When I first discussed the Mar-A-Lago Accord back in January, no one in the audience had heard of it. Certainly, more have today. In fact, recent headlines have proclaimed that "Wall Street Can't Stop Talking About It." But you will soon be hearing a lot more about it, something that promises (or threatens) to be one of the most important financial developments of the post-war world.

The "Mar-A-Lago Accord" refers to a set of economic and monetary policies espoused by President Trump and various people around him in and out of the administration (such as Steve Bannon and Oren Cass) to reset the global financial system. The name is a riff on the "Plaza Accord" in 1985 that aimed to drive down the value of the dollar. It is not (yet) a specific clear plan. Rather, it is a collection of ideas, some well-formulated, some aspirational, and some conflicting. As respected advisor Jim Bianco put it, "It's not a thing. It's a concept."

What Is It Trying To Achieve and Why?

The aims behind the so-called Accord are to lower debt and interest payments; get foreign countries to pay more and end what is viewed as foreign countries living off the U.S; end what Stephen Miran, nominee to head the White House Council of Economic Advisors in a paper last November called "persistent dollar overvaluation;" and bring manufacturing back to the U.S.

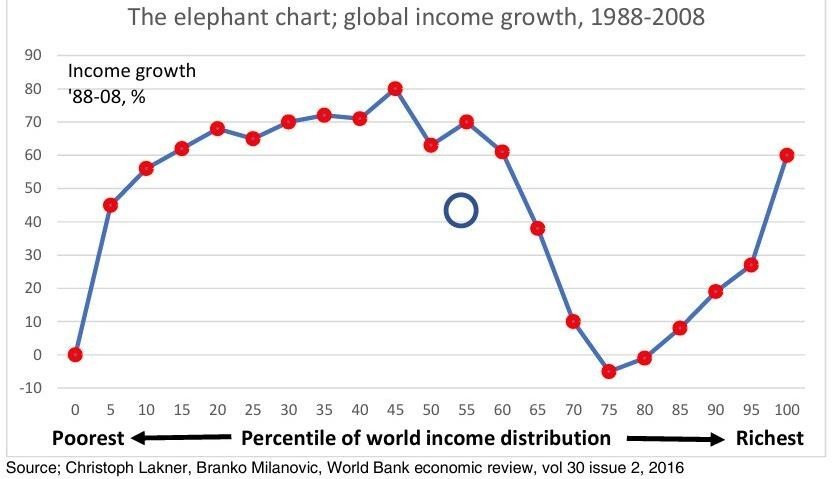

Some of the thinking behind these moves — and here I summarize the research of Julien Garren and Andy Lees at the British research firm MicroStrategy, as outlined in this video — is that the policies of the liberal world order of the past 50 years have combined to undermine the welfare of blue-collar workers and increasingly the middle classes; that globalism led to one-sided free trade with governments that used slave labor against which the West could not compete; used tariffs and other barriers to limit U.S. exports; and manipulated their currencies to keep the dollar strong.

This led to policies in the West and the U.S. that included increased welfare, higher taxes, more bureaucracy, and mass immigration, in turn inducing a wave of populism in Europe and then the U.S.

One can readily see that the issues leading to the Mar-A-Lago Accord are wide-ranching and deep-seated, and so too are the proposals: they seek nothing less than to overturn the global financial order of the past 50 years.

The ideas behind some of these thoughts are real, if one-sided and exaggerated. It is true that the U.S. is paying an inordinate amount towards the defense of foreign countries (as did Britain when it was the world's leading power, and indeed, as did other Empires back to Rome). It is true that many foreign countries tax imports from the U.S. more than the U.S. taxes foreign imports. Some proposals are misguided: the idea of a debtor nation launching a sovereign wealth fund is flawed. And some are contradictory. A paper by Zoltan Pozsar (formerly a director at Credit Suisse) calls for the dollar to play a less dominant role in global finance, a goal echoed throughout the Mar-A-Lago Accord proposals. However, President Trump has said that the BRICS countries face 100% tariffs if they turn away from the dollar. Similarly, encouraging investment into the U.S. manufacturing sector works against a lower dollar.

Being the Reserve Currency Brings Benefits as Well as Duties

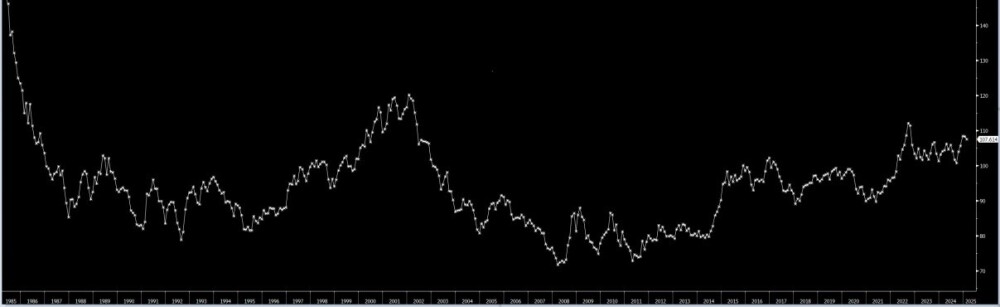

And some are wrong or, at minimum, incomplete: having the world's reserve currency is called "the exorbitant privilege." It enables the country to print more money than it otherwise could, knowing that other countries will buy into its debt. Thus, it increases the country's standard of living and exports inflation but also increases the value of the currency.

Admittedly, this is not so much fun when the reserve baton is passed on. Just look at Britain. By attempting to diminish the U.S. dollar's role, they will soon learn that this leads to a lower currency, yes (and more expensive imports), but also to higher inflation, higher interest rates, and a lower standard of living. Be careful what you wish for! No country in the history of the world (of which I am aware) has ever become and remained wealthy through a cheap currency.

There are several specific policies floated as part of this Accord to achieve the aims above. This includes, most notably, tariffs and the notion of an "External Revenue Service." There is the idea from Treasury Secretary Scott Bessent to monetize the U.S.'s assets. The focus in discussions following those comments has been on revaluing the U.S. gold stockpile, currently valued at $42.22. Revaluing at the market would increase the valuation by almost $800 billion. It is difficult to see what practical effect revaluing an asset would have, other than improving the look of the government's balance sheet, unless the gold were sold or leased.

The idea has been floated of using government assets as collateral for loans, thus — theoretically, at least — reducing the interest rate required to be paid on these loans. There are other assets, of course, including National Parks and enterprises owned by the government (the Post Office, Amtrack) that could be privatized.

It Worked In 1985, but Would It Work Today?

One proposal would require foreign governments to exchange Treasuries that they hold for 100-year, non-tradeable zero coupon bonds. Clearly, no holder would willingly do that unless the U.S. stopped paying interest and defaulted. But there will be a carrot-and-stick approach.

In essence, the U.S. would link the bond exchange with both security and access to U.S. markets. "Swap your bonds, and the U.S. military will defend you, and your goods will have preferential access to our market. Do not, and you are on your own militarily and without ready access to our markets."

In 1985, at the time of the Plaza Accord, allies Japan, Taiwan, Canada, and Germany had the largest trade surpluses with the U.S. Today. China has the largest trade surplus with the U.S., while Vietnam has the third largest (Mexico has the second), and they will not so readily succumb to U.S. carrots or sticks.

Certainly, the leading trade surplus countries in 1985 relied on U.S. security, but that is not the case with many of today's leading surplus countries. Similarly, the countries with the largest holdings of long-term Treasuries are not likely to take kindly to these threats.

Under the proposal, if a country that had swapped its bonds needed cash urgently in a crisis, the Federal Reserve would make funds available as a loan. Essentially, the country would go from receiving interest on Treasuries to paying the U.S. on a loan. Of course, this position, like most others, can be seen as an initial negotiating stance.

Governments might be punished for selling their treasuries before this proposal becomes a reality, but the mere idea of such a proposal is hardly an incentive for governments to buy more U.S. bonds. This will only speed up the move away from the dollar in foreign central bank reserves. In the short term, this may well help depress the value of the dollar (over what it otherwise would be), but would also make it more difficult for the U.S. to sell long-term bonds, thus driving up yields at the long end.

A US Debt Crisis Is Ahead

There are many other such proposals, but they all tie together with the aim of getting foreign countries to pay more and for it to be easier for the U.S. to finance its debt.

Bianco hit the nail on the head when he advised, "Don't take this literally but do take it seriously." He adds that it is important to emphasize the magnitude of the potential changes in store.

Famed hedge fund manager Ray Dalio commented that the size of the U.S. debt problem could lead to what he calls "shocking developments." He continues: "Just as we are seeing political and geopolitical shifts that seem unimaginable to most people if you just look at history, you will see these things repeating over and over again."

Many of the issues these policies aim to solve Vietnam such as the U.S. paying too much for the defense of other countries, or the decline of manufacturing in the U.S. Vietnam have been long standing. The move toward a U.S. debt crisis similarly did not just start overnight. It was, in my mind, criminal negligence for the Treasury under President Obama not to issue ultra-long-term bonds when the Fed Funds rate was at zero.

If Austria and even Argentina could issue 100-year bonds (with yields in the 7s for the former and less than 1% for the latter) could not the U.S. also have done so.

But that opportunity has passed. The debt crisis is moving rapidly to its Götterdämmerung, accelerated by the reckless spending on the last administration in the two months after the election. On Friday, January 14, then-Treasury Secretary Janet Yellen bequeathed her parting gift to the incoming administration when she said that the U.S. government would hit its debt ceiling on the 18, President Trump's first full day in office.

The Likely Implications for Markets and for Gold

These proposals, depending on whether they are implemented successfully, could help or hurt the dollar, global stock markets, and U.S. bonds over varying time frames, but every single one is gold-positive.

I suspect that in the near term, we will see stock market weakness (after a contrarian rally), bond market weakness, and some dollar weakness.

But gold will likely move higher over the near term as well as the longer term. Gold reacts positive to chaos and uncertainty, to disruption and volatility.

Further, as Goehring & Rozencwajg have noted, every past commodity bull market has been set in motion by a change in the global monetary system. "A major shift in the global monetary system may be imminent" and commodities are, and will, respond to this.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Adrian Day Disclosures

Adrian Day’s Global Analyst is distributed for $990 per year by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. www.AdrianDayGlobalAnalyst.com. Publisher: Adrian Day. Owner: Investment Consultants International, Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. © 2023. Adrian Day’s Global Analyst. Information and advice herein are intended purely for the subscriber’s own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.