Just over the past few days, Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC) has commenced the powerful breakout move that we were looking for in the original article posted on February 20. Before reviewing this development and what it portends on the latest stocks charts we will overview the fundamentals of the company.

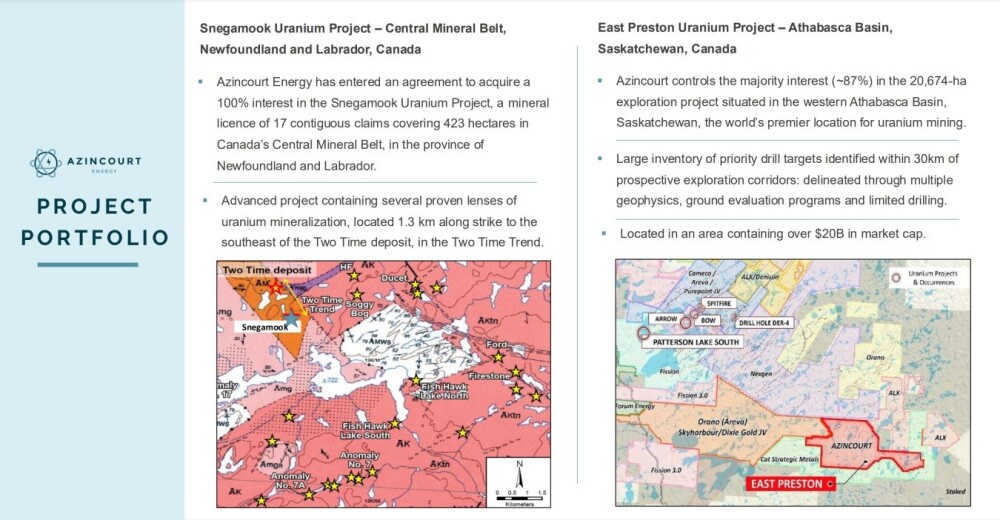

Azincourt Energy Corp's business is the acquisition, exploration, and development of clean energy / fuel projects, specifically uranium. Although the company owns three properties, it is focused primarily on two advanced uranium projects in Canada's most prospective uranium-rich jurisdictions, one in Labrador's Central Mineral Belt and the other in the Athabasca Basin in Saskatchewan.

The company has entered into an agreement to acquire a 100% interest in the Snegamook Uranium Project in Labrador, which is 423 hectares in extent, and it holds an 87% interest in the 20,674 hectares East Preston Uranium Project in the Athabasca Basin. A brief overview of these two properties is provided on this slide taken from the company's investor deck.

The company's two principal properties are located in highly prospective regions and close to big uranium deposits and discoveries owned by some of the world's largest mining companies as we will see when we look at the maps shown on some of the following slides.

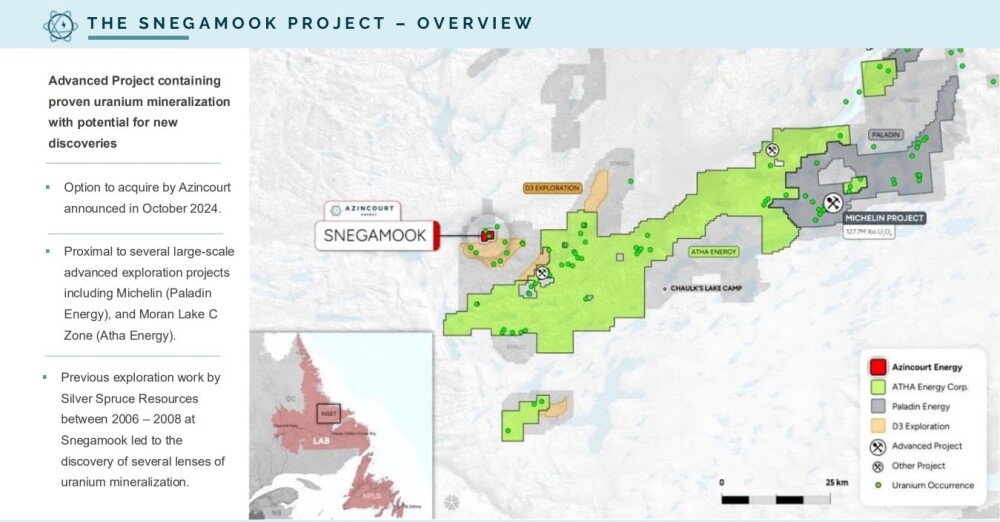

The next slide shows the geography of the Snegamook Project and its proximity to a very large project owned by Atha Energy Corp, also a uranium company.

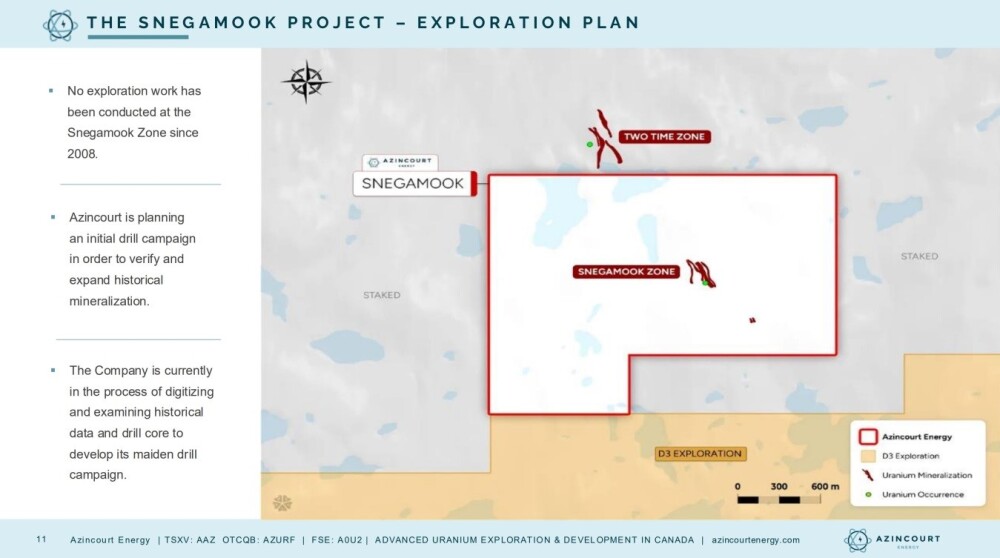

The company is advancing towards its maiden drill program on the Snegamook Project, as described on this slide.

It is of note that no exploration work has been carried out there since 2008.

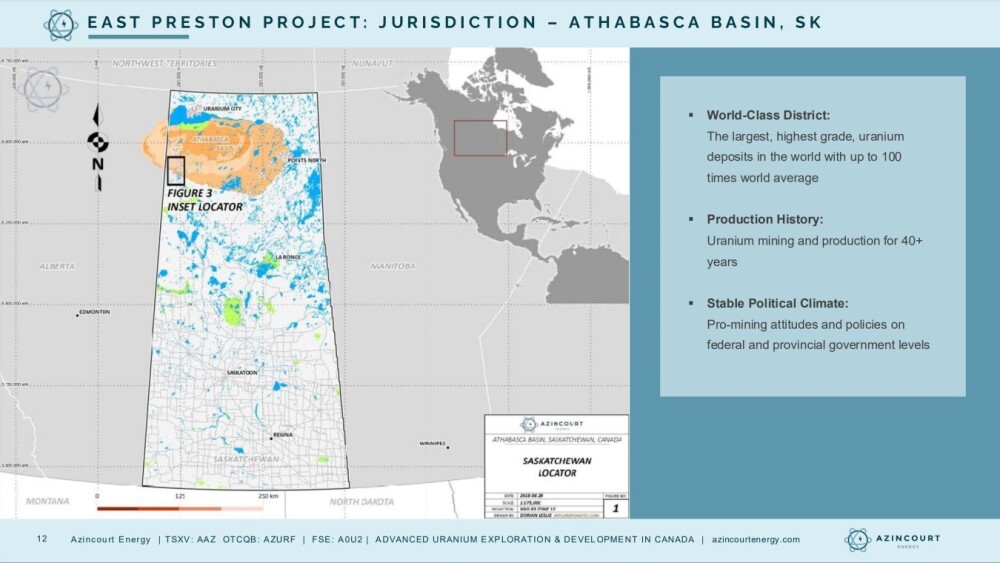

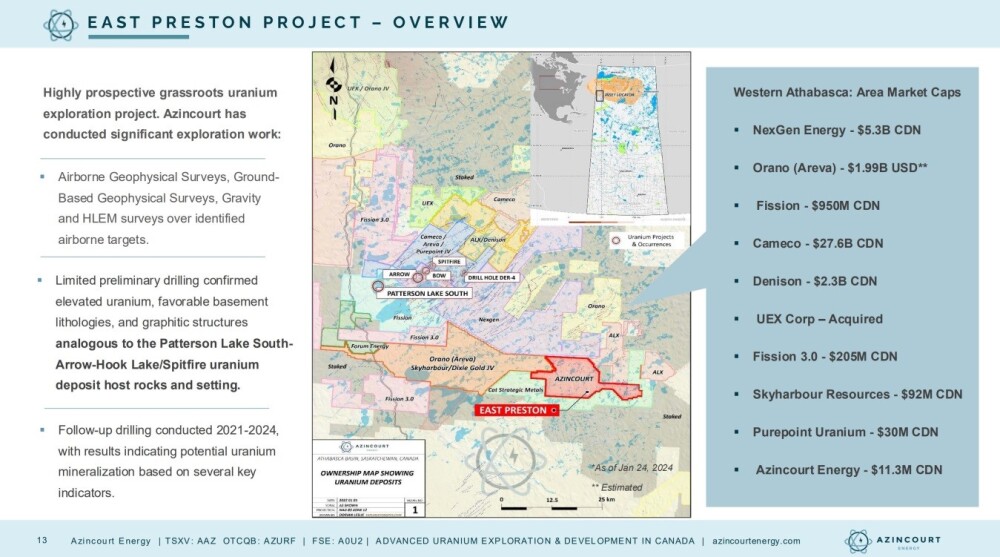

Azincourt's other principal project, the East Preston Uranium Project, is situated in the Athabasca Basin in northern Saskatchewan, which hosts the largest and highest grade uranium deposits in the world, which clearly augurs well for significant discoveries at East Preston going forward.

Following is an overview of the East Preston Uranium Project, and on the map presented on i,t we see that not only is the project sizable, but it is situated very close to other big projects in the Athabasca Basin owned by major players in the sector,r such as Cameco Corp. (CCO:TSX; CCJ:NYSE), Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT), Fission Uranium Corp. (acquired by Paladin Energy), NexGen Energy Ltd. (NXE:TSX; NXE:NYSE.MKT), and Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE), which means that there is a strong probability of significant discoveries on the property.

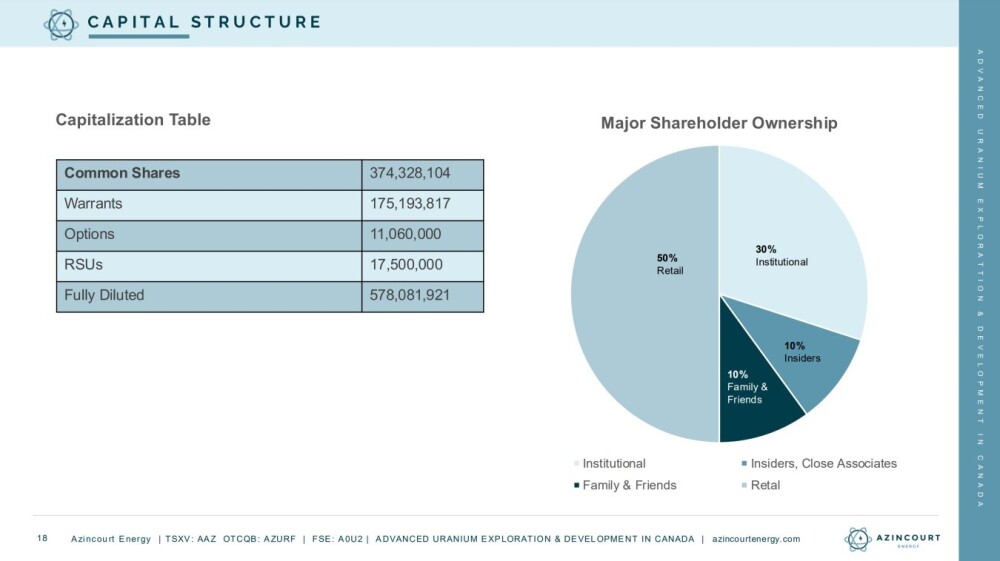

The capitalization table shown below makes clear that there is a high number of shares in issue at 374 million, and stock dilution in the past may account to a large extent for the current low price of the stock.

However, this also means that the large number of shares in issue has already been discounted by the market and factored in, but on the plus side, as half the stock is owned by institutions, insiders, and family and friends, the quantity of stock in the float is correspondingly reduced.

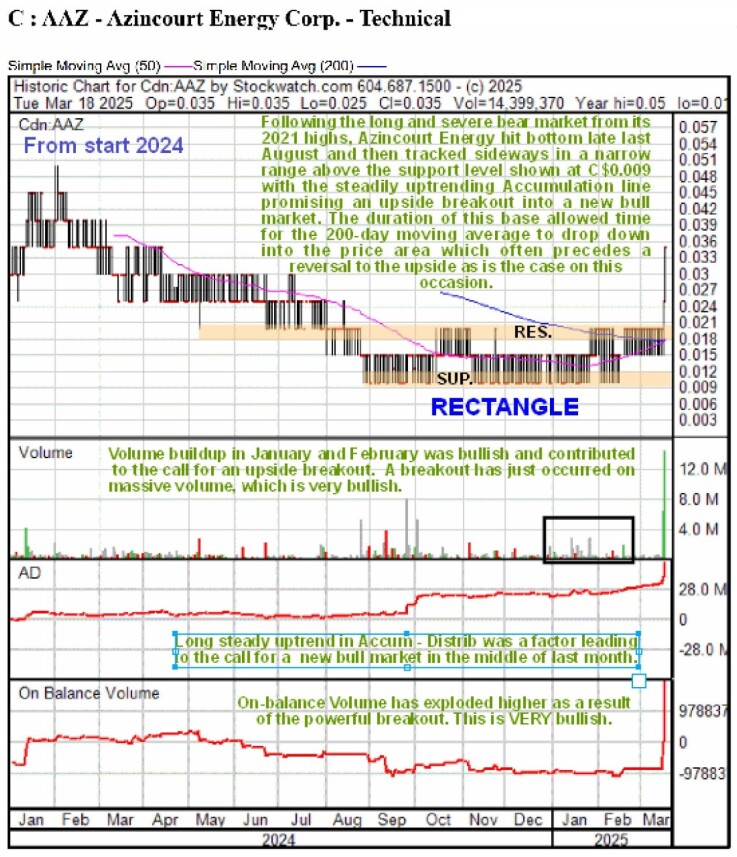

Turning now to the stock charts for Agincourt Energy, we see on the latest chart from the start of 2024 that just over the past couple of days, we have witnessed the breakout that we were expecting in the original article mentioned above.

Thus far, this breakout move is powerful, being as it is on a four-year record volume.

We are at the stage where the biggest percentage gains of all are made. This is because the price is at the tail end of a multi-year base pattern and, thus, at a very low level. The fact that this base pattern is tilted to the downside tends to magnify the breakout move when it finally happens. This is because most observers are fooled by seeing the stock continuing to make new lows, view it as a bear market, and do not understand that it is actually very late in a basing process.

The reason that a breakout from this position results in such big percentage gains in short order is that a group of investors suddenly grasp that the company is "turning the corner" and pile into its stock, driving it steeply higher. As we can see from the projection on the chart, this move is just getting started and has a way to run, so we should now see big gains over the short to medium term before the stock "beds down" in a dull period as the Handle of the pattern then forms whose purpose is to allow the fundamentals of the company to catch up to investors newly heightened expectations.

Since the breakout that we have just seen marks the start of a big move probably to the CA$0.13 – CA$0.15 zone that is likely to be achieved quickly, Azincourt Energy continues to be rated an Immediate Strong Buy here.

The first target for the advance now underway is CA$0.10. The second target is CA$0.15, and the third target on breakout from the giant base pattern is the CA$0.35 – CA$0.40 area.

Azincourt Energy Corp.'s website.

Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC) closed for trading at CA$0.035, US$0.021 on March 18, 2025.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Skyharbour Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, Azincourt Energy Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Azincourt Energy Corp. and Cameco Corp.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.