Eguana Technologies Inc. (EGT:TSX.V; EGTYF:OTCQB) is viewed as presenting an outstanding opportunity for investors at this time. It has been a long and challenging road for the company, which has at last arrived at the point of liftoff. The reasons for this are twofold. One is that the crisis in energy generation has reached an acute stage where both utilities and their customers or end users urgently require radical solutions.

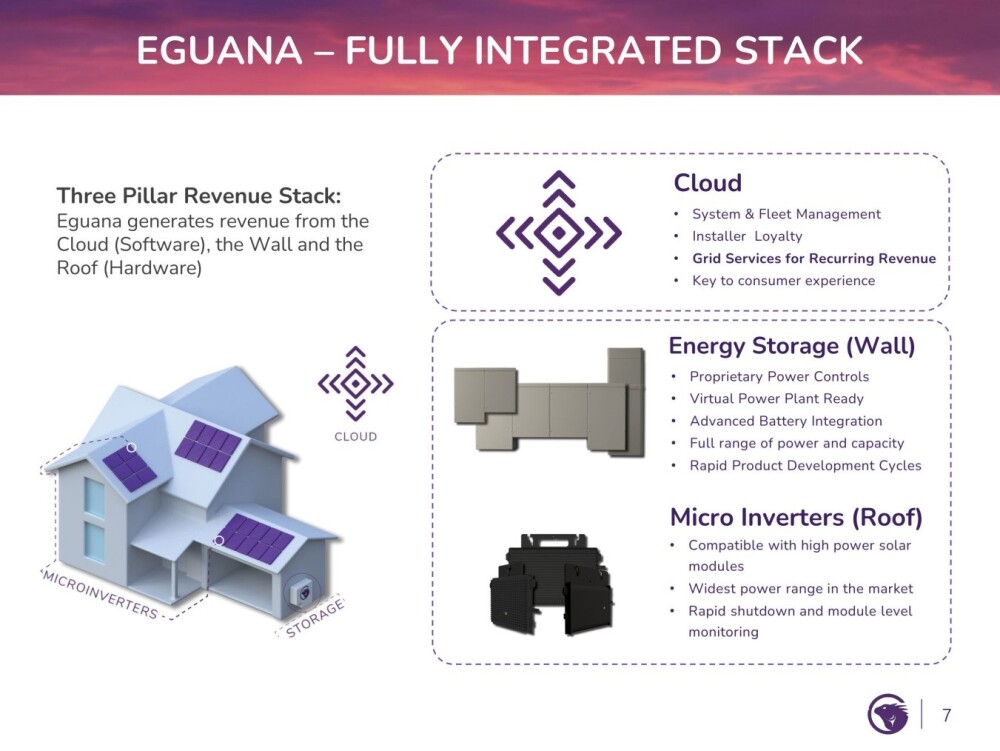

The other is that Eguana has developed a comprehensive and integrated suite of solutions, including relevant hardware and software that fully address all aspects of end-user power generation, distribution, and energy storage to effect vast improvements in the efficiency of energy usage that translate into greatly reduced costs and the elimination of power outages for end users.

At the same time, Eguana has forged strong partnerships across the industry with respect to manufacturing and procurement, installation, and sales so that it is centrally positioned to mobilize to meet a broad-based surge in demand for its systems.

The reason that Eguana presents an outstanding opportunity for investors in light of the above is that this is a stock that once traded as high as CA$55 back in the year 2000, soon after the company began, and is now trading at just 1 cent despite all that it has developed in the intervening years. Whilst we can argue about why it is trading at such a low level, reasons including cash burn, investment in the development of products and systems, stock dilution, etc, the fact is that these are irrelevant to the forward-thinking investor.

What matters is that the Traditional Grid system is at the threshold of a major transformation into the new Distributed Grid system, and Eguana is centrally positioned to be a part of this transformation. What also matters is that there is clear evidence that the stock has been under persistent accumulation since last September, and we will look at this evidence when we review the stock charts after first overviewing the fundamentals of the company and the industry.

Interim liquidity issues, which, of course, go a long way toward explaining the current stock price, have just been addressed in a decisive, game-changing manner. Key to this has been the news of the 20th of this month that Eguana reached a settlement to a collaboration agreement with Duracell Power Center. As part of the settlement, Duracell Power Center has paid Eguana a termination fee of US$250,000 in cash. A most important element of the settlement is that "Duracell Power Center will transfer ownership of US$1.1 million in additional finished goods, consisting of both five-kilowatt and 10 KW Evolve systems under the agreements to Eguana."

As Eguana chief executive officer Justin Holland commented, "The settlement agreement increases our finished goods inventories, which have been key to executing the feeder enhancement project in British Columbia, as well as providing additional systems to continue accelerating our utility strategy."

Notwithstanding the settlement, Duracell Power Center has agreed to increase the amount of manufacturing credit available to Eguana under the agreements by US$250,000 to US$1.45 million. The credit must be fully utilized by Eguana within the next 36 months. Eguana CEO Justin Holland further observes, "The cash component has provided some near-term liquidity relief, and the manufacturing credit and raw materials will reduce working capital requirements balance of year and through 2026."

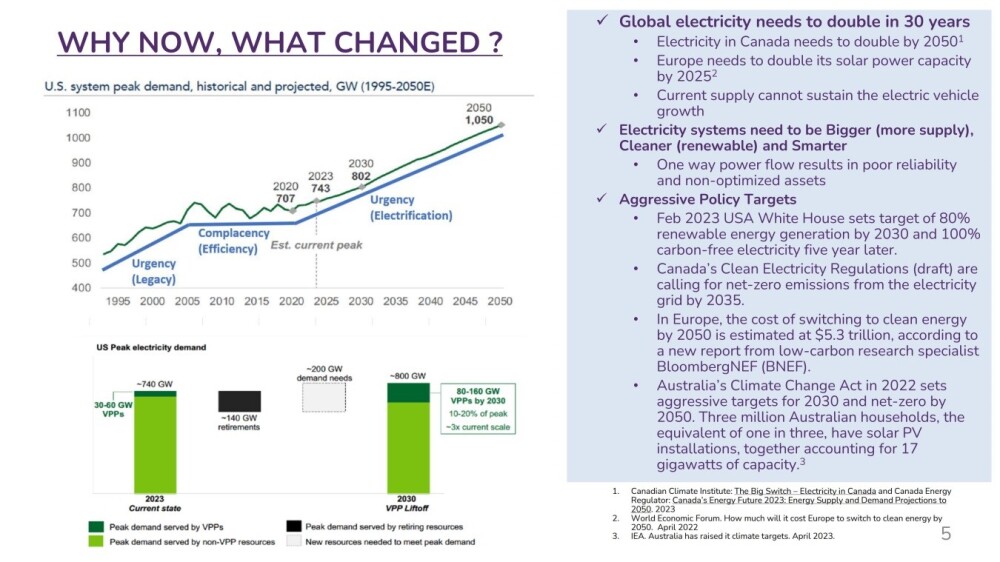

Problems with the traditional energy grid are set to worsen considerably due to growth in demand coupled with past underinvestment and malinvestment, and this is especially the case in the U.S., where infrastructure is crumbling due to prolonged serious neglect in the past.

Up until now, Utilities have been able to "get away with it" because demand growth has been offset by energy efficiency gains in smart appliances and other smart devices, but there is only so far you can get with this, and now it's "crunch time" — there is no alternative but to step up supply storage. Utilities can increase capacity through Investment in grid infrastructure and power grid transformation (urgent electrification), and this has now begun.

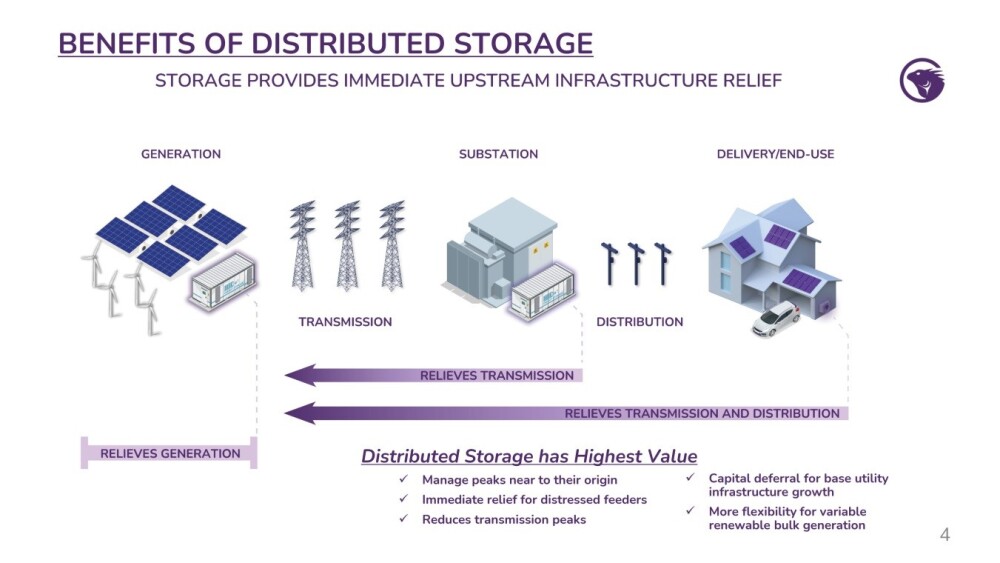

This all requires significant capital, which is exacerbated by recent supply chain constraints pushing traditional material requirements out up to five years, making utilities keen to find opportunities for capital deferral. Residential smart batteries provide immediate feeder line congestion relief at a fraction of the cost of traditional poles and wires and substation upgrades, and these investments can be made incrementally, year-by-year, to meet near-term needs and avoid making investments based on load forecasts looking decades into the future.

Meanwhile, due to the worsening supply situation, many residential and small business end users are mobilizing to secure energy supplies by installing on-site power generation capability coupled with sophisticated networked energy storage systems. Enter Eguana Technologies, which, over many years, has developed and manufactured all of the systems, hardware, and software to meet the needs of both end users and utilities in addressing these supply issue problems for many years into the future.

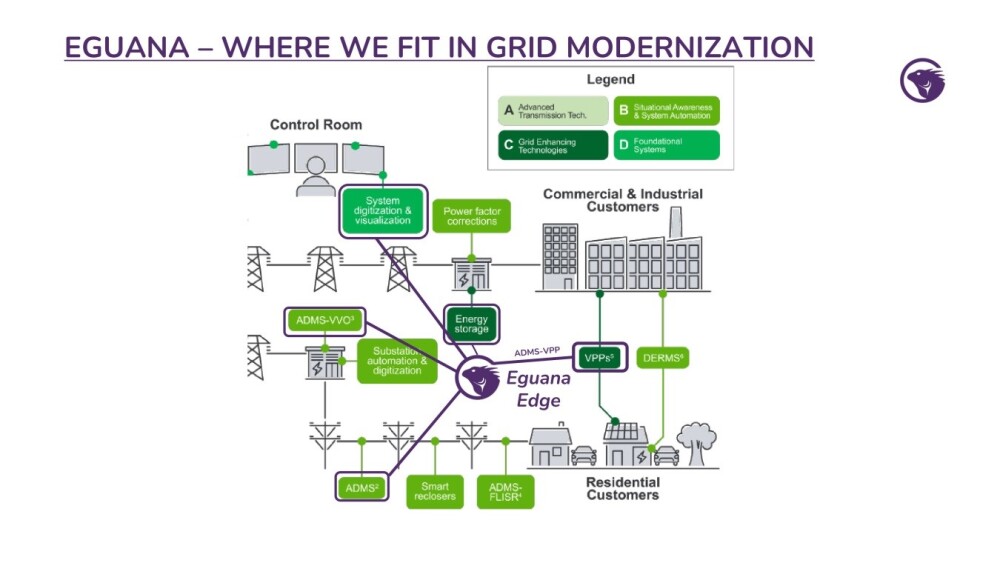

Eguana is in the vanguard of grid modernization. . .

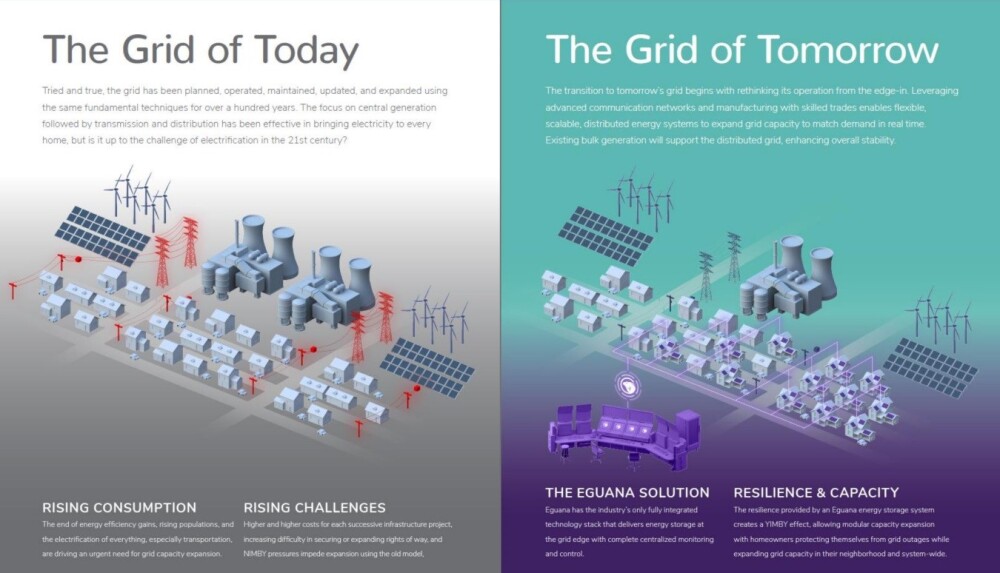

The rickety traditional centralized grid structure is at or close to its limits and requires transformation.

The illustration below shows the traditional grid on the left as it is now and how it will be transformed in the future.

The benefits of Distributed Storage are set out on this slide:

The advantages of this transformation will be huge — a massive increase in capacity, vastly more efficient utilization of power generated, decreased demand on centralized power generation, and protection of the end user, corporate or private, from power outages.

The reasons that we are on the doorstep of this massive transformation of energy generation and storage are made abundantly clear on this slide:

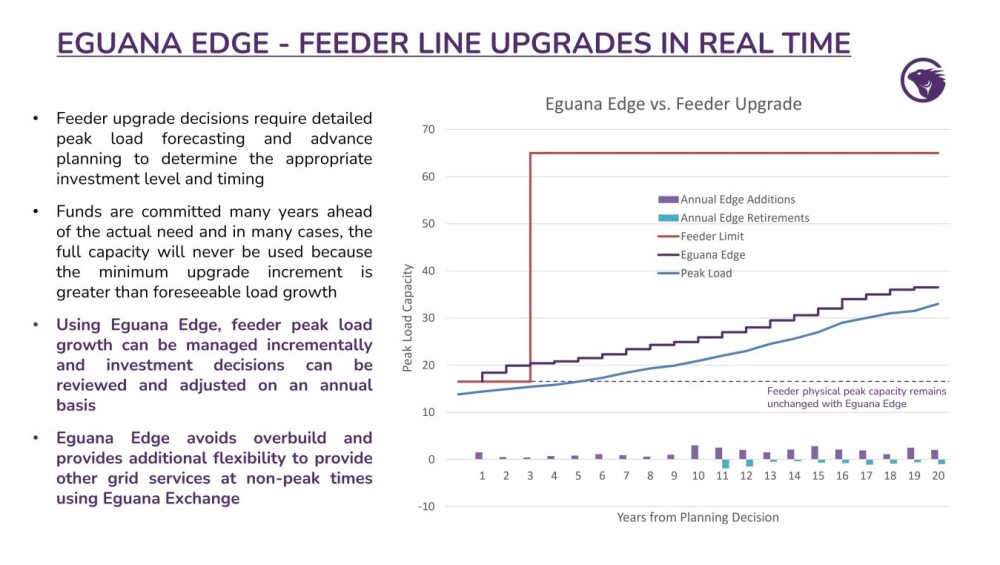

Eguana Edge provides feeder line upgrades in real-time. What this means is that load capacity is scaled higher incrementally in response to and in advance of increased demand rather than in a crude piecemeal fashion as in the past, which involved major investment ahead of time in a capacity that oftentimes was never fully utilized.

The crudity and wastefulness of the earlier approach is made starkly obvious on the chart below by the orange line.

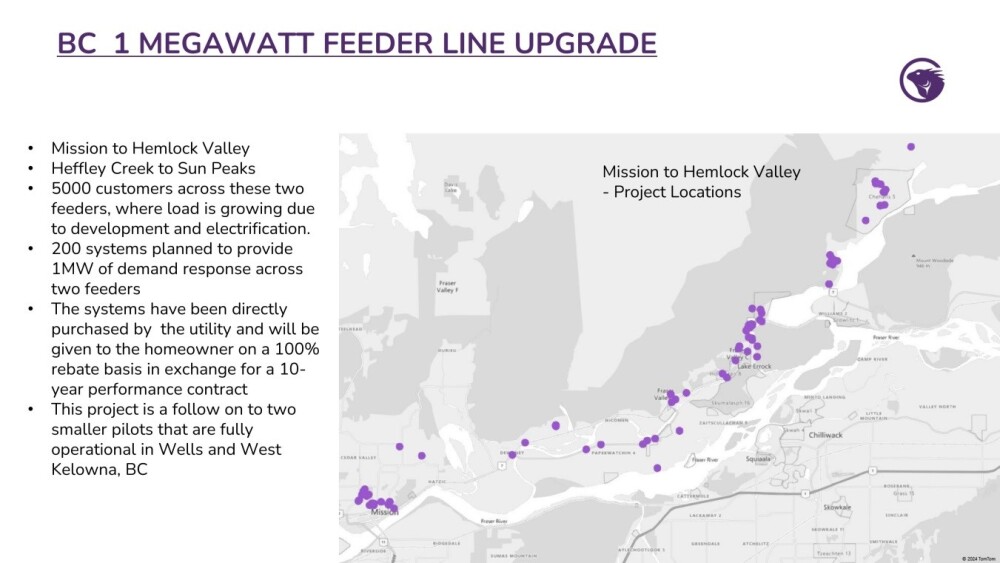

These Feeder Line Upgrades have gone from the drawing board to being implemented, as on the following slide, which shows the Mission to Hemlock Valley upgrade in British Columbia, where 200 systems are planned to provide 1MW of demand response across two feeders.

A very important development with respect to the Feeder Line upgrade detailed above — and any other upgrades in British Columbia — is that the province has removed all Tesla products moving forward in response to U.S. tariffs, and the way this works is that Tesla products will now be excluded from BC Hydro rebates, and the province of Ontario looks set to do the same. This is big news because Eguana is perfectly positioned to fill the gap.

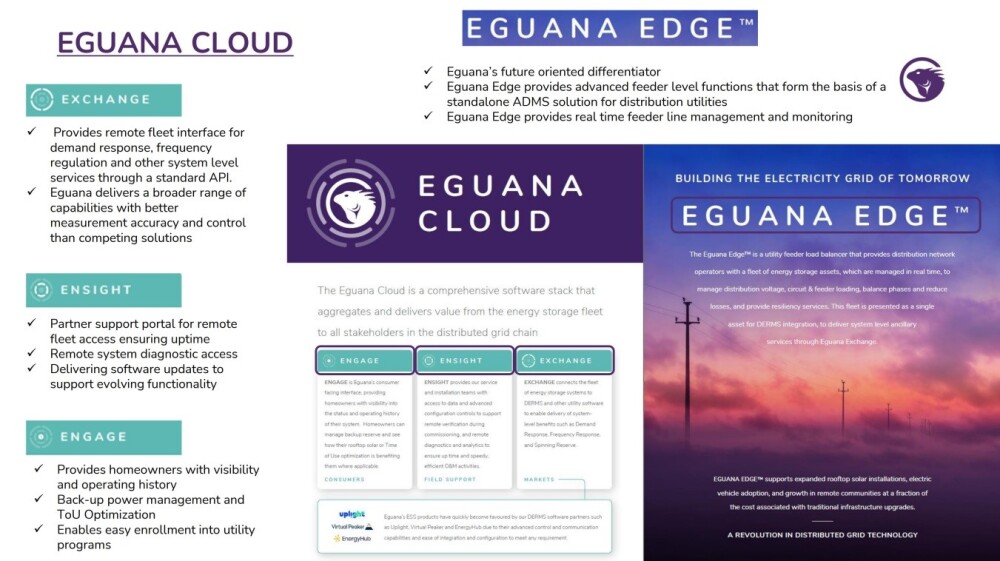

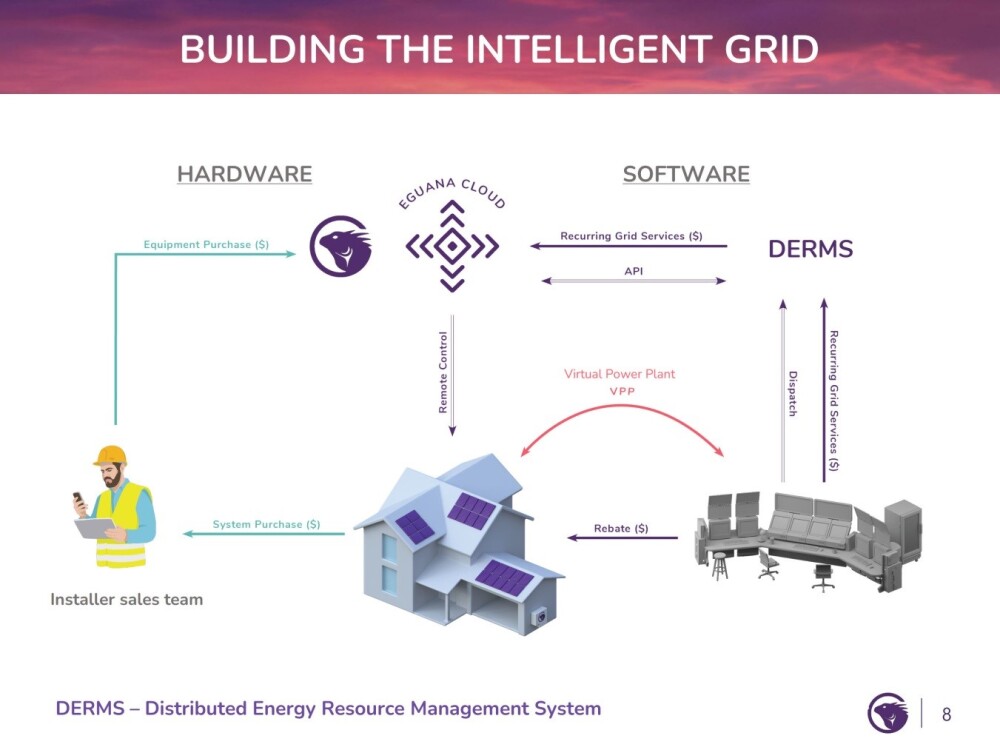

The whole thing is operated by the Eguana Cloud, which is a software stack that controls everything and optimizes inputs and outputs continuously in real-time.

Here is where Eguana fits in the grid modernization:

Eguana will generate revenue through two complementary ways: its energy storage hardware platform and recurring streams through Eguana Cloud's integrated software applications.

Here is how it works:

The following table shows that Eguana is well up with its competitors in the industry and, in many instances, ahead of them.

The company has already reached many of its development goals as the following list of milestones achieved sets out:

On March 11, it was announced that Eguana completed Evolve integration with EnergyHub.

There are various additional aspects not covered here for reasons of space, and you are invited to peruse the company's new investor deck for additional information.

Last but not least, regarding the fundamentals, we have big news from the company this morning: Eguana and Itron will collaborate to deliver advanced utility control of distributed energy storage.

From the news release: "Eguana Technologies, a leading provider of high-performance energy storage systems, is pleased to announce it is collaborating with Itron, a leading provider of grid edge monitoring and control solutions, to deliver advanced utility control functionality through a standards-based integration of its energy storage systems with Itron's IntelliFLEX grid edge DERMS solution. Through the collaboration, Eguana and Itron will jointly, and independently, market the combined solution to respective utility customers, with a focus on utilities that are interested in ramping up distributed energy storage procurement but prefer to use a grid edge dispatch and monitoring network that is already well established and integrated into their operations."

Now, we will review Eguana's latest stock charts.

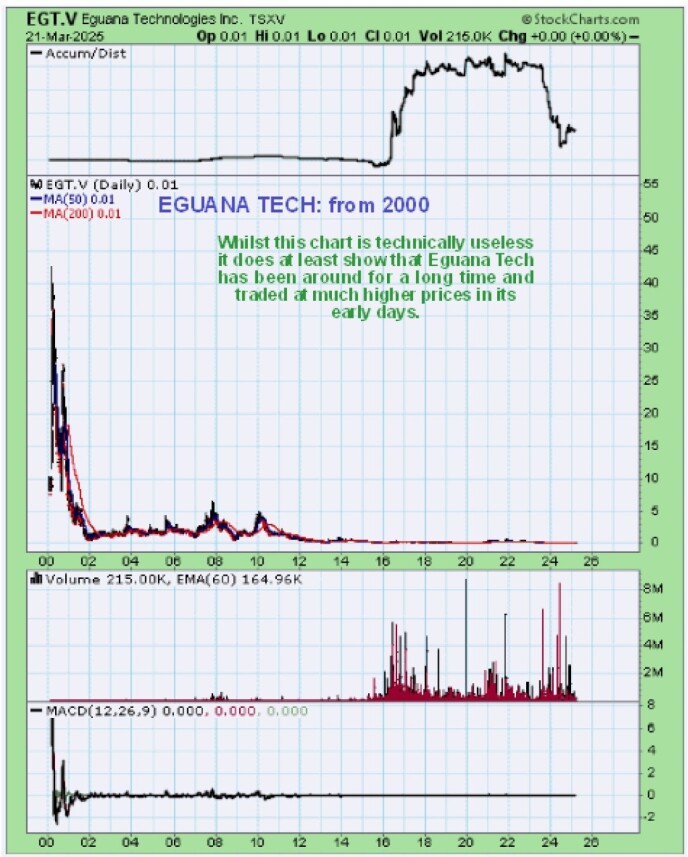

The stock charts for Eguana Technologies show that it is has been basing at a very low level for almost a year, but before we look at the latest developments in detail, it's important to step back and take a look at The Big Picture to see how we got here and to put recent action in context.

While the very long-term chart for Eguana going back to the year 2000 is virtually useless for predictive purposes, it does at least show us that the company has been around for a long time and that its stock traded at much higher prices in its early days, having gotten as high as CA$55 very soon after it starting trading, which can just be seen on the chart below. However, it has traded at a comparatively very low level for many years now, below CA$1 since early 2012.

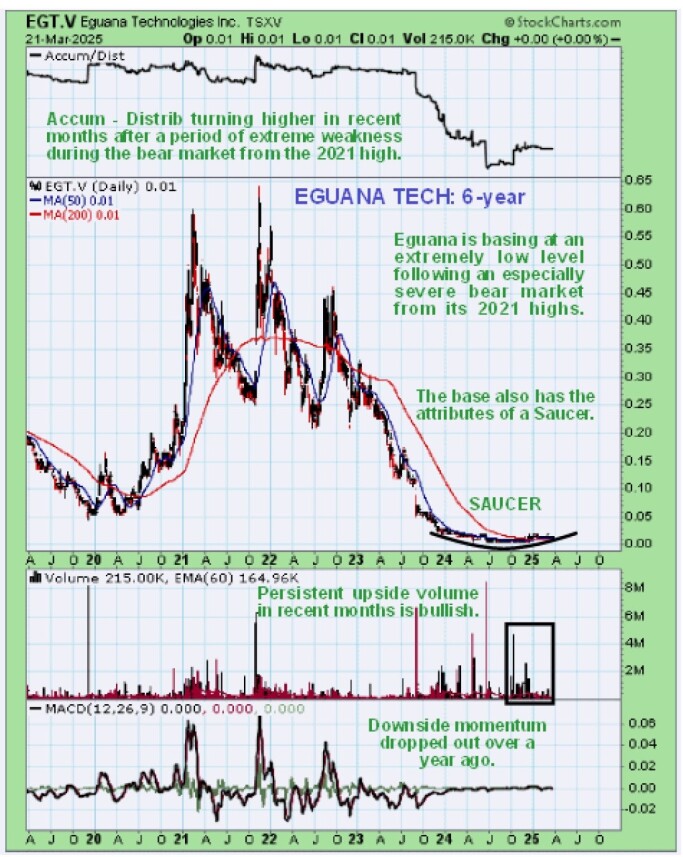

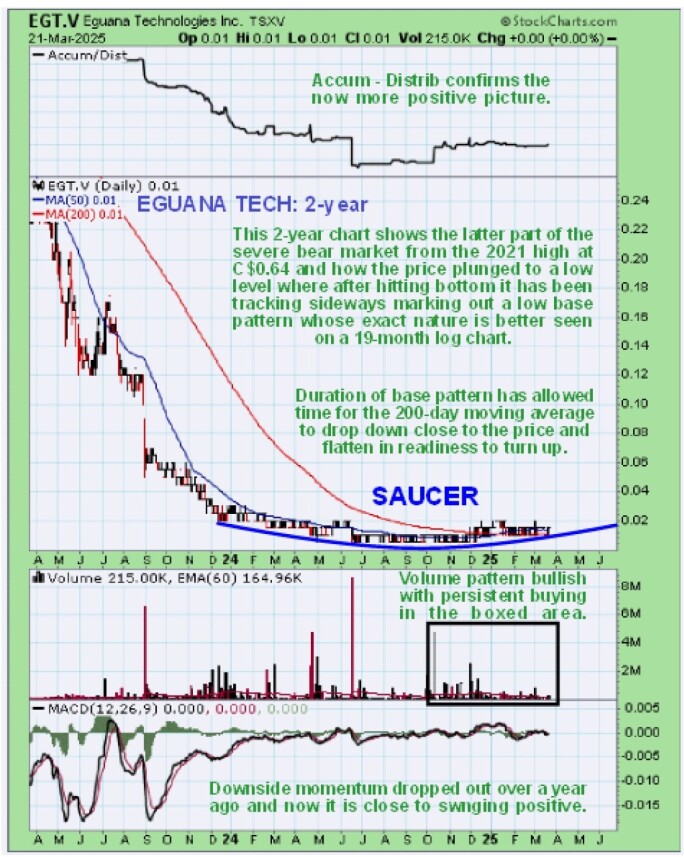

Zooming in now via the 6-year chart eliminates the early high prices and enables us to examine the action of recent years in much more detail. On this chart, we see that, following the late 2021 high when it touched CA$0.64, Eguana went into a severe bear market that, by the time it had run its course in the middle of last year, had rendered the stock almost worthless, but we also see that from late 2023 the rate of decline eased dramatically with what looks like a Saucer base pattern forming last year that has been accompanied by an increasingly bullish volume pattern.

On the 2-year chart, we can see the Saucer-like base pattern that formed last year in much more detail. The duration of the Saucer allowed time for the falling 200-day moving average to drop down close to the price so that it can now flatten out / turn up, a frequent prerequisite for a new bull market.

Also worthy of note is the buildup in upside volume from September last year, which has driven the Accumulation line higher. This volume action is bullish and strongly suggests that the base pattern is genuine and will lead to the birth of a new bull market. In addition, the volume pattern and On-balance Volume are definitely positive on the chart for the U.S. traded stock.

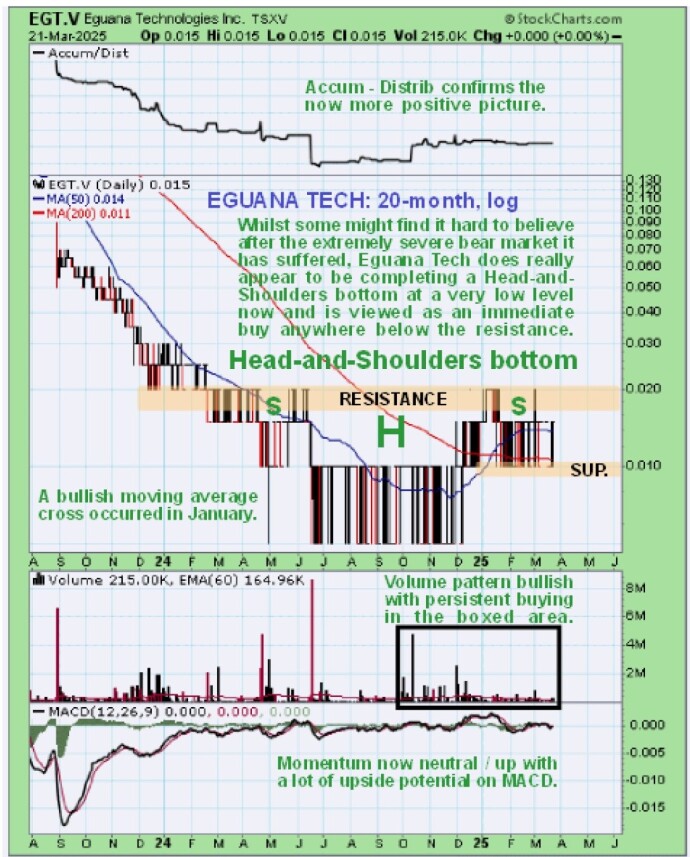

If we now zoom in a little closer using a 20-month chart and switch the scaling to log to "open out" the chart, we can discern that embedded with the Saucer base pattern is a Head-and-Shoulders bottom whose "neckline" or upper boundary is a line of resistance at 2 cents. The increased upside volume that we have remarked on above is what is driving the gradual change of trend from down to up, and it now looks like the price is marking out the Right Shoulder of the pattern.

If this interpretation is correct, then we are at an optimal time to buy the stock from a price / time perspective since buyers here could net substantial or even very large percentage gains relatively quickly should it complete the pattern soon and break out into a new bull market as looks probable.

Eguana Technologies is viewed as a stock with an exceptionally positive risk / reward ratio and is therefore rated a Strong Buy here for all time horizons.

The first target for an advance is CA$0.06 – CA$0.07. The second target is CA$0.10, and the third is CA$0.20. Upon implementation of the planned 1 for 10 share rollback, these targets must be adjusted to CA$0.60 – CA$0.70, CA$1.00, and CA$2.00, respectively.

Eguana Technologies' website.

Eguana Technologies Inc. (EGT:TSX.V; EGTYF:OTCQB) closed for trading at CA$0.01, US$0.0103 on March 21, 2025.

| Want to be the first to know about interesting Special Situations and Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Eguana Technologies Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Eguana Technologies Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.