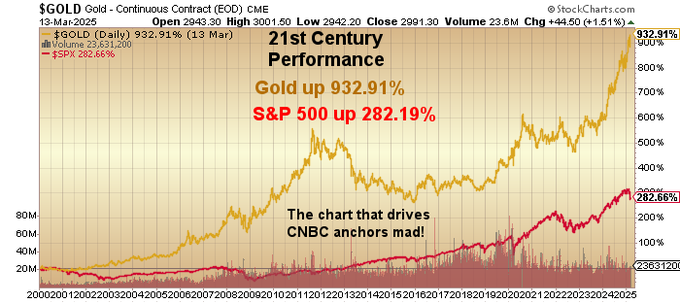

This is a week that shall go down in the annals of history, the week that a "barbarous relic" under the guise of a "pet rock" took its rightful seat on the throne of superior performance, bludgeoning the wailing anchors of CNBC into actually recognizing the ascendancy of gold and its little brother, silver. As the equity markets in the United States went into virtual freefall, the same bubbleheaded, narrative-spewing cast of characters were out in force, beseeching their global viewers to not panic and instead hold on because the Fed "has your backs."

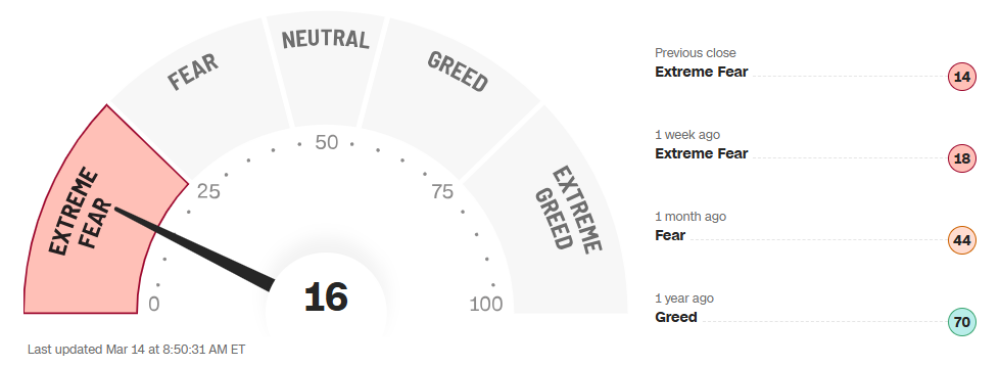

As gold soared Thursday evening and the wee hours of Friday morning above the magical $3k level, the CNBC Fear-Greed index slumped to a reading of 16, placing it squarely into <EXTREME FEAR>, a zone from which many market bottoms were born. The lowest reading for this index was in April 2020 during the COVID Crash, when it hit a reading of 1. At that point, there was literally nobody left to sell stocks as the world was convinced that the bubonic plague was descending upon us and that humanity, as we then knew it, was doomed.

That marked the bottom of the market in 2020, after which the combination of fiscal stimulus ("cheques to households") and zero interest rates led to record liquidity levels for the Wall Street banks and a new S&P 500 high a mere five months later. I told subscribers mid-week that now was not the time to sell their holdings and load up on put options and/or volatility. It is also not the time to back the truck into the stock market loading dock and forklift copious amounts of the "MAG Seven" into the bed. March 2025 is not March 2020 because the U.S. government no longer enjoys the privilege of being able to print money. They cannot "save" the stock market by arbitrarily slashing interest rates to zero and engaging in the fiscal helicopter drop that Ben Bernanke boasted of in 2009.

By contrast, now is the time to carefully recalibrate one's investment objectives and/or risk tolerance profile and above all else, get liquid. With an ample amount of cash, one can survive meltdowns but with leverage and/or no cash, one is completely indebted to and victim of the vagaries of the stock market. Now, if you own gold stocks and/or physical gold or silver, you are liquid; if you do not own them, you are enslaved. I want all subscribers to be free from worry so sell enough of your non-precious metals holdings to allow uninterrupted sleep to dominate the wee hours. Stocks closed the week with a 117-point S&P rally. Into any follow-through next week, increase your cash positions.

I expect that gold will take more than a one-off overnight spike in order to surpass the $3k level as a sustained move.

I expect that profit-taking will have it in a range of $2,975-$3,025 for several more days and perhaps weeks before it can achieve escape velocity above the magic number.

Politics, Economics, and Stocks

I wish I could have been embraced more gently as a youngster to my introduction to the field of politics, but ever since November 22, 1963, and the days and weeks thereafter, I have been totally jaundiced by the mere mention of the word "politics." When the assassin's bullet ended the life of a truly popular and indeed charismatic president in the form of John F. Kennedy in Dallas that day, it ended for me and an entire generation of baby boomer idealism that carried an engrained belief that the United States of America was indeed the "Promised Land."

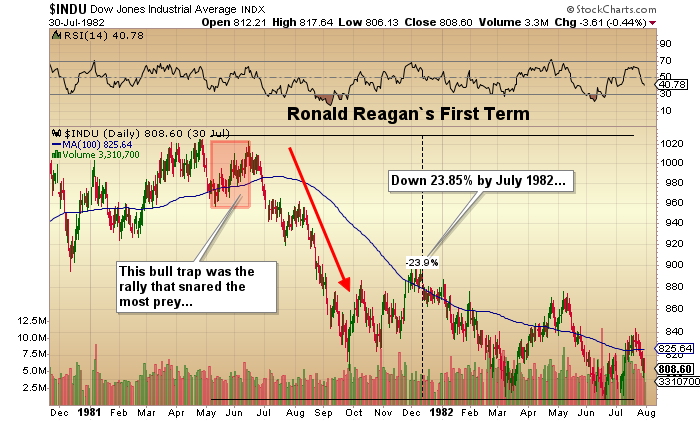

After Kennedy came LBJ and Viet Nam, Nixon and Watergate, Jimmy Carter and the Stagflation '70s, and then the "Reagan Miracle" that rhymes beautifully with "Trump 2.0." In 1981, Reagan had David Stockman; in 2025, Trump has Scott Bessent. In 1981, economic advisor to the President, David Stockman embraced the media with "supply-side economics"; in 2025, Elon Musk embraces the media with the "Department of Government Efficiency" ("DOGE").

In 1981-1982, there was "The Laffer Curve," a theoretical model in economics that suggests there's an optimal tax rate that maximizes government revenue, with revenue falling at both very high and very low tax rates. Yet despite all of the brainpower assisting Reagan, after two years of soaring interest rates and falling polling numbers, the Reagan Team bailed on their anti-inflation mission and opened up the fiscal and monetary floodgates in order to salvage some respectability in the mid-term elections.

The bear market ended in 1982 a mere ten weeks before the 1982 mid-term elections with a rapid and aggressive wave of monetary easing as then Fed Chairman Paul Volcker slashed the Fed Funds rate sending the S&P 500 up 40% from the August lows to early November. Needless to say, the Republicans carried the mid-terms.

With the pullback in the DJIA, S&P 500, and the NASDAQ 100 in the past three weeks, it closely resembles the end of the Reagan "honeymoon period," which stretched from election day 1980 until May of 1982. When the bloom came of the rose in May of 1982, it triggered a nasty bear market that lasted for fifteen long months, and while it wasn't nearly as long or as arduous as the 1973-1974 bear, the interest rate crunch bankrupted many individuals and corporations that were carrying inordinate amounts of debt.

Here in 2025, it is the government of the U.S.A. and certain commercial real estate borrowers that are carrying inordinate amounts of debt while the average household and majority of corporate balance sheets are in relatively good shape. However, as happened in 1981-1982, the Reagan-esque "new morning in America" that Trump 2.0 promised in the form of "Make America Great Again" is threatening to be preceded by "The Nightmare on Wall Street" as the fiscal juice that kept the economy chugging along through most of 2024 has now ended leaving Scott Bessent with a very ugly balance sheet and some US$8 trillion of refinancing to pull off in an environment where the usual foreign buyers of U.S. Treasuries are being hit or threatened with tariffs.

Good luck with that, Scott. . .

I stick to my call that the current market outlook is a repeat of May 1982 and based upon the 117-point SPX reflex rally on Friday, this next 2-3 weeks could be the same bull trap that snared so much prey back in May 1982 before the ravenous bear started to feast in earnest. From a tactical viewpoint, last week I covered all shorts with put positions being sold as the SPY April $600 puts went from $8.00 to $38 in three short weeks.

As you have all heard many times before, "In a bull market, you are either flat or long or very long, but you are not short." If SPX 6,147 was THE top, then the correct move is to wait for the rally to run out of gas and then short it. However, thus far, the SPX:US is only in correction mode, which does not rule out new all-time highs. Furthermore, because this decline has been triggered by the White House policy initiatives, any moderation in the bearish rhetoric could send stocks screaming back to their February highs in very short order. For now, stay pat, stay liquid, and focus on this emerging bull market in the metals.

Metals

As much as CNBC would like to ignore the chart posted on page one showing the superior performance of gold since the Turn of the Century, if my portfolio is any indication, owning the metals has been the best trade to begin a year since 2001.

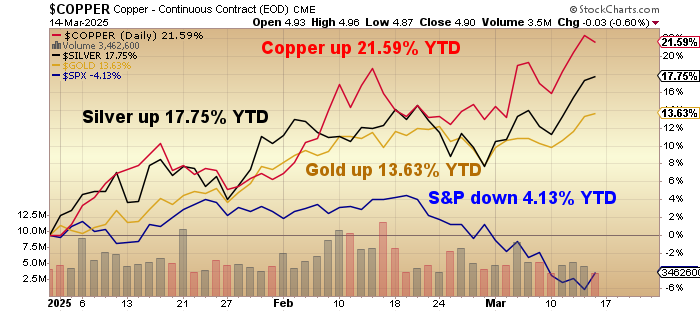

Record highs on gold with copper close behind and silver threatening a break-out. Even the juniors are now starting to capture a little of the love that has been reserved for technology and "meme" stocks.

Surprisingly, when you surf around on "X" (Twitter) or YouTube, you find interview after interview and story after story on gold and silver, but outside of Robert Friedland, there is literally nothing on copper.

Then you look up at the 2025 year-to-date performance figure, and out in front leading the charge is good ol' Dr. Copper, up 21.59% YTD versus 17.75% for silver, 13.63% for gold, and minus 4.13% for the S&P 500.

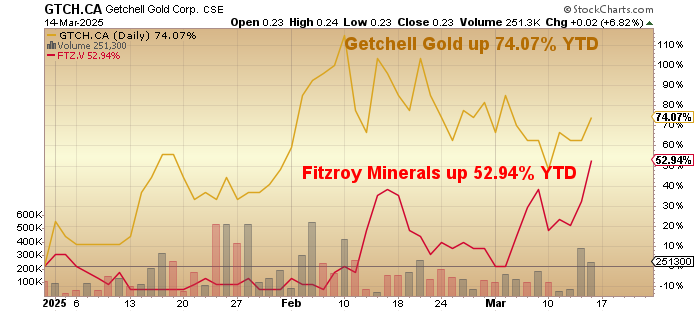

My two largest positions just happen to be in two junior developers (Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) and Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB)) and with one developing (and expanding) a 2.317 million-ounce gold deposit in Nevada while the other has multiple copper projects in Chile, the world's largest producer of the red metal. I am scanning the landscape for a new silver name, and I think I have found one that is relatively unknown and under-owned, which means it has upside potential.

However, until silver can scale that mountain of resistance between here and US$35.07, I am sidelined silver but happily long the copper and gold combo that have served us so well in 2025.

Remember that old adage from the School of Successful Stock Promotion: "Hang on to your cat, your coat, and your girlfriend; there ain't no fever like gold fever!"

Copper may wish to dissent. . .

| Want to be the first to know about interesting Gold, Silver, Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp. and Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.