Copper, often referred to as "Dr. Copper" for its historical ability to reflect global economic health, has been on a steady upward trend. As the foundation of electrification, electric vehicles (EVs), renewable energy, and critical infrastructure, copper demand is surging at a pace unseen in previous decades. With supply constraints mounting and global initiatives accelerating green energy investments, many analysts predict a bullish trajectory for copper prices through 2030 and beyond.

With junior copper exploration companies increasingly gaining attention, there is a tremendous opportunity to capitalize on the next phase of the copper supercycle. The industry has entered a pivotal moment where fundamental supply and demand factors are aligning with bullish technical signals, setting the stage for a potential historic rally in copper prices.

The Fundamentals: Demand vs. Supply Imbalance Driving Higher Prices

Rising Demand: Electrification and Infrastructure Spending

Copper's unique electrical and thermal conductivity makes it irreplaceable in modern technology. It plays a vital role in renewable energy, EVs, AI-driven data centers, and global grid expansion. The demand for copper is set to accelerate exponentially over the next decade, driven by the following factors:

The electric vehicle (EV) revolution is one of the largest catalysts for copper demand. EVs require three to four times more copper than traditional gasoline-powered vehicles due to their batteries, wiring, and charging infrastructure. With global EV sales expected to exceed 50 million units per year by 2030, copper demand in the automotive sector is projected to skyrocket.

The renewable energy transition is another massive driver of demand. Copper is essential for solar panels, wind turbines, and battery storage systems, all of which rely on copper wiring and components. The International Energy Agency (IEA) projects that copper demand from renewables could triple by 2040 as nations push toward net-zero carbon emissions.

Beyond energy and transportation, AI-driven data centers and electrical grid expansion are set to consume enormous amounts of copper. The rapid growth of AI computing, cloud storage, and high-performance processing units has led to a surge in energy consumption, which in turn requires a stronger and more resilient electrical grid. AI-related electricity demand is projected to rise 10X by 2030, further amplifying copper's importance in modern infrastructure.

By 2030, global copper demand is expected to reach 25-31 million metric tons, up from ~24 million metric tons today. This growth, combined with the challenges on the supply side, will likely lead to a severe supply deficit and substantially higher prices.

Supply Constraints: A Structural Deficit is Emerging

Despite the surging demand, copper supply is struggling to keep pace. Several factors are contributing to a looming structural deficit in the copper market, making higher prices almost inevitable.

Declining ore grades have become a significant challenge for copper producers. Many of the world's largest copper mines, located in Chile, Peru, and Indonesia, are experiencing declining yields, requiring more energy and investment to extract the same amount of copper. According to BHP, one-third to one-half of the world's copper mines will struggle with declining grades by 2035.

Underinvestment in new copper projects over the past decade has left the industry unprepared for the expected surge in demand. New copper mines take 15-30 years to develop, meaning the supply response will be delayed even if major investments are made today. Today, it appears that no significant new large-scale copper mines are set to launch before 2027, highlighting the long-term structural supply shortage.

Mine closures and geopolitical risks further exacerbate the supply issue. The shutdown of Cobre Panama, one of the world's largest copper mines, is an example of how regulatory changes can severely impact global supply. Additionally, increasing resource nationalism in Peru, Chile, and Indonesia, which together account for over 40% of global copper production, poses a risk to future copper output.

Given these factors, experts warn that a structural deficit of 1.6-9 million metric tons could emerge by 2027-2028, potentially pushing copper prices significantly higher.

Technical Analysis: Where Are Copper Prices Headed?

Chart 1: Short-Term Outlook (2025-2026)

Currently, copper is trading at $4.89 per pound (~$10,780 per metric ton). The short-term technical setup suggests a bullish breakout is forming, with key resistance and support levels emerging.

Copper's immediate resistance levels are at $5.18 and $5.97, while strong support levels exist at $4.32 and $3.75. The short-term copper chart (Chart 1) shows that if copper breaks above $5.97/lb, it could trigger an acceleration toward $6.20/lb in 2025.

Chart 2: Long-Term Outlook (2027-2030 and beyond)

Chart 3

The long-term copper charts (Charts 2 & 3) indicate that copper is following historical multi-decade price cycles, with previous bull runs seeing 740%+ gains.

Between 2002 and 2012, copper surged from $0.60 to over $4.50, marking a 740% increase. Applying the same move from 2020's $2.00/lb lows, we see a potential long-term copper price of $15.00/lb by 2030.

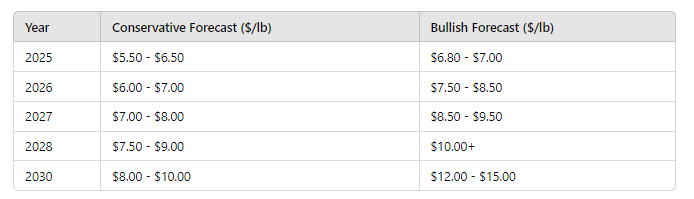

If supply deficits materialize as expected, prices could accelerate toward $8-$10/lb by 2028-2030, with further upside potential if new copper supply fails to come online.

Investment Opportunities: Positioning for the Copper Boom

As copper prices trend higher, investors and mining companies have tremendous opportunities to capitalize on the next phase of the copper bull market.

Junior copper exploration stocks are one of the best ways to play the long-term trend. With major miners scrambling to secure future supply, high-quality exploration companies with promising copper discoveries could become prime takeover targets.

Established copper producers will benefit significantly as copper prices rise. Low-cost, high-margin producers will generate record-breaking cash flow, rewarding investors with strong earnings growth and higher share prices. Stocks like Teck Resources, Capstone, Hudbay, and Freeport-McMoRan are well-positioned to thrive in a high-copper-price environment. That being said, the real investment opportunity could be with the junior explorers, that dare to put risk capital to work, in an effort to find the much-needed future supply.

For passive investors, copper ETFs and futures provide a way to gain exposure without having to pick individual stocks. The Global X Copper Miners ETF (COPX) is one of the top-performing ETFs in this space, offering diversified exposure to copper mining companies.

With Major investment houses reporting that M&A activity is accelerating, investors should keep an eye on smaller copper companies with high-grade projects, as they could become potential acquisition targets in the coming years.

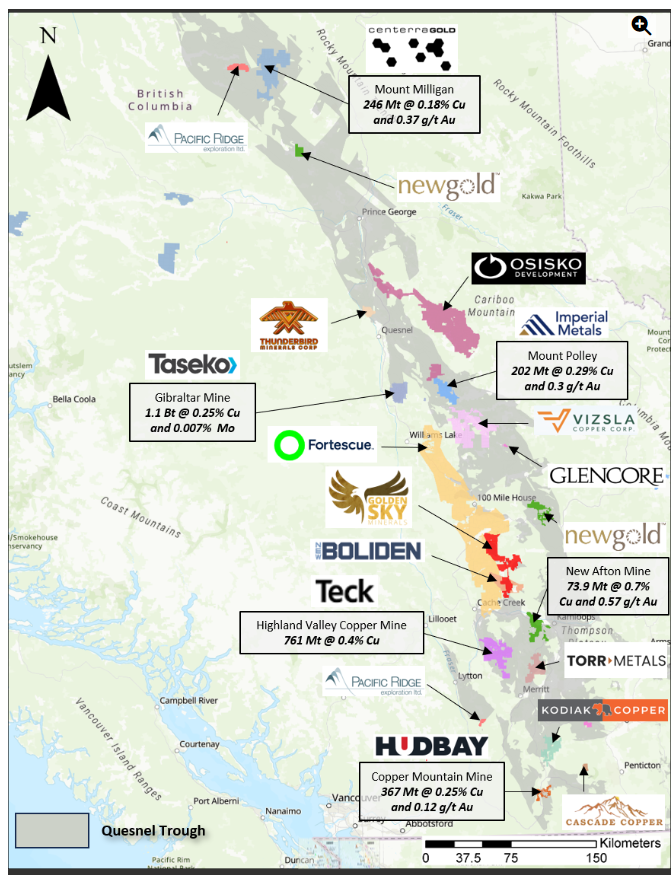

One example is Imperial Metals, which is shown in the chart below. Imperial Metals (III.TO) is one of the junior copper producers poised to benefit from the ongoing copper bull market. The company owns and operates the Red Chris Mine in British Columbia, Canada, a major copper-gold porphyry deposit with expansion potential. Imperial Metals also has stakes in Mount Polley and Huckleberry Mines, giving it a diversified asset base in a mining-friendly jurisdiction. Below is a map of the famous Quesnel trough a mineral terrane that Imperial Metals Mt.Polly is situated in.

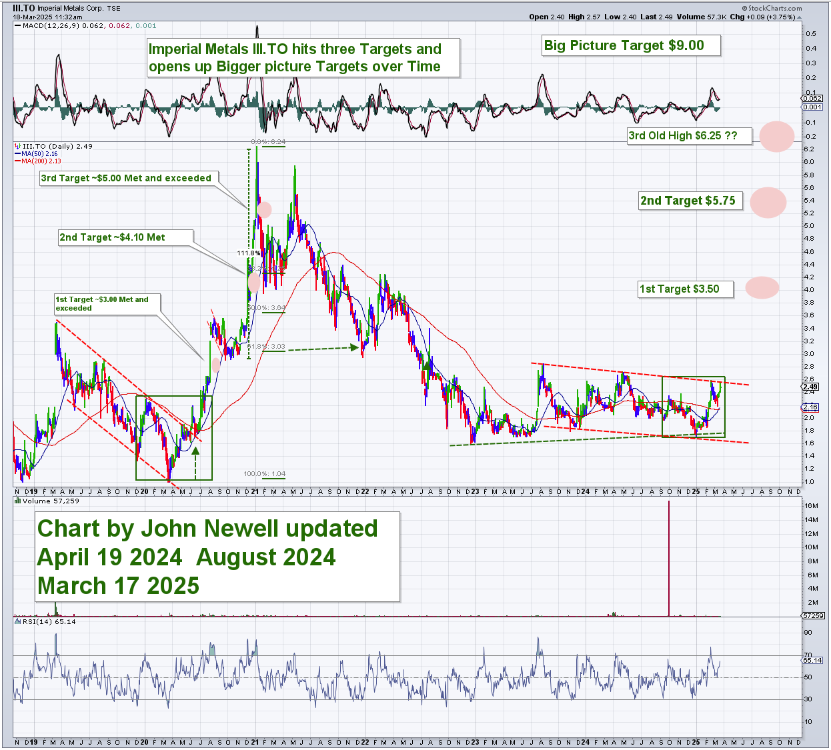

Technical Outlook on Imperial Metals (III.TO)

The chart of Imperial Metals Corp. (III:TSX) shows that the stock has already hit and exceeded key price targets, in the last runup early 2020 into the 2021 highs. It then corrected far more than expected but now appears to have set up again.

Looking forward, the next potential price targets include:

- $3.50 as an initial breakout target. $5.75 as a second target. $6.25 as a previous high level.

- And a potentially big-picture target of $9.00, which aligns with the broader bullish copper market trend.

As copper prices continue their upward trajectory, junior copper producers like Imperial Metals stand to benefit significantly. With strong technical setups and a rising commodity price environment, Imperial Metals is positioned as a high-upside opportunity in the junior copper mining space.

Five-Year Copper Price Forecast (2025-2030)

Conclusion: The Copper Supercycle is Just Beginning

Copper's supply-demand fundamentals and bullish technicals suggest that we are in the early stages of a long-term super cycle. With electrification, AI, and renewable energy accelerating demand and supply struggling to keep up, copper is poised for a historic bull run.

With prices potentially reaching $10-$15/lb by 2030, the time to position for the copper boom is now. Is copper the next big trade? The charts and fundamentals say yes, and the decade-long super cycle might just be getting started. As a resource investor you must ask yourself, are you ready for the next phase of the copper super cycle?

For John’s previous article on copper see this link.

| Want to be the first to know about interesting Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- John Newell: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.