I find it darkly amusing the number of fuzzy-cheeked bloggers out there calling this minor setback in stocks a "crash." With the S&P down a modest 17.6% from its peak in February, it has yet to enter the realm of "bear market" still residing in "correction" territory, although certain subsectors are definitely feeling the bear's claws, such as the NDX100 and the Russell. The "(not so) Magnificent Seven," whose adherence to "artificial intelligence" set them at the top of the food chain for most of 2023 and 2024, have demonstrated more "artificiality" than "intelligence" with market leader Nvidia Corp. (NVDA:NASDAQ) down 38.7% from the all-time highs.

This week, the sudden recognition by the kiddies that neither the White House nor the Fed "had their backs" sent these serial dip-buyers scurrying for the safety of cash because they threw everything overboard except, of course, Bitcoin and its cryptocurrency brethren, which is no surprise as it takes a few million dollars of orders to rig a market dominated by less than the number of players on a basketball court.

What the youngsters have to understand is that a real bear market is nothing they have ever witnessed since the lows in 2008. Either the Fed or the White House, taking their marching orders from those Wall Street campaign donors, rode to the rescue on a white stallion called "Liquidity," saving stocks from what had been "normal" since the first shares traded owners on the old "Curb" in New York some 150 years ago, a normal and healthy cooling off period where stocks could be allowed to both inhale AND exhale instead of the constant defibrillation being exerted every time AAPL:US sneezed.

Old-timers recall the 1981-1982 bear market, where interest rates soared into the clouds in an effort to break the Stagflation that plagued the 1970s. The senior citizens who mentored me spoke of the grandaddy bear of 1973-1974, where stockbrokers were forced to take second jobs as cab drivers in order to supplement incomes that were deemed as exorbitant back then, as do the incomes of today's mega-rich investment bankers and hedge fund gurus.

The SPY:US went out for the week sporting a relative strength reading of 23.43, the lowest print since the March 2020 Covid Crash, which, by the way, marked the nadir for the correction.

I elected to add to my beloved Freeport-McMoRan Inc. (FCX:NYSE) that was trading above $43 a week or so ago, with copper at record highs only to end the week under $30 after hitting a low of $28.48(!).

RSI for FCX was 25.97, which was the lowest since 2020 as well, and given the earnings outlook for the company even at $4.40 copper, I would classify it as a "must-own."

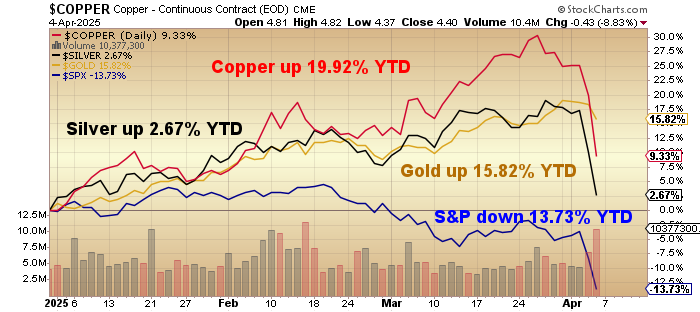

Copper and gold are leading the pack and still ahead on the year despite the vicious clubbing everything took last week. More importantly, when things settle down, the bullish factors setting them apart are not going to disappear. Tariffs are not going to stop China from building out its electrical grid to accommodate the massive increase in electricity being soon generated by the 50-odd new modular nuclear reactors currently under construction.

The cuts to fiscal stimulus being engineered by DOGE are not going to prevent the global central banks from diversifying away from U.S. treasuries and into gold. Tariffs and fiscal austerity will hamper stocks but it will not impede the march into hard assets.

Also worthy of consideration is the leadership group in the 2025 capital market structure. After the mauling of the past month, the Mag Seven are not going to be leading the charge to new highs any time soon. I believe that the multi-year bull market in the U.S. dollar is now over, which bodes very well for commodities, at least those inversely correlated with the dollar. It is also significant that cryptocurrencies led by Bitcoin have been treated not as "safe haven" assets but rather as "risk assets" now that Bitcoin is officially in a bear market. If you look at charts of both Bitcoin and NASDAQ, you will notice that they enjoy a wonderful symmetry that is perfectly correlated with one another.

Emails have flooded in asking what the right course of action should be, and I reply the same way I did in 2008 and 2020 –=— you want to be scanning the charts for quality companies whose RSI's are under 30 (and preferably closer to 20), and you want to buy them. Do not listen to the armchair "strategists" predicting a 30's-style Depression or a global financial meltdown.

This correction is known as a "tail event" caused by the whims and wishes of a legacy-seeking President who prides himself as a "maker of deals." As quickly as he has engineered a multi-trillion dollar sell-off in grossly overvalued stocks, he could (and probably will) engineer a massive reversal by suddenly announcing that he is either reversing or moderating the terms of his tariffs.

Given that he craves the adoration of the American people, administering the ultimate in the financial "pleasure-pain" syndrome would be very Trump-ian, leaving the doom-and-gloomers on the wrong side of the market once again. Subscribers, as well as thousands of "X" followers, know all too well that I have been calling Trump 2.0 to be a mirror image of Ronald Reagan's first term, which included a 27% drop in the Dow in 1981-1982. Thus far, it is playing out perfectly, with my two largest positions still well ahead for the year.

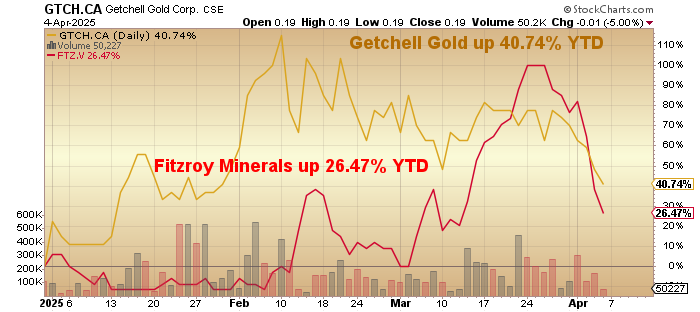

The junior portfolio which holds outsized positions in Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) and Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) has been a star performer thus far in 2025 with gains 40.74% and 26.47% respectively and that is after sizeable corrections last week from earlier highs.

I continue to add to both issues with the full knowledge that many unsophisticated shareholders took advantage of sizeable bids in FTZ/FTZFF and dumped into the drill hole news that arrived a week ago last Thursday with reports of a 200-metre intercept of .88% Cu-equivalent mineralization. That intercept included 42m of 2.31% Cu-Eq rock that triggered a one-million-plus volume explosion, which then triggered an onslaught of "sell-the-news," amateur-hour selling into what was arguably a world-class drill result.

If the broad market had not buckled under the weight of the tariffs, FTZ/FTZFF would have ended the month and the week with a 100%-plus YTD performance. As it stands, it is still ahead 26.47% YTD, and when you consider that 2024 darlings like Hercules Metals Corp. (BADEF:OTCMKTS; BIG:TSXV) and American Eagle Gold Corp. (AE:TSXV; AMEGF:OTCQB) are down 7.27% and 40.58% YTD, I would say that the Fitzroy team are doing a fine job.

Also of note was the closing of the Ptolemy Mining transaction, which brings in the Buen Retiro and Sierra Fritis concessions and, with them, the potential for a Candelaria-style IOCG deposit. Drilling began a week ago at Buen Retiro, so with the rig returning to Caballos shortly, and with drilling also ongoing at gold-copper-silver prospect Polimet, little FTZ/FTZFF will be generating a ton of news that they would be wise to keep shuttered until this broad market panic subsides.

Speaking of analogs, I recall with great fondness the plight of silver developer Aftermath Silver Ltd. (AAG:TSX.V; AAGFF:OTCQX; FLM1:FRA) back in 2020 during the COVID Crash. It had been as high as $0.50 in the latter part of January 2020 before that nasty little flu bug caught the investment world by surprise.

By the time the panic had ended, AAG/AAGFF was back under CA$0.10, with everyone and their brothers begging for bids. I held my nose and bought a chunk of stock into that panic at CA$0.085 and convinced myself to hold it for at least $0.50. Well, after the markets settled down and the politicians and the central bankers opened up the stimulatory floodgates, the juniors embarked on a lovefest that resulted in a price of CA$1.70 by January of 2021.

I ignored the snapperheads that were predicting the end of the world and took a well-calculated plunge that resulted in a sizeable capital gain in 2021. Those same thoughts reverberated through my head all last week in light of that spectacular discovery by Fitzroy at Caballos. World-class discoveries always spit in the face of market corrections, and that is exactly what we have at Caballos. For those readers who have the intestinal fortitude to step up to the plate, I will stake my entire newsletter career on a buy-out within the next eighteen months.

The next week will be interesting because we all know that stocks are ripe for a bounce. As I wrote a couple of weeks ago, any rally from here is doomed to failure because, after the carnage of the past month, stocks will most certainly retest the lows. The only commodity that I will avoid, like the proverbial plague, is silver, not because I do not think it is undervalued relative to gold but more so because I am sick and tired of listening to the incessant cheerleading. With gold crushing it in 2025, silver should be trading at $50-75 per ounce, but because it is caught in this Texas Death Match between the silver bugs and the bullion banks, I simply cannot face the ordeal. I will stay with my trusty copper-gold dynamic duo and let them carry me away to a blissful retirement and avoid the aggravation of the silver soap opera.

Longterm subscribers will recall the Email Alerts of March 16, 2020 when I urged everyone to go "All-IN" on the gold miner ETF (GDX:US). It proceeded to advance from the opening that fateful day at $15.13 and then proceeded to double within a month.

This is the kind of tape action that happens when "tail event" crashes send everybody scurrying for rationalizing narratives. Gold and copper producers are generating huge free cash flow right now and that will continue well into 2025 and beyond.

They should be bought.

| Want to be the first to know about interesting Critical Metals, Base Metals, Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., Fitzroy Minerals Inc., and Aftermath Silver Ltd.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Freeport-McMoRan Inc., Getchell Gold Corp., GDX:US, Aftermath Silver Ltd., and Fitzroy Minerals Inc. My company has a financial relationship with: Freeport-McMoRan Inc., Getchell Gold Corp., GDX:US, Aftermath Silver Ltd., and Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.