Bob Moriarty of 321Gold finds real value in five precious metal junior resource companies. Below is an interview between myself (Rick Mills Editor/ Publisher, Ahead of the Herd) and Moriarty.

Rick Mills (RM): Bob, I'm noticing Israel and Turkey appear headed for confrontation in Syria, while Gaza hostilities have resumed, with Israel launching its most aggressive campaign yet. American forces are targeting Houthi positions as Trump simultaneously threatens Iranian airstrikes, and Russia seems engaged in prolonged stalling tactics throughout Ukraine.

Meanwhile, the Chinese military conducts shooting drills surrounding Taiwan, NATO faces disintegration with potential American withdrawal, European unity hangs by a thread amid constant disagreement, and military interventions loom over Greenland and Panama. Washington has even threatened to economically cripple Canada into becoming another state.

International alliances seem to be crumbling everywhere. Is there any possible resolution, or will this geopolitical turbulence persist indefinitely?

Bob Moriarty (BM): The situation will likely deteriorate further. About five weeks ago, a confidential document leaked revealing Israeli strategies for attacking Iran. American military assets have been positioned on Diego Garcia, enabling Iranian strikes, while Trump has issued ultimatums demanding complete dismantlement of Iran's nuclear capabilities or face severe consequences; experts confirm they lack weapons programs, yet demands extend to prohibiting defensive systems, making armed conflict virtually inevitable within the coming month.

RM: Is military engagement with Iran imminent?

BM: Yes.

RM: Is the Middle Eastern region engulfed in conflict?

BM: That region has experienced perpetual conflict since 1948.

RM: The intensity has fluctuated while tensions remained constant. Direct American-Iranian warfare represents something entirely different from Israeli-Arab skirmishes. Should Washington directly challenge Tehran, all other conflicts would appear insignificant by comparison, according to my assessment.

BM: A particularly notable development involves China essentially surrounding Taiwan with naval forces. My analysis suggests that China, Russia, and Iran anticipate imminent hostilities and have positioned accordingly. A plausible scenario involves American-Israeli forces initiating Iranian strikes, followed by an immediate Chinese naval blockade around Taiwan, suddenly forcing America into simultaneous conflicts on opposite fronts.

RM: Such blockades would disrupt South China Sea shipping channels, which handle roughly $2 trillion annually. Advanced semiconductor access would vanish, particularly cutting-edge 2nm technologies exclusively manufactured within Taiwan. Manufacturing facilities would likely sustain damage, creating catastrophic disruptions throughout global commerce and technology sectors.

BM: Last Wednesday's developments essentially represent Trump hurling explosives into crowded financial markets, creating terrifying instability throughout global bond and equity exchanges. I'm currently hearing completely contradictory expert opinions; several brilliant analysts describe this as history's most catastrophic financial blunder. Conversely, equally respected financial voices hail it as a brilliant strategy. No consensus exists — personally, I anticipate economic calamity.

RM: My instincts align similarly. Diplomatic pathways appear nonexistent. Neither party demonstrates flexibility, and when stubborn positions eliminate negotiation possibilities, dangerous situations emerge alongside numerous additional challenges.

Let's examine America's national debt approaching $40 trillion. Nearly $28 trillion requires immediate refinancing. Trump simultaneously seeks to reduce long-term borrowing costs alongside currency devaluation. These contradictory goals complicate debt management while undermining America's international financial standing.

Current international commercial disputes deserve proper recognition as trade warfare. Federal monetary authorities contemplate interest reductions while market participants anticipate quarterly adjustments throughout the year. Market volatility indicators show alarming spikes as recession predictions range between Goldman Sachs' 45% probability estimation announced earlier today through Morgan's 60% likelihood scenario. Nations experiencing trade hostilities or pursuing isolationist procurement policies while suffering diplomatic insults seem unlikely candidates for purchasing American sovereign obligations.

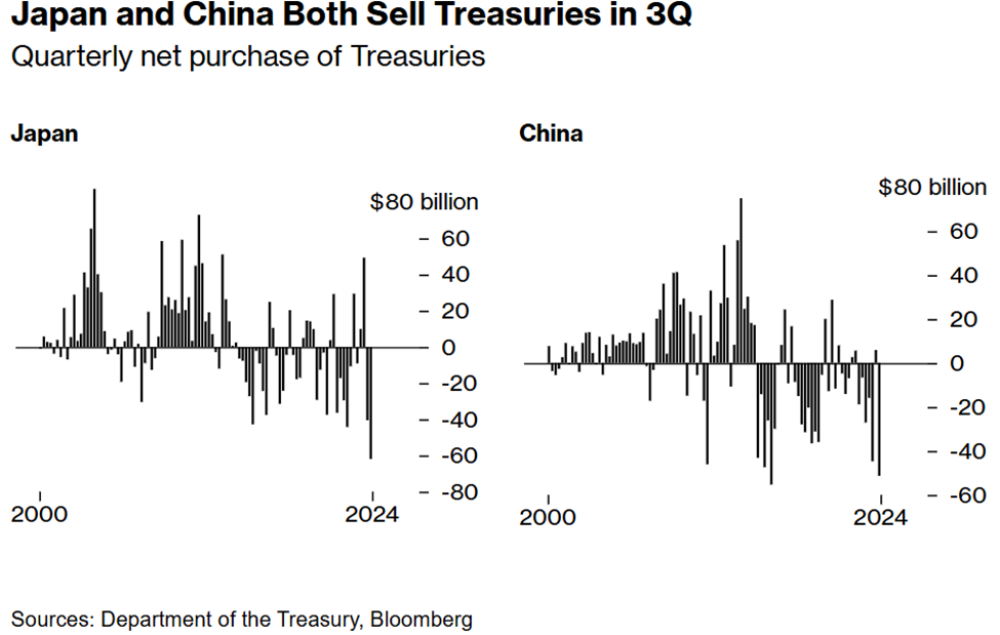

Chinese authorities have recently accelerated the liquidation of dollar-denominated assets, while European participation appears doubtful. Should international buyers abandon American debt auctions, Washington would necessarily purchase its own securities, triggering inflationary pressures.

Furthermore, depending on investment redirection strategies, substantial capital might return stateside, creating additional inflationary impacts. Food prices, particularly, could experience substantial appreciation. What perspective do you offer?

BM: Curiously, my view differs slightly. Although food costs have certainly escalated, imported Chinese merchandise will experience dramatic price increases under these tariffs — retail establishments like Walmart or Kmart could see merchandise costs jump between 25-50%.

American dollar prominence since 1944 has traditionally enabled citizens to purchase goods more affordably than worldwide consumers, yet we've initiated commercial hostilities against the very nations needed to finance our deficit spending. Financial publications today report accelerated Treasury liquidation by Chinese and Japanese institutions. Tariff policies represent flawed strategy, negotiation through intimidation proves counterproductive, and inflationary consequences will extend far beyond agricultural sectors.

RM: Your projections exceed even my pessimistic outlook.

BM: Ironically, Americans have normalized inflationary environments. Reflecting back to August 15, 1971, public memory focuses on gold standard abandonment rather than the speech's actual purpose.

Nixon primarily addressed wage-price controls prompted by inflation approaching 3%, whereas current rates substantially exceed that threshold, with further increases inevitable. Economic conditions appear perfectly aligned for triggering a global financial collapse.

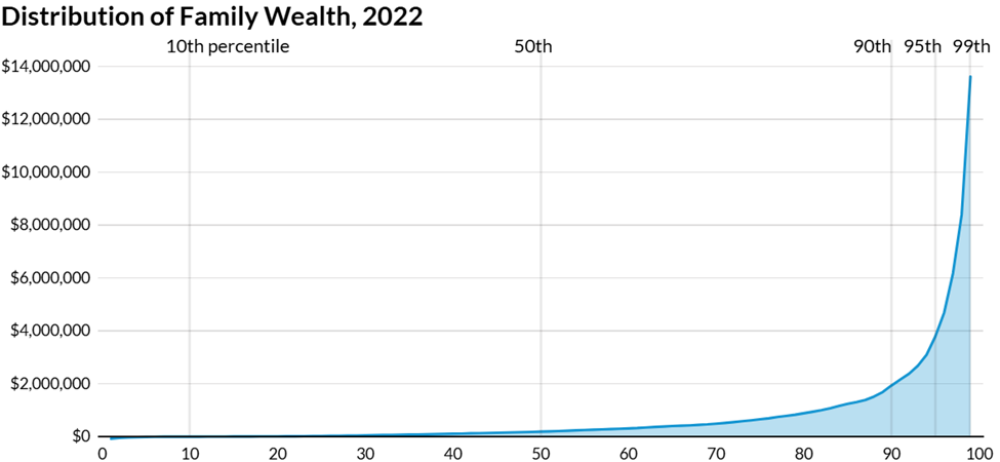

RM: Consider historical parallels with Arab Spring uprisings triggered by agricultural price spikes. Widespread civil disobedience emerged alongside essential commodity shortages across sectors amid profound societal inequality.

American society currently demonstrates unprecedented income and healthcare disparities. Economic divides have reached historical extremes while inflation threatens agricultural producers. Import restrictions damage farming communities that previously supplied international assistance programs, while educational meal initiatives face cancellation, leaving vulnerable children without nutrition.

Rural producers previously supplied these programs, creating simultaneous agricultural crises, food insecurity, and widening socioeconomic divisions throughout American communities. Might domestic upheaval similar to global precedents emerge within 24 months? Initial protests already target financial entities, industrial figures, and economic policies.

BM: My publication "The Art of Peace" from 2016 contains remarkably prescient final passages, accurately forecasting current developments nearly a decade ahead.

Contemporary events represent unprecedented global revolutionary conditions — widespread instability throughout Romania, French territories, the United Kingdom, Venezuelan regions, and Brazilian states — ultimately stemming from monetary instability developing gradually over decades.

Agricultural insecurity certainly threatens America, though paradoxically, farmers face oversupply conditions without adequate distribution channels.

RM: Evidence mounts regarding Chinese import restrictions. Brazilian soybean harvests reach record levels while American crops approach maturity without secured buyers since Beijing redirects purchasing toward Brazilian exports. Logically, this might prevent domestic shortages, though practical distribution mechanisms function contrary to theoretical expectations, correct?

BM: Absolutely contrary.

RM: Examining broader implications, does domestic unrest appear equally probable alongside European or British disturbances?

BM: Global conditions prevail everywhere, fundamentally traceable to abandoning metallic currency standards. The resulting instability, combined with the shocking governmental corruption revealed during Trump's administration, has staggered even deeply cynical observers like myself. Widespread upheaval appears inevitable, potentially triggered through Ukrainian, Iranian, or Chinese flashpoints, representing destructive patterns I've witnessed previously.

My six-year Marine Corps tenure, including 20 months in Vietnam, created profound anti-war convictions based on direct observation of human consequences.

Particularly bewildering, Trump imposed 47% tariffs specifically against Vietnam, reflecting profoundly misguided economic understanding. Have you examined the fundamentally flawed tariff calculation methodology?

RM: Devastating Vietnamese textile exports, despite America's lacking domestic manufacturing capacity, creates impossible sourcing dilemmas. Yesterday's projections indicated 17% domestic textile price increases without Vietnamese trade agreements.

BM: Treasury Department procedures originally established reciprocal tariff guidelines. German 10% automotive import duties logically suggested equivalent American responses.

Instead, Trump's administration calculated payment differentials against sales volumes exclusively within physical merchandise categories, ignoring service sectors and examining limited economic segments. Vietnamese economic realities — monthly wages averaging $600 in impoverished regions — make American luxury vehicle exports impossible regardless of tariff structures, rendering 47% rates completely irrational.

Vietnamese officials subsequently proposed eliminating all American import restrictions, which was countered by Navarro citing non-tariff barriers and representing completely baseless assertions. Vietnam poses zero competitive threats against American interests, yet policies risk destroying Vietnamese, Chinese, and Pakistani economies alongside our own — defying rational analysis.

RM: Essentially creating mutually assured economic destruction.

BM: Precisely.

RM: Considering historical perspectives, your reference to metallic currency standards deserves exploration. Few citizens comprehend the 1913 machinations when banking representatives from Morgan and Rothschild families gathered at Jekyll Island, developing the Aldridge Plan subsequently approved through procedural manipulation during overnight congressional sessions.

Most fail to recognize how authentic power operates indirectly through controlled institutions rather than visible political structures. Ultimate authority resides neither with elected officials, corporate executives, or billionaire figures, but banking institutions controlling monetary systems and information channels — these entities govern societal outcomes while opposing gold-backed currencies, creating operational constraints.

While favoring metallic reserve standards around 40% backing seems reasonable, extracting controlling interests from established positions while neutralizing institutional influence presents insurmountable challenges.

BM: Presidential plans include potential gold revaluation, with credible (though unconfirmed) projections suggesting $40,000 valuations. America's $37 trillion obligations mathematically cannot be satisfied under any scenario. Recent statements from Musk correctly identified Social Security as fundamentally unsustainable — history demonstrates universal failure patterns for such arrangements.

Banking institutions have indeed been compromised — representing core systemic problems. Society faces unprecedented divisions between Washington power structures versus working populations, particularly affecting agricultural communities facing bankruptcy through trade policies – representing serious consequences.

When economic disparities prevent basic nutritional access — approaching current conditions — revolutionary environments emerge. Financial institutions perceive unlimited authority despite practical limitations evident throughout military history. Despite deploying 550,000 troops throughout Vietnam, the conflict ended unsuccessfully. Afghanistan absorbed $2.3 trillion, yielding defeat against modestly equipped adversaries wearing traditional garments and basic footwear.

Banking institutions perceive victories contrary to objective evidence. Fundamental conflict exists between Western debt-based systems against resource-based BRICS frameworks — with BRICS eventually prevailing.

RM: What assessment can you offer regarding Fort Knox auditing procedures potentially facilitating precious metal liquidation funding cryptocurrency reserves?

BM: Presidential cryptocurrency endorsement immediately preceding inauguration likely signaled peak valuations. Digital currencies fundamentally lack intrinsic value — resembling 15,000 collectible variants without substance.

My quarterly projections consistently anticipated cryptocurrency and equity market reversals followed by a collapse — matching current conditions exactly. Digital currencies represent fraudulent mechanisms despite proponents highlighting isolated success stories.

Forthcoming publications within days will document credible research identifying approximately 500 coordinated manipulation participants controlling Bitcoin markets. While allegations regarding precious metal manipulation appear questionable, cryptocurrency manipulation represents documented certainty. Presidential endorsement coincided with a New York Times report indicating 86% investor losses, suggesting digital currencies will follow collectible market implosions (such as the Beanie Baby boom).

RM: I've observed critics of government-issued currencies paradoxically embracing digital alternatives — wondering how they'd respond if electronic infrastructure suddenly failed.

We've examined numerous challenges with the substantial agreement, recognizing historical parallels from the 2007-08 and 2020 experiences. While severe market disruptions remain thankfully infrequent, recent examples provide valuable perspective.

Market corrections typically involve indiscriminate selling across sectors – including precious metals and mining shares — though historical patterns show rapid precious metal recovery within days while offering exceptional purchasing opportunities. Our discussion today highlights five particularly promising candidates.

Beginning alphabetically with Banyan Gold Corp. (BYN:TSX.V). Your 2020 assessment identified Banyan as globally significant within gold exploration. Operating throughout Tombstone Gold Belt — please elaborate regarding their operations.

BM: Banyan operates under the leadership of my respected colleague Tara Christie — a truly exceptional mining industry executive, embodying professional excellence regardless of gender considerations. Her husband previously managed Victoria Gold, which was experiencing technical difficulties that prompted exchange-mandated reorganization despite fundamentally viable operations. Banyan currently offers gold exposure at $11 per ounce, with production feasibility at $3,000 gold — representing an extraordinary value proposition. My profound respect for management continues while market overreactions create exceptional opportunities available for perceptive investors.

RM: Current valuation at $0.20 per share includes fully-funded exploration program encompassing 30,000 drilling meters, generating substantial forthcoming announcements including inevitable discovery potential.

Next candidate, Harvest Gold Corp. (HVG:TSX.V). Crescat Capital's advisor Quinton Hennigh expressed enthusiasm regarding district-scale property acquisition throughout Quebec's Urban Barry greenstone formation, describing "underexplored territory containing notable emerging gold discoveries" — representing significant endorsement.

BM: Quinton fundamentally misinterpreted crucial factors.

RM: Please explain.

BM: His analysis emphasized geological considerations — the company controlling three major Abitibi belt projects throughout unexplored regions — while overlooking fundamental valuation metrics: three-cent shares valuing the entire enterprise below $2 million Canadian. My financial publications consistently emphasize fundamental resource investment principles: acquire assets during undervaluation periods while divesting during premium valuations. Basic corporate structures, including minimal office infrastructure, typically command $3-4 million valuations, making sub-$2 million capitalization fundamentally irrational.

RM: Valuation falls below empty corporate shell considerations.

BM: Exactly.

RM: Following candidate, Sitka Gold Corp. (SIG:TSXV; SITKF:OTCQB; 1RF:FSE), which you have previously compared to Snowline Gold Corp. (SGD:TSX.V; SNWGF:OTCQB).

BM: Such comparisons understate reality.

RM: Pardon?

BM: Sitka significantly surpasses Snowline's prospects.

RM: Snowline demonstrates considerable success.

BM: Its valuation appears excessive. Speaking candidly, Quinton Hennigh represents my closest professional relationship — we communicate frequently while participating alongside most Crescat investments.

Sitka discussions occurred during 7-9 cent trading ranges, prompting substantial personal investment. Promising developments — representing opinion rather than established metrics given Snowline's substantial resource confirmation — involve Sitka's deep drilling program likely announcing within fortnight results showing approximately 150 visible gold occurrences throughout core samples.

Despite substantial appreciation from entry levels, Sitka maintains $180 million valuation compared against Snowline's $1.1 billion capitalization, offering superior accessibility. Exploration funding covers 30,000 meters with imminent announcements potentially doubling share valuation immediately.

RM: Established resources include 1.3 million ounces indicated alongside 1.5 million inferred ounces. Internet commentary regarding excessive depths reveals technical ignorance, block-cave mining represents perfect extraction methodology.

Another recommendation, Silver47 Exploration Corp. (AGA:TSX.V; AAGAF:OTCQB), controlling 60-kilometer VMS/SEDEX trend throughout consolidated district. Most impressive aspects include extraordinary exploration upside — unprecedented surface mineralization indicators visible throughout property. Tremendous expansion potential exists beyond current 168 million silver-equivalent ounces classification.

BM: Another relevant example — coincidentally involving Quinton Hennigh and myself, originally under Australian ownership, whose management disregarded recommendations.

Pandemic restrictions prevented securing drilling personnel, eliminating the 2020 field season throughout Alaskan properties approximately 100 kilometers from Fairbanks — representing an accessible location.

Financial resources diverted toward Australian projects before regulatory changes regarding environmental bonding effectively eliminated corporate viability. Quinton and I approached current Silver47 management team. Their previous Canadian silver project faced regulatory complications favoring local control effectively terminating development.

Silver47 required replacement assets while I documented Alaskan property values five to seven years previously — representing approximately $5 billion contained metal value. Recent financing completion alongside significant undervaluation creates situation where market recognition will eventually establish premier North American silver investment status.

RM: Complete agreement from my perspective. I recently conducted an interview with CEO Gary Thompson, which appears on my website. The property represents premier silver opportunity observed throughout the extended timeframe.

Returning to the Tombstone Belt discussion, Victoria pioneered development, followed by Snowline, Banyan, and Sitka, alongside emerging participant Trifecta Gold Ltd. (TG:TSX.V:TRRFF:OTCQB). Any additional commentary?

BM: Notable regional junior enterprises include Rackla [Metals], Snowline, Sitka, Banyan, and Trifecta alongside Eagle Deposit. Reinforcing fundamental investment principle: acquire during undervaluation periods while divesting during premium valuations. Rackla without established resources commands $20 million capitalization while Trifecta similarly without confirmed resources trades at $6.5 million — creating potential 300% appreciation without operational progress, metal price improvements or presidential economic disruption.

RM: Successful investing requires counter-cyclical acquisition during market distress followed by patience throughout corporate development cycles – occasionally requiring simply straightforward approaches?

BM: Such approaches represent universal effectiveness.

RM: Today's exchange provided exceptional insights and enjoyment. I would like to talk more.

BM: I am glad we did this. Your work has featured prominently throughout my publications for years without direct communication. Current fascinating yet disturbing developments combined with mainstream media unreliability necessitate alternative information sources that misrepresent reality significantly less frequently than established outlets.

RM: Complete agreement. Continued discussions forthcoming, Bob. I appreciate you being here.

BM: Looking forward to it. Thank you.

You can view more from Rick and Bob at Ahead of the Herd and 321Gold.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Silver47 Exploration Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Snowline Gold Corp. and Silver47 Exploration Corp.

- Rick Mills: I, or members of my immediate household or family, own securities of: Harvest Gold. My company has a financial relationship with Harvest Gold and Silver47 Exploration Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Bob Moriarty: I, or members of my immediate household or family, own securities of: Sitka, Trifecta, Harvest and Silver47. My company has a financial relationship with Harvest Gold, Trifecta Gold, and Silver47 Exploration Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Ahead of the Herd Disclosures

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.