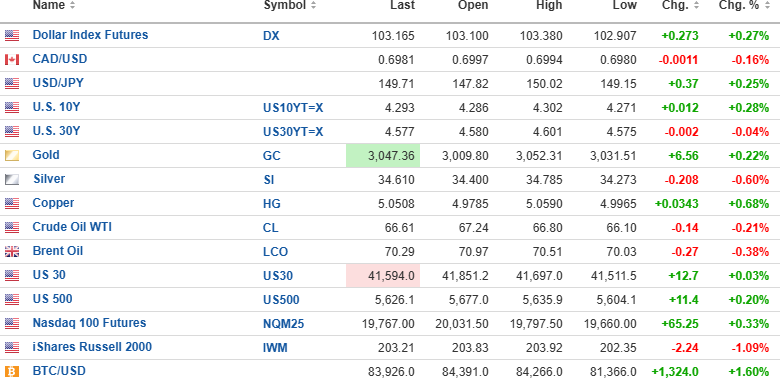

U.S. Dollar Index futures are up 0.27% to 103.165, while the 10-year bond yield is up 0.28% to 4.293%, but the 30-year bond yield is down 0.04% to 4.577%.

Gold (+0.22%) and copper (+0.68%) are up, while silver (-0.60%) and oil (-0.21%) are down.

The DJIA futures (+0.03%) are higher by 12.7 points, while the S&P 500 futures (+0.20%) are up 11.4 points, and the NASDAQ 100 futures (+0.33%) are up 65.25 points.

Risk barometer Bitcoin is up 1.6% to $83.926 but still in bear market territory, down 23.29% from the top.

Markets

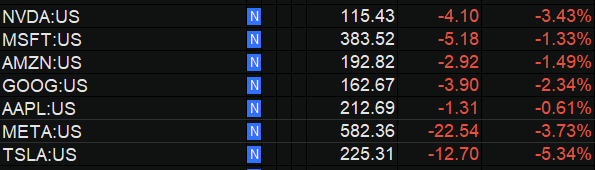

Stocks gave back some of the rebound yesterday as the DJIA and SPX retreated .62% and 1.08%, respectively, while the NASDAQ 100 containing the Mag Seven group got bombed for 1.61%, with every name in the Mag Seven group getting slammed. Whenever the leaders of a prior bull move fall from grace, the broader markets can take weeks and even months before a new leadership group emerges.

Judging from discussions I have been having with members of the crypto community in Toronto, the Great Rotation has begun with an entire generation of tech-savvy entrepreneurs migrating into the "hard asset" space, which is not to say they are abandoning crypto or the blockchain but instead diversifying their considerable wealth into the resource extraction industries such as energy and mining.

One thing is certain: they prefer silver over gold because of its application in the "alternative energy" field, such as solar panels. Its application in electronics is well known to these high-intellect GenZ-ers, so when the generalist portfolio managers get the nod from their well-heeled younger clients, I see silver entering the mania stage last seen in 2010-2011 and 1979-1980.

As for the equity markets, I have only one modest volatility position on and no shorts or puts at this time in anticipation of the rebound that is already underway, albeit choppy and bereft of any real momentum. I am banking on a retest of the lows in the SPX at 5,507 (now 5,614) but first I look for an attempt to regain the 200-dma at 5,743.87.

Volatility remains in a downtrend as the hedges are all being lifted and the big premiums on the put options are shrinking, which is completely normal after the sharpest corrective move down in years appears to be over. I use the term "appears to be over" because it is the first rally off a correction that is referred to as a "sucker's rally" that snares the most prey.

The "Buy the Dip" crowd that has been trained by the Wall Street-governed Fed to never worry about a bear market is, in my humble opinion, going to run headlong into a hostile fiscal regime under Scott Bessent, who was recently quoted as saying that he "did not particularly care about the recent decline in stock prices," a total departure from the past five Treasury Secretaries whose personal benchmark for success was the level of the QQQ's. I see the VIX dropping down into that accumulation zone under 15 if this rally can get any real "legs," so for now, I am avoiding any bullish bets on the SPY:US or the QQQ:US but have added to my beloved Freeport-McMoRan Inc. (FCX:NYSE) shares and calls that are now onside. I am still underwater on the March $40's and may need to ride them right into expiry if copper continues its ascent and FCX follows.

Stay tuned. . .

Fitzroy Minerals

Fitzroy Minerals Inc.'s (FTZ:TSX.V; FTZFF:OTCQB) Ptolemy Mining acquisition is very close to the consent of the regulators and I fully expect it next week.

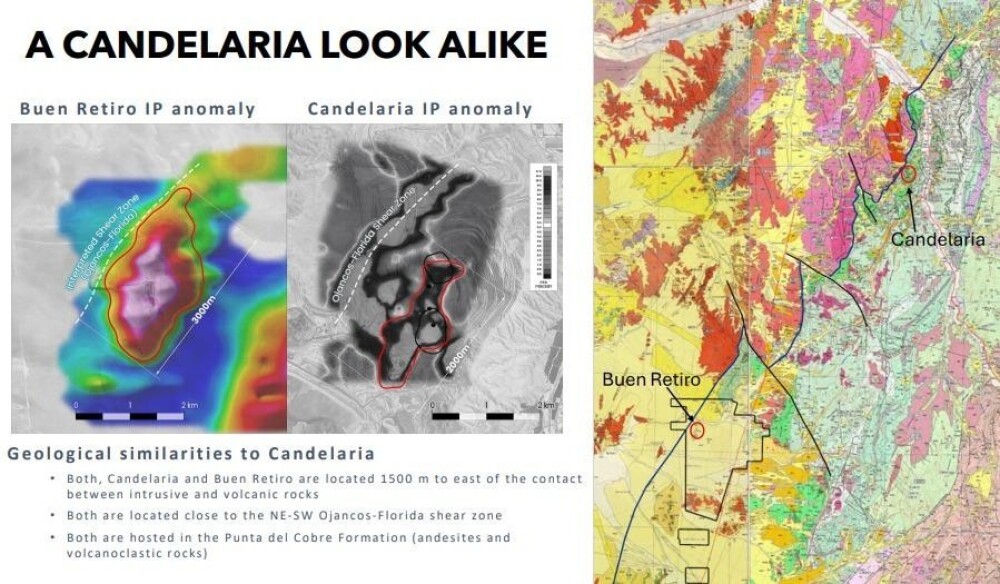

I cannot tell you how excited I am in anticipation of the upcoming drill program at Buen Retiro. Technical Advisor Gilbert Schubert lays out a very compelling story regarding the similarities between BR and the monstrous Candelaria Mine owned and operated by Lundin Mining Corp. (LUN:TSX; LUNMF:OTCMKTS) 45 miles NE of BR.

In very short order, FTZ/FTZFF will be drilling this puppy, and if that big anomaly turns out to be a sulfide-bearing IOCG deposit, remember that LUN:TSX has the Candelaria Mine on its books at US$3.5 billion. The only difference between Buen Retiro and Candelaria, according to Gilberto, is that "Buen Retiro is bigger."

As I await the assays for their surprise intercept of 185.7 meters of sulfides at Caballos, where they have 85-meters of "elevated mineralization," I can only daydream over the impact on the stock price if it turns out that this little junior sporting a US$22.7 million market cap winds up with two economic-grade discoveries. It is the sole reason I make big bets on well-run juniors like FTZ/FTZFF.

News should be out next week to provide us with more clarity on the two main projects. Do not forget about Polimet either where they have just completed a 7-hole program with assays pending there as well. All within a little junior fully-funded until well into next year.

| Want to be the first to know about interesting Critical Metals, Silver, Base Metals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.