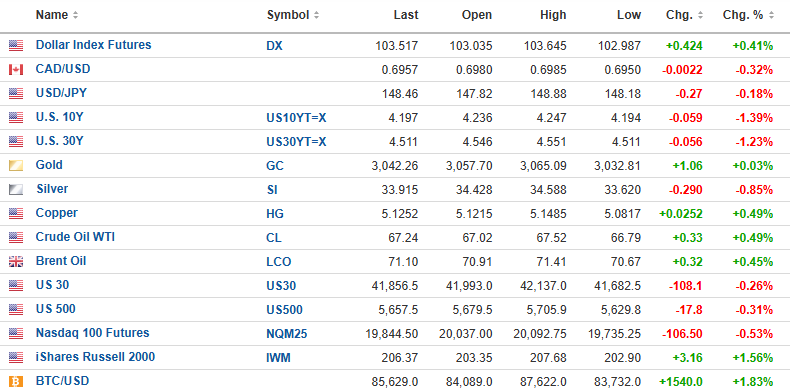

U.S. Dollar Index futures are up 0.41% to 103.517, while the 10-year bond yield is down 1.39% to 4.197%, but the 30-year bond yield is down 1.23% to 4.511%.

Gold (+0.03%), copper (+0.49%), and oil (+0.49%) are up, while silver (-0.60%) is lower.

The DJIA futures (-0.26%) are lower by 108.1 points, while the S&P 500 futures (-0.31%) are up 17.8 points, and the NASDAQ 100 futures (-0.53%) are up 106.50 points.

Risk barometer Bitcoin is up 1.83% to $85,629 but still in bear market territory, down 21.74% from the top.

Stocks

Stocks rallied sharply yesterday afternoon after the FOMC elected to leave the Fed Funds rate unchanged but reduced the rate of quantitative tightening ("QT") from US$20 billion per month to US$5 billion per month, which is another way of reducing the rate of drain on liquidity in the banking system.

This process involves the allowance of maturing bond issues to simply run off rather than rolling them over (re-issuing them). Stock traders viewed that as the first sign of the Fed "blinking" after this MAMMOTH <sarc> 10% drawdown in the SPX. Accordingly, they took the S&P 500 up 1.08%, leaving it still 70.78 points below the 200-dma.

With futures pointing to a lower opening, the only long positions I have that gyrate with the major markets are 5,000 Freeport-McMoRan Inc. (FCX:NYSE) and two call positions with March and June expiries. Nine days ago, on March 11, I posted this chart with the caption "Rally Time" and told subscribers that it was no longer time to be adding put options or volatility to trading positions, and that was pretty much the low for the year. We have since rallied $12.00 per share (120 S&P points).

Now, I move to the same chart updated to last night's close, and it clearly shows how the indicators all lined up to provide us with what a tradable bottom was.

However, I think that a much larger cyclical top is in for certain sectors (technology, communications, etc.), which may spill over into a rotational event from the former leaders like the Mag Seven to the cyclical stocks (Materials, Energy. . . ), which is why I elected to add to FCX.

Copper

The chart below confirms what I have been writing about for most of the past two years, although I was forced to change the rankings to gold first and copper second for performance in 2025.

As you can see, Dr. Copper is well out in front as the global recession theme brought on by tariffs and reduced government spending has been supplanted by the inflationary impact of retaliatory tariffs and global demand for copper.

I remain long FCX, looking for sharply higher prices and a test of the May 2024 peak at $55.23 within the next three months. However, in the GGMA 2025 Trading Account:

- Sell 100 March $40 calls at $1.25

If I get my price, then the 50 calls FCX June $40 will need to see $4.75 in order to offset the loss on the March calls, but since the stock position is on the books at $37.43, I have $17,850 of unrealized gains to consider. In other words, FCX doesn't owe me a dime and still remains my favorite blue-chip stock as the world's #1 copper producer.

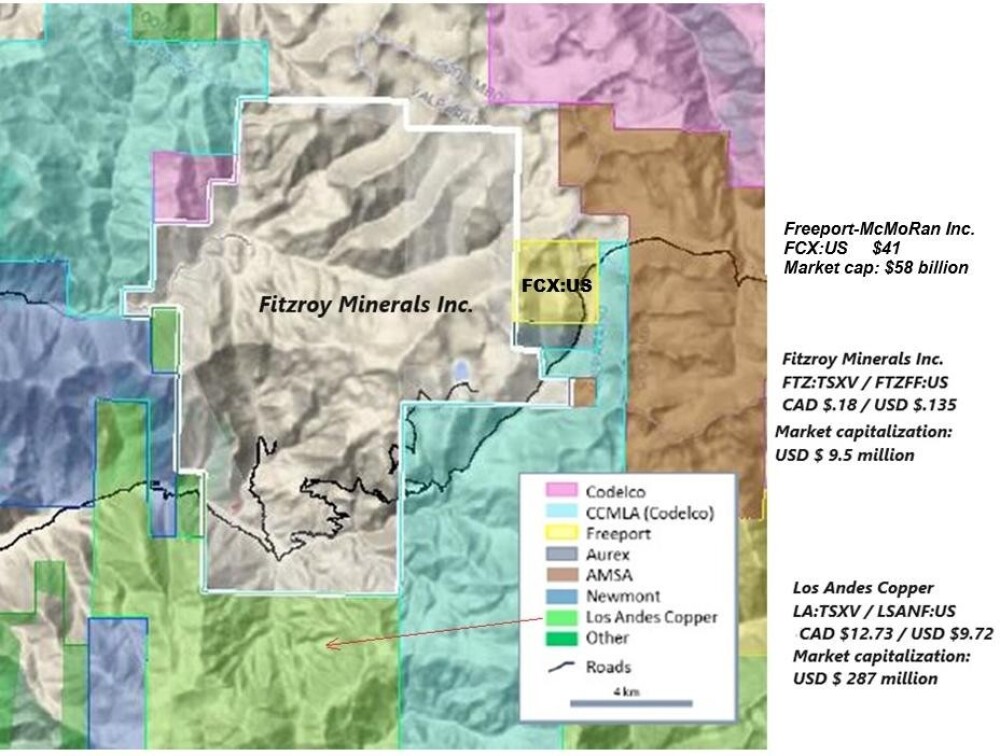

What is also ironic is the map of Fitzroy Minerals Inc.'s Caballos Copper-Molybdenum Property located in Chile.

Look at the block of ground tied onto the eastern portion of their boundaries. I wonder whether the M&A wizards at FCX are following the progress at Caballos. . .

Silver

This is day three of my bold and ill-fated attempt to play the pending breakout in the silver market. It rose to within $0.05 of that critical breakout point at $35.07 on Tuesday and like a fool, I gambled that it would be a successful breakout.

Well, it did not break out and in fact has now been repelled down under $34 so rather than let this trade bleed out, I am bailing.

In the GGMA 2025 Trading Account

- Sell 2,000 SLV:US at market on the opening

- Sell 50 SLV May $30 calls at market on the opening

The next time you read anything that is vaguely suggestive of a long position in silver, send me a ball-and-chain hammer so I can knock some sense into myself.

| Want to be the first to know about interesting Critical Metals, Base Metals, Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.