Jericho Energy Ventures Inc. (JEV:TSX.V; JROOF:OTC; JLM:FRA) dropped even further after we looked at it under a year ago, but now, after arriving at a long-term cyclical low, it appears to be approaching the completion of a base pattern. The business of the company is on a solid footing, and the reason for this update is that the company came out with the news yesterday morning that Jericho Energy Ventures unveiled its innovative modular data center initiative, which will transform natural gas assets into AI powerhouses.

This is potentially highly significant as the company has vast quantities of natural gas in the U.S. that can be used to feed power-hungry AI data centers, and it looks like this could turn out to be a major source of revenue.

From the news release. . .

"JEV's management believes the company is ideally positioned to capitalize on the Trump administration's pro-energy and pro-development regulatory landscape by leveraging its strategic partnerships, robust infrastructure, prime acreage in Oklahoma's storied energy corridor, and abundant availability of cost-effective natural gas to power data centers.

Jericho's Modular Data Center business will be overseen from its Tulsa, Oklahoma regional office, where the company's oil and gas joint venture currently owns and operates approximately 40,000 acres of productive land.

By converting its natural gas into long-term reliable on-site power, JEV intends to offer secure, modular, latest, and next-generation computing infrastructure tailored for AI applications - enhancing efficiency, reducing waste, and strengthening energy resilience."

Now, we will look at several charts for Jericho.

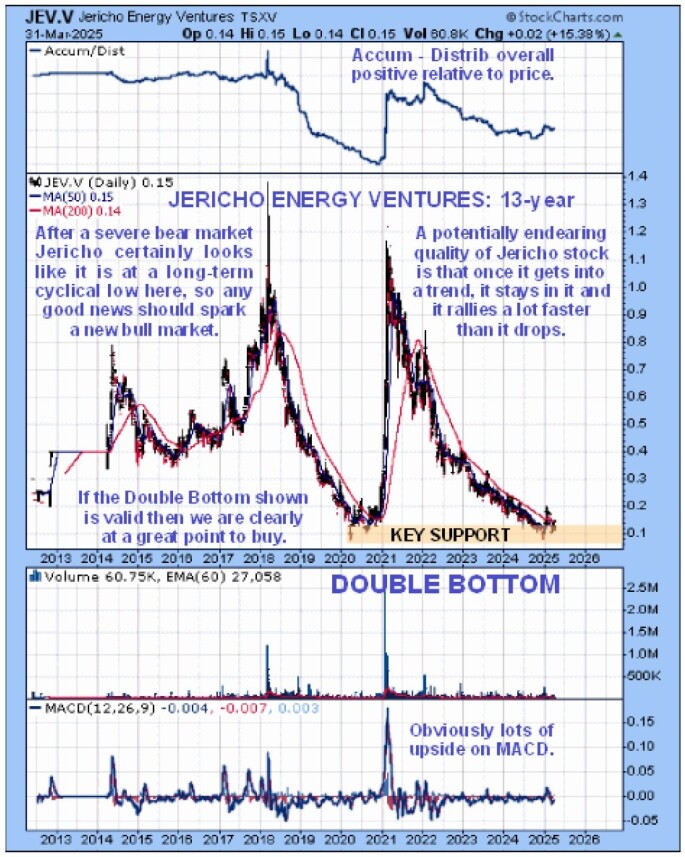

Starting with the long-term 13-year chart going back to inception, we see that the stock has been in a long and persistent severe downtrend from its early 2021 spike high that has brought it all the way down to support at a cyclical low at its 2020 lows, which is clearly a very good point for it to stabilize and start higher again — and yesterday morning's news could be the catalyst.

Now we zoom in to look at the period that includes the 2020 – 2021 spike and the bear market that followed in some more detail. The reason for using a log chart is twofold — it opens out the two base patterns shown so that it is easier to see what was going on within them and also enables us to define a parallel downtrend from the 2021 high.

An important point to note is that the price tried to break out of this downtrend in January, and although it didn't succeed, this attempt was a bullish indication and a sign that the stock is basing and will likely succeed in breaking out of it before long. Another important point to observe is that the Accumulation line has been showing positive divergence overall, and it broke out with the price in January and has not given back much of its gains.

The 1-year chart shows recent action in much more detail and on it we can see that the rally from the lows in December and into January was on good volume, the Accumulation line is relatively strong and we have this month seen a bullish cross of the moving averages.

So it looks like some sort of base pattern is completing.

Jericho Energy Ventures is therefore viewed as an Immediate Speculative Buy.

The first target for an advance is relatively close by at CA$0.20. The second target is resistance in the CA$0.80 area, and the third target is much higher in the CA$1.20 – CA$1.30 zone.

Jericho Energy Ventures' website.

Jericho Energy Ventures Inc. (JEV:TSX.V; JROOF:OTC; JLM:FRA) closed for trading at CA$0.15, US$0.1054 on March 31, 2025.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Jericho Energy Ventures Inc.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.