Nuclear Fuels Inc (NF:CSE; NFUNF:OTCMKTS) acquired the TenSleep uranium (U3O8) project, located near its flagship Kaycee asset in Wyoming, by staking 188 mineral claims and obtaining two state mineral leases, noted a news release.

"We see the acquisition as a prospective addition to Nuclear Fuels' portfolio given the limited exploration work the asset has seen to date and the potential to delineate additional instances of unconformity-type mineralization," Haywood Securities Analyst Marcus Giannini wrote in a March 3 report. "Looking ahead, the project should add some optionality to Nuclear Fuels' exploration pipeline."

TenSleep is known to host uranium mineralization based on historical production and exploration work, but it is not the roll front sandstone-hosted type typically seen in Wyoming and throughout the U.S. Rather, it is what Giannini mentioned, unconformity-style mineralization, similar to the uranium deposits in Saskatchewan's prolific Athabasca Basin. This makes TenSleep unique.

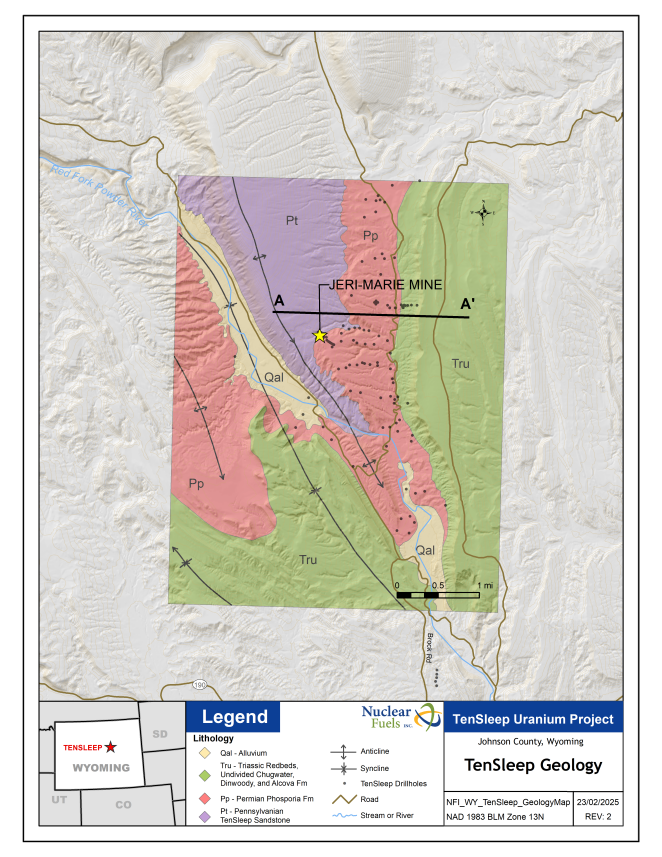

Specifically, the release explained, uranium mineralization at TenSleep is found along the contact between the TenSleep and Phosphoria formations.

Specifically, the release explained, uranium mineralization at TenSleep is found along the contact between the TenSleep and Phosphoria formations.

The younger, overlying Phosphoria is an organic-rich marine unit, containing siltstone, sandstone, limestone and dolomite and enriched in uranium and other elements.

This described contact, or unconformity, at TenSleep is similar to the host environments of Athabasca's high-grade uranium ore bodies.

"Unconformity-style uranium deposits are much larger and higher grade than roll front-hosted deposits, underscoring the potential at the project should this geological analogue play out," noted Giannini.

The lack of exploration at TenSleep with the Athabasca Basin model in mind "presents an excellent opportunity for the discovery of an exciting new type of potentially in situ recovery (ISR)-amenable uranium in Wyoming," Nuclear Fuels Chief Executive Officer (CEO) Greg Huffman said in the release.

ISR is a minimally intrusive, environment-friendly, and economically competitive alternative to conventional mining.

The lower contact of the 380-feet-thick, sandstone TenSleep Formation is the priority target, for two reasons.

One, the Athabasca's high-grade unconformity-type uranium deposits also occur at the lower contact of a thick sandstone sequence. Two, historical drilling at TenSleep in the early 1970s mostly focused on the upper contact, with only 10 holes targeting the lower contact.

However, of those 10, eight showed pervasive mineralization or anomalies.

Focus on U.S., ISR Potential

Nuclear Fuels is a uranium explorer advancing early-stage, district-scale, ISR-amenable projects in the U.S. toward production.

The company's priority is Kaycee, spanning 3,000 acres in Wyoming's Powder River Basin, a hotbed of ISR uranium production since the 1970s. The project encompasses a 35-mile mineralized trend and 430 miles of identified and mapped roll fronts.

Nuclear Fuels consolidated Kaycee under single-company control, the first time it has been this way since the early 1980s. EnCore Energy Corp. (EU:TSX.V; ENCUF:OTCQX) owns an equity interest in Kaycee and has a back-in right to 51% ownership, to take the project to production, according to Nuclear Fuels' March 2025 Corporate Presentation.

Nuclear Fuels conducted drill programs at Kaycee in 2023 and 2024, totaling 400 holes, which confirmed and expanded the historical zones of mineralization and discovered two new mineralized trends. High-grade results were shown throughout the Saddle, Spur, Stirrup, Trail Dust and Outpost zones. Historical data are available for 3,800 drill holes.

Along with TenSleep and Kaycee, the uranium explorer also owns the Boothill and Bobcat projects, both in the Shirley Basin, also in Wyoming, a state that historically has produced 215,000,000 pounds of uranium via ISR. According to the Wyoming State Geological Survey, the largest known uranium ore reserves in the U.S. are in this mining-friendly state, which historically has ranked No. 1 in uranium production nationally.

Nuclear Fuels' project pipeline also includes Lisbon Valley in Utah and Moonshine in Arizona.

U.S. Needs Domestic Uranium

The U.S. must produce more U3O8 domestically to reach energy independence and decarbonization goals, experts said.

The country produced 50,000 pounds of U3O8 and imported 640 times that, 32,000,000 pounds (32 Mlb), in 2023, the most recent full-year data available, according to the U.S. Energy Information Administration. Most of the States' uranium came from Canada and Australia but also Russia, Kazakhstan and Uzbekistan.

In comparison, the country will need an estimated 121−165 Mlb of U3O8 each year to support 300 gigawatts of nuclear power capacity, its 2025 decarbonization goal, according to CarbonCredits.com. This target is about three times what the country has now, Statista reports.

A spate of new and proposed laws in the U.S. indicates strong government support for nuclear energy and uranium. Among them are H.R. 1622 (2025), calling for uranium to be added back to the U.S. Geological Survey's list of critical metals; the Prohibiting Russian Uranium Imports Act (2024) and the Nuclear Fuel Security Act (2024).

Demand for nuclear energy is growing not just in the U.S. but globally, too. According to the World Nuclear Association, uranium demand from nuclear reactors is expected to climb 28% by 2030 and almost double by 2040, noted OilPrice.com.

BMO Capital Markets Analyst Alexander Pearce expects worldwide uranium demand to see about a 2.9% compound annual growth rate to 2035, he wrote in a recent report. He anticipates the "modest" supply deficit in the global uranium market persisting to 2029.

Reuters Columnist Andy Home echoed these sentiments earlier this year. He wrote, "The uranium market is recharged after a decade in hibernation. The resurgence of nuclear power means the world is going to need a lot more uranium, and supply is already struggling to match demand." These factors should drive up the uranium price.

According to Swiss Resource Capital (SRC), on Feb. 26, some experts predict the uranium price will surpass US$100 per pound (US$100/lb) this year.

"It should, therefore, not be too late to invest in the uranium sector, especially for long-term investors," SRC wrote on Feb. 26. "A possible short-term fall in the price of uranium would not change the longer-term outlook."

Sprott wrote in its March 10 Uranium Report, "The global uranium bull market is still intact on long-term fundamentals. At about US$65/lb, uranium's current spot price weakness presents a potentially attractive entry opportunity for investors who can weather near-term turbulence."

Chris Temple of The National Investor also has a favorable outlook on the metal.

"The uranium space is one where I am getting close to going back to a Buy on everything," he wrote on March 11. "I have said for quite some time that one of the reasons I like the fundamental setup here is that uranium is one commodity that is least likely to suffer a drop in demand no matter the economic outlook."

The Catalyst: Exploration Progress

Nuclear Fuels has several events slated for the rest of 2025, which could boost its share price, the company said. Expected in the near term is finalization of the next drill program for Kaycee, to include following up on the discoveries in the Outpost and Trail Dust zones. Drilling is slated to commence there in May.

"The company has recently shifted its focus from confirmatory drilling in areas of known historic mineralization to more regional exploration targets," wrote Haywood Securities' Giannini.

He pointed out that Nuclear Fuels' evaluation of 500-plus oil and gas logs has helped define drill targets at Kaycee to date. He added, "Given the strong reconciliation seen thus far, we expect the company to continue to benefit from additional targets generated by this evaluation throughout their 2025 drill program."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Nuclear Fuels Inc (NF:CSE;NFUNF:OTCMKTS)

Also on the horizon is the completion of Nuclear Fuels' exploration plan for TenSleep. Plans call for capitalizing on historical data and modern geological modeling, drilling to delineate the extent of uranium mineralization at the upper and lower contacts of the TenSleep Formation, and evaluating the potential for ISR mining there. The company is looking at late 2025-early 2026 for the start of drilling.

Ownership and Share Structure

Ownership of Nuclear Fuels, according to Refinitiv, is divided among strategic entities (nine) at 19.73%, institutions (two) at 2.7%, and retail with the rest.

The Top 3 shareholders overall are EnCore Energy Corp. with 17.05%, Alps Advisors Inc. with 2.68% and Nuclear Fuels' board and management including CEO Greg Huffman with 2.44%.

As for share structure, the company has 97.88 million (97.88M) outstanding shares and 78.57M free float traded shares. Its market cap is CA$17.03 million. Its 52-week range is CA$0.23–0.56 per share.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.