Remember that November 2024 tale suggesting Trump's second term would harm gold prices?

It claimed that tariffs might trigger a U.S. dollar short squeeze, while tariff-induced inflation would force the Fed to implement stricter monetary policies.

This story quickly faded, but gold certainly experienced a sharp bull-market retreat during the two weeks after the November 5 U.S. election:

The Trump 2.0 gold pullback of November 2024 concluded on November 14 at $2,537/oz.

Gold has been climbing steadily since.

The U.S. dollar short squeeze did materialize briefly. However, it's becoming increasingly evident that the Trump Administration aims to weaken the U.S. dollar to rebalance U.S. trade deficits. Meanwhile, the de-dollarization trend continues steadily.

Regarding tariff-driven inflation, Fed Chair Powell clarified during last week's press conference that he considers inflation from tariffs as 'temporary.' He also stressed that the Fed is monitoring economic impacts from tariff uncertainty, ready to intervene if US employment conditions worsen. This suggests the Fed would more likely ease monetary policy due to tariff consequences.

Bank of America recently released a comprehensive research paper titled "Gold plating guns and cannons." The report outlined several positive catalysts for gold while also noting potential challenges to the optimistic gold outlook.

Positive demand drivers & economic factors boosting gold:

- China's Insurance Sector: New regulations permit insurers to allocate up to 1% of their assets to gold, potentially adding 300 tonnes of gold purchases (6.5% of the annual physical market demand).

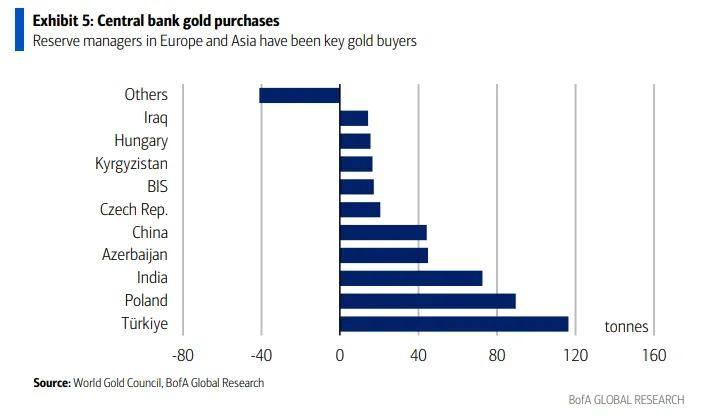

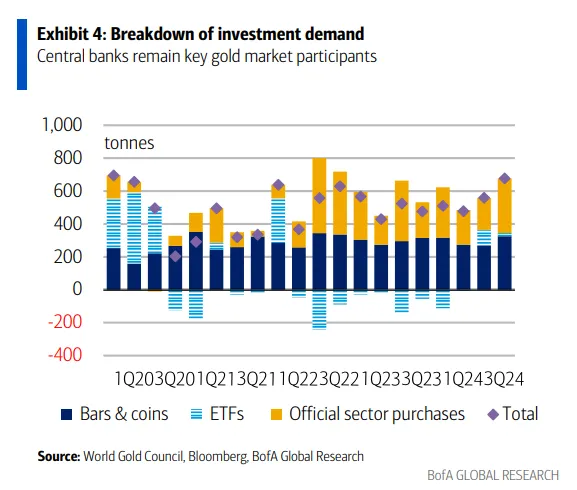

- Central Banks (CBs): Currently maintaining 10% of reserves in gold, CBs might increase to 30% for greater portfolio efficiency.

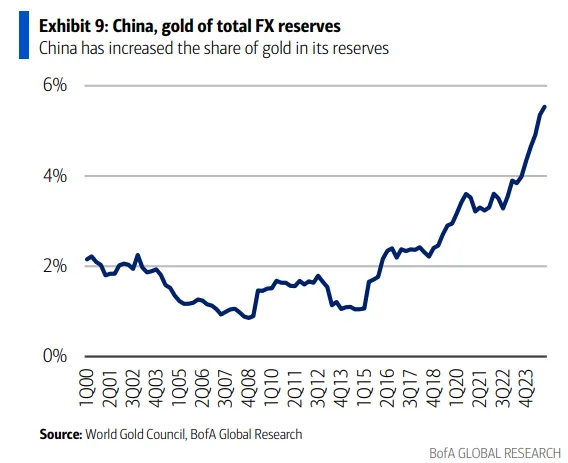

- China's PBoC boosted its gold reserves to 5.5% of total FX reserves in Q4 2024; numerous central banks are actively cutting USD holdings in favor of gold.

- U.S. Economic Strategy: Ambiguity surrounding tariffs, trade policies, and fiscal gaps is stimulating demand for gold.

- U.S. Dollar Decline: A softer dollar supports gold prices, as global diversification away from USD holdings persists.

- Geopolitical Tensions: Intensifying trade frictions and global policy uncertainty are enhancing gold's reputation as a safe-haven asset.

- Gold-backed ETFs witnessed 4% year/year expansion, reversing previous outflows. Retail investment continues to climb, especially in North America and Europe.

- Multi-Polar Landscape: The global shift from U.S.-led unipolar dominance to a multi-polar world heightens gold's allure. If global CBs pivot away from USD holdings, gold will probably benefit as a reserve asset.

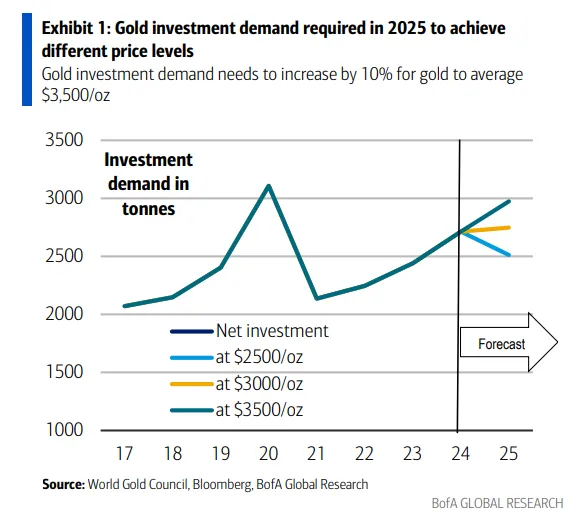

The blend of sustained global central bank gold acquisition, heightened retail investor enthusiasm in Europe and the U.S., and China's insurance industry emerging as a substantially larger force in driving physical gold demand could push gold to $3,500 by mid-2026.

BofA identifies three primary threats to the bullish gold perspective:

- U.S. Fiscal Improvement: If the U.S. successfully shrinks deficits, it may dampen demand for gold.

- Robust USD & Interest Rate Increases: Higher real rates could diminish investor interest for gold.

- Enhanced Geopolitical Harmony: A return to stronger global cooperation could restrict gold's appeal.

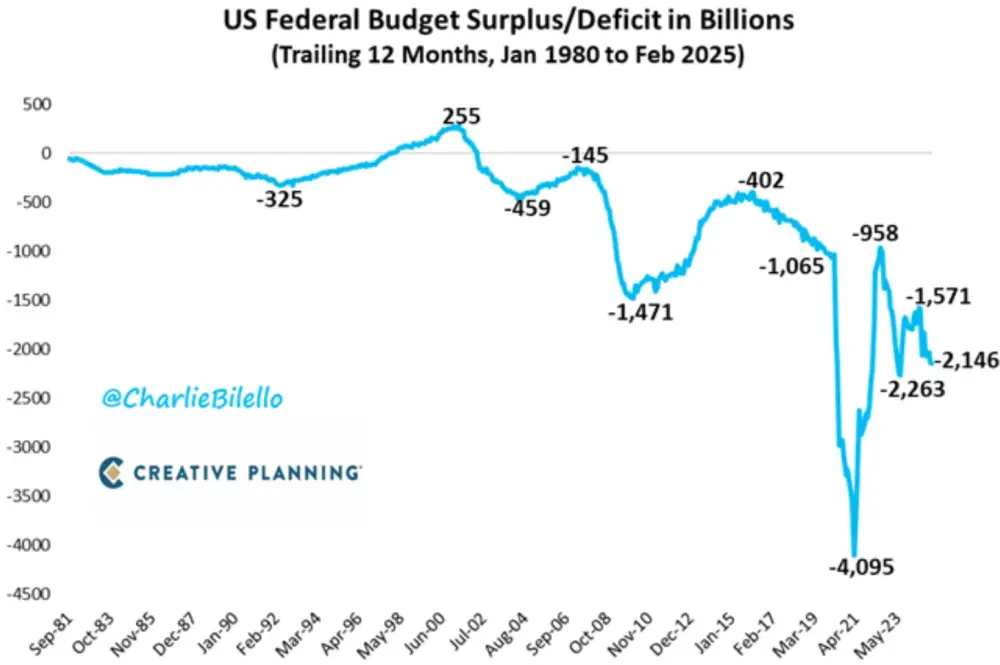

The second and third points seem unlikely scenarios. The likelihood of reduced U.S. fiscal deficits remains an unpredictable variable — judging by the U.S. government deficit forecasts for the current fiscal year, prospects appear dim:

In February alone, the US government posted a $307 billion budget shortfall! That accumulates to a $2,150,000,000,000 deficit over the past 12 months.

Perhaps the most significant immediate threat to gold's rally is the possibility of Trump retracting most tariff threats. While this doesn't appear highly probable currently, if it happens, we might see stocks surge and Treasury yields climb. Potentially subjecting gold to selling pressure.

Ultimately, Trump 2.0's "America First" approach might culminate in an "America Alone" outcome. By turning inward to address the twin deficits, the U.S. risks alienating trading partners and former allies. The possibility of U.S. withdrawal from NATO represents perhaps the most significant example of a potential "America Alone" scenario.

The consequence of growing American isolationism could be a further reduction of U.S.dollar holdings by foreign central banks and a weakened U.S. dollar. Gold stands to gain significantly in such circumstances.

Gold's future looks promising.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Robert Sinn Disclosures

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. West Red Lake Gold Mines Ltd. is a high-risk venture stock and not suitable for most investors. Consult West Red Lake Gold Mines Ltd’s SEDAR profiles for important risk disclosures.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.sedarplus.ca for important risk disclosures. It’s your money and your responsibility.