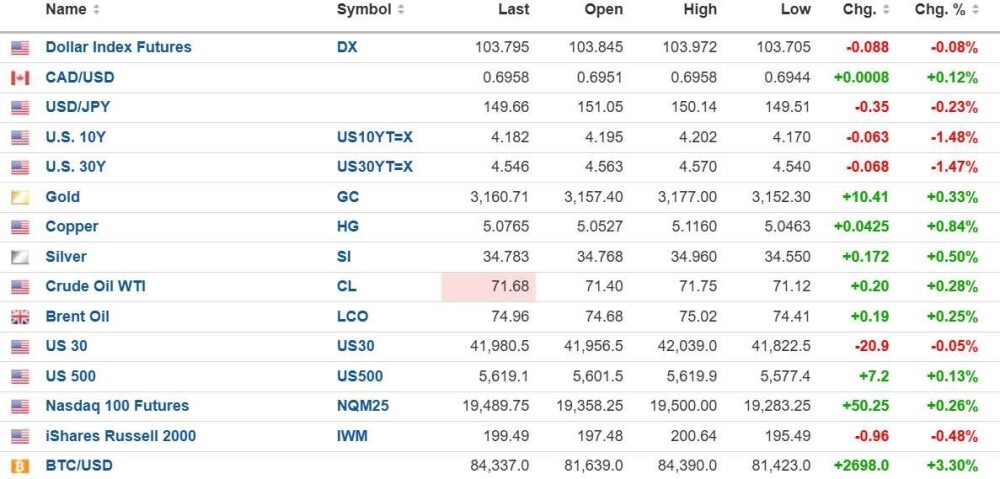

The U.S. dollar index futures (-0.08%) are down to 103.795, while the 10-year yield is down 1.48%) to 4.182, while the 30-year yield is down 1.47% to 4.546%.

Gold (+0.33%), silver (+0.84% ), copper (+0.84%), and oil (+0.28%) are up.

Risk barometer Bitcoin is up 3.3% to $84,337 and remains in bear market territory, down 22,90% from the top.

Stocks

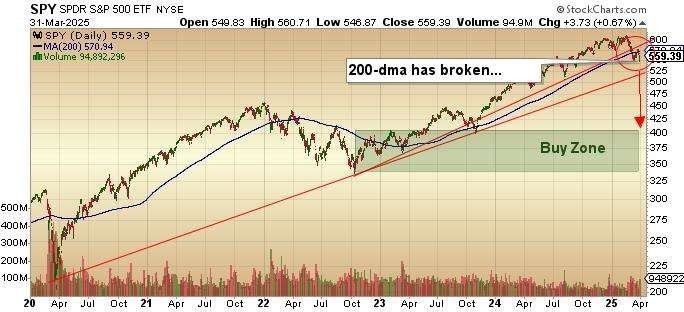

Stocks rebounded yesterday from Friday's mauling with a rather tepid 30-point advance in the S&P 500, and while everyone and their brother are alluding to the "deeply oversold condition" that pervades what they see, I am one armchair technician who sees nothing oversold about this market with RSI in the low 40's and MACD and MFI neutral at worst.

What IS alarming for the bulls is that the longer the SPY:US spends below the 200-dma at $570.94, the more difficult it is going to be to mount a rally. Also alarming is the rate at which the 20-dma is knifed through the 200-dma and also how the 50-dma is on its way to doing the same.

Once it crosses it, you will have a perfectly executed "Death Cross" that is one of the most powerfully bearish formations out there. Stocks are called moderately lower today, but given the passive money flows that arrive during the first two or three sessions of the new month, if stocks cannot rally now, then you are going see further weakness right through to the third week of this month when the corporate buybacks resume. Unfortunately, that is a lot of ground to cover and could lead to some nasty surprises.

Metals

Gold continues its relentless advance, taking over the lead from copper, which needed to work off its oversold condition. That said, I was surprised by the ferocity with which the algobots were throwing Freeport-McMoRan Inc. (FCX:NYSE) overboard. Since the day I put out the "sell" on the June $40 calls, it has been straight down from north of $43 to $36.33 in a mere four days, which is ridiculous given that a third of their production aside from copper is gold and yet they still dumped it with surprising savagery. I remain bullish on FCX.

Silver is again lagging, and I thank my lucky stars that I refrained from getting sucked into that false breakout last week above $35.07 that had Craig Hemke and his legions of #SiIverSqueeze mouth-breathing idiots all taking victory laps. While a gold price at $3,160 cannot fail but to drag silver kicking and screaming into the $40-50 range, timing it and trading it properly has been a nightmare.

For now, I continue to stand aside and focus on gold and copper.

Fitzroy Minerals Inc. closes acquisition of Ptolemy Mining ("Buen Retiro")

At long last, the most important move in the life of this little junior has been completed, and the only comment to review is the following from the company:

Merlin Marr-Johnson, CEO and President of Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB), commented:

"We are thrilled to announce the successful completion of this acquisition, which marks a significant milestone for Fitzroy Minerals. With this transaction, we are well-positioned to target commercially viable copper resources in the Chilean coastal IOCG belt. Additionally, with the concurrent financing, we are fully funded for an 8,000-meter drill program in 2025 at the Buen Retiro Copper Project. We are also pleased to welcome Gilberto Schubert as our new Chief Operating Officer — his extensive expertise in resource development and operational leadership will be instrumental in advancing our projects and strengthening the Company. We look forward to an exciting year ahead as we execute on our strategy and create value for our shareholders. "

The full release can be found here: Ptolemy closing.

What the world does not recognize is that they started work on Buen Retiro a number of days ago so news regarding that copper-bearing oxide cap should be forthcoming in the next month. With another rig returning to Caballos shortly and one working away at Polimet, this company will have potential price-impactive news flowing from three projects, all fully-funded until 2026.

FTZ/FTZFF is a STRONG BUY into this incessant "sell the news" amateur insanity plaguing the junior markets. In a few days, the underlying trend and value proposition will re-emerge, resulting in new all-time highs above CA$0.69.

| Want to be the first to know about interesting Silver, Critical Metals, Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.