StrikePoint Gold Inc.'s president and chief executive announced the company is currently drilling at its flagship Hercules gold project in Nevada's Walker Lane with the first batch of drill results in "mid to late October."

Michael G. Allen gave an update to shareholders in a short YouTube video on March 27, saying it was "a very exciting time for StrikePoint Gold.

"What we're doing on the project right now is we're drilling," Allen said. "We're putting in about six or seven drill holes, … testing a geological concept that we came up with back in 2020."

Allen said he plans to be able to update the market on the company's progress later this month.

In March, StrikePoint announced the start of the infill and expansion drilling program, which is meant to build on its recently published exploration target at the project in a technical report earlier this month.

The drill-defined, bulk-tonnage exploration target, as described in the NI 43-101 compliant report, hosts between 819,000 ounces and 1,018,000 ounces (1.018 Moz) of gold (Au) within 40.3 million to 65.6 million tonnes of mineralized material with estimated grades between 0.48 and 0.63 grams per tonne (g/t) Au.

CEO: 'In a Past Life'

The Tier 1 gold projects in the Walker Lane include Kinross Gold Corp.'s (K:TSX; KGC:NYSE) Round Mountain, about 130 kilometers north of StrikePoint's Cuprite, which produced 15 Moz of gold, noted the Convergent article, and AngloGold Ashanti Ltd.'s (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE) Silicon Gold and Merlin discoveries, about 75 kilometers southeast of Cuprite.

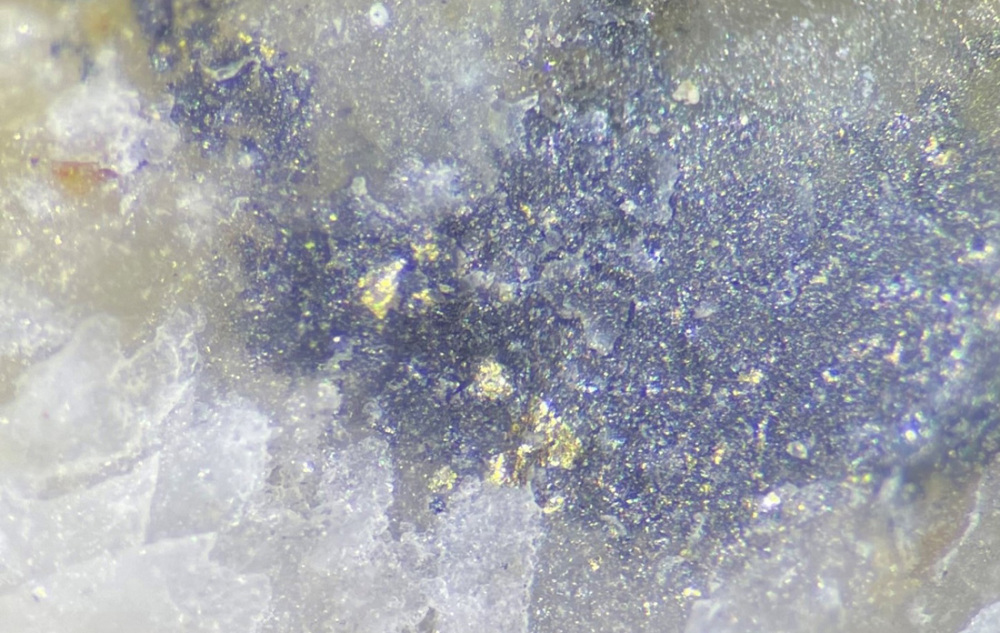

Spanning 100 square kilometers, Hercules features a low-sulfidation epithermal gold system, shown through historical drilling directed by Allen, shares geological similarities with the nearby Comstock Lode, and boasts multiple drill-ready targets.

Allen said the project itself already has about 300 holes drilled in it, including 40 he drilled there "in a past life in about 2020."

"I sold the project for CA$25 million as a part of a merger, and then recently I was able to buy it back for about CA$250,000," he said.

StrikePoint has amassed a land package of 145 square kilometers and owns two projects, Hercules and Cuprite in the Walker Lane gold trend. Walker Lane hosts some of the largest volcanic-hosted deposits in the West but has not seen much modern production, according to a Convergent Mining article. The deposits, which often contain silver and base metals too, are of a type that allows for relatively easy gold extraction.

"The Walker Lane has so much more to give," the article's author wrote. "With a massive land area, known significant deposits and the emergence of new exploration models, the Walker Lane may very well take the top spot in gold production from the Carlin Trend sometime in the not-so-distant future."

Hercules contains more than 45 untested geophysical and geochemical targets, some of which include visible gold at surface, the company has noted. Also, areas of mineralization remain open for expansion and possibly resource conversion.

"Previous drilling has only scratched the surface of this project's potential," Allen said. "We believe that the Hercules gold project has the potential to be Nevada's next multimillion-ounce gold resource."

Hercules to Get the Most Attention, Expert Says

The company's other Walker Lane project, Cuprite, covers 44 square kilometers and encompasses 574 unpatented claims.

*"Cuprite was off limits for exploitation up until relatively recently, and so by Walker Lane standards, it is relatively 'virgin' territory with big discovery potential," Technical Analyst Clive Maund wrote in a recent contributor opinion.

Last year, StrikePoint completed a five-hole maiden drill program at Cuprite, which showed mineralization in four of the holes.

Shortly after the target report was released,

Jeff Clark of The Gold Advisor noted that he was looking forward to StrikePoint's exploration plans this year.

"Based on the prospectivity of Hercules, especially given this new exploration target report, I expect this project to receive the lion's share of StrikePoint's attention in 2025," wrote on March 6. "That said, I’m still waiting for an actual exploration program at Hercules before I move the company off our hold list."

Maund described StrikePoint as a stock with big upside and very little downside.

The Catalyst: Gold Goes Up, Up, and Away

The gold market continues to be buoyed U.S. President Donald Trump's tariff policies as the yellow metal is often seen as a safe haven for investors as the U.S. stock markets are getting over their worst quarter in years, reported Maria Aspan for NPR on April 1.

The price of gold has been hitting all-time highs this week, she noted. Early Tuesday, gold futures hit a new record price of US$3,177 per ounce and are still up more than 18% from the start of the year — while the S&P 500 is down more than 4% over the same period.

Some believe the price will keep going up. Michael Widmer, head of metals research at Bank of America, last week published a report projecting that the price of gold would soar to US$3,500 per ounce over the next 18 months, Aspan reported.

Widmer said in an interview with NPR that many factors have contributed to the years-long run-up in gold prices — but the recent surge has been "almost exclusively driven" by tariffs-related fears and uncertainty.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB)

Others said it could rise even further. "An explosive move toward US$8,000/ounce is not just possible; it's increasingly probable," John Newell of John Newell and Associates wrote in a recent article.

"For those looking to hedge against inflation, preserve wealth, and capitalize on a potential historic price surge," added Newell, "gold remains one of the most compelling investment opportunities of our time."

Ownership and Share Structure

According to Refinitiv, Executive Chairman Shawn Khunkhun owns 0.28% of the company, President and CEO Allen owns 1%, Director Ian Richard Harris owns 0.07%, and Director Adrian Wallace Fleming owns 0.02%.

Refinitiv reported that institutional and strategic investors own approximately 13.47% of the company, including 2176423 Ontario Ltd. with 7.17%, and Pathfinder Asset Management Ltd. with 4.81%.

According to Refinitiv, the company has 41.59 million shares outstanding and a market cap of CA$7.03 million. It trades in a 52-week range of CA$0.12 and CA$0.85.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |