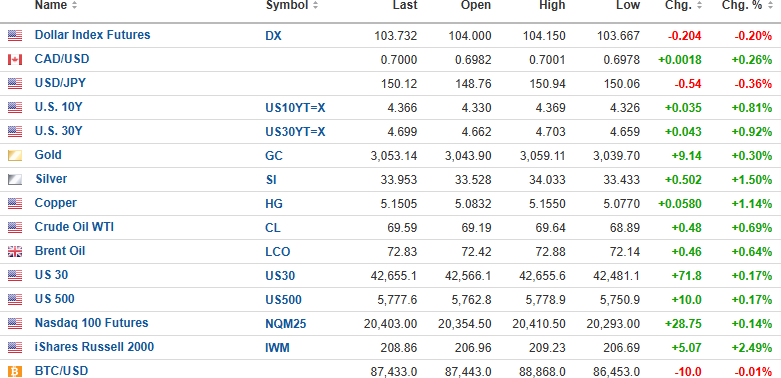

U.S. Dollar Index futures are down 0.20% to 103.732, while the 10-year bond yield is up 0.81% to 4.366%, and the 30-year bond yield is up 0.92% to 4.699%.

Gold (+0.30%), silver (+1.50%), copper (+1.44%), and oil (+0.69%) are all higher. The DJIA futures (+0.17%) are higher by 71.8 points, while the S&P 500 futures (+0.17%) are up 10 points and the NASDAQ 100 futures (+0.14%) are up 28.75 points.

Risk barometer Bitcoin is down 0.01% to $87,433 and barely in bear market territory, down an even 20.09% from the top.

Stocks

The Trump "tariffs on, tariffs off" fiasco sent stocks sharply higher yesterday, taking Freeport-McMoRan Inc. (FCX:NYSE) up 3.38% to $41.61, and it is $42.25 bid in the pre-opening market. All the copper producers caught a big bid since last week, so while it came a little too late for the March $40 calls, the additional stock and the June $40 calls are making up for it in spades. I see $45-47 by Friday, and it would be a lot higher if copper could break out to record highs.

The SPY:US was a tempting trade for me last week after I called the lows around March 7. I covered all puts and sold the big volatility trade (UVIX:US) at $40.50 (now $29.20) a few premature days before it hit $52.99 on March 10. Catching the lows of that correction was not that difficult as every time the CNBC Fear-Greed index gets into the <EXTREME FEAR> quadrant, the market is usually ripe for a rally.

The SPY:US is now rallying on a MACD "buy signal" and a bullish reversal in the Money Flow Indicator. TRIX is lagging, being it is a longer-term indicator, but it is starting to turn up, which is encouraging. RSI at 49.21 gives this trade a great deal of runway and a legitimate shot at the 50-dma at $588.11, which is $14 higher from yesterday's close. I will not be putting on any new positions as I am traveling until April 11, but for those subscribers looking for a trade, I think it is safe to take a position with a stop at $550. However, follow it up with trailing stops because the first rally off a correction low rarely lasts and is often followed by a retest.

If that retest fails and markets move to new lows, then the $613.23 top reached on Feb. 19 will be the bull market top and the start of a new bear market. So, be very nimble if you take the trade.

No recommended action on FCX or the FCX June $40 calls as I think the copper producers are ridiculously cheap relative to spot copper at $5.15/lb.

Metals

Copper remains the rock star in the metals arena this morning as it has new highs written all over it.

If we get a breakout through the old high at $5.199, I am forced to look back at the correction in 2024 from the May top to the low in August of 25% and then the correction from September until the last day of 2024, which was 16%.

Using those two percentage numbers as benchmarks, if $5.199 is overtaken, then the target range for Cu is $6.03-6.51 per pound. In the copper world, that is insanely profitable for companies like FCX, but that kind of pricing places incredible upside pressure on new copper discoveries in the mode of what we may hear from FTZ/FTZFF from Caballos.

You all now know my strategy for this exciting little junior. I will not even think of selling until they drop a few deep holes beneath that oxide cap at Buen Retiro and if it turns out to be massive sulphides as in IOCG mineralization, then the only action will be a tendering of my shares to an offer.

More later in the day if I have time.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.