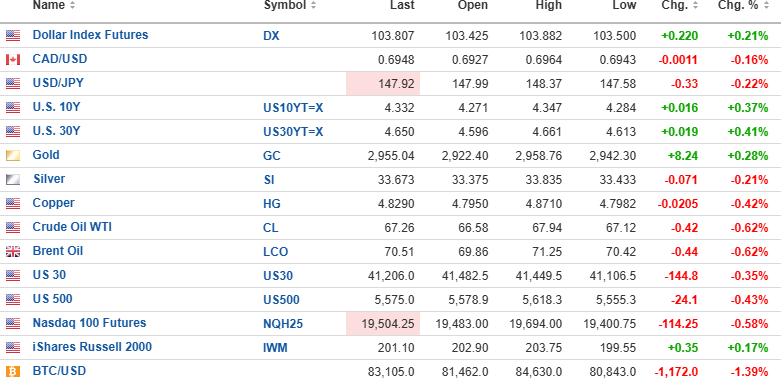

U.S. Dollar Index futures are up 0.21% to 103.807, while the 10-year bond yield is up 0.37% to 4.332%, and the 30-year bond yield is up 0.41$ to 4.650%.

Gold (+0.28%) is up, while silver (-0.58%), oil (-0.62%), and copper (-0.42%) are all lower.

The DJIA futures (-35%) are lower by 144.8 points, while the S&P 500 futures (-0.43%) are down 24.1 points, and the NASDAQ 100 futures (-0.93%) are own 114.25.

Risk barometer Bitcoin is lower by 1.59% to $83,239 and still in bear market territory.

Copper

In the GGMA 2025 Trading Account:

- I added 2,000 Freeport-McMoRan Inc. (FCX:NYSE) at $37.00

- Target: $45

For option players:

- I bought 50 contracts FCX June $40 calls at $2.50

- Target: $7.50

These calls replace the FCX March $40 calls currently quoted at $0.22 and which are probably going to be a "failed trade."

It is astonishing that companies like BHP, FCX, TECK, and IVN are all trading 30-40% off their 52-week highs, with copper approaching US$5.00/lb. From articles I have read in Bloomberg and in the Wall Street Journal, the vast majority of portfolio managers (who all run together in crowds) are positioning portfolios in expectation of a global trade war and recession.

Copper producers are classically cyclical performers, so this dichotomy of rising copper and falling copper producers is going to be resolved either by a vicious snapback from the producers or a bearish reversal in copper prices.

Conclusion: a crystal ball would be helpful, but the answer lies between the ears of the current American president.

For those subscribers that participated in the 2023 funding for Relevant Gold Corp. (RGC:TSXV), the stock is now trading at CA$0.40, which is a nickel higher than the offering price of CA$0.35. I am executing the following "switch" this morning:

In the GGMA 2025 Trading Account:

- Sell all RCG:TSXV at CA$0.40 or better

- Invest proceeds of sale into FTZ:TSXV / FTZFF:US at CA$0.20 / US$0.14

As I told a subscriber this morning "you may wish to hold RGC.V and that would be fine but I would absolutely stake my reputation on FTZ.V blowing its doors off by the end of March."

| Want to be the first to know about interesting Gold, Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Freeport-McMoRan Inc. My company has a financial relationship with Freeport-McMoRan Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.