My grandparents on both my mother's side and my father's side hailed from the United Kingdom, specifically England. My mother's brood was from the southwest tip of England in an area called "Lands End," while my father's side toiled in an area east of London called "Gravesend." As was the case with many immigrants to Canada, both families came to Canada and settled in the Toronto area, where my parents met just after Dad returned from WWII, where he served as a navigator with the RCAF.

My first recollection of his mother, my "Gran," was when I was very young, as she would frequently look after my brother and me on weekends or when Mum was incapacitated. She was very typical of English parents in that discipline was an absolute necessity to the extent that the teaching of the use of "manners" in all areas of deportment was a daily routine whether you were five or 15 years old. I learned table manners from that wonderfully scary lady by avoiding the wooden spoon that would come thundering down on one's knuckles if you ate with your mouth open or failed to keep your serviette on your lap. Opening doors for the elderly or for the fairer sex was a discipline handed down from generation to generation, and that applied especially to the ragamuffins who grew up in the aircraft factory town of Malton. In fact, back then, there were no police stationed in Malton because they knew that the mothers had policed the village with fierce tenacity and a ferocious sense of revenge should any of the youngsters "cross the line."

More importantly, it was my "Gran" that educated me on the necessity of hard work and how every time I helped her with a particular chore, she would go to her handbag and pull out her change purse and hand me a few pennies or a nickel and tell me to put it "straight away into your piggy bank" which I did obediently every time. She would lecture us for hours on the importance of savings and how we should always show respect for all those pennies, nickels, and dimes that added up over the weeks and months.

Every time I visited her at her house in Mimico, I would mow her lawn with an old rusty push mower, and every time, she would hand me a quarter for a decent job and a whole dollar if I cleaned out the eaves or raked up the clippings. I learned to have respect for the art of saving one's earnings because outside of stray empties in the roadside ditch that got you a nickel refund at the local supermarket, there was never a job for a pre-teen youngster unless you could hitchhike five miles up the road to the local golf course and caddy for one of the rich lawyers driving those wide-fin Cadillacs that were popular in the 1960s.

I carried that old Victorian work ethic, complete with the lessons on manners and respect, all through my teen years and did my best to bestow them upon my own children. That was admittedly a challenge because of the dramatic shift in attitudes toward corporal punishment in parenting and in schools. Nevertheless, it warms my heart these days whenever I see a young man give up his bus seat to an elderly man or lady. It is acts of respect such as these that create great cultures and successful civilizations.

I often wonder what my dear ol' Gran would think if she were alive today, witnessing the last 15 years of debasement that has become a serial preoccupation of the banco-politico elite. The complete abandonment of all forms of respect for the sanctity of one's savings and the purchasing power of all those pennies and nickels and dimes that were the result of a citizen's hard work is a criminal act. It is a confiscation of sorts and no different than outright theft.

So, when I hear that Fed chairman Jerome Powell is currently pleased with an inflation rate that shaves 3% off the purchasing power of my savings each and every year, I get rather upset. If I do a count of the items that I purchased in 2020 and then do the math as to how much they cost me here in 2025, I go apoplectic when the Fed Chairman says that he is satisfied with the "inertia" (or lack thereof) of the U.S. economy. When he is questioned about the U.S. entering a possible era of Stagflation, he rejects the "stag" part and says he sees no evidence of the "flation" despite the recent PPI number that came in as "hot". He also confirmed that the tariffs being imposed on April 2 by the White House "may be inflationary" but has no problem sticking with two more rate cuts by the end of 2025.

That type of brazen disregard for the sanctity of the savings accounts of millions upon millions of unsuspecting American citizens is symptomatic of the generational drop-off in the reverence of and stewardship over the nation's currency. And they wonder why country after country is abandoning the U.S. Treasury Bond market in favor of gold. Add to that the hostility being shown to America's two continental neighbors, followed by the military abandonment of the European theatre, and you have a recipe for disaster.

There is a point where the term "No Respect" is going to apply to changing attitudes toward the global reserve currency, already under siege by the steadily growing BRICS nations. My "Gran" would be on the city hall steps waving her umbrella and screaming bloody murder if she were witness to the complicity of the banco-politico elite in this debasement exercise that seems to always find a new excuse to flourish. It will continue until it doesn't, and that day has all but arrived.

Stocks

The SPY:US has rallied smartly off the lows of March 13 and briefly managed to get back above the 200-dma at $569.75. Although it is hard to confirm from the chart shown above, we either got a bullish MACD crossover and "buy signal" on Friday, or we are getting one on Monday.

With sentiment in the tank and the RSI reversing from the oversold low below 30 a week ago, stocks are poised for a rally, but the major question is whether or not we get a successful retest of the $548 low or will this ETF continue to grind its way higher back above the 200-dma into heavy overhead resistance.

If it moves higher, I will be an aggressive seller, but if it goes into retest mode, unless we see new lows below $548, the downside risk in this market is slight.

Gold (and Silver)

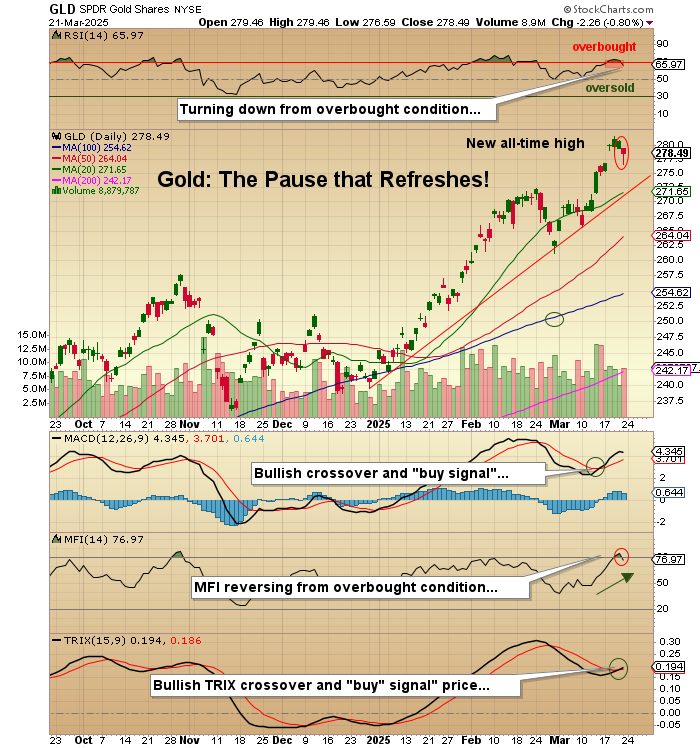

The gold market is full of mixed and very confusing signals, and while the RSI and the MFI indicators are rolling over bearishly, the MACD and TRIX are the exact opposite.

On occasions like this, it is wiser to stay on the sidelines, at least with one's leveraged and/or trading positions. Last week, I told the world that I was "sidelined" on silver, awaiting the inevitable breakout above US$35.07 basis May, and yet I turned around two days later and thought, "Damn the torpedoes, full speed ahead!" and went head over heels into the SLV:US as well as a few calls stating that " as long as there are no whipsaws, I'll double up looking for $38 and then $45."

Well, guess what happened?

Seeing that I had the audacity to tempt fate and go against my gut instincts and execute a high dive off the Acapulco cliffs into the roiling seas of silver, the silver market turned on a veritable dime and headed back down. It nudged up to $35.07, ever so close, and then reversed with an extended middle finger pointed, as is always the case, directly at ME.

So I exited the SLV:US positions with small losses on Thursday that would certainly have grown to large losses on Friday and asked subscribers to do the following: "The next time you read anything that is vaguely suggestive of a long position in silver, send me a ball-and-chain hammer so I can knock some sense into myself." Wise advice. . .

It has been a long and arduous five years covering the junior miners while the vast majority of traders and investors have steered well clear of these "penny dreadfuls" that have done their absolute best to bankrupt any and all that wander into their "Killing Fields." When I launched the GGM Advisory in January 2020, I had no idea that a phony flu bug would frighten those feckless politicians into shutting down the world economy while printing trillions of dollars, yen, and euros for the express purpose of enriching their beloved money center banks.

Moreover, I thought that with the arrival of the Powell Printing Press after they launched the Great Financial Bailout in 2009, the traditional "GO TO" safe havens of precious metals would enjoy a flourishing bull market. However, that did not happen until March of 2020 when the Covid Crash took it down to a low of $1,560 before embarking on the current bull market, which is now a few percentage points shy of a veritable double. However, the correction from August 2020 until March 2022 at $1,620 was an unbelievably painful journey. No matter what was announced, nothing in the junior precious metals space could catch a bid.

You see, the new generation of "kiddies" (as I love to call them) that now manage portfolios of unimaginable value are an entirely different breed of manager from the ones I dealt with in the 1980-2010 era. These are incredibly bright young men and women far more equipped than any of the members of my generation, save maybe the Eric Sprott's or Robert Friedland's of the world.

A few Sundays ago, I was on a ZOOM call with a young man in his late 20s who has amassed an astounding fortune, having founded, bought, and sold two businesses and is now on his third endeavor. Being trained at the Wharton School in the wonderful world of high finance in the 1970s and 1980s, I thought I was fairly well-versed in the world of standard deviation and discounted net present values, but as much as I have learned (and forgotten) since the 1980s, this young man was light years ahead in every aspect of financial analysis.

Just as my old "Gran" used to watch in amazement as I typed messages on my computer to my friend 2,000 miles away, I sit in amazement at just how skilled this new generation has become. Call it Darwinism or call it "selective advancement," the human species is growing more advanced in all aspects as the decades and centuries roll by.

The point of this longwinded story about twenty-something billionaires and the predilection for huge home runs in the technology space is that they are now finally ready to spread their wings and diversify out of their comfort zones (technology, IT, AI, and crypto) and into the world of hard assets, with particular emphasis upon those minerals that address the generational fixation upon the environment which means that the Electrification Movement is alive and well, at least in the minds and hearts of these "baby billionaires."

That means that septuagenarians like me must adapt or get left behind because there is no chance that they will ever listen to the protestations of the Boomer men and women that think they know best when it comes to the "public good". The kiddies did not need MY help to figure out that gold was (and is) a manipulated market, so they used their technological skills to create their own private, digital gold market in the form of Bitcoin, and despite opposition from the banco-politico elite, they drove ahead and dragged an entire demographic (actually three demographics) over the wall and into the blissful, invite-only world of crypto.

That movement has now been saturated. They are looking elsewhere. They hate gold because gold is their grandfather's naïve way of protecting the purchasing power of those savings accounts he has had for decades. They do, however, love silver largely because silver is a "green mineral," an absolutely necessary ingredient in the construction of solar panels, which are part of the "renewable energy" sector of the mineralogical food chain.

The demographic is infinitely wealthier than anything I remember in my Twenties and a whole lot smarter, so when they say they are looking for assets friendly to the "Green" movement, I look to copper, uranium, and lithium,m and since the junior market had a huge lithium exploration bubble in 2021-2023 and a similar move in uranium from 2022-2024, the one metal that has been absent anything vaguely resembling a "bubble" — copper — is long overdue for the arrival of the "billionaire babies" into that space which will most certainly include the junior copper players.

2023 and 2024 saw two of the copper explorers get a large dollop of love from the retail community in the form of Hercules Metals Corp. (BADEF:OTCMKTS; BIG:TSXV) and American Eagle Gold Corp. (AE:TSXV; AMEGF:OTCQB). Both companies now have major mining companies as investors, but the one chart that caught my eye was the BIG chart. Their discovery hole was a large interval of high-grade copper-equivalent mineralization, with the most intense section being 45m of US$213/t rock that propelled the share price from the teens to over $1.60 per share and a CA$416m market cap. This is the kind of move that is entirely possible when the new generation of investors decides to descend upon a discovery and make it "their deal."

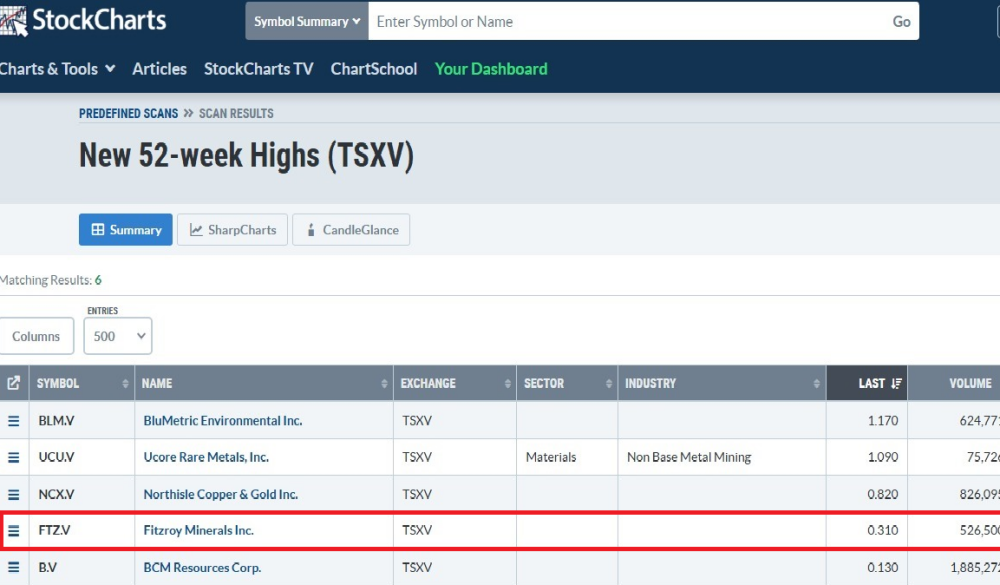

On February 10, Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) released the following statement: "Drilling Intersects 185.7 m Interval of Sulphides at Fitzroy's Caballos Copper," and since then, I have been watching the stock like a proverbial hawk for any sign that someone somewhere might "know something."

Well, today, a clue may have finally arrived:

Sometimes, the tape has a way of sending subliminal messages to you, especially since the company laid it out for everyone to see when the press release stated: "Stronger mineralization, including tourmaline and chalcopyrite clusters, and molybdenite veinlets, is observed over 73.0 m (from 154.0 m)." They told us all in true, plain, and full disclosure that there was a high-grade core to this intercept, and I have been speculating that it just might be a barnburner.

The shares moved up all week long and appeared to be under aggressive accumulation, with both TSXV and US OTC QB volume increasing daily. So when the stock broke out above the 52-week high at $0.30, I took that as a confirmation that "the tape never lies," an old trader's horse chestnut from decades ago. Keep in mind that this is one property (Caballos) in a four-property package, with the fourth and final acquisition (Ptolemy Mining) not quite complete but close to closing, with final regulatory blessings soon to arrive.

This new intercept at Caballos is most surely a discovery and quite possibly a major discovery in a part of the world where world-class copper deposits are quite common. However, the final approval of the Ptolemy Mining deal brings an entirely new scope of potential to this little company currently capped at a paltry US$34 million.

The new high registered this week should be considered an omen of sorts, and I urge all followers and subscribers to pay very close attention.

Nuff said. . .

| Want to be the first to know about interesting Base Metals, Gold, Silver and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Fitzroy Minerals Inc. My company has a financial relationship with: Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.