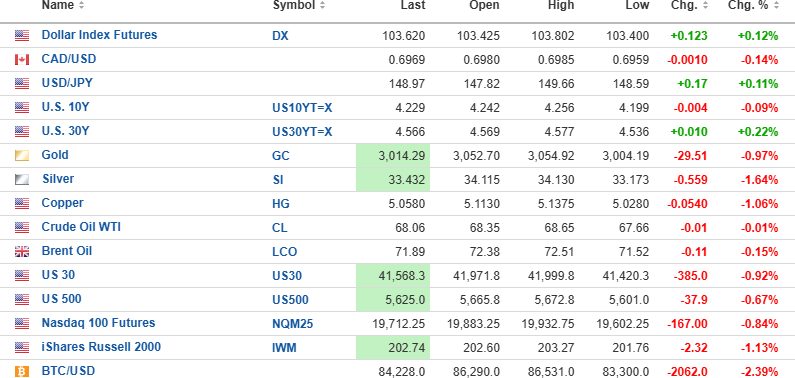

U.S. Dollar Index futures are up 0.12% to 103.620, while the 10-year bond yield is down 0.09% to 4.229% and the 30-year bond yield is up 0.22% to 4.566%.

Gold (-0.97%), silver (-1.64%), copper (-1.06%) and oil (-0.15%) are all lower.

The DJIA futures (-0.92%) are lower by 385 points, while the S&P 500 futures (-0.67%) are down 37.9 points and the NASDAQ 100 futures (-0.84%) are down 167 points.

Risk barometer Bitcoin is down 2.39% to $84,228 and still in bear market territory, down 23.02% from the top.

Stocks

Today is a big option expiration day with $4.7 trillion in notional value being liquidated by the closing bell. With liquidity being drained from the system on a daily basis, the fuel that usually propels the equity markets and the "Buy the dip" mentality is slowly disappearing.

I look for a retest of the lows of March 13 when the SPY:US touched $548.48. This week it has rallied to just above the 200-dma resistance level, so while certain aspects of this market remain oversold, the RSI is back at 41, so technically, it has resolved the oversold problem and may be headed back down for the retest. I am making no moves into the quadruple expiration day but will take action on Monday.

Gold (and Silver)

I took the hit on the SLV:US trade, which included the May $30 calls, and it was a good thing I did. It is another "Freaky Friday" with gold off $39.00 and silver down $0.80. Those calls I pitched at $1.25 ($1.28, actually) are now in the ditch at $1.06, proving once again that I am totally incapable of trading silver.

Gold should find a bid around the $3k level, and if it does, I may open a small position in the GLD:US via the April $275 calls.

Copper

Copper is also getting clobbered today, and that is no surprise as it has run from the $4.15/lb. level to over $5.10/lb. in a virtual straight line all on "tariff threats."

With RSI closing above 70 and MFI at 75, copper was in overbought territory for most of the week so a "pause that refreshes" was overdue. Freeport-McMoRan Inc. (FCX:NYSE) is also pulling back to under $40 again, and I will be a buyer early next week as well.

| Want to be the first to know about interesting Base Metals, Gold, Critical Metals and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.