Although the price of Armory Mining Corp.'s (ARMY:CSE; RMRYF:OTC; J2S:FRA) stock has drifted off since we first looked at it early in February, its technical condition has strengthened greatly as we will see when we come to review its latest charts which means that it is more of a buy now.

Armory Mining Corp. changed its name from Spey Resources in November and is a junior company focused on exploring for critical minerals that are vital to the future of security and military applications, such as antimony, gold, silver, lithium, and various other minerals that will be in increasing demand in the future with the prospect of much higher prices for most of them. So it's not surprising that the company's stock has been under accumulation for many months, and especially in recent weeks, and is completing a large base pattern from which it is set to break out into a major bull market soon.

Before we look at the stock charts, which make a clear and robust case for buying Armory Mining, we will first overview the fundamentals of the company using slides lifted from the investor deck.

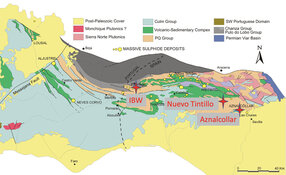

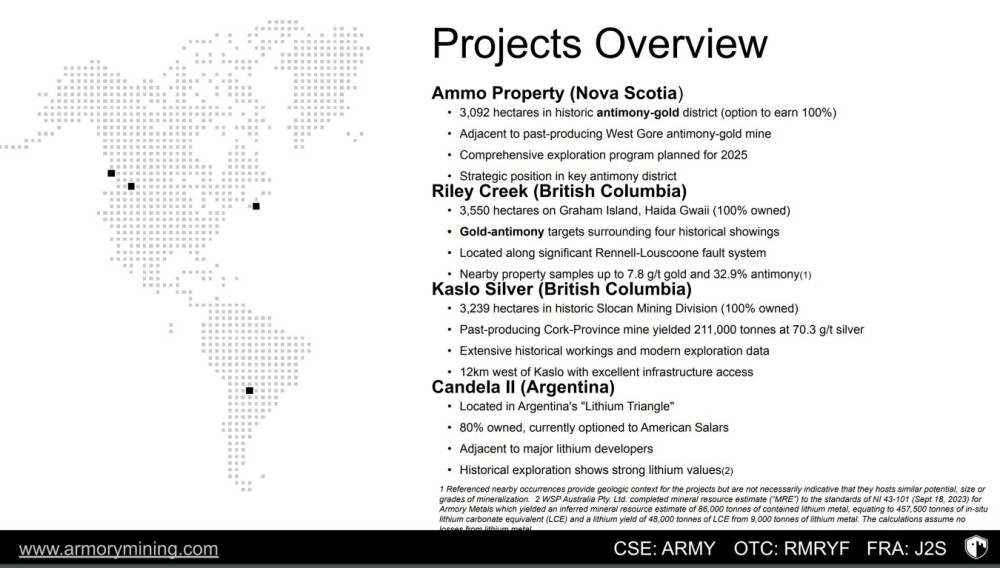

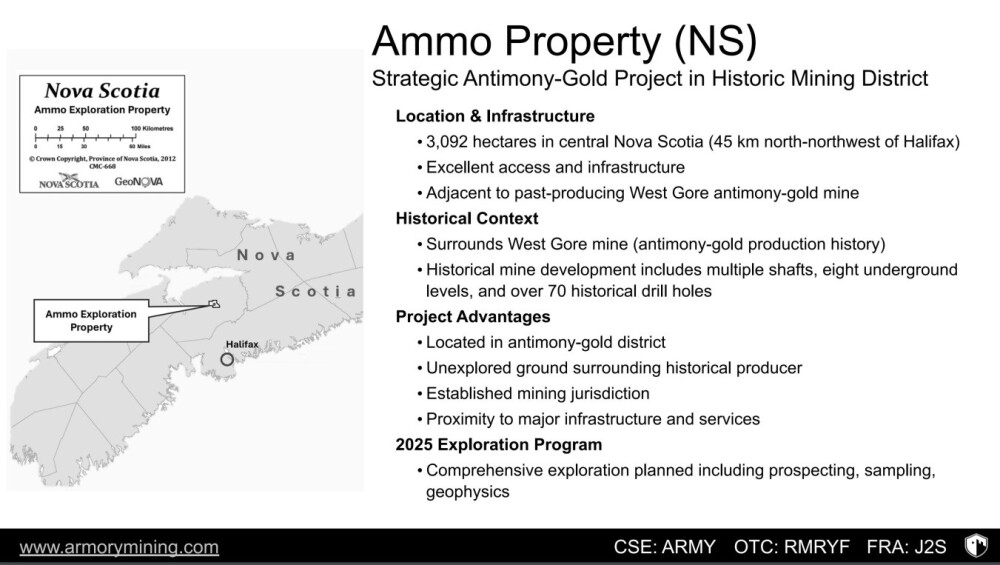

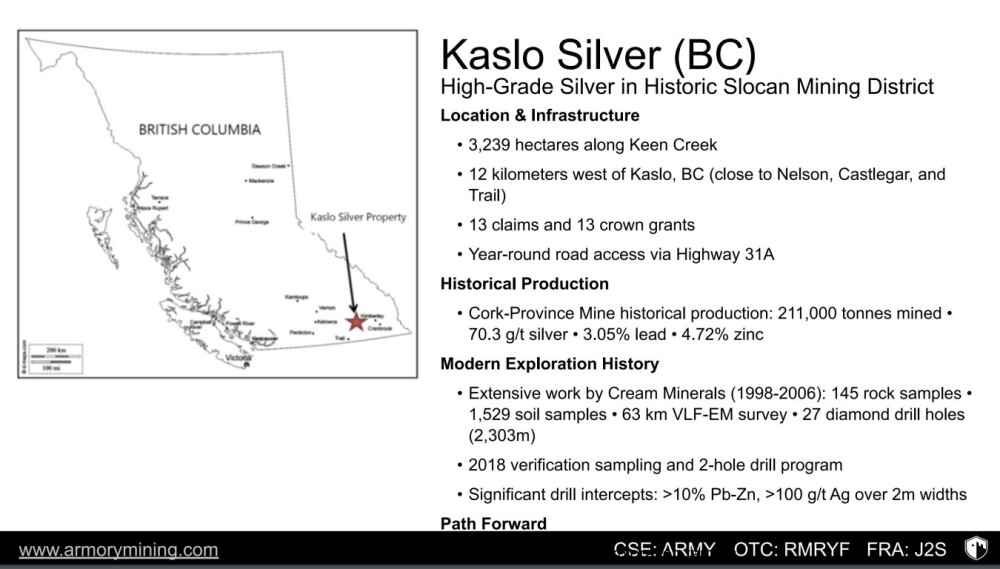

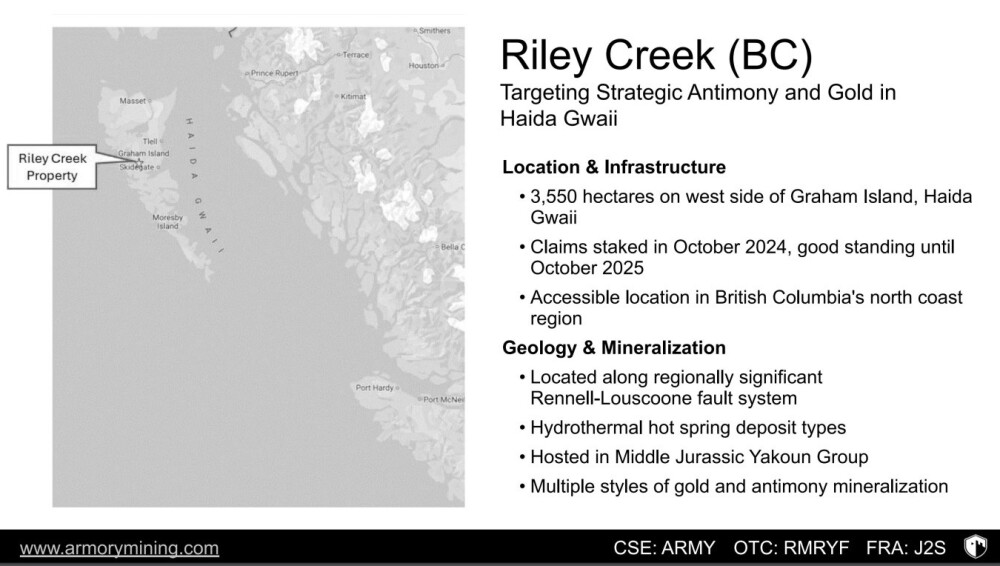

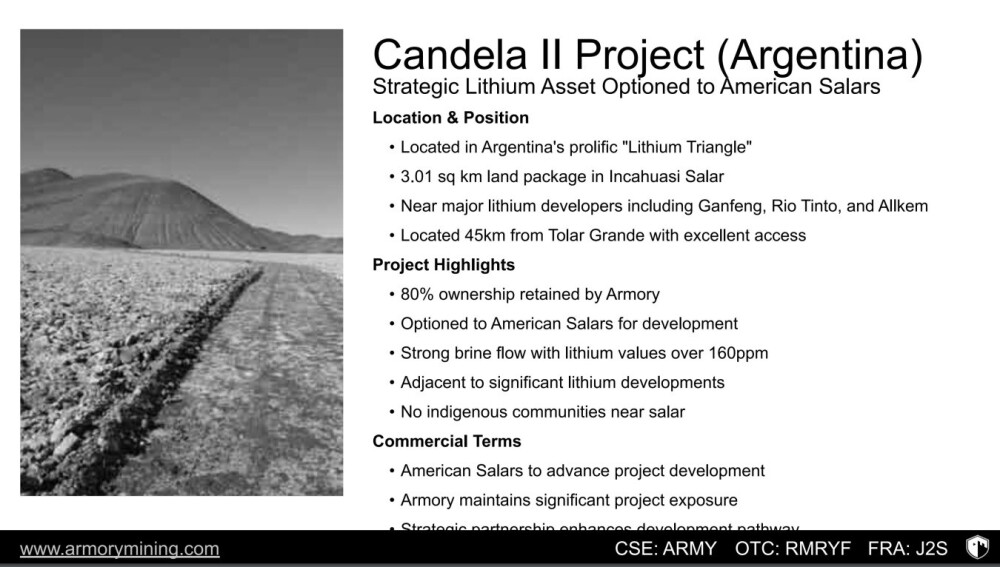

Armory Minerals has four projects situated in proven mining districts that have past-producing mines where the infrastructure is good. The approximate locations of these projects are shown on the following slide. Three of them are in Canada, with the remaining one in Argentina. The Ammo Property in Nova Scotia and the Riley Creek property in British Columbia are chiefly antimony and gold projects, while the Kaslo Silver property in British Columbia is, as its name implies, primarily silver, and Candela II in Argentina is a lithium deposit. . .

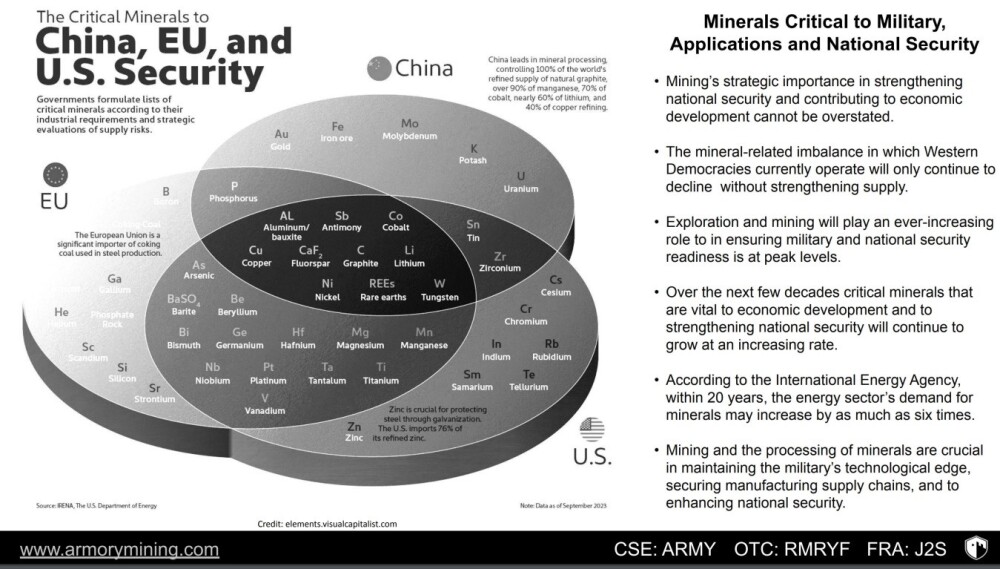

With the growing imposition of tariffs and trade barriers, the importance of producing antimony in North America is becoming increasingly clear since China is the dominant source of this semi-metal, and its price looks set to continue higher.

The following pages from the investor deck overview each of the projects in turn.

Since we last looked at Armory in February, there has been news that the company is to retain control of this lithium project because American Salars Lithium Inc. (USLI:CSE; USLIF:OTC; Z3P:FWB; A3E2NY:WKN) has relinquished its option to develop it.

This slide details the importance of different critical minerals to the major world trading blocs.

The company highlights are on the below slide.

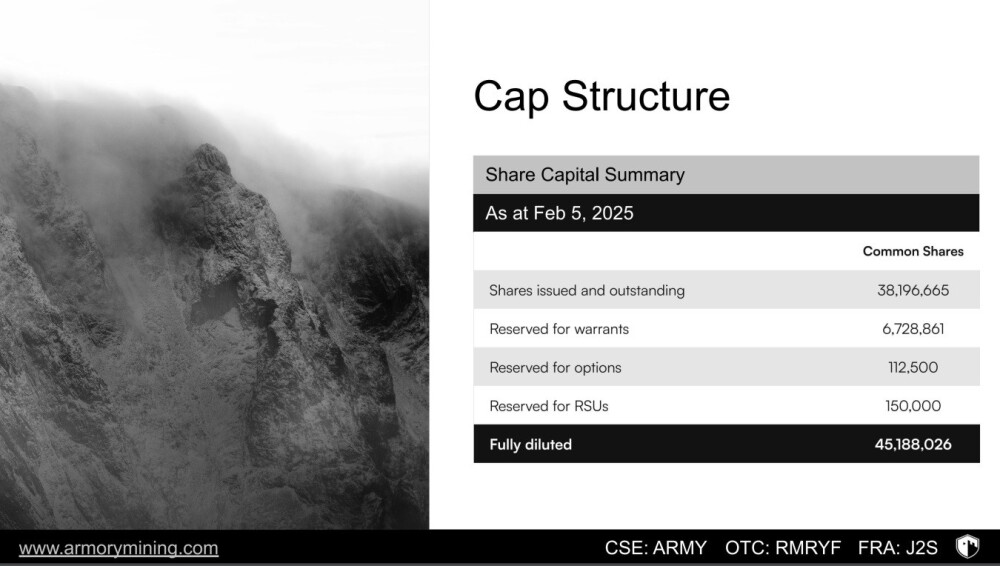

On this last slide, we see that the company has a reasonable 38.2 million shares in issue.

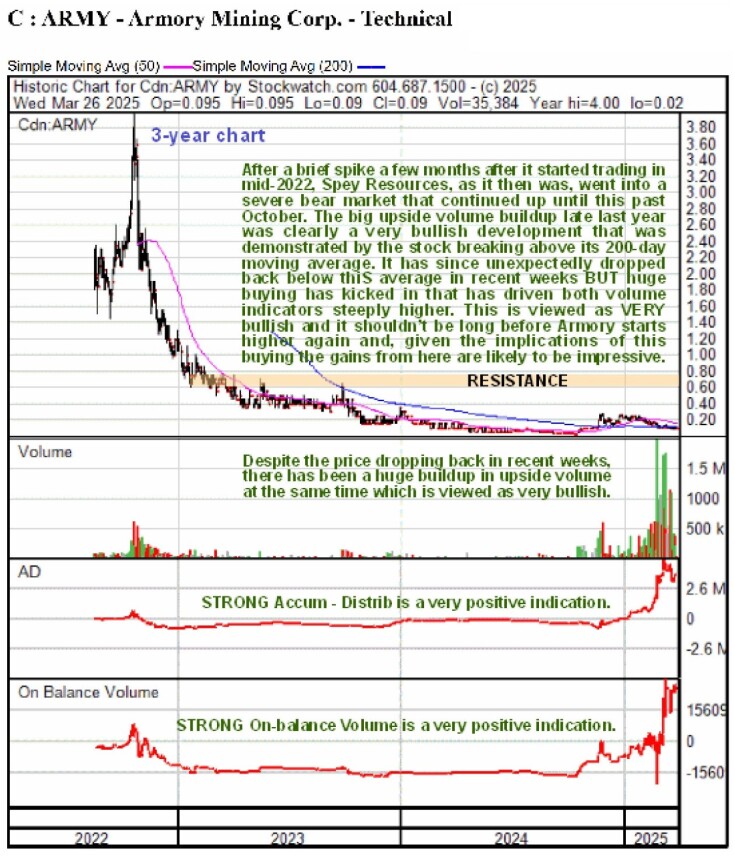

Now, we will review the latest charts for Armory Mining.

The situation is paradoxical — although we have taken quite a hit with this since it was recommended early in February, the charts look far more bullish than they did even then for reasons that we will now examine.

Starting with the 3-year chart we see again that Armory Mining is late in a basing process following the severe bear market from September – October of 2022 through early – mid 2024. The difference between now and when we first looked at it in February is that there has been a massive buildup in upside volume even though the price has retreated somewhat that has driven both volume indicators shown strongly higher. This is very bullish and may even be described as creating a "pressure cooker" effect.

On the 18-month chart, we can see much more clearly what has been going on in the recent past. Back in February, we had thought, on the basis of the strong volume pattern and volume indicators, that the Handle part of the pattern was about to complete and that the price should advance, but instead, it broke lower and dropped back some, requiring us to adjust the boundaries of the Pan & Handle pattern.

However, although the price has lost ground, the technical picture has strengthened dramatically. This is because volume became extremely heavy with most of this volume being upside volume, as evidenced by the volume towers and also by both the volume indicators shown rising steeply. A big reason why this is so bullish is because this persistent heavy volume means that there has been a lot of stock rotation with the new buyers "locking up" a lot of stock, because they won't be inclined to sell until they have turned a significant profit — and we can presume that they bought for a reason. What this means is that any significant influx of demand will find a market short of stock, so if they want to buy they will have to bid the price up. We will now look at the recent dip in more detail on a 6-month chart.

On the 6-month chart, we can easily see the persistent heavy upside volume as the price has drifted somewhat lower in the orderly downtrend shown and how it has driven volume indicators higher — and they have remained buoyant as the price has drifted even lower.

This downtrend has brought the price back to a zone of significant support, and we can see that the stock is already nudging a breakout from this downtrend, which looks likely to occur soon. for the reasons set out above, a breakout from this downtrend could quickly lead to a steep ascent from here.

Holders of Armory Mining should therefore stay long and this is considered to be an excellent point to buy or add to positions. The first target for an advance is the resistance at the top of the Handle approaching and at CA$0.27. The second target is another band of resistance in the CA$0.60 area with higher targets possible.

Armory Mining Corp.'s website.

Armory Mining Corp.'s (ARMY:CSE; RMRYF:OTC; J2S:FRA) closed for trading at CA$0.09, US$0.0589 on March 26, 2025.

| Want to be the first to know about interesting Gold, Silver and Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Armory Mining Corp.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.