Although Pasofino Gold Ltd. (VEIN:TSX.V; EFRGF:OTCQB; N07:FSE) drifted lower since we last looked at it at the end of December due to lack of action on the takeover front, the value of its primary asset has continued to appreciate as the gold price has continued to trend strongly higher, making the company more and more attractive to a JV partner or partners or as a takeover candidate.

It is thus interesting to observe that, despite the broad stock market caving in last week, the price of Pasofino stock surged on the news that Pasofino entered a support deal with Hummingbird, Nioko. This sharp move higher on good volume caused the stock to break out of the intermediate downtrend it had been stuck in since last October, as we will see when we look at its latest stock charts. First, we will overview the company's fundamentals using slides from its latest investor deck (March).

Recently, Pasofino Gold Ltd. Chief Executive Officer Brett A. Richards made the following observations: "Over the past two or three years, Pasofino Gold and its Dugbe Gold Project have been a secondary focus to Pasofino's major shareholder — Hummingbird Resources plc. Now that Hummingbird has been acquired by Nioko Resources, all parties and shareholders recognize the strategic significance of such a large, highly economic gold project in one of the most (if not the most) attractive geo-political jurisdictions in West Africa. I think that is obvious from the numerous interested parties that we have engaged with in the past six months, who had an interest to acquire the project for value.

This recent Co-operation Agreement signed between Nioko Resources, Hummingbird Resource and Pasofino Gold, represents a re-birth of the Dugbe Gold Project, now having a strongly aligned partnership, committed joint funding and an operating plan to create transformational value for all shareholders over the next eighteen (18) months.

In this current and forecasted gold price environment, Pasofino represents probably the most under-valued gold junior in the market today, given the size, scale, quality, and economic voracity of the current feasibility study. To that end, we have developed a joint path with our major shareholder to unlock that value and build on the already robust nature of the project."

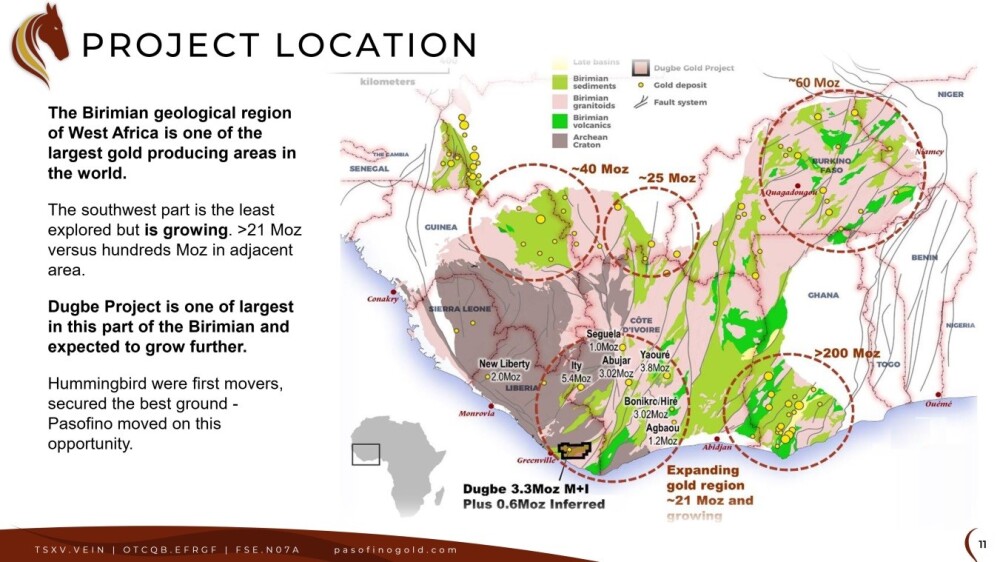

Pasofino Gold is developing its 100% owned Dugbe Gold Project in mining-friendly and now politically stable Liberia in West Africa. The following map shows the location of the project in Western Liberia. It is at the western end of the prolific Birimian Gold Belt, which extends to the north and east of Liberia into the Ivory Coast, Ghana, Burkina Faso, and Senegal. The presence of other large impressive deposits within this belt bodes well for further discoveries in and around Dugbe.

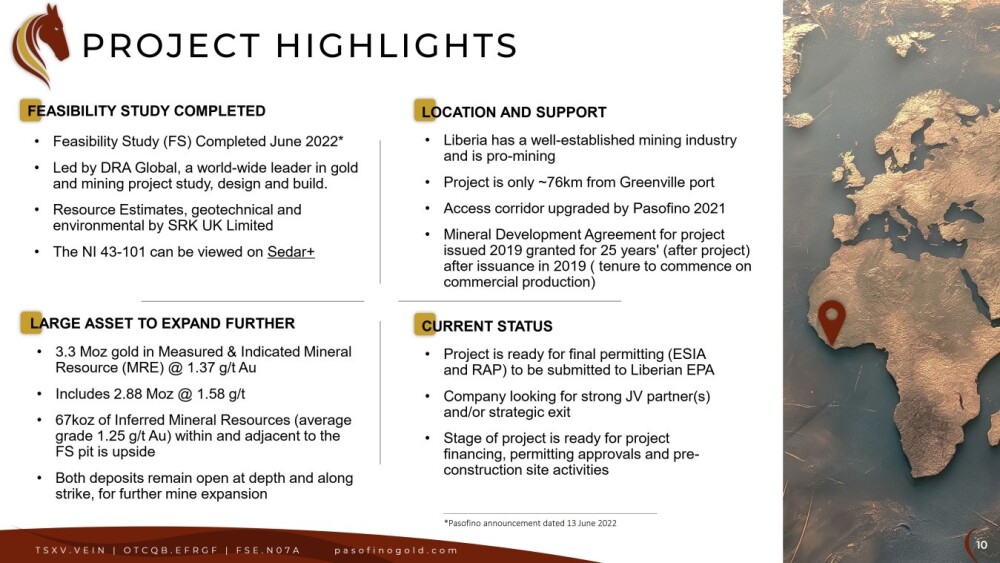

Liberia is now a good place for mining.

Here are the project highlights:

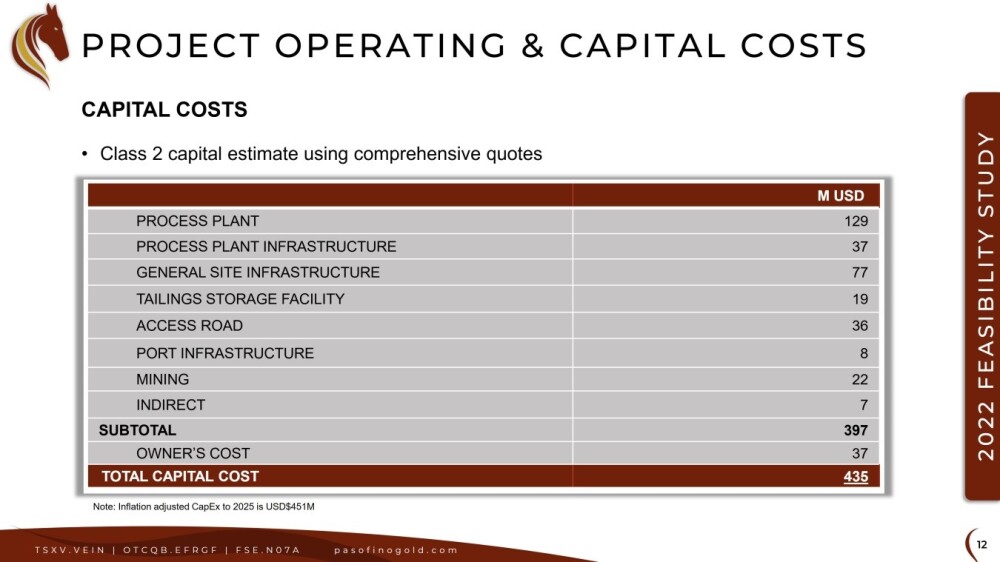

Capital Costs of the Project are estimated as follows.

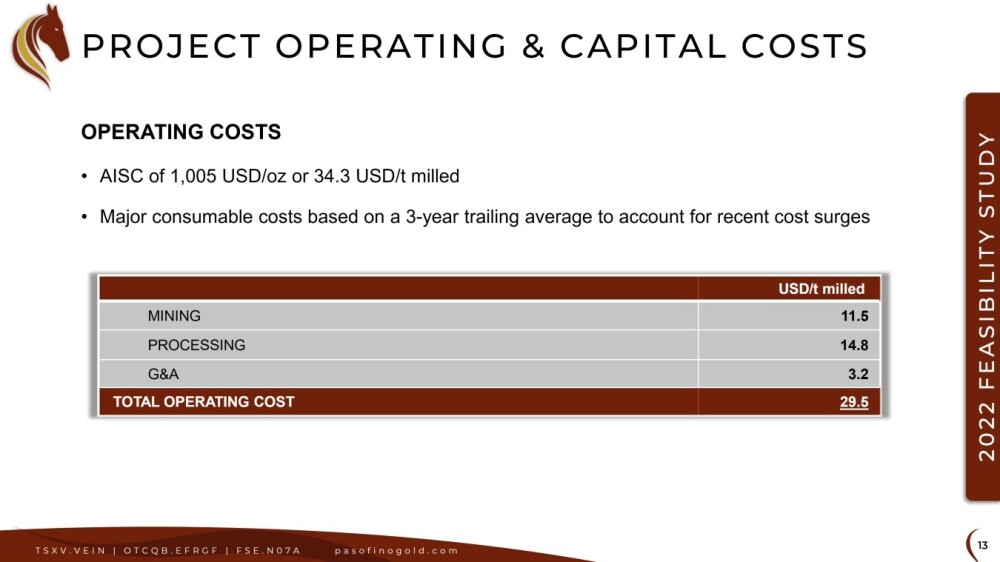

The operating costs of the project are listed here:

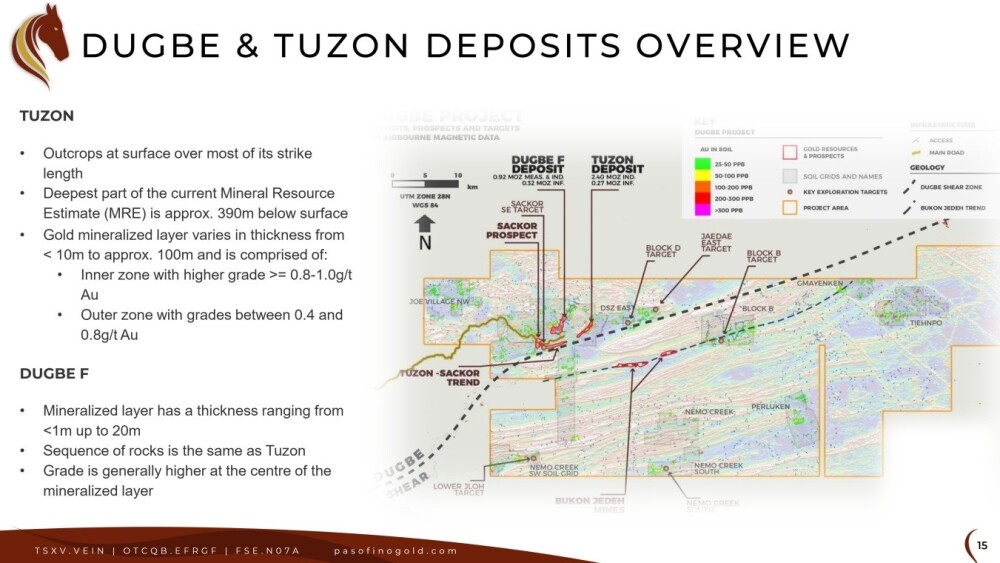

The following map overviews the Dugbe and Tuzon deposits.

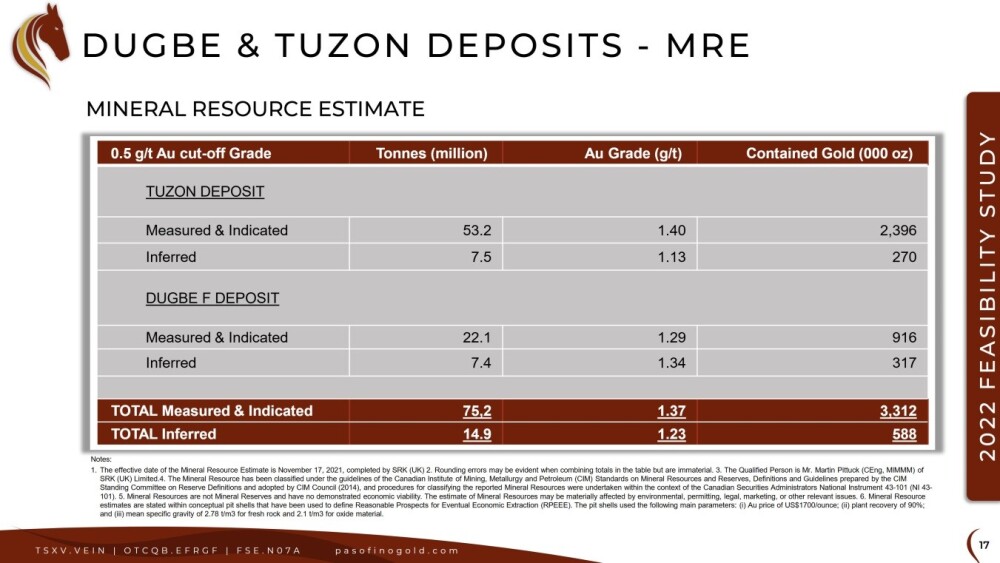

The Dugbe and Tuzon MREs (Mineral Resource Estimates) are below.

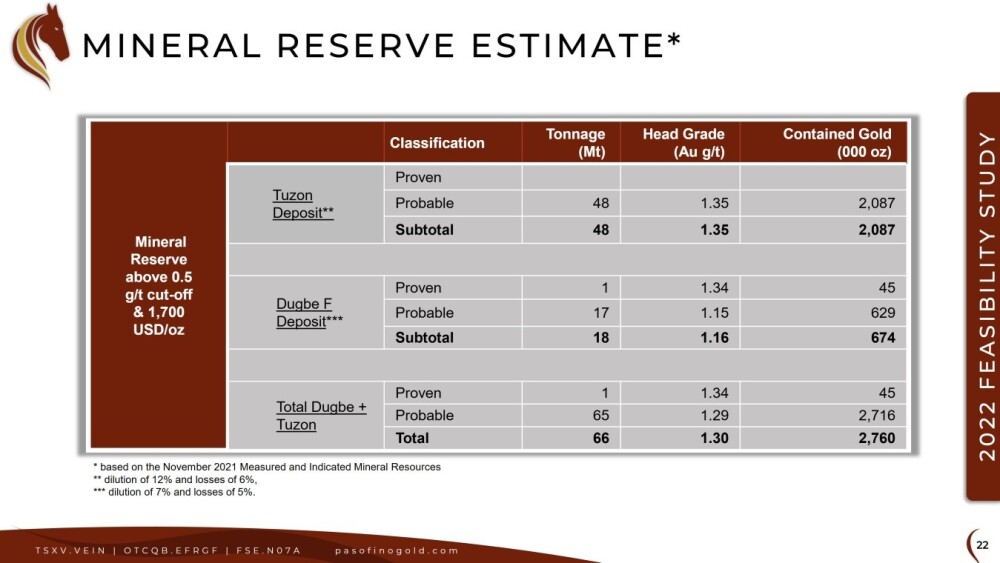

The Dugbe and Tuzon Reserve Estimate is below.

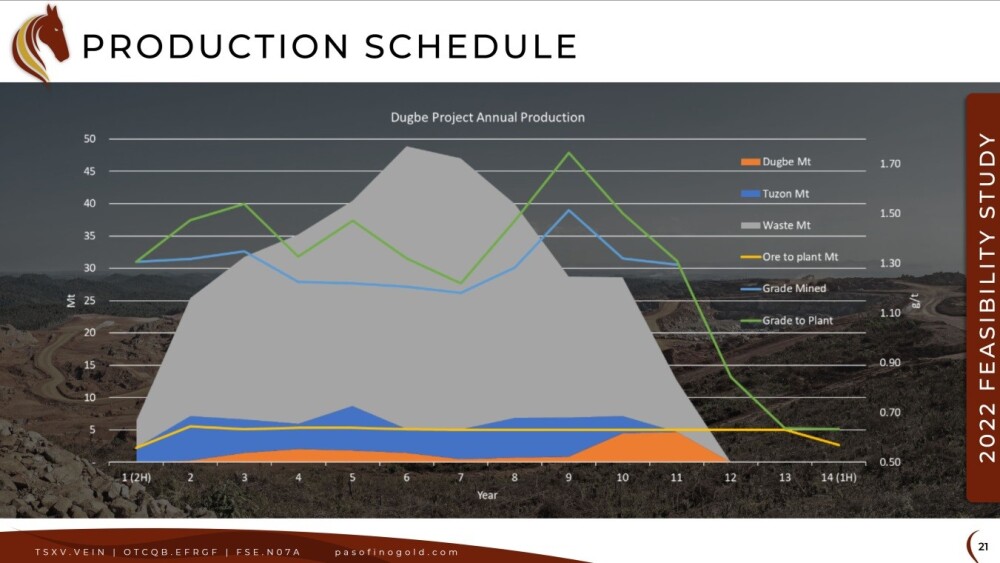

Here is the production schedule:

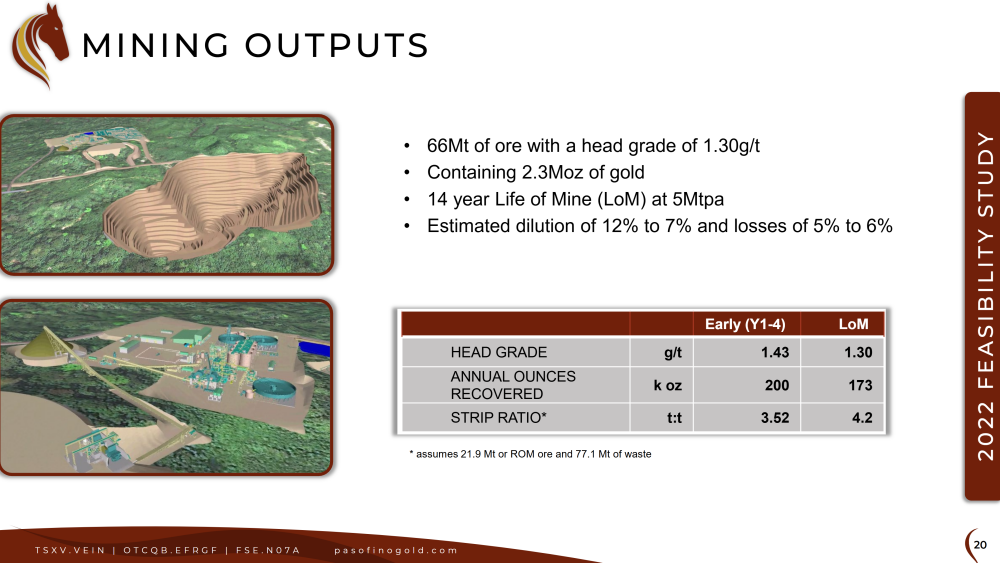

Here are the mining outputs:

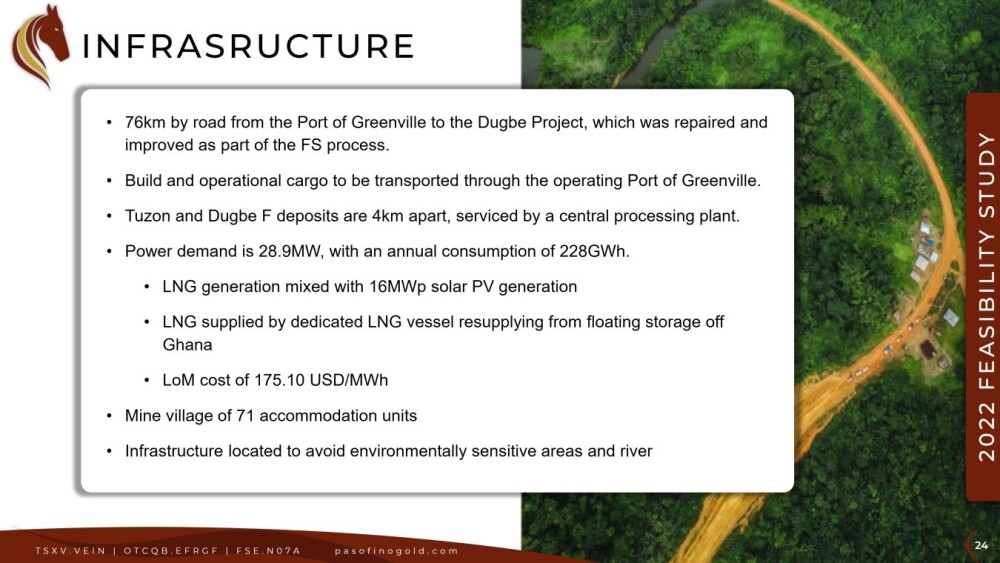

The infrastructure is good.

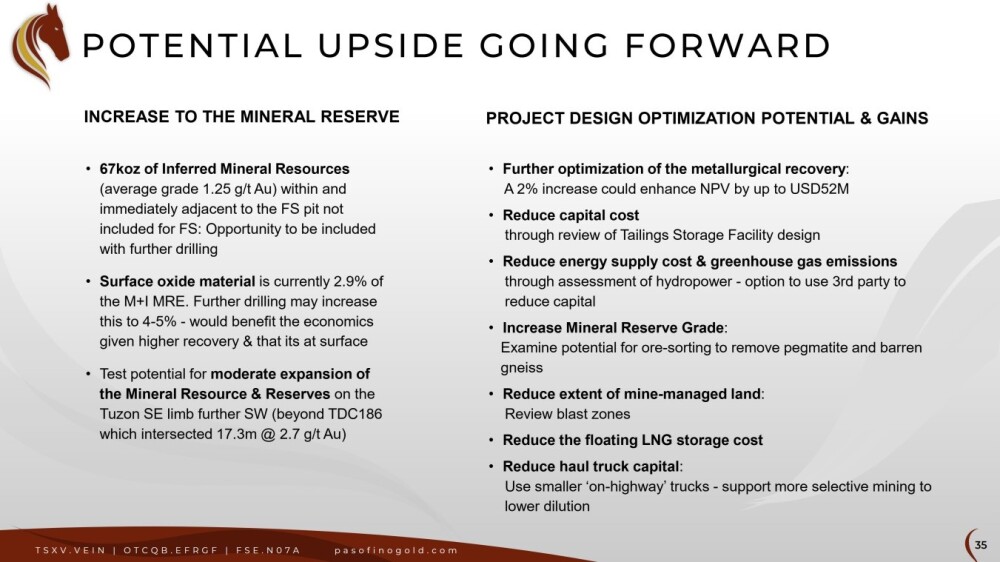

There is upside going forward arising from possible increases to the Mineral Reserve and Project Optimization.

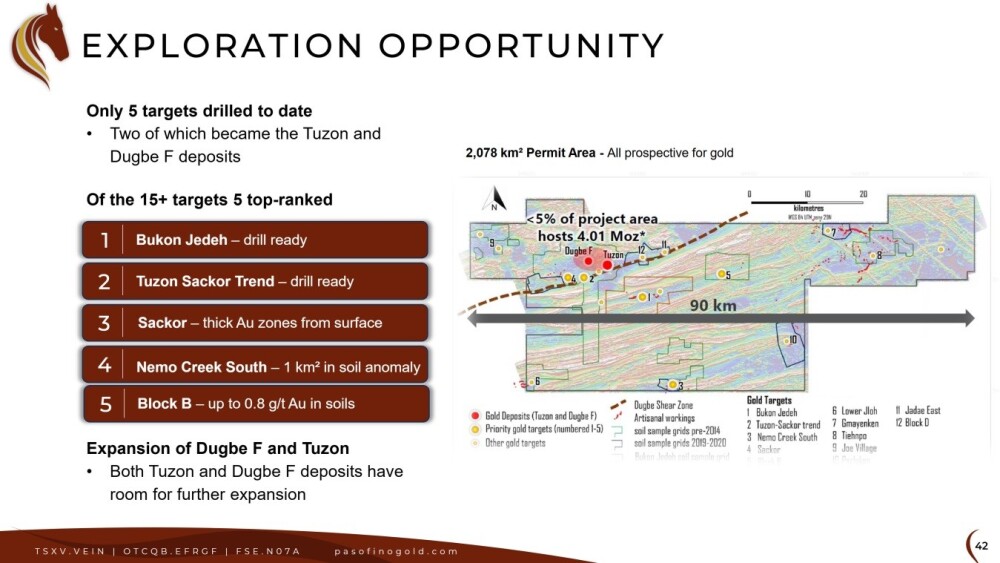

Only five of the 15+ targets have been drilled to date, so there is plenty of exploration opportunity.

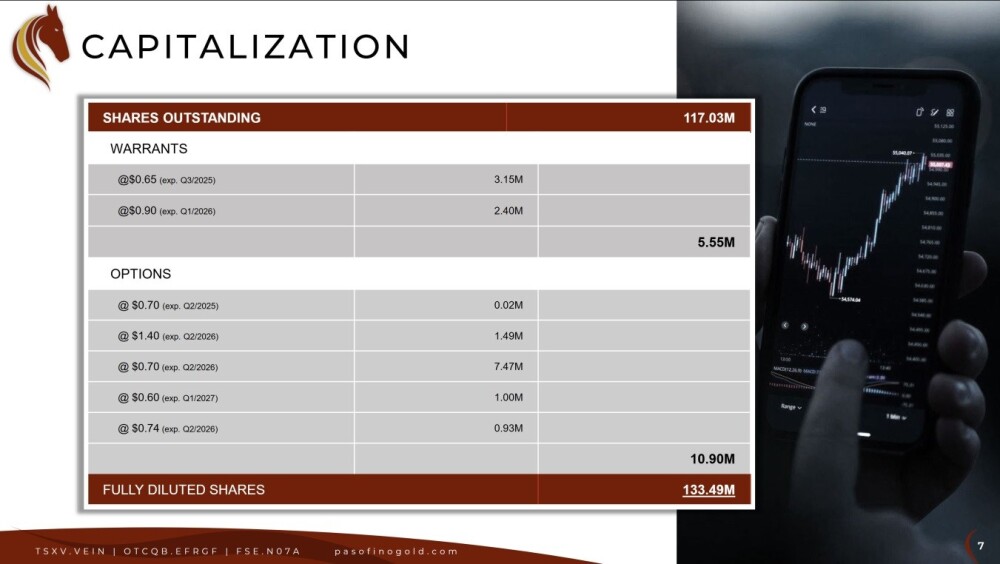

The capital structure of the company is as follows, with 117 million shares outstanding.

Turning now to the latest stock charts for Pasofino Gold, we see on the latest 8-month chart that, after continuing to drift lower in light volume on lack of interest from the New Year, it suddenly came to life last week, breaking out of the intermediate downtrend in force from last October on the news mentioned above.

This breakout was portended by almost all volume from the start of the year being upside volume and the relatively strong Accumulation line that resulted from this.

In conclusion, Pasofino Gold looks very undervalued here and like it is now starting a new bull market, and with a high and growing probability of a buyout soon on favorable terms for shareholders, it is rated an Immediate Strong Buy.

The first target for an advance is the CA$0.75 – CA$0.80 area at resistance at the highs of last September – October. The next target is CA$5.00 – CA$6.00 with higher targets possible.

Pasofino Gold's website.

Pasofino Gold Ltd. (VEIN:TSX.V; EFRGF:OTCQB; N07:FSE) closed for trading at CA$0.435, US$0.382 on April 7, 2025.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Pasofino Gold Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Pasofino Gold Ltd.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.