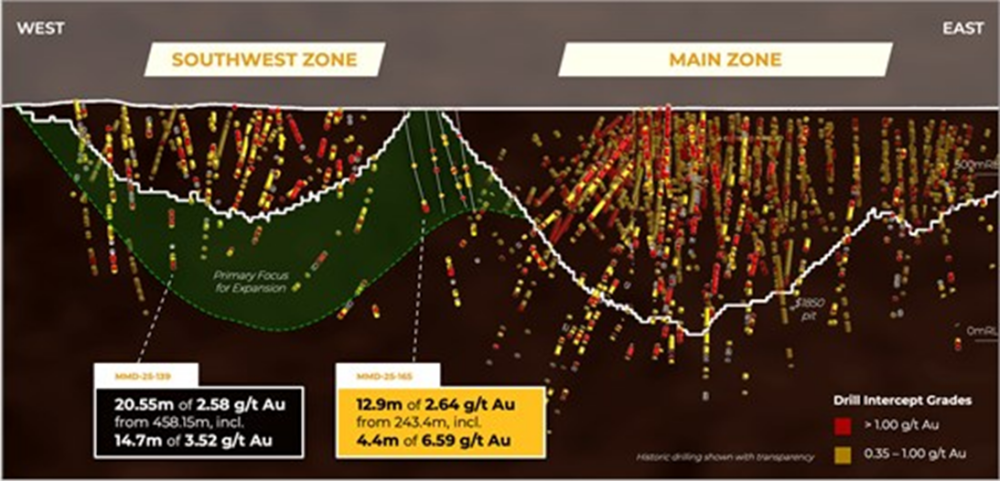

With recent drill results, Goldshore Resources Inc. (GSHR:TSX.V; GSHRF:OTCQB; 8X00:FWB) closed the gap between the Southwest and Main pits and deepened the Southwest conceptual open pit at its Moss gold project in northwestern Ontario, thereby demonstrating its "emerging nature and growth potential," the company noted in a news release.

"These results further validate our decision to expand the winter drill program by 5,000 meters (5,000m)," Chief Executive Officer Michael Henrichsen said in the release. Originally, the plan was for 15,000m of drilling, reported Streetwise Reports on April 11.

In this latest announcement, the explorer-developer reported four holes. Two, MMD-25-165 and MMD-25-166, targeted the area between Main and Southwest. Both of these intersected new high-grade mineralization and showed that a 75m wide mineralized corridor connects the two zones.

As far as highlight intercepts, MMD-25-165 returned 12.9m of 2.64 grams per ton gold (2.64 g/t Au) from 243.4m downhole, including 4.4m of 6.59 g/t Au from 250m. MMD-25-166 showed 2m of 2.81 g/t Au from 98m downhole and 5.4m of 1.59 g/t Au from 143.6m, including 0.4m of 18.2 g/t Au from 143.6m.

The other pair of holes, MMD-25-167 and MMD-25-168, tested the extension of deep mineralized shear zones in Main and demonstrated they continued to surface.

MMD-25-167 showed 10m of 0.55 g/t Au from 147m downhole, including 2m of 1.51 g/t Au from 151m, and 8.05m of 0.58 g/t Au from 185.95m. MMD-25-169 returned 27m of 0.46 g/t Au from 154m downhole.

Sights Set on 10 Moz Resource

Headquartered in British Columbia, Goldshore Resources acquires and advances gold assets in tier one jurisdictions, Moss being its current focus. To date, the company has infused this 100%-owned project with about US$60 million (US$60M) and completed about 80,000m of drilling there, noted the April 2025 Corporate Presentation. The total, including historical drilling, is 235,000m.

"Goldshore Resources has the vision to turn Moss into a Top 10 Canadian producing gold mine," wrote Kitco News recently. "[It] is one of the few remaining major Canadian gold deposits positioned for development in this cycle."

Moss has an NI 43-101 mineral resource estimate comprised of 1,540,000 ounces of gold (1.54 Moz) of 1.23 g/t Au gold in the Indicated category and 5.2 Moz of 1.11 g/t gold in the Inferred category. This resource, though, encompasses only 3.6 kilometers (3.6 km) of the 35 km mineralized trend, still open at depth and along strike. Metallurgical testing has demonstrated gold recoveries at Moss of 92%.

"Can this 6 Moz pit grow? One hundred percent," Henrichsen said. "It's going to grow if we keep investing dollars into the ground. The basic work hasn't been done, and that is an extremely advantageous position to come into. It's exciting to see how much potential there is."

The project is located in a highly prospective gold jurisdiction, 110 kilometers west of Thunder Bay in Ontario, directly accessible from the Trans-Canada Highway and near infrastructure, including hydroelectric power. The regional workforce is skilled and the local communities, supportive. In fact, Goldshore already has two exploration agreements with First Nations groups in place.

"If you were going to put a big bulk tonnage gold deposit somewhere, this would be the place I'd pick," Goldshore's CEO told Kitco. "From an infrastructure standpoint, from an execution standpoint, its location decreases the risk profile considerably."

Wesdome Gold Mines Ltd. (WDO:TSX), from which Goldshore acquired Moss in 2021, has one final progress payment of 12,500,000 (12.5M) shares to make, either when a feasibility study is completed or on June 4, 2025, whichever comes first. Wesdome has a 1% royalty on Moss, which Goldshore may buy back for US$5.5 million (US$5.5M) in cash plus US$2M in shares.

Gold's Bull Market Rages On

According to Technical Analyst Clive Maund on clivemaund.com, gold current upleg has much further to go. The low silver:gold ratio, indicating little retail interest in the sector, suggests this, he wrote on April 14. Also, the chart dating back to the year 2000 shows gold to be advancing "in an orderly uptrend from a cup and handle continuation pattern that is so gigantic, it can clearly support a bull market that will take it much higher than the current price," Maund wrote. The uptrend could accelerate and steepen soon.

"It looks like we are still in the early stages of what should prove to be an epochal bull market for the precious metals sector, that could dwarf all previous ones," the analyst added.

At the last market close, gold was about US$3,350.70 per ounce (US$3,350.70/oz), reflecting a 25% year-to-date increase.

In the current economic environment, with a U.S. recession looming, "gold is emerging as the best bet," as shown by investors moving into exchange-traded funds (ETFs) and buying physical gold and central banks continuing to amass quantities of the metal, noted Financial Express' Sunil Dhawan on April 15. More money flowed into global gold ETFs in Q1/25 than in any quarter during the past three years, according to the World Gold Council.

Cuts to the real interest rate by the U.S. Federal Reserve and the increased amount of selling of U.S. Treasuries are likely to help the gold price climb even more.

"Overall, in 2025, unless the factors that are pushing the gold price higher change, the price of the yellow metal is expected to keep going higher," Dhawan wrote.

According to Adrian Day of Adrian Day Asset Management, gold is likely to be higher a year from now, even if one or more pullbacks occurred in the meantime," Day wrote earlier this month. "Gold, which has actually gained more than the S&P Index over the past four years, may continue to shine; it responds well to uncertainty, whether geopolitical, economic or monetary."

Goldman Sachs' new year-end 2025 gold price forecast is US$3,700/oz, recently boosted from US$3,300/oz on the expectation of a surprising surge in demand reflected in one of three ways, reported GoldFix on April 15. These are central bank accumulation, exchange-traded fund inflows tied to growing recession concerns and investor positioning spurred by macroeconomic volatility. Should demand occur in large numbers in all three, gold could reach US$4,500/oz, noted Goldman. Investing Haven's 2025E gold price prediction is more conservative, at US$3,275/oz.

"Whether gold prices move higher into uncharted territory remains to be seen," wrote Dhawan on April 12. He pointed out that many analysts believe gold is heading into its rally's last leg and the metal's price will peak this month.

Avi Gilburt is one such analyst. "One of the most accurate market prognosticators of the past two decades," as described by The Gold Newsletter's Brien Lundin, Gilburt wrote recently, "While I do think we can still see higher levels over the coming year or so in the gold market, I am starting to see signs that we are moving into the final stages of this decade-long rally."

Further out, Investing Haven has "firmly bullish" year-end targets, of US$3,805 in 2026, US$4,400 in 2027 and US$5,155 (the peak) by 2030. This firm expects sporadic price retreats throughout the forecast period.

During the next five years, the global gold market is forecasted to expand at a 5.1% compound annual growth rate, according to a March Research and Markets report. Cited drivers include economic volatility and uncertainty, technological advancements, expansion of the middle class in emerging economies, new uses for gold, global trade policies and geopolitical tensions.

"Investors should be prepared to add to positions on any short-term pullback in the price," Ronald Stewart, Red Cloud Securities mining analyst, advised in a recent sector update.

These positions, according to Lundin, should be in junior mining stocks because they offer one of the best ways to capitalize on the current, or any, secular metals bull market.

"The mining stocks remain near long-term lows," the newsletter editor and publisher noted. "Again, this is a generational opportunity and one that should not be wasted."

The Catalyst: Project PEA

Goldshore is working with the mining consultancy firm, G Mining, on completion of a preliminary economic assessment (PEA) of Moss. The study will evaluate the potential to develop a high-grade starter pit and mine higher grades early on to accelerate cash flow and in doing so, derisk the project and recoup capex faster.

Henrichsen told Kitco he expects the PEA to provide a conservative base case while Goldshore continues exploring the Moss deposit's full potential.

"We are not looking at producing a marketing document with our PEA," the CEO added. "We're here to give real guidance to our investors so they can make informed decisions."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Goldshore Resources Inc. (GSHR:TSX.V; GSHRF:OTCQB; 8X00:FWB)

He envisions that in about two years from now, Goldshore will commence a prefeasibility study and at the same time, begin the formal permitting process, to move Moss toward a construction decision, he said. Business management firm, One-Eighty Consulting Group, is on board to fast-track permitting.

Ownership and Share Structure

The company provided a breakdown of its ownership, where 6% of Goldshore is held by management and directors.

Institutions own approximately 20% of the company. Strategic shareholders own 25% and include Lutry Investments, Brian Paes Braga and members of the SAF Group.

The rest is with retail investors.

The company reports that there are around 338.3 million shares outstanding, while the company has a market cap of CA$111.7 million as of March 31, 2025. It trades in a 52-week range of CA$0.09 and CA$0.40.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Goldshore Resources Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Goldshore Resources Inc.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.