When I sat down to write the Easter weekend issue of the GGM Advisory Weekly edition, I had to first revisit the April 4 and April 11 issues to remind myself of the extreme volatility of the past month. That was important as an exercise because it emphasizes the outright insanity that has been the trademark of the U.S. equity markets for the past decade and a half and forces a strategist like me to reflect on the moral hazard now ingrained in the global financial system.

Thanks to the incessant bailouts that started in 1987 with the creation of The Working Group on Capital Markets that began as a way of preventing events like the October market crash of that year, it gradually then suddenly became "The Plunge Protection Team (PPT)," springing to the rescue with the monetary fire hose spewing out massive amounts of conjured ("phony") liquidity every time the S&P slid a few percentage points. In 2008, after the geniuses in the multinational banks vaporized the financial system with abject abuse of the mortgage market, the PPT found itself woefully under-armed in dealing with a completely frozen global banking system so ex-Goldman Sacks CEO Hank Paulson was forced to get down on one knee and beg the U.S. Congress for a $700 billion bailout package that allowed the Treasury Department to buy all of those "toxic assets" (i.e. "bad trades") from the banks. By Christmas of 2008, 7-figure bonus cheques were in the mailboxes every hundreds of banking executives as dutiful reward for "a job well done."

The mainstream media, led by the CNBC bubbleheads, were able of hundreds of banking executives as a to gloss over the fraud and abuse by obsessing over the S&P 500 and its remarkable rise that was coddled, cuddled, and coerced into a decade of multiple expansion the likes of which would make Joe Granville turn over in his grave. When it looked like it was all going to come crashing down in late 2019 when the REPO market first began to leak oil, along came that nasty flu bug in 2020 that became the perfect cover story for shutting down the global economy (except Amazon and Costco, of course) while injecting US$5 trillion in liquidity into the financial system through "stimmie cheques" and even greater corporate welfare grants. This was all carried out on the pretense that it would solve the plight of the average citizen in dealing with that stubborn little microbe that seemed to be putting only senior citizens at risk while forcing the rest of the planet to engage in social distancing and masks, both completely useless is stopping the spread of anything,

Sadly, the real beneficiaries of the Great Pandemic of 2020 were the Wall Street hooligans who once again found government rescue money, created with the magic wand of financial wizardry, flooding into bank and brokerage accounts like the Mississippi in April. It all came to a resounding climax in 2024 after four years of government largesse and fudged economic data designed to pad the economic track record of the Biden-Harris administration when Donald J. Trump blew in on an ill wind and took control of the public narrative and the White House, bringing along an army of "champions of industry" like Elon Musk and Scott Bessent for the expressed purpose of rattling the institutions of the D.C. "swamp" to their very foundations.

The rocket scientist market strategists in New York slapped the label of "American Exceptionalism" and "Regulatory Relief" on this new regime, thinking rather incorrectly that Trump would never dare to change the way they do business in Washington. Not in a million years would a sitting U.S. president prevent the monetary gravy train from hampering the delivery of ever-rising stock prices and 8-figure salaries for the Wall Street intelligentsia.

Tariffs?

"Just a negotiating tool . . . " they chortled while bidding stock prices up to record highs within eight weeks of the Trump victory. But, when he decided on April 2 to use Hank Paulson's bazooka to impose tariffs on everyone not sporting a star-and-stripes baseball cap and egregiously large tariffs at that, it was as if a little boy at the side of the road suddenly informed the delusional crowds that "the Emperor has no clothes" at which point not just Wall Street but the entire global investment community from Beijing to Zurich to Melbourne made a fateful decision — "Sell U.S.; Buy Europe and Asia."

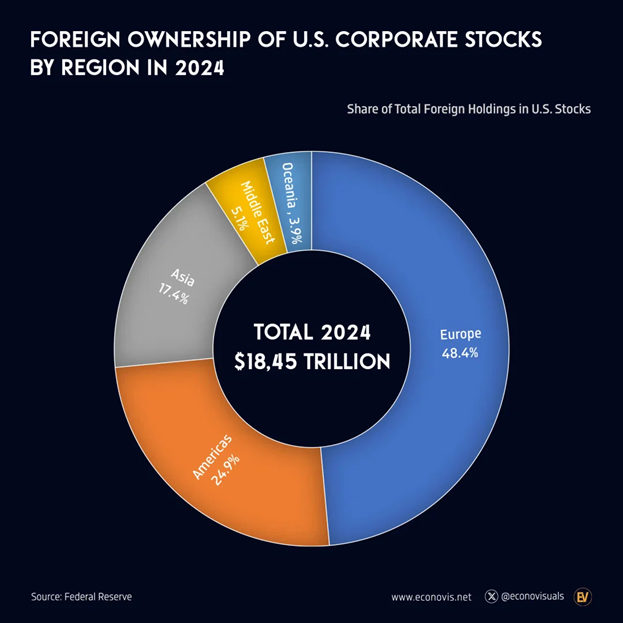

What the average investor fails to grasp is the sheer volume of U.S. assets owned by non-U.S. investors. It is estimated that the foreign investors own US$18.45 trillion worth of American stocks, of which Europeans own nearly half, and the Americas (South and Central, plus Canada and Mexico) own almost a quarter.

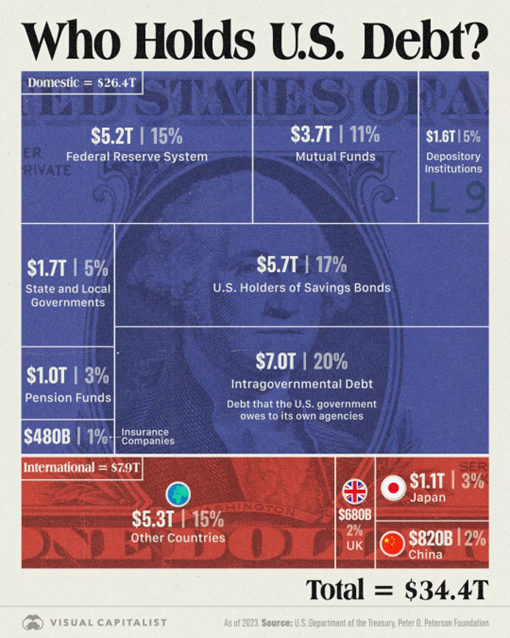

Almost as chilling is the breakdown of foreign ownership of the U.S. debt markets, which stands at US$7.9 trillion. When I think of the ramifications of imposing tariffs on "other countries" that own 15% of the U.S. bond market including China ($820 billion) and Japan ($1.1 trillion), I cannot begin to fathom where or how they will be able to place US$7.9 trillion of U.S. Treasury bonds that could be up for sale as retaliation for the tariffs.

Compounding the error is the boneheaded move by former Treasury Secretary Janet Yellen, who moved most of the treasury issuance into the short end (T-bills) such that another US$7 trillion has to be rolled over in 2025 alone.

I keep asking, "Just WHOM do they think is going to buy $14 trillion worth of U.S. bonds?"

As always, the MSM focuses on the S&P 500, Bitcoin, or NVidia for the story of the day, but as I have been espousing since 2020, the problem staring the U.S. directly in the face is DEBT, pure and simple. Tariffs are not going to reduce the debt, and they are most certainly not going to induce the affected foreign nations to thank the Trump Administration by buying their bonds.

So, with that as a backdrop to last week's letter, the most popular of the U.S. market ETF's of the past century has to be the proxy for U.S. technology sector affectionately known as "the Q's" which is actually the Invesco QQQ Trust (QQQ:US) that has been the "go-to" trade for fuzzy-cheeked financial advisors and newbie investors since the very first utterance of the term TARP (Trouble Asset Relief Program), the 2008 $700 billion bailout package referred to a few dozen paragraphs ago.

The health of the U.S. retail investor, into whose arms Wall Street usually deposits its unwanted trash of underperforming securities or "risky assets," can usually be gauged by the health of the Q's. This past week, an interesting technical development went largely unnoticed by the CNBC cheerleaders. The Q's experienced the all-encompassing and omnipotent "death cross," where the 50-day moving average ("50-dma") crosses below the 200-dma in a pattern that is generally interpreted as a sign that the correction could be metastasizing into a deeper downtrend.

The only mention of it was on one of the popular podcast morning shows where this perma-bull, anti-gold "portfolio manager" shrugged it off, saying that it really "doesn't matter" and that it is not a guarantee of lower stock prices in any way, shape, or form.

Well, as Mark Twain was quoted "History may not repeat but it can certainly rhyme," the last time we had the "death cross" was back in February 2022 and that resulted in a corrective move that took the Q's down 30% from the level where the cross occurred to its nadir in October of that same year. While I certainly agree that since this correction appears to have been caused by the imposition of tariffs making it a "tail event" correction rather than anything structural, these perma-bull cheerleaders point to the 2001 dotcom crash and the 2008 subprime crash as "credit events" while the 2025 tariff tantrum is not a "credit event."

This is where I strongly disagree. A 10% crash in the U.S. Dollar index since the peak in January is most certainly a "credit event" because to dovetail right back to the foreign ownership breakdown in both stocks and bonds shown earlier.

Portfolio managers around the world are not going to sit back and watch their P&L's get torched because they are on the wrong side of a currency trade. For the first time in recent memory, the U.S. dollar is refusing to provide them with "safe haven protection" from the claws of the bear, and when the leader of the free world is actively campaigning for a lower U.S. dollar, they have to act. They are selling U.S. assets.

It is my belief that we are witnessing not only a bona fide "credit event" unfolding under the guise of "tariff tantrums" but rather a potentially system-breaking event, and what, pray tell, is my evidence? How about a quick peek at the price of gold, which hit an intraday high of US$3,371,90 (basis June futures) yesterday.

After being long volatility three weeks ago and covering all positions into the first week of April, I got very lucky and opened a long position in the UPRO:US calls just before Trump issued the fateful pause on tariffs on the evening of April 8. Doing my best impression of an ADHD child on caffeine and steroids, I dumped those calls into the spike and then proceeded to flip again, advising subscribers that we were approaching the ominous "death cross" on not only the Q's but also the SPY:US which was confirmed by the end of the week.

I went into the weekend comfortably short the U.S. stock market by way of the SQQQ:US both stock and call options, which is an inverse ETF tracking the SPY:US only with a goodly amount of leverage, for good measure.

If the foreigners that are holding trillions (with a "t") of dollars worth of American stocks and bonds decide in earnest to repatriate those dollars back into euros, yen, pesos, and yuan, there will be very little the CNBC spin doctors can do to prevent a very nasty and very hungry "Papa Bear" from a well-deserved feast.

Gold

There is an expression that I use to remind subscribers of the danger one incurs when complacency lulls one an illusion of false confidence in any asset they are holding that has treated them well for an extended period.

The recent move in gold prices from US$2,536 a week after last November's U.S. presidential election outcome mirrored the same event in 2016.

Since the lows of the Trump Victory Celebration, gold has advanced 32.9%, and as I discussed earlier, it has nothing to do with tariffs. Tariffs are simply a distraction designed to take the focus away from the real issues haunting Secretary Bessent and Fed Chaiman Powell — it is the DEBT.

Enormous swaths of malodorous, seething debt that was manufactured out of the mistaken idolatry for "all things American" by an administration that left poor Donald & Company in a very difficult, verging on disastrous state of affairs.

As I wrote to subscribers last week: "As a gold (and copper) bull, I am proud to say that I am anything but a gold "bug." Gold "bugs" cannot and will not ever sell as much as a nickel worth of any gold position. Silver bugs are even worse. They take immense pride in "stacking" thousands of ounces and hiding them in the broom closet or under floor boards in cabins hidden away in the woods. Me? I do not suffer from maladies such as those of the "bugs." As you can see from the chart shown above, the trend line for gold has indeed moved from "gradual" to "vertical" and is now approaching the terminus of the advance. Now, it doesn't provide me with any clues as to what the exact price will be at the top of the advance; it only tells me that in terms of the X-Axis — time — a near-term top is close."

That near-term top may or may not have been the intraday high seen on April 17. If there is one thing that forty-eight years of following the precious metals have taught me, it is that gold, unlike any other asset, moves in mysterious ways. The MSM commentators all come up with reasons why gold is up or why gold is down but in the end, only gold itself knows why it moves in any direction.

For 5,000 years, gold has been a divining rod for geopolitical, economic, or natural disasters. This explosive move in gold that has the "bugs" all shaking fists and screaming "See? I told you so!" and popping champagne corks while taking victory laps around the Twitter and YouTube tracks has me — a septuagenarian veteran of the gold pit wars of the late 70s — absolutely terrified.

If history proves out my thesis, only with the fullness of time will I really know what gold was actually seeing when it started this massive advance, and again, if history is any guide, it will not be pretty.

As to strategy, I challenged the incredible karma of the gold gods on Friday and liquidated a number of gold positions that have been lagging while taking on an embarrassingly modest short position in the GLD:US.

I recognize that half of the self-professed gold "gurus" are now talking "correction" are almost in vocal crescendo with their adamance in that posture but I simply note that when any asset moves from a gradual ascent (or decline) into a vertical ascent (or decline), it is always in advance of the terminus of the move. I also acknowledge that the problem with taking on a dogmatic opinion based on any one thesis is that it can be either wrong or early.

In explosive geometric progression such as the Y-axis for the current gold market, being "early" can be devastatingly-painful even if I am early by a week or two. Markets that go parabolic as in the "AI" stocks early 2024 can take months to top out just as declines like March 2020 can drop a lot further than you might imagine once they go "vertical."

This is the reason I use a put option to speculate on a near-term pullback in GLD:US rather than actually shorting the stock or — God forbid — gold futures. I will let this position go for a short walk in the park, allowing it the freedom to sniff here and scratch there, but it will be on a very short leash because, as we all know, in bull markets, one is either long, leveraged long, or flat. To be short in a bull is to be hedged against other positions only, a rule never to be forgotten.

I also pointed out to the world last week that as smart as I sometimes like to profess to be, I am as humanly flawed as the next person in that there are often investment selections upon which I err. Just as the truly brilliant gold bulls such as Fred Hickey and John Oliver were ridiculed as being "wrong" for most of 2022-2024 for owning the gold miners as opposed to the Mag Seven and "AI," recent performance numbers for top holding like Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) and Kinross Gold Corp. (K:TSX; KGC:NYSE) has them up 57.34% and 62.57% YTD versus Nvidia Corp. (NVDA:NASDAQ) down 22.18% YTD. In a similar fashion, I sometimes feel like an abject failure because I elected to place my golden wager on the gold developers first rather than the producers, and I have paid dearly for that decision.

My largest gold holding is Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) and while it is up 55.56% YTD, rather than taking a victory lap for a company apparently acting quite admirably, I grow increasingly frustrated by the investor apathy toward the company.

Last week, I wrote:

"The leverage is still in the junior developers like Getchell Gold Corp. as the value of their 2.317 million ounces has increased by US$1.15 billion in gross metal value since I published the GGMA 2025 Forecast Issue last December. GTCH/GGLDF owns 100% of a deposit that has a gross metal value of US$7.46 billion yet carries a fully-diluted market capitalization of only US$32,017,450. That is .43% of the value of the deposit with historical values running as high as 5%. At the 5% valuation level, GTCH/GGLDF would trade at US$1.81 or CA$2.51. At the tail end of the 2002-2011 bull market, the junior developers regularly traded in the 5% range with a gold price barely able to exceed $2,000 an ounce. At $3,220, these developers with growing resources are "dirt cheap" and are the absolute best way to play the generational shift out of U.S. assets into hard assets. Many of us are suffering from "investor fatigue" because of the length of time it has taken for the juniors to be recognized. Since all investment positions have a "shelf life", the tendency is to look at $0.05 or $0.10 moves as an opportunity to get liquid on a name that quite frankly has taken far too long to advance. That is categorically the wrong move because the final phase of all golden bulls has generalist investors scrambling for gold mining names and it is this process that lies ahead for Getchell and many of its developer/explorer brethren.

It has taken a long time but we will have our day. Getchell is a "BUY."

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Agnico Eagle Mines Ltd. and Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.