On the weekend I presented a chart on gold and expected it would correct down and consolidate in the support zone shown below, around $3,000 and so far that is what has happened.

I expect we will now head back up again as hedge funds and investors who had to sell gold to meet margin calls will buy back positions. A pattern I have seen many times in the past.

The physical demand for gold will continue at a high pace, and we have been witnessing strong inflows of physical gold from London to the U.S., so U.S. bullion banks and some hedge funds are now joining the party. They are covering shorts and putting physical gold on the books over paper gold as physical gold is a tier one asset under Basel III that has its final effective date on July 1.

Paper gold is actually becoming a liability because banks have to put up a certain percentage of cash or collateral when they hold paper contracts. We should see strong inflows in the U.S. for the next three months. Gold is not consumed; it is the only thing that is eternal. Gold is money; it never rusts or burns and cannot be destroyed. It is nobody's liability, like fiat money.

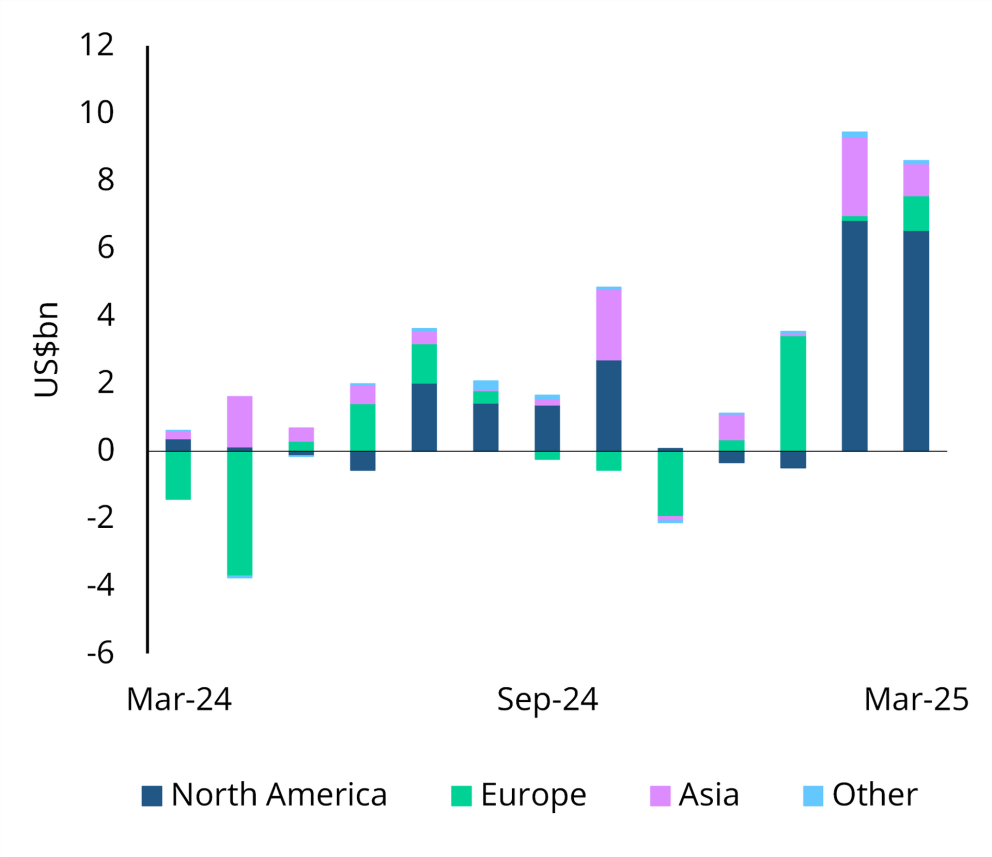

The March ETF data was out this morning, and that is what I was expecting. Global gold ETFs saw US$8.6bn (92t) in March inflows, pushing Q1 totals to US$21bn (226t) — the second strongest quarter on record. North America and Europe led with 83% of flows, while Asia outperformed relative to its 7% AUM share.

Back in 2011, we sold Rio Alto for over a 1,700% gain. We first bought Mexican Silver Mines in 2007 and was renamed Rio Alto Mining. Today I want to tell you about Rio Alto 2, called Rio2 Ltd.

It is much the same team with several directors from Rio Alto, and I highlight below.

Management:

Alex Black, Executive Chairman, has over 40 years of experience in the mining industry, founded Rio2 Limited, and has been Director, President & CEO of the company since 2016. In 2009, after successfully negotiating the acquisition of the La Arena Gold Project from Iamgold Corp, Rio Alto S.A.C. was acquired by Mexican Silver Mines and renamed Rio Alto Mining Limited. In 2014, Rio Alto also completed the successful acquisition of Sulliden Gold and the Shahuindo Gold Project for C$300M. Mr. Black, as President & CEO of Rio Alto Mining Limited and his experienced management team built Rio Alto from a CA$12M company in 2009 to a CA$1.2B company in 2015 at the time of the acquisition by Tahoe Resources Inc.

President and CEO Andrew Cox is based in Lima, Peru, and has over 28 years of experience in mining operations worldwide. Andrew also held various positions at Rio Alto Mining Ltd. from 2011 until acquired in 2015. Following the acquisition of Rio Alto Mining Ltd. by Tahoe Resources Inc., Andrew was the corporate operations manager in Peru until December 2016.

Kathryn Johnson, EVP - CFO & Corporate Secretary, is based in Vancouver and has over 15 years of experience in the mining industry, primarily in Latin America. Kathryn held various senior positions at Rio Alto Mining Limited until it was acquired in 2015. Her last position was Chief Financial Officer and, prior to that, Vice President - Corporate Reporting and Corporate Controller. While at Rio Alto Mining, Kathryn was a key member of the team that successfully completed the acquisition of Sulliden Gold and the Shahuindo Gold Project for $300 million in 2014.

Enrique Garay, Senior VP Geology - MSc P. Geo/FAIG, is a seasoned senior geologist with over 25 years of experience in the precious and base metal resource sector, with a focus on exploration and mine geology. He has worked for a number of leading mining companies including Barrick, Hochschild Mining, Trafigura, Consorcio Minero Horizonte, Rio Alto Mining, and Nexa Resources.

Rio2 Ltd.

Recent price - $0.75

52-week trading range - $0.40 to $0.93

Shares outstanding - 426.6 million

Major shareholders of Rio2 Ltd. (RIO:TSX.V; RIOFF:OTCQX; RIO:BVL) include Eric Sprott 7.46%, Power Corp 5.57%, Gam Holding 4.57%, Chairman Alex Black 4.38% along with some other funds.

I don't know if we can make a 1,700% gain with Rio2, but it is possible with gold going up to $5,000 to $10,00 as I expect longer term in this bull market.

Rio2 is an advanced-stage development company that is expected to go into production in early 2026. Rio2 is focused on taking its Fenix Gold Project in Chile to production in the shortest possible time frame based on a staged development strategy.

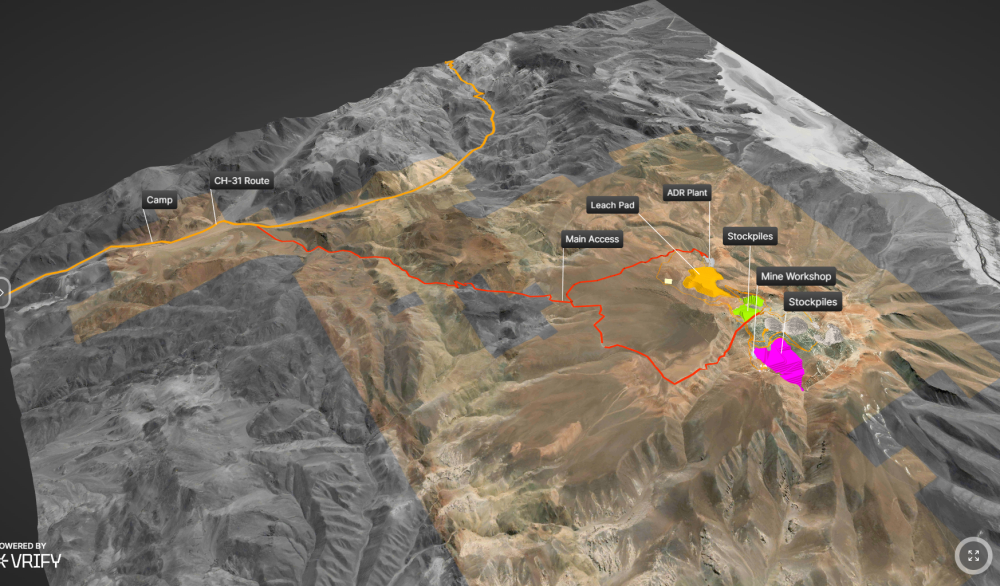

Fenix Gold Project (37,291 ha), Chile

It is located in the Atacama Region, in the Copiapó Province - Chile, specifically in the Maricunga Mineral Belt, approximately 160 kilometers northeast of Copiapó by International Road CH-31.

It is the largest undeveloped gold oxide heap leach project in the Americas. The Maricunga Mineral Belt is a well-known mining district that contains over 70 million ounces of gold and hosts the La Coipa and Refugio mines, as well as the Volcan, Caspiche, Lobo Marte, and Cerro Casale deposits. Some of you may remember a number of these mines from the old Bema Gold days.

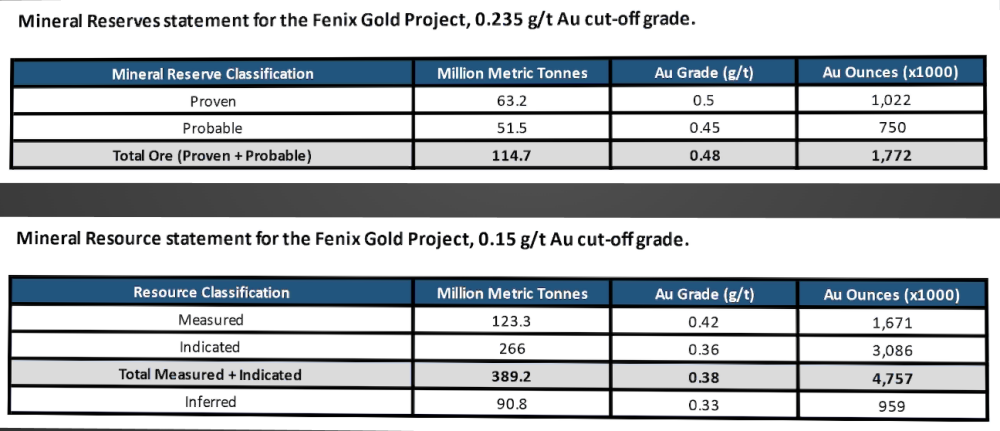

The project has 4.8 million ounces Measured and Indicated, with another 1 million inferred. The feasibility was completed in 2023 and highlights a 17-year mine life with 91,000 ounces per year for the first 12 years. The strip ratio is low at 0.85, and gold grade to heap leach is 0.48 g/t. The initial CAPEX is only US$235 million with Initial sustaining capital. All in Sustaining Costs are estimated at $1,237 per ounce so this is going to a very profitable mine at today's gold price. The mine being contemplated will be a run-of-mine heap leach operation. No crushing or tailings storage facilities are required, thereby minimizing the overall impact and footprint of the project.

The project began official construction at the beginning of February; the projected construction capital expenditure for 2025 is estimated to be $ 122 million (U.S.) (excluding Chilean VAT tax, which is refundable), with construction expected to be completed in November 2025. First gold production is currently guided for January 2026.

This is an excellent view of the mine setup. I would encourage you to view their presentation, which is all in 3D and gives an excellent understanding of the project and how mines are built.

Financial

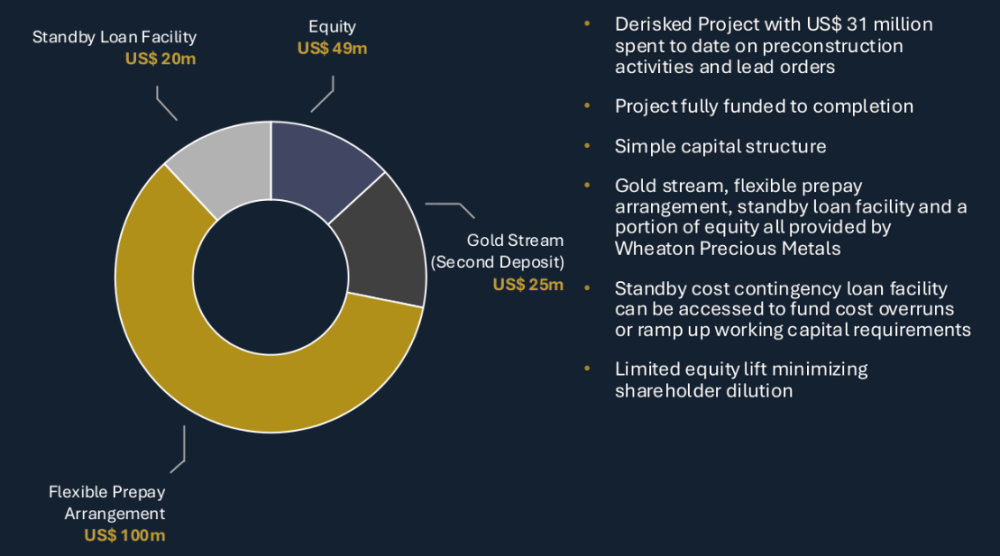

The project is fully financed for production, and this slide shows its components.

Conclusion

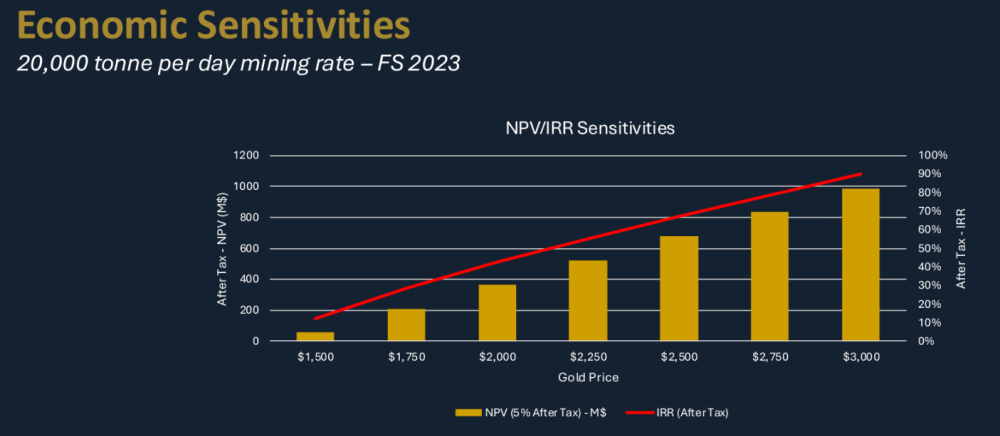

Since Rio2 started to develop this project, the gold price has increased significantly, and you can see at $3,000 a very high IRR of 80%.

This will be a real cash cow for the company.

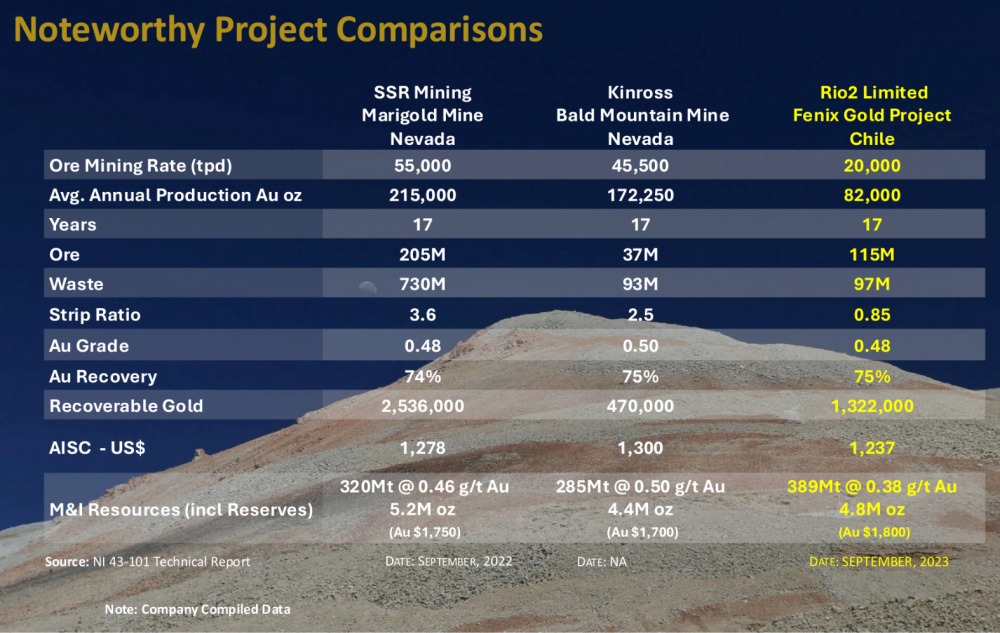

This company slide does a comparison to a couple of similar mines that I am familiar with as I followed SSR and Kinross.

Rio2's best advantage to these two is the low strip ratio of 0.85. Further down the road, it would not take much for Rio2 to expand to 30,000 to 40,000 tpd.

The enterprise value per M&I ounces is only around US$45 which I believe is very very low for a mine fully financed to production and $3,000 gold prices.

The stock has been a bit of a roller coaster ride that maybe helps explain some of the bargain price.

In 2022, the stock got whacked when the EIA was rejected in a regional vote as not having supplied sufficient information to eliminate possible negative impacts on three species of fauna.

After more information was provided and a review, the EIA was approved, and the stock continued to grow higher in 2024 with higher gold prices, and the mine financing was completed.

I believe the stock is way undervalued for the asset and stage it is at. A stock usually sees a big move higher when production starts with cash flow and earnings. The recent correction is an excellent entry point.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Ron Struthers: I, or members of my immediate household or family, own securities of: Rio2 Ltd. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.