an interview by Rick Mills, the editor and publisher of Ahead of the Herd, with Bob Moriarty of 321Gold.

Rick Mills (RM): What are your sentiment-tracking measurements telling you currently?

Bob Moriarty (BM): Let me share something intriguing, you've known me for quite a while. I consider myself a contrarian and in my publications I explicitly claim that investment knowledge is secondary if you can accurately gauge market sentiment.

The current situation is noteworthy due to this week's developments and I'll provide a hint. Gold increased three consecutive days, $100/oz, how much impact do you imagine that had on the DSI [Daily Sentiment Indicator]?

RM: I suspect it's quite significant.

BM: Surprisingly, it's minimal overall. One week ago gold's DSI registered 86 and following three days where gold jumped $100, it went 86, 79, 82, 87 which represents its peak, and with yesterday's minor decline it's fallen to 80. I can definitively state it hasn't peaked at 87 — when it reaches 95 or 96 that will signal a substantial peak but we're nowhere near that level.

There's considerable mystery surrounding sentiment measurement, it's not some random figure he generates, he's performing mathematical computations on commodities but it's remarkably precise and for the DSI to decline to 80 with gold at $3,300 that's simply astounding to me.

RM: It appears counterintuitive, doesn't it?

BM: Here's the crucial point, it shouldn't appear logical. It represents exactly what it is, simply a measurement of sentiment and nothing additional and all these industry personalities claim oh, when the Dow Jones rises gold prices fall, if gold prices increase the S&P decreases, and they're attempting to link elements that aren't necessarily always connected.

Sentiment remains sentiment. When we experience an all-time high it will be evident and I believe if you examine April 25th of 2011 I think silver sentiment exceeded its January 1980 levels.

RM: You're essentially dealing with psychological factors — fear and greed, that's what sentiment represents and if you can somehow quantify that accurately and express it numerically that's Bernstein's methodology.

BM: He's discovered something valuable, I've recognized sentiment's importance for decades, but finding the most reliable sentiment gauge was extremely challenging.

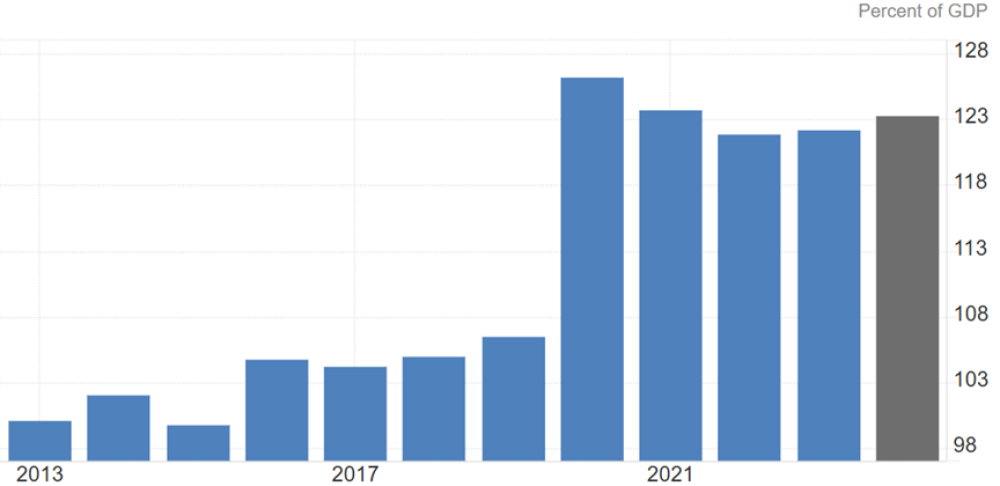

RM: America carries $9.2 trillion of obligations that must be either satisfied, refinanced or newly secured and a substantial portion includes $2 trillion deficit due this year. We're aware Treasury auctions have proceeded successfully, so currently no discussion about debt monetization, actually there was an enormous Treasury auction in February and literally everyone participated, including the eurozone, Britain, Taiwan and even BRICS nations like China, India and Brazil.

We witnessed the largest increase in foreign purchasing since '21 and they predominantly acquired long-term securities, short-term instruments simply weren't compelling, and they purchased long-term debt yielding approximately 4.28%.

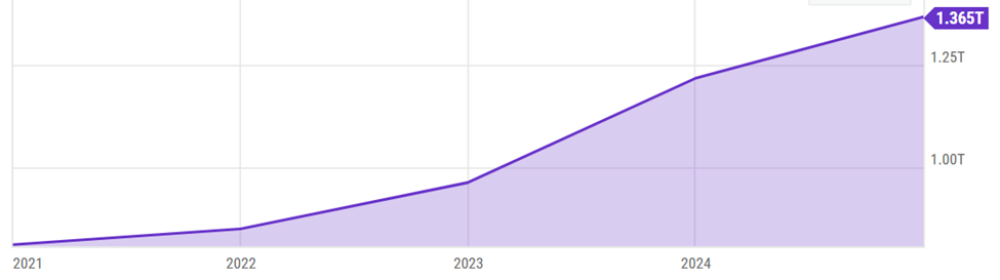

We understand the Trump administration strongly desires lower interest rates because currently they're attempting to solidify their agenda, working to maintain tax reductions and everything else, and I believe when people recognize one crucial fact, which will truly resonate with many individuals, is that American military expenditure reaches $1 trillion.

Actually it substantially exceeds that figure because nuclear weapons aren't included, those fall under Energy, neither are Special Forces nor Veterans' Administration — the VA, so your primary expense category on federal government financial statements currently is military spending.

That's changed now, with this major refinancing and debt purchasing at such elevated yields, and the reason they're acquiring long-term American debt — the 10, 20, 30-year instruments, is because only one alternative offers higher returns, specifically Britain. All other nations' bonds yield approximately half, their 10-year securities around 1.6% perhaps 2.1%, they're securing excellent returns on extended American debt, but consequently they're pushing interest payment expenses beyond a trillion dollars.

Now your predominant line item in annual government accounting will become interest payments on outstanding debt. That suggests to me something completely unmanageable, what's your perspective?

BM: Curiously, you employed the most accurate description possible. When Elon Musk described Social Security as a Ponzi scheme he possessed sufficient wealth and prominence to state something universally acknowledged, correct? Social Security operates as a Ponzi scheme and we understand how Ponzi schemes conclude, and I've maintained for years, this represents a struggle between the BRICS resource-based system against the Western debt-based framework.

We've transformed from a manufacturing nation into a country where 32% of economic activity involves shuffling documents. It constitutes a crisis but one solvable only through collapse and complete restart. My concern is Donald Trump has entered a fragile environment swinging a baseball bat vigorously. He seeks to antagonize our largest trading partner, I simply cannot envision how that succeeds.

I believe it's not exclusively Donald Trump and tariffs themselves, the collapsed basis trade carries far greater significance than tariffs, believe it or not. A crisis currently unfolds a liquidity emergency occurs behind the scenes within the global financial structure it's about to explode dramatically, no resolution exists except default and it worries me because I observe Trump selecting the warfare path, thinking it provides escape from Depression I believe substantial probability exists we'll initiate conflict very shortly.

RM: Did you notice Citi [bank] has indicated the American stock market no longer warrants buying and they've downgraded U.S. equities to neutral from overweight? They also suggested investors should begin diversifying beyond America.

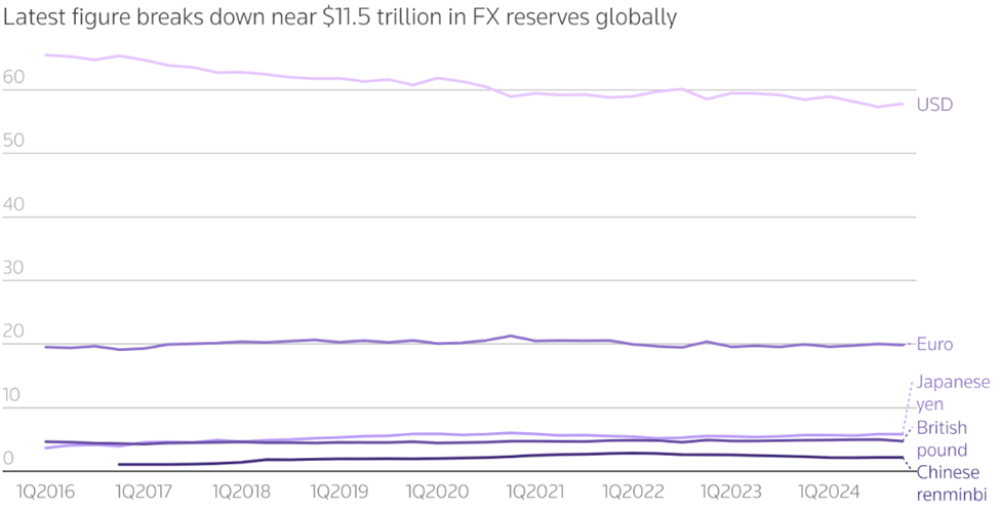

Deutsche Bank stated that markets are reevaluating the dollar's fundamental underpinnings as global reserve currency, due to geopolitical and strategic shifts, de-dollarization and BRICS initiatives.

New transaction systems avoiding American banks, and commodity exchanges increasingly denominated in non-dollar currencies.

Ultimately, bonds, dollars and stocks are simultaneously declining. Structural weaknesses exist in bond markets and people are reconsidering the dollar's position.

BM: Well structural problems plague the entire global financial framework, not merely bond markets, it's the complete system and Donald Trump just tossed an explosive into a packed venue. You cannot enter a motorcycle establishment and challenge the largest individual without expecting severe consequences and Trump's inconsistent tariff approach lacks coherence and numerous supporters remain because some positions he advocates I consider brilliant.

We're experiencing a fascinating historical turning point, it will prove interesting observing developments, I believe considerable likelihood exists we'll engage in warfare.

RM: We discussed this during our previous conversation where we both concluded Middle Eastern conflict might trigger events.

Are you worried about America's massive unfunded liabilities?

BM: No, we discuss funded obligations as though they're significant, they're entirely inconsequential. There's a principle few comprehend and practically nobody except myself fully recognizes. All debts get settled, either by borrowers or lenders. The issue isn't America's accumulating debt, but America's spending because payment becomes inevitable, whether through taxation, inflation or default and I see no resolution to this debt crisis except catastrophic default.

RM: Well the federal government collects slightly above $5 trillion annually, current year expenditures exceed $7 trillion, creating $2 trillion deficit requiring financing. Interest payments on unfunded obligations already constitute the government's largest expense. Such spending restricts many worthwhile policy initiatives.

Federal Reserve chairman Powell appeared on television saying something particularly striking and we haven't reached stagflation yet but he expressed concern about rising inflation, increasing unemployment, and already slowing growth, that precisely defines stagflation. We haven't arrived there yet, but I believe America heads toward severe stagflation — would you agree?

BM: I think conditions are worse. Substantially worse. I've forecasted for 15 years an impending massive financial crisis in America culminating in market collapse across all sectors exceeding 1929 severity. I believe it's commenced, it's begun though nobody recognizes it yet, Donald Trump's tariff actions inevitably create enormous complications, he's throwing wrenches into an already vulnerable system. Introducing mechanical obstructions into machinery doesn't improve operations it worsens them.

RM: The stagflation scenario probably represents the optimistic projection for forthcoming events.

BM: I experienced stagflation during Nixon and Carter administrations and people could manage it, many lost employment and interest rates climbed and circumstances deteriorated but we survived.

RM: But precious metals surged, and mining investments performed excellently during the '70's, vastly outperforming bonds and traditional markets. That situation appears to be developing currently, stagflation or comprehensive collapse.

Bob you and I observe these developments together, I've got substantial free time too. I conduct extensive research and frequently browse online and simply shake my head watching events unfold, it's somewhat pleasant avoiding daily routines. I've been retired 20 years and we retired my spouse early and together we manage our business, televisions remain active as we monitor global situations. Occasionally we simply must switch off the nonsense and disengage due to absolute foolishness pervading statements and actions. Nothing makes logical sense whatsoever.

BM: Let me illustrate. Being French naturally, Macron discusses deploying French troops to Ukraine. Starmer in Britain contemplates similar measures. The entire British Army could occupy Wembley Stadium leaving vacant seats. British forces total 75,000 personnel, requiring 72,000 for ceremonial functions, leaving potentially 3,000 individuals for Ukrainian deployment.

Ukraine represents history's most senseless conflict. It began as civil unrest instigated by America and NATO targeting Russia, resulting in complete disastrous failure for NATO, Germany, European Union, United States and nobody possesses courage to acknowledge mistakes. Why not terminate operations correct? Worthwhile endeavors deserve proper execution while pointless activities warrant abandonment.

That constituted an incredibly stupid confrontation offering no victory path and Russia honestly isn't Europe's adversary, nor America's enemy. All rhetoric regarding Russian European invasion intentions is fabricated nonsense. France faces no Russian threat, France confronts American hazards.

When America sabotaged Nordstream [pipeline] and as both intelligence operative and combat veteran I assert America destroyed Nordstream no alternative perpetrator exists, they effectively destroyed European economic foundations. So why does Macron fear Russia? Why does Starmer worry about Russia? They should concern themselves with America, America represents their adversary not Russia.

RM: America seems to behave extremely antagonistically toward numerous parties.

BM: Well we inhabit fascinating times making me grateful for advanced age. Speaking today on Good Friday, do you know my primary concern?

RM: Easter celebration costs?

BM: No. Our entire societal structure verges on catastrophic failure due to systemic complexity and now Trump's administration introduces explosive devices into crowded environments.

RM: "The complexity of everything." That's quite astute Bob captures it perfectly.

Bob I forwarded information regarding Basel III. Fundamentally for us it might ultimately involve allocated versus unallocated gold and American responses, interestingly they announced reassessing certain asset valuations then DOGE requested Fort Knox gold audit.

What's your perspective regarding Basel III and American Endgame? Do you anticipate increased retail interest in gold? Central banks actively purchase gold, suggesting possible connection with global currency system reset. What thoughts regarding Basel III?

BM: It represents ongoing developments with fascinating implications and essentially Basel III requirements mandate banks maintain stronger reserves including gold. I attempt addressing overlooked topics. I'll pose questions for your best responses.

RM: Certainly.

BM: Avoid numerical answers, but comparatively how large is the silver marketplace?

RM: Minuscule.

BM: Extremely small. Negligible. And comparatively how extensive is the gold marketplace?

RM: Not substantially larger, perhaps slightly bigger but minimal, equally insignificant.

BM: Appreciated. Everyone unnecessarily complicates matters. During 2007 I wrote regarding GFC [Global Financial Crisis] stating everyone believes securing seating remains possible when music stops. But suppose seating scarcity exists?

Similarly applies to gold especially silver. When music ceases everyone will shock discovering seating absence, understood?

What happens when gold appreciates $500 daily becoming unobtainable? Imagine multiple buyers competing for each ounce? Resulting unprecedented chaos awaits. Generally I retain rather than sell precious metals, understood? Those represent my financial turmoil insurance.

Gold and silver mining stocks' relative value compared against metal prices registers lowest levels in 45 years understood? Observing gold appreciating 3% single day represents significant movement. We experienced three instances last week.

I anticipate my gold investments appreciating 10 or 15% because they should command premium above gold price increases. People remain so skeptical regarding gold it's guaranteed, understood, for profit generation.

Gold ownership serves multiple purposes. Primary purpose involves financial chaos protection. Financial chaos manifests currently pleasingly since I maintain protection.

Investment aspect exists additionally and I constantly evaluate optimal current investment opportunities. Now I'll state numerous gold and silver companies exist poised for 50 or 100-fold appreciation. People will express astonishment.

RM: Shouldn't surprise anyone because between us, we recognize historically optimal leverage against rising precious metals prices involves owning quality junior exploration companies seeking and developing gold and silver deposits. That represents indisputable factual reality.

BM: No you're mistaken, quality isn't mandatory. I visited one Tanzanian company around 2007, 2008 where describing management as fraudulent dishonest incompetent would constitute compliment because actual situation exceeded those descriptions. They completely depleted finances completing financing at five cents, understood? Currently numerous 5-cent stocks exist but few existed then.

They secured financing at 5 cents, subsequently drilled previously held property yielding excellent results driving shares to 5 dollars. Having warned about management incompetence deception dishonesty cheating thievery what outcome befell that company?

RM: Presumably collapsed, disintegrated completely.

BM: Thank you, so prepare for astonishment some companies led by corrupt incompetents will appreciate 100-fold having already occurred previously.

Curiously discussed in my financial publications, sentiment's importance relates directly to history's greatest human behavior analysis "Extraordinary Popular Delusions and the Madness of Crowds". Reading that confirms human stupidity. Simply determine prevailing behavior then act contrarily understood?

You recall several months ago predicting stock market peak alongside cryptocurrency peak. Everyone dismissed me as blithering imbecile proven incorrect.

RM: You followed sentiment indicators?

BM: Obviously. That motivated writing those financial books initially. They represent straightforward publications anyone comprehends within hours and future generations will reference those books because I express numerous concepts with absolute clarity avoiding confusion,

When purchasing investments seeking profits sell upon achieving profits.

RM: Two observations regarding this discussion. Firstly, regarding your books, selling advice remains timeless. Sound guidance maintains relevance today tomorrow indefinitely.

Secondly, my selling decisions stem from discomfort continuing ownership, that motivates selling. Future projections past performance external recommendations holding selling, all prove irrelevant.

I sell experiencing discomfort continuing ownership, fearing profit loss. So selling occurs when discomfort arises regarding accumulated profits if comprehensible.

BM: Perfect comprehension indeed, referencing "Extraordinary Popular Delusions and the Madness of Crowds" sometimes people object to my characterizing humans as exceedingly unintelligent. Well justification exists within observable behavior patterns.

People exhibit maximum optimism at absolute peaks and maximum pessimism at absolute bottoms, numerous resource sector stocks several months ago couldn't attract interest, understood? I recognize opportune acquisition moments.

I continue purchasing certain stocks at 2 or 3 cents because despite potential worthlessness, potential exists for 20 or 30 cent appreciation, we're entering territory 99% of investors never experienced. Have you examined ancient cartography from 15th, 16th centuries? Depicting unknown territories?

RM: "Here be dragons."

BM: Precisely describes current circumstances. "Here be dragons." So purchase during inexpensive periods and sell during expensive periods.

RM: The gold-silver ratio during our initial conversation registered 102 and remains 102, gold's $3,300 silver's $32.50. Conducting casual research I utilized AI searching. I investigated average gold-silver ratio spanning 20 years, receiving 60 to 1 response, suggesting $55 silver today.

So, acknowledging gold's attractiveness, silver offers superior opportunity in my opinion and our discussion covered numerous topics, gold silver justifications and my firm conviction that optimal leverage against rising precious metal prices involves quality junior exploration companies, but I perceive major discrepancy, specifically gold-silver ratio disconnect and I intend discussing one silver opportunity shortly. But would you elaborate regarding New Found Gold Corp. (NFG:TSX.V; NFGC:NYSE.American) Your thoughts?

BM: Ok, investors must understand personal responsibility for profits and losses, so rather than seeking gurus, comprehend why guru popularity exists? It seems counterintuitive yet simple why are gurus popular?

RM: I employ comprehensive analytical frameworks, macro-micro examination for everything proceeding accordingly. I disregard gurus, questioning why anyone heeds them.

BM: Well guru popularity exists, revisiting "Extraordinary Popular Delusions" human irrationality prevails, because someone receives blame following mistakes.

I possess extraordinary narratives spanning hours regarding promising stocks where isolated poor decisions caused implosion.

I possess reasonable judgment but people heed gurus avoiding personal responsibility, returning to New Found Gold.

You've examined assay results revealing hundreds of ultra-high grade gold intersections. The primary mistake those young executives controlling the company made involves resource estimation methodology, utilizing scattered sampling attempting evaluation across the entire project covering extensive area, producing extraordinary results, but attempting evaluation across dozens of kilometers strike length they erred with excessive drilling intervals.

They secured numerous positive gold intersections, when qualified professionals prepare 43-101 documents two considerations apply. They consider drilling spacing intervals and regardless of grades, larger drilling spacing reduces estimated gold content due to uncertainty within undrilled zones.

Another critical yet largely unknown factor involves capping ultra-high grades understood? With 75 gram intersection you've analyzed half the core. Will remaining half contain 75 grams? Answer: not necessarily, potentially containing 150 grams or merely 5g so with 7-meter 75g gold intersection you cap it. You estimate 10 grams rather than 75 grams throughout.

RM: Myself and many others question whether NFG contains more than 2 million ounces?

BM: While avoiding guarantee terminology however I'll definitively state 2,000,000 ounces reflecting 43-101 measurement, accuracy probability equals zero.

It's absurdly conservative ensuring subsequent 43-101 will contain substantially greater gold, representing Fosterville-type deposit understood? Fosterville transformed Kirkland Lake from $3 billion company into $18 billion company.

Recent New Found Gold purchasers will profit tremendously, it's extraordinary project, lacking fundamental flaws.

Some decisions retrospectively appear misguided but given robust market conditions which we lacked, perhaps they weren't actually wrong merely temporarily inappropriate but anticipate substantially exceeding 2 million ounces.

Two respected geologists, two individuals I know discussing New Found Gold's 43-101 both employed identical terminology, specifically the 43-101 is nonsensical.

RM: I experienced profound shock witnessing such modest resource estimation.

BM: The gold exists, Fosterville featured depth, New Found Gold lacks depth maintaining shallow mineralization indicating additional gold. Meaning subsequent 43-101 promises intrigue.

Naturally management will appear heroic but share prices declined through Labrador Gold share disposals alongside exceptionally conservative 43-101.

RM: Two discussion aspects. Initially, regarding your publications, selling guidance remains perpetually relevant. Worthwhile advice retains relevance indefinitely.

Secondly, my selling decisions originate from ownership discomfort, that triggers selling. Future projections past performance external recommendations holding selling prove irrelevant.

I sell experiencing discomfort continuing ownership, fearing profit loss. So selling occurs when discomfort arises regarding accumulated profits if comprehensible.

I'll discuss an attractive silver opportunity from my advertiser portfolio. I appreciate CEO Jason Weber demonstrating intelligence, I admire his Silver North Resources Ltd. (SNAG:TSX.V; TARSF: OTCQB) development. Trading symbol SNAG, they control property optioned to Coeur [Mining] while Coeur operates CRD along Yukon border.

Silver North's Tim property remains under Coeur option. Coeur continues property exploration. Confidence levels remain extraordinarily high regarding carbonate replacement system presence resembling Coeur's neighboring project. That project presents interest though optioned allowing Coeur continuing earn-in.

The property receiving today's focus involves Silver North's Haldane property situated within Yukon's Keno Silver District, representing globally premier high-grade silver region. The district produced 200 million silver ounces historically with mines classified primary silver operations generating zinc lead byproducts.

SNAG's Haldane project neighbors Hecla [Mining], who commenced mining during 2023 possessing proven probable reserves approaching 50 million ounces @ 700 grams per tonne. Their project mineralization, currently under production, resembles Haldane project characteristics.

Average Keno district silver operation contains 30 million ounces understood, with historical production grades approximating 1,100 grams per tonne silver, classified primary silver operations rather than silver-equivalent operations.

Silver North maintains clear plans, focused direction and implementation. They recently secured $1.35 million representing hard money preceding upcoming charity financing potentially reaching $4 million and charity financings typically require comfortable hard money reserves initially.

Observers recognize this pattern and they completed charity financing last year suggesting anticipated success raising potentially $4 million focusing on drilling 2,000 to 5,000 meters, depending upon financing outcome, targeting their recent Main Fault discovery.

They've completed three modest drilling campaigns each yielding discoveries, however Main Fault stands exceptional, representing substantial mineralization exhibiting three distinct layers. They believe current year drilling will minimally establish clear visibility towards, if not outright achieving, standard 30-million-oz Keno deposit.

Given current share pricing they could complete 17.5-cent financing calculated fully including warrants yielding 138 million shares outstanding fully diluted. Additionally $1.5 million in warrants at 15 [cents] potentially exercisable.

Conducting valuation analysis, the property contains 12 kilometers vein potential; additional discoveries exist including high-grade West Fault. Considering current market capitalization reasonable expectations include multiple returns following successful drilling campaign.

I favor this project for standalone potential, alternatively providing integration opportunity with Hecla's existing operation. Consider, they possess 49.7 million ounces proven probable mining reserves, you're adjacent, merely 2 kilometers from Hecla's processing facility. Demonstrating 30, 40, 50 million silver ounces likely attracts serious consideration from Hecla.

BM: I've not monitored this however during your presentation I conducted research and another project priced so affordably that believing in silver justifies investment. Substantial historical silver production occurred there, predicting Yukon popularity this year.

RM: I favor their prospects building primary Keno silver deposit.

BM: Indeed, acknowledging silver appreciation requires recognizing leverage available through quality pure silver investments. Hecla proximity represents substantial advantage.

RM: Absolutely crucial, Hecla maintains junior-friendly corporate culture, they maintain cooperative relationships with juniors, they're approachable business partners.

BM: Timing appears nearly perfect and I commend them securing adequate funding for meaningful drilling program.

RM: Were additional topics warranting discussion today Bob?

BM: Future discussions await certain topics.

RM: I appreciate your time commitment with us.

You can view more from Rick and Bob at Ahead of the Herd and 321Gold.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Silver North Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver North Resources Ltd.

- Rick Mills: My company has a financial relationship with Silver North Resources Ltd. I determined which companies would be included in this article based on my research and understanding of the sector.

- Bob Moriarty: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Ahead of the Herd Disclosures

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.