Beeline Holdings Inc. (BLNE:NASDAQ) is looking like a Strong Buy here for both fundamental and technical reasons as we will now proceed to see. The company is a technology-driven mortgage lender and title provider offering a fully digital, AI-enhanced, platform that simplifies and accelerates the home financing process for homeowners and property investors. Based in Providence, RI, Beeline is dedicated to transforming the mortgage industry through innovative technology and customer-centric solutions.

Beeline Labs, a wholly owned subsidiary of Beeline Holdings Inc., empowers lenders and other businesses to leverage SAAS products designed to expedite transaction times, increase efficiency, improve conversions, and lower costs. These innovative proprietary AI and blockchain solutions were developed internally to solve long-standing legacy mortgage problems — now partners, businesses, and consumers can benefit. Beeline Financial Holdings licenses out its technology to solve legacy mortgage production problems by lowering costs and decreasing turn times.

Beeline Labs has developed the MagicBlocks SAAS (Software as a Service) application, which was rolled out last year. MagicBlocks is a separate company and is raising money. Beeline will maintain a full diluted equity interest of about 30% of the company, and it will receive a 10-year license agreement with favorable terms and accelerated production capabilities from MagicBlocks of new ideas and products developed in partnership with MagicBlocks. MagicBlocks enables virtually any business to quickly deploy its own emotionally intelligent AI Agent that proactively converts more leads into sales for a low monthly subscription cost. It converts, on average, 43% more site visits into customers automatically, at almost zero cost. Now, we will look at the features of both BlinkQC and MagicBlocks and, starting with the former, using pages from the company's website.

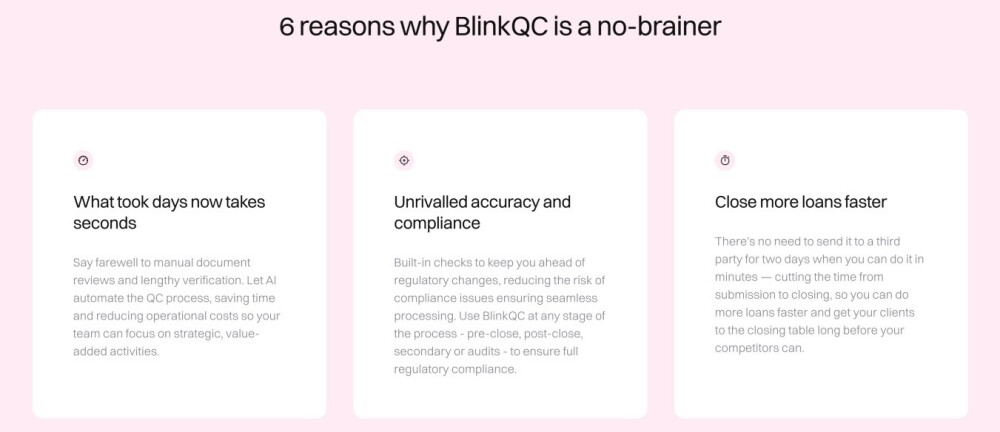

BlinkQC

With respect to lenders, Beeline Labs has developed BlinkQC which is an AI-powered Quality Control solution designed to streamline compliance and auditing for lenders. BlinkQC cuts hours of tedious manual review and detects issues early — so there's no scrambling on closing day and loans are neatly buttoned up and not lingering on a lender's credit lines.

BlinkQC is an AI-driven document processing tool that automates pre-closing Quality Control, which frees up human resources by eliminating manual review and verification, making sure your loan documents are accurate, complete, and compliant before closing — for a fraction of the cost. The efficiencies it delivers are as follows. . .

- 4+ hours saved from each file

- 2 – 3 days saved in closing time

- 80% cut in errors

- 15 – 20% cut in investor late fees and hedging costs

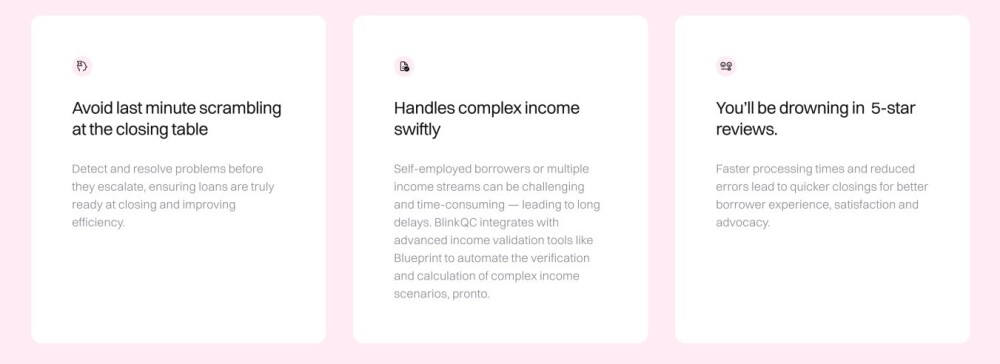

MagicBlocks

Improvements in performance with MagicBlocks are detailed below.

Here's what the AI Agents do round the clock, 24/7, effortlessly and automatically:

Beeline CEO, Nick Liuzza, commented:

What MagicBlocks AI Sales Agents do is shown below.

Because the AI Agent has a built-in emotional intelligence it can respond with empathy or humor, so that some users may even prefer it to a human agent — after all, it never "gets out of the wrong side of the bed in the morning," doesn't wander off at a tangent rambling on about its personal problems because it doesn't have a private life, never gets grumpy or tired, never nags the boss for a raise and keeps the user on track towards the goal.

Human Agents versus MagicBlocks' AI Agents:

From this, it is clear that the MagicBlocks Agent relieves the Human Agent of the more tedious tasks associated with the business, freeing him or her up for the more meaningful tasks involving interaction with the customer, such as closing deals.

It is also worth mentioning that Beeline recently announced that its 2024 loan origination volume of just under US$200 million "outpaced the broader industry by around 30%," which was up 9%. You can read more about this here.

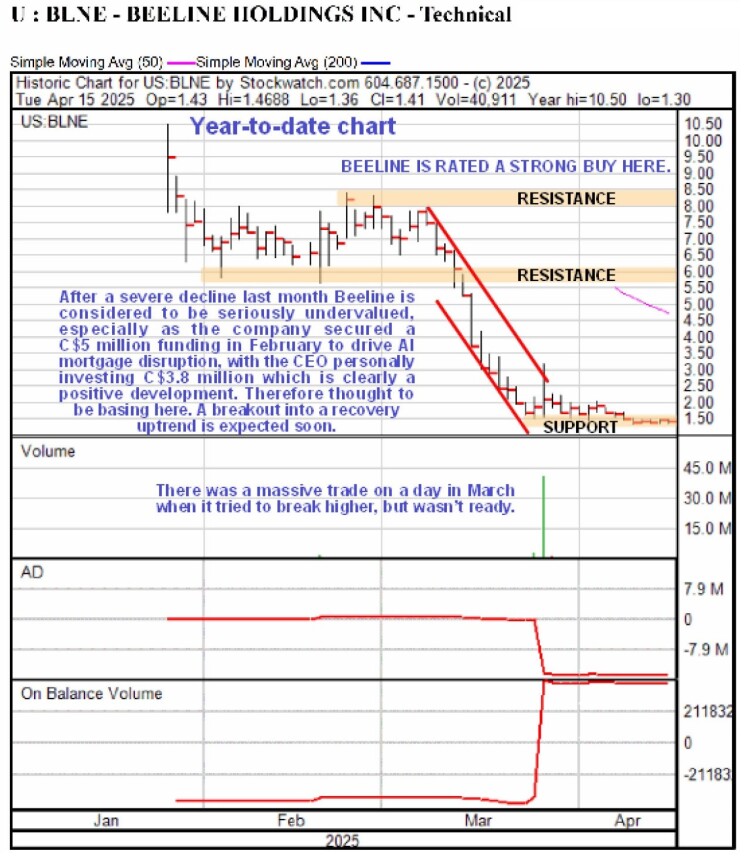

Now, we will proceed to review the company's stock chart on which we will quickly see why this looks like a very good point to buy.

Last month, the stock broke down from a trading range into a severe decline that took it down to about US$1.50, where it stabilized, with a narrow trading range forming above the support in the US$1.50 area over the past several weeks.

Meanwhile, the CEO of the company and co-founder Nick Liuzza continued to build a big position in the stock, and there was a massive volume on the day of March when the stock tried to break out of the downtrend shown. Even though it didn't succeed in breaking out at that time and slipped back into the base pattern, the attempt is viewed as bullish, especially as it has since broken out of the downtrend by virtue of moving sideways.

Given that the company secured a US$5 million funding in February and the news in March that Beeline's AI Sales Agent 'Bob 2.0' delivers 6X more leads than a human chat, and following the public launch of MagicBlocks, an AI-powered sales agent platform on the first of this month, as well as today's news mentioned above, it seems highly like that the stock will break out of the recent narrow trading range to the upside and it should be noted that even if the broad stock market enters a prolonged bear market, Beeline's disruptive and revolutionary innovations in the mortgage and property space mean that it should do well regardless of the general state of the economy.

Beeline Holdings Inc. is therefore rated an Immediate Strong Buy here. The first target for an advance is the resistance in the US$5.70 - US$6.20 zone. The second target is the resistance at the upper boundary of the earlier trading range, which is at US$8.30 - US$8.50.

Beeline Holdings Inc.'s website.

Beeline Holdings Inc. (BLNE:NASDAQ) closed for trading at US$1.47 on April 14, 2025.

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Beeline Holdings Inc. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Beeline Holdings Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.